Bitcoin (BTC) continues its meteoric rise as merchants eye the extremely anticipated $100,000 value milestone. With the crypto market surging amid institutional inflows and bullish sentiment, the importance of this psychological threshold is being hotly debated. Is the $100K mark a mere quantity, or does it symbolize a turning level for the crypto market’s broader adoption and maturity?

On this detailed market evaluation, Coin Push Crypto Alerts explores Bitcoin’s value motion, macroeconomic drivers, and the elements shaping its trajectory as we method the year-end bull run of 2024.

Bitcoin’s Rollercoaster Experience: Value Motion Highlights

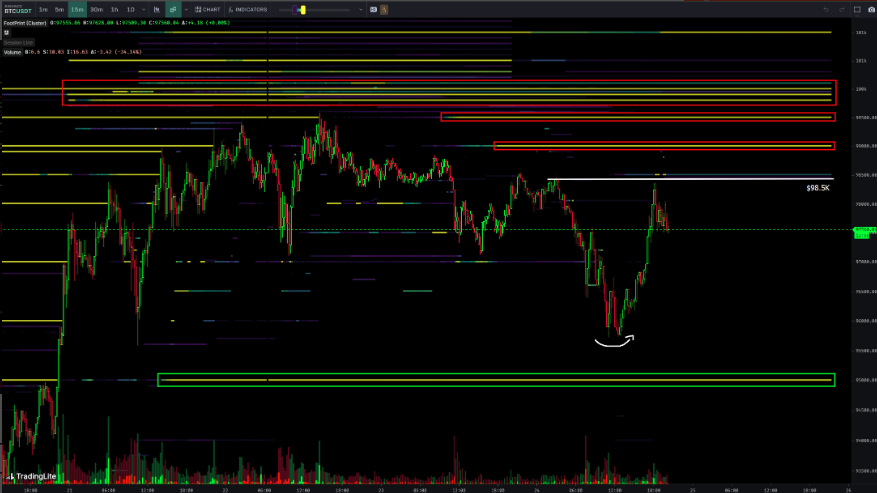

Bitcoin’s latest value motion noticed it flirt with $100K, recording a historic weekly shut at $98,000. Regardless of a dip to $95,800 throughout a low-liquidity weekend, robust shopping for stress reversed the decline. This resilience displays merchants’ confidence in Bitcoin’s potential to interrupt previous the six-figure mark quickly.

Set up Coin Push cell app to get worthwhile crypto buying and selling alerts as cell notifications.

Take a look at our article about Crypto Futures Signals to be taught extra!

Don’t miss our article about crypto alerts and telegram groups for futures traders. Keep up to date with Coin Push Crypto Alerts as we observe the continued developments all through Bull Run 2024.

