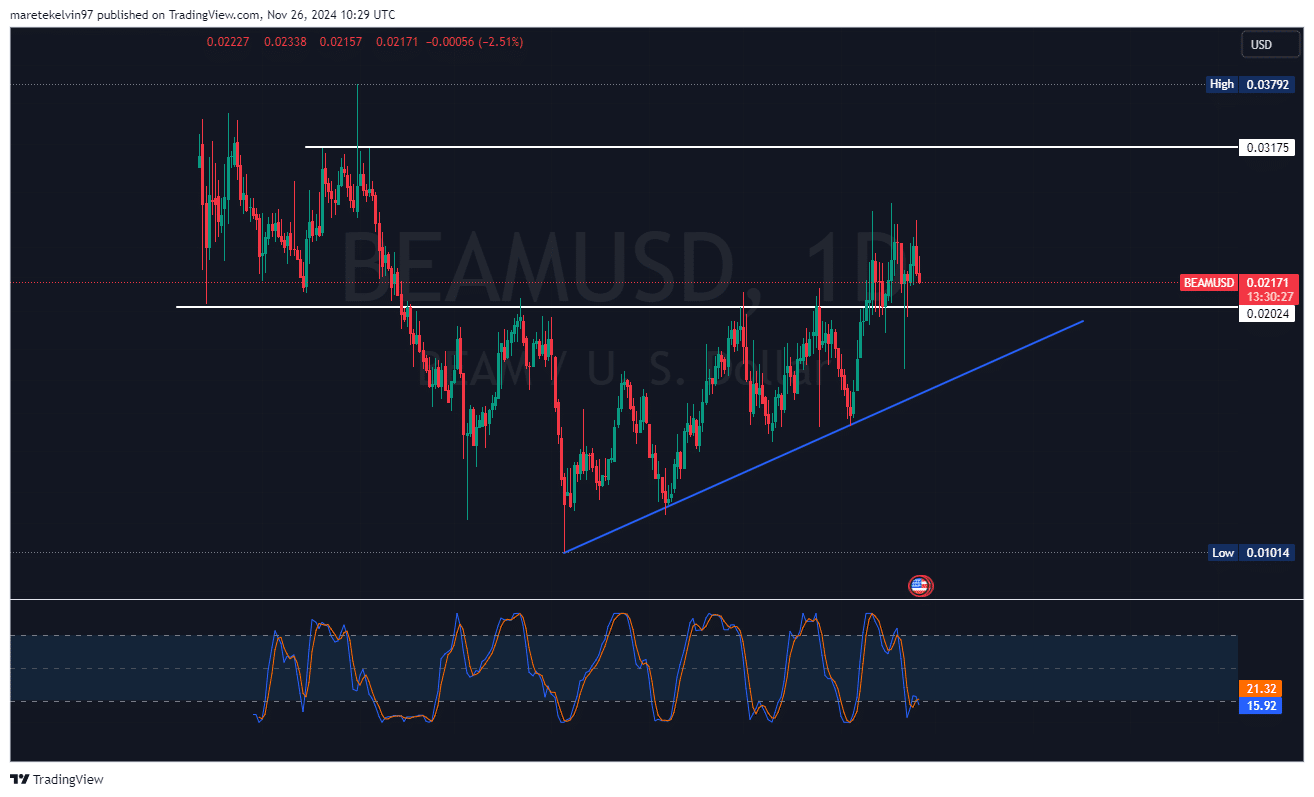

- Beam was approaching a vital assist degree of $0.0202 at press time.

- On-chain metrics pointed to declining whale and buying and selling exercise.

Beam [BEAM], a privacy-focused crypto, was in for a essential check as its worth neared a key assist degree of $0.0202 on the day by day chart.

The asset has dipped sharply by over 16% in lower than 48 hours alone, elevating issues amongst market contributors about its short-term trajectory.

As Beam’s worth continued to slip, the stochastic RSI was approaching an oversold zone at press time.

This improvement might sign a possible worth reversal, a near-term bounce, and thus providing a glimpse of hope for the Beam bulls.