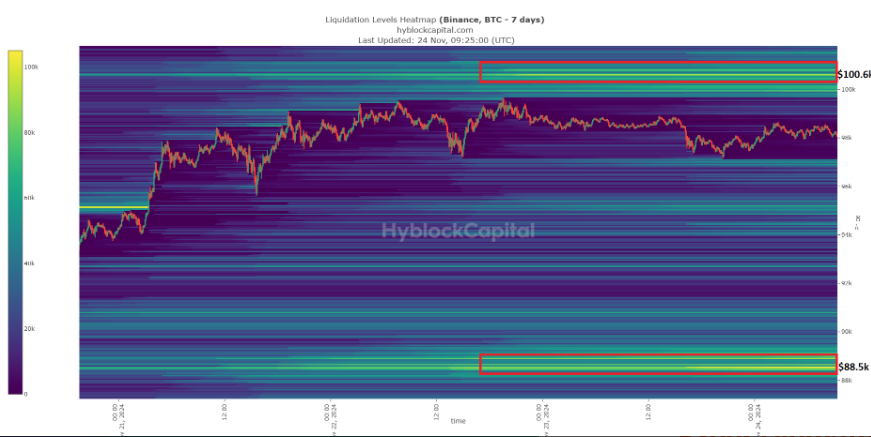

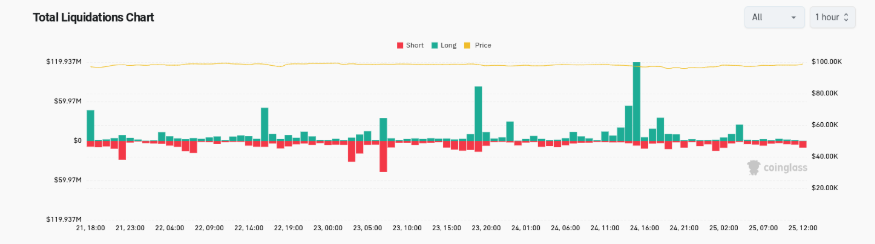

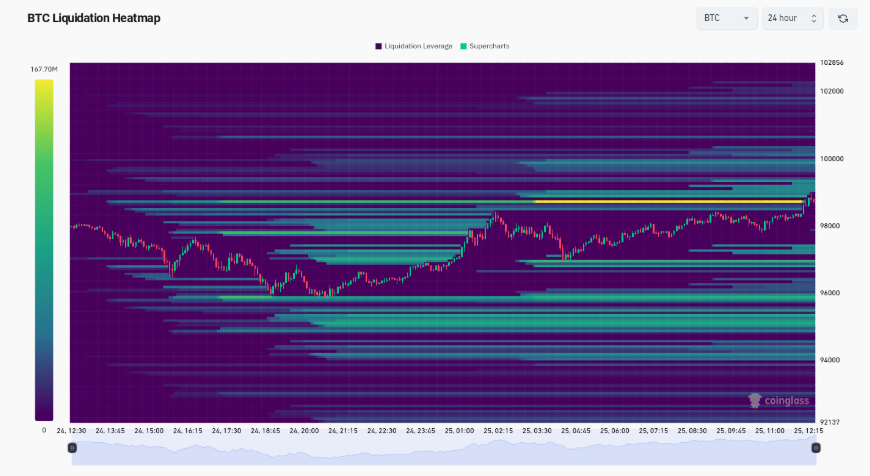

Huge liquidations accompanied the volatility, with $500 million value of positions worn out, underscoring elevated risk-taking conduct. Whereas key ranges like $98.5K maintain significance, the market stays divided over whether or not Bitcoin will check deeper liquidity zones close to $88.5K earlier than making a decisive breakout.

Psychological and Technical Significance of $100K

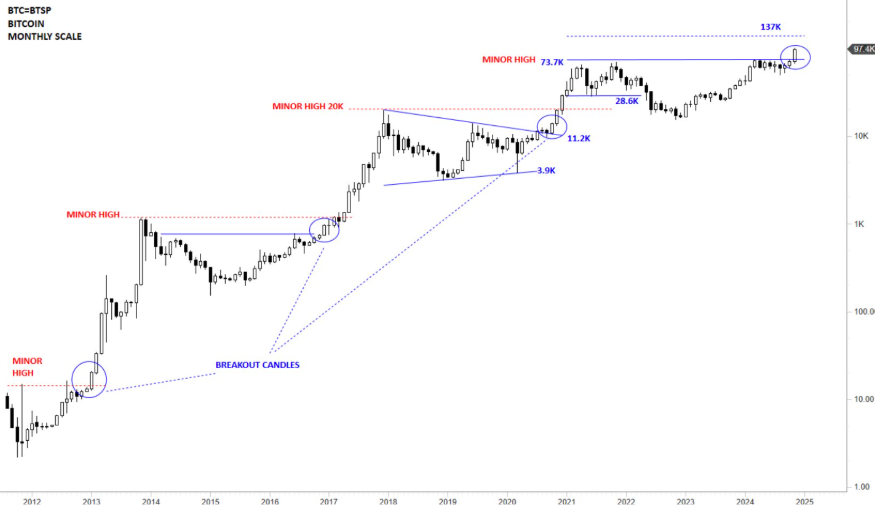

For some, the $100,000 price ticket represents greater than only a quantity. It symbolizes institutional validation and the rising mainstream enchantment of Bitcoin as a retailer of worth. Nonetheless, merchants like Aksel Kibar argue that $100K is “only a assortment of digits on a display,” suggesting that the main focus ought to shift to extra substantial ranges, comparable to $140,000.

This debate mirrors Bitcoin’s historic journey previous vital milestones, comparable to $20K and $50K, the place skepticism usually preceded sharp rallies. As of now, market contributors are cut up between anticipating a correction and anticipating a strong continuation above $100K.