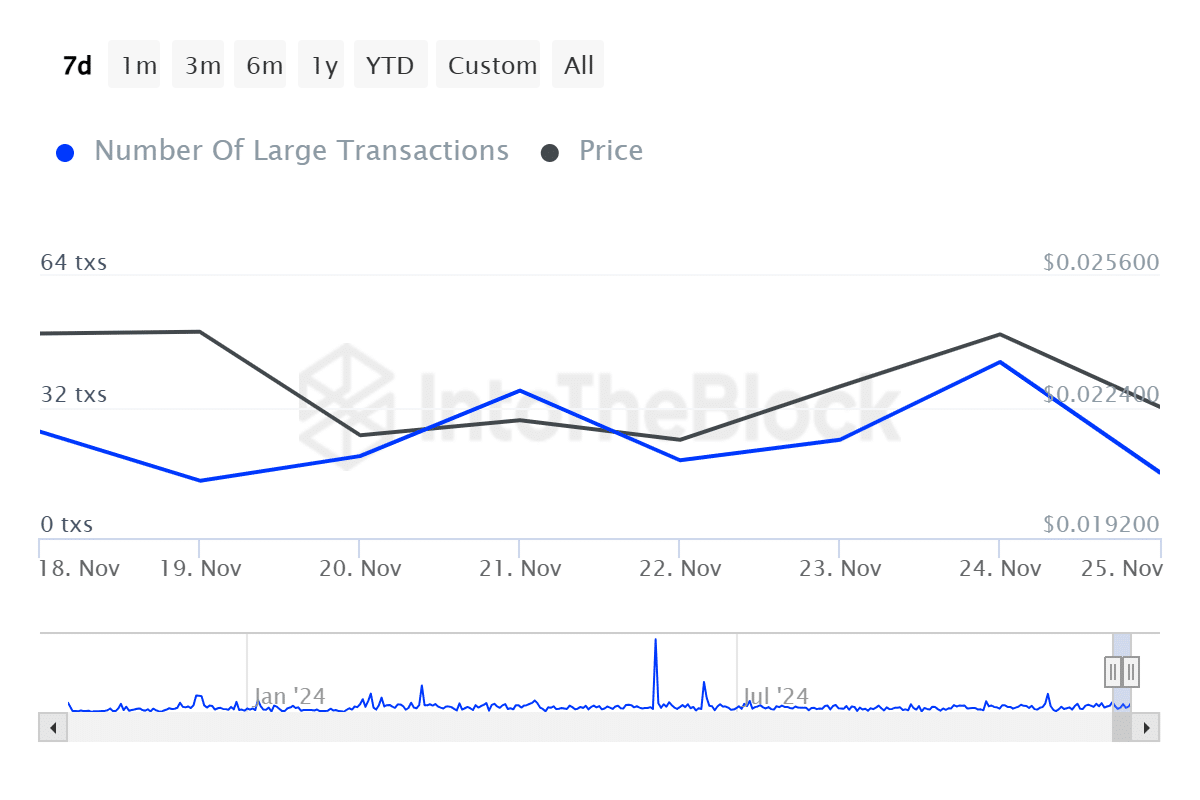

Declining whale and buying and selling exercise

Primarily based on AMBCrypto’s evaluation of IntoTheBlock’s knowledge, nearly all of the parameters have been leaning bearish. This was majorly propelled by the decline in giant transactions, which have been down 69% over the previous 24 hours.

This recommended that the large gamers are in a “wait-and-see” state of affairs — whales are observing Beam’s response to the $0.0202 assist degree.

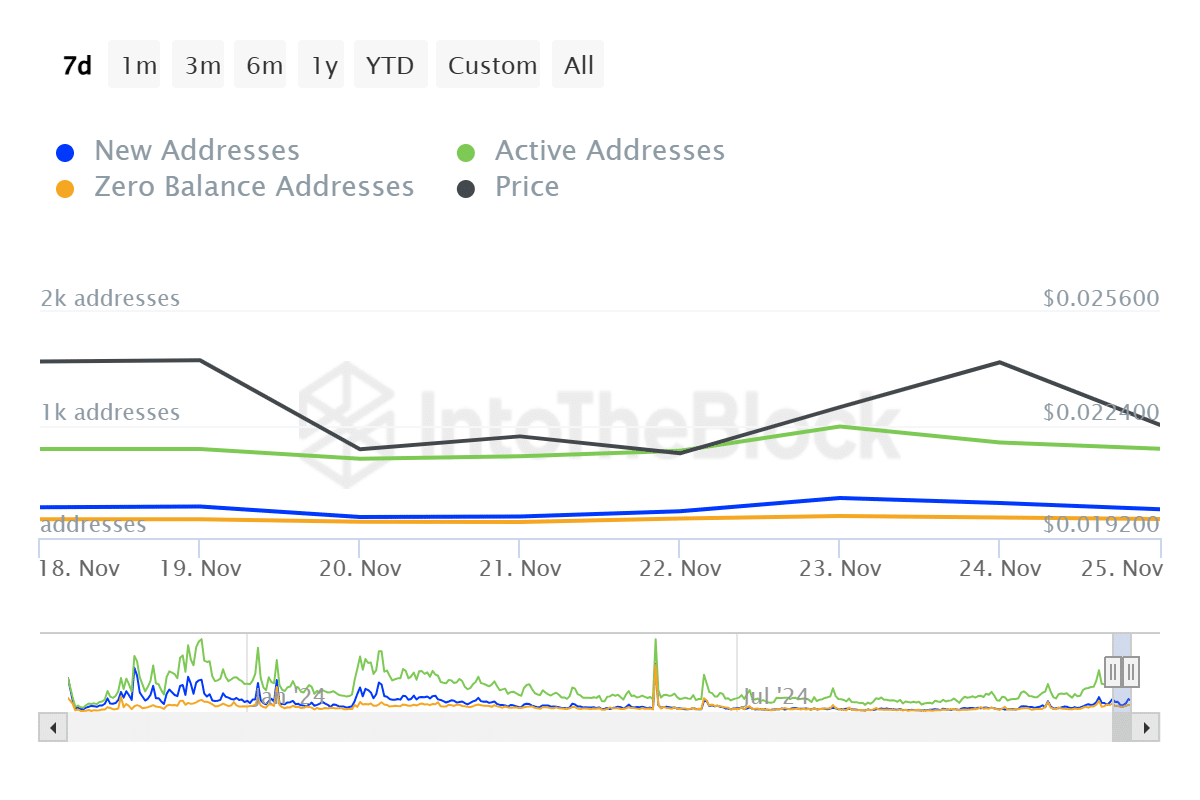

The shrinking whale exercise was additional bolstered by a 7% drop in energetic addresses. This important drop within the variety of energetic addresses indicated a discount in total Beam buying and selling exercise on the community.

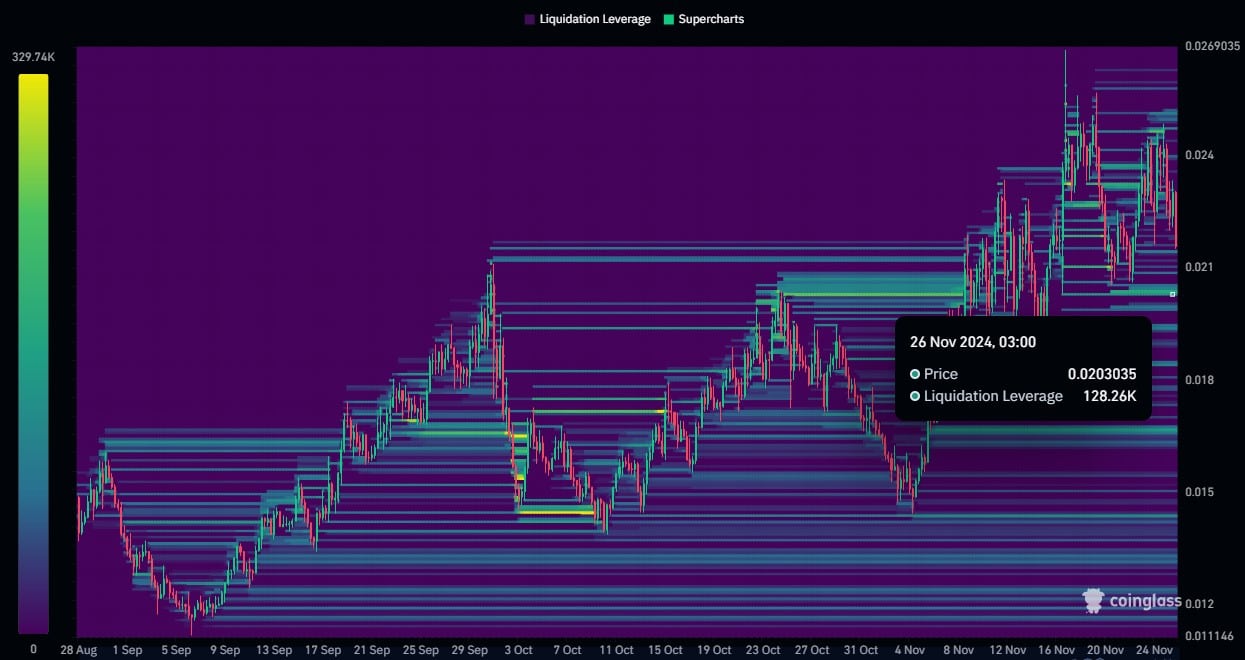

Liquidation pool to drag worth additional

Nonetheless, a considerable liquidation pool value 128.26K on the worth degree of $0.0203 added to the Beam’s bearish outlook.

This pool coincided with the important thing assist degree at $0.0202, and any breach might result in additional downward strain on Beam’s worth.

What’s subsequent for Beam?

The confluence of declining on-chain metrics and a bearish worth motion paints a regarding image for Beam’s short-term outlook.

Learn BEAM Price Prediction 2024-25

Nonetheless, the stochastic RSI provides optimistic assist for the bull, as there might be a worth correction in retailer in the long term.

The $0.0202 assist will likely be essential for the following worth setup. A breach beneath the worth degree might recommend an extra bearish run, whereas a bounce again might construct a foundation for a possible bullish rally.