Macro Drivers: Thanksgiving Week Volatility

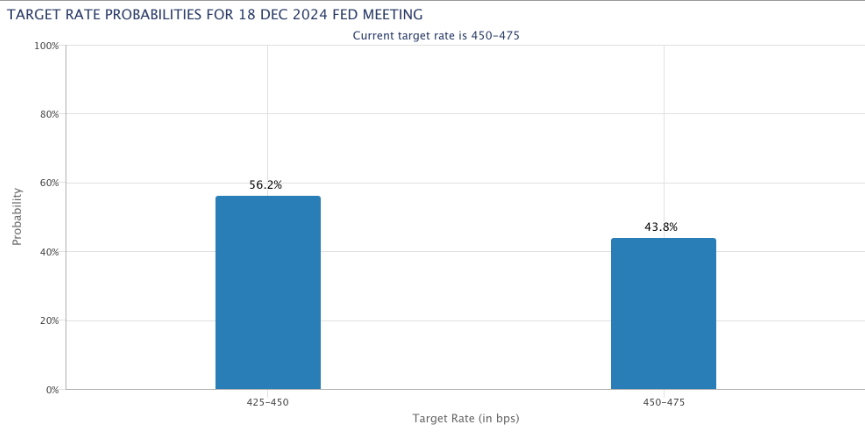

The ultimate week of November brings crucial U.S. macroeconomic information that would affect Bitcoin’s value momentum. The Federal Reserve’s most well-liked inflation metric, the Private Consumption Expenditures (PCE) Index, can be launched alongside revised Q3 GDP information. Moreover, unemployment figures might affect market sentiment.

With the Fed’s December assembly looming, markets are carefully awaiting alerts of additional fee cuts. Whereas the percentages of a 0.25% fee lower stand at 56%, any deviation from expectations might introduce vital volatility to threat property like Bitcoin.

Revenue-Taking and Lengthy-Time period Holder Habits

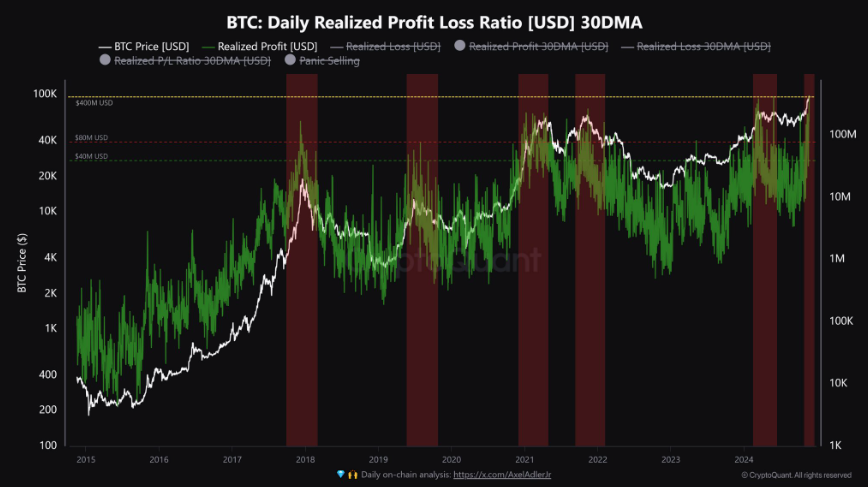

On-chain information reveals that Bitcoin long-term holders (LTHs) are capitalizing on the bull market, realizing earnings at a document tempo. Mixture realized earnings reached $443 million on November 22, highlighting the cyclical nature of profit-taking throughout robust rallies.

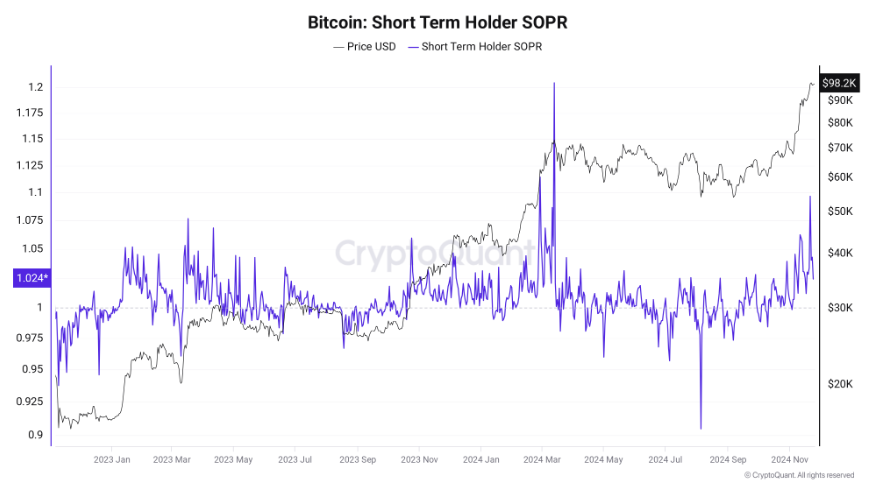

Brief-term holders (STHs) are additionally exhibiting basic bull market conduct, with the 30-day shifting common of the Spent Output Revenue Ratio (SOPR) reaching 1.02—a degree traditionally related to corrections. Whereas these developments counsel near-term resistance, sustained demand might offset promoting stress.

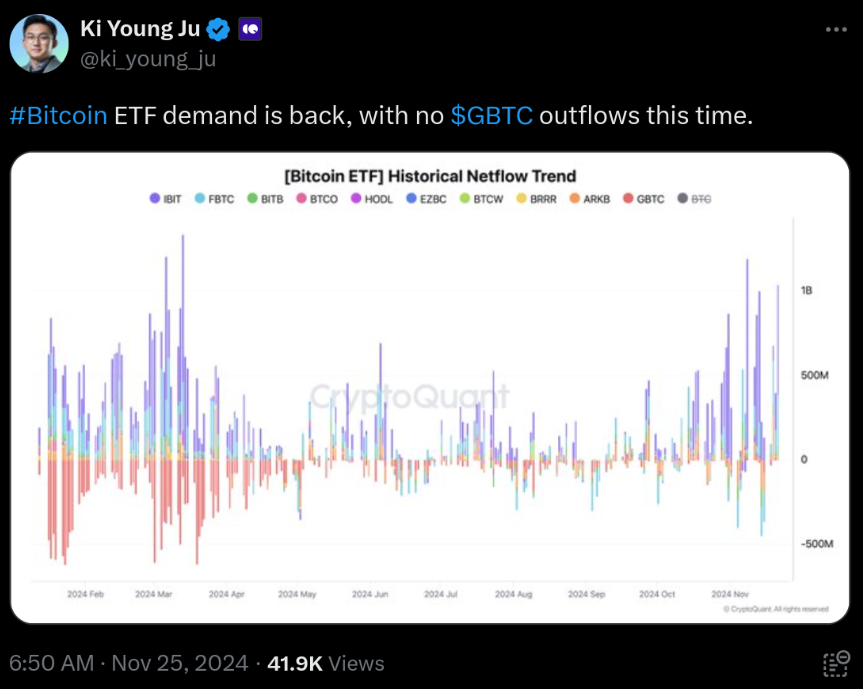

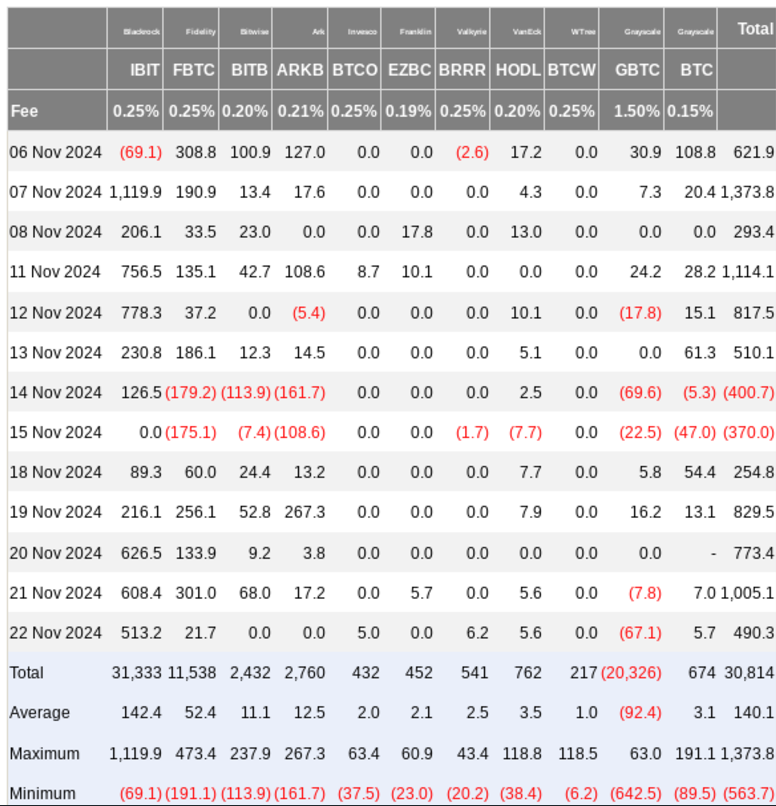

Institutional Inflows Bolster Optimism

The function of institutional traders stays pivotal, with U.S. spot Bitcoin ETFs attracting document inflows. The 5 buying and selling days resulting in November 22 noticed $3.35 billion in web inflows, bringing November’s whole to almost $7 billion. This surge in demand from ETFs might present a buffer in opposition to sell-side stress, fueling Bitcoin’s subsequent leg up.

As Rafael Schultze-Kraft of Glassnode notes, “With vital inflows into Bitcoin ETFs, the market is well-positioned to beat short-term promoting stress, paving the way in which for brand new all-time highs.”

Key Insights for November 2024

- Market Sentiment: Whereas $100K is a psychological milestone, broader elements comparable to institutional inflows and macroeconomic circumstances are driving the market’s trajectory.

- Threat and Reward: Merchants ought to stay cautious as Bitcoin navigates between key assist ($88.5K) and resistance ($100.6K) zones.

- ETF Affect: Document inflows into Bitcoin ETFs spotlight rising institutional curiosity, offering a powerful basis for continued value progress.

#CryptoAlerts #CryptoSignalsApp #Bitcoin #Ethereum #Altcoins #BullRun2024 #MSTR #microstrategy #saylor

Disclaimer: All hyperlinks offered are for informational functions solely. Coin Push Crypto Alerts doesn’t endorse or take accountability for the content material or companies offered on exterior web sites.

Disclaimer: The knowledge offered on this article doesn’t represent funding recommendation, monetary recommendation, buying and selling recommendation, or every other recommendation, and shouldn’t be handled as such. Coin Push Crypto Alerts doesn’t advocate shopping for, promoting, or holding any cryptocurrency. All the time conduct your due diligence and seek the advice of a monetary advisor earlier than making any funding choices.

Be a part of Coin Push Crypto Alerts for High Crypto Calls

There are indications that the crypto can be distributed to gamers over two years relatively than abruptly. This method is probably going designed to stop a speedy drop in value after itemizing, with the intention that solely the “whales” will stay to purchase up your cash progressively.

Set up Coin Push Crypto Alerts at this time and take step one in the direction of mastering the market in 2024. Select reliability, select transparency, and unlock the complete potential of the upcoming bull-run.

Coin Push

Coin Push Crypto Alerts stands as a testomony to the ability of mathematical algorithms and data-driven analysis in providing actionable insights to traders. By prioritizing reliability and transparency, Coin Push Crypto Alerts empowers merchants to make knowledgeable choices and navigate the complicated crypto market with confidence.

And at all times keep in mind – No fortune telling, simply math!

With Coin Push Crypto Alerts main the way in which, traders can trade smarter, not tougher, and seize the numerous alternatives the crypto market gives. Select reliability, select transparency, and install Coin Push Crypto Alerts.

Comply with Us on social @coinpushapp

Disclaimer: Crypto is a high-risk asset class. This text is offered for informational functions and doesn’t represent funding recommendation. You may lose your entire capital.

Commerce Like a Professional with Coin Push Crypto Alerts

Are you trying to enhance your trading skills or confirm your strategies? AltSignals supplies exact buying and selling signals to help both novice and experienced traders. Discover Coin Push to remain ahead of the market and make knowledgeable buying and selling choices.

Set up Coin Push Crypto Alerts at this time and take step one in the direction of mastering the market in 2024. Select reliability, select transparency, and unlock the complete potential of the upcoming bull-run.

FAQ

How does whale exercise affect Dogecoin’s value actions?

Why is $100,000 a crucial degree for Bitcoin?

The $100,000 mark serves as each a psychological milestone and a technical barrier. Breaking this degree might ignite vital shopping for curiosity, whereas failure might result in a retracement to decrease assist zones like $90,000 or $85,000.

What makes Solana’s trendline essential for its value motion?

Solana’s trendline has been a key assist throughout its restoration. Holding this line might result in additional features, whereas breaking under it’d end in a deeper correction to assist ranges like $216 or $184.

Keep forward of the market with Coin Push Crypto Alerts, your trusted supply for crypto insights in the 2024 bull run.