Siren [SIREN] surged 27% in the last 24 hours, extending weekly gains to 97% as speculative momentum accelerated.

The AI-themed memecoin, deployed on the BNB Chain, saw daily trading volume climb to $17 million. That rise suggested renewed trader participation.

However, on-chain data hinted that the demand may not be entirely organic.

Is SIREN demand artificial?

Data from Nansen showed aggressive bot participation over the past 24 hours. One wallet accumulated more than $100,000 worth of SIREN within two hours.

Those purchases began near the $0.21 level. Since then, the price advanced more than 41% at its local peak.

That timing suggested algorithmic activity may have fueled the breakout rather than broad retail inflows.

In fact, Open Interest stood at $36.56 million, according to CoinGlass. That figure was well below the peak near $59 million on the 8th of February.

That divergence mattered. Rising price alongside muted Open Interest (OI) expansion often signal limited conviction from derivatives traders.

This left Spot-driven flows under scrutiny.

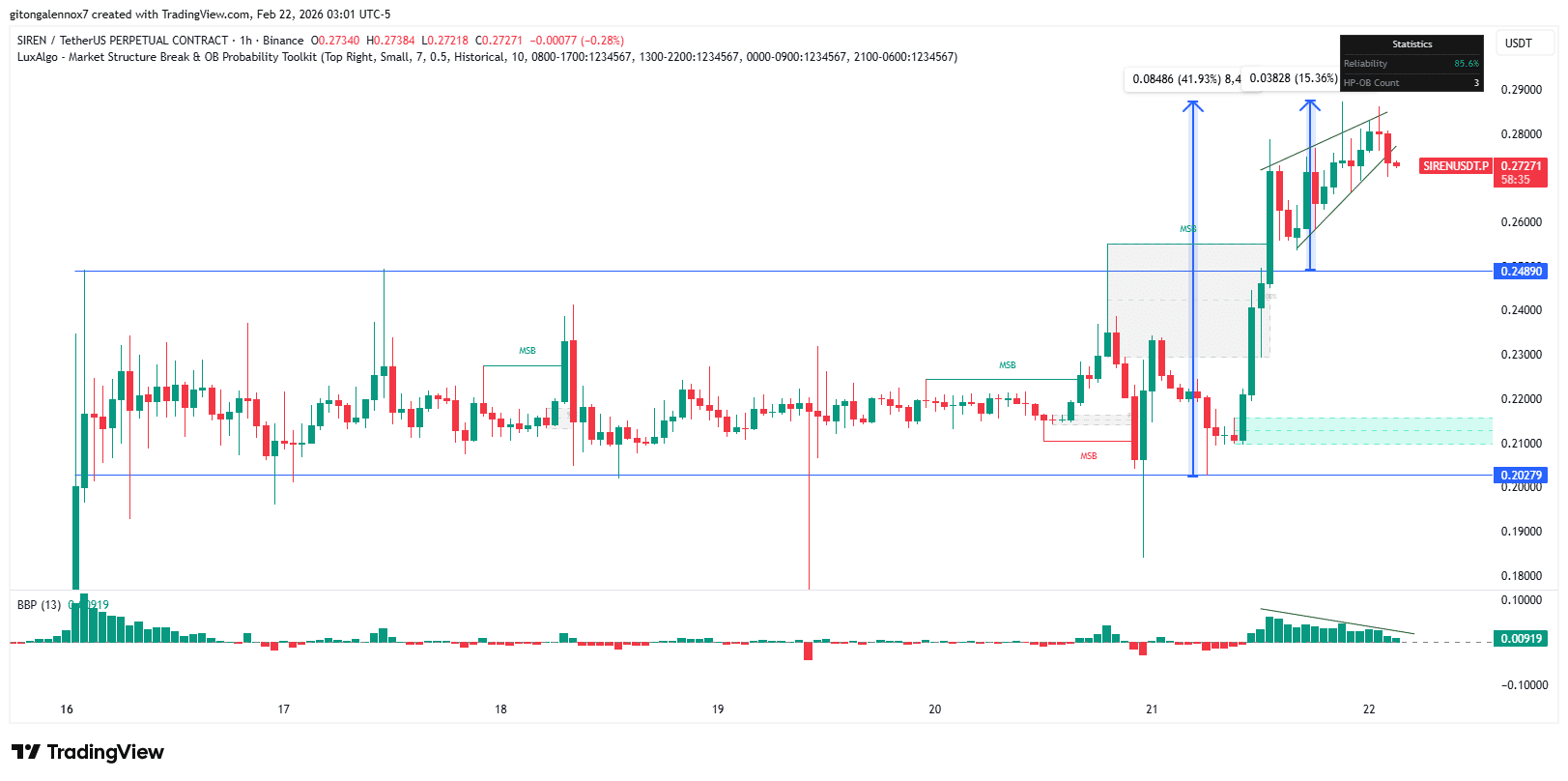

Market structure breaks as momentum slows down

Price action confirmed a Market Structure Break on higher timeframes. SIREN flipped the $0.25 resistance into support and gained another 15%.

For five sessions, the price oscillated between $0.21 and $0.25. Momentum remained flat during that range.

Even so, the Bull Bear Power (BBP) indicator showed weakening bullish pressure after the high on the 21st of February.

That slowdown aligned with visible rejection near $0.30.

On lower timeframes, the price formed a rising wedge pattern. Such formations often precede short-term pullbacks if volume fails to expand.

However, continuation toward the prior $0.40 peak could materialize if smaller timeframes sustain higher lows.

This left the token at a technical crossroads.

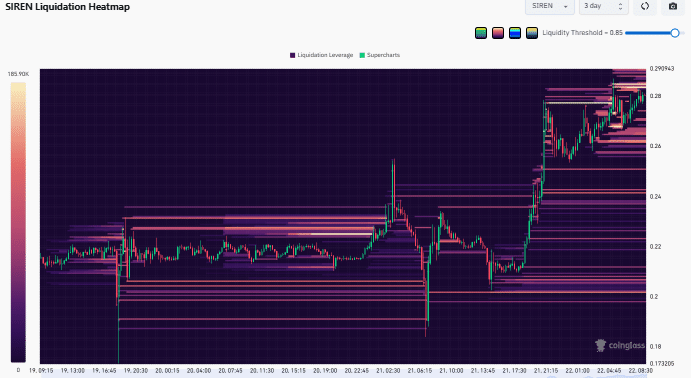

Denser liquidity clusters are building

The Liquidation Heatmap for the past 3 days showed the next move would be more robust than the current one. This is especially true if the price continued to bounce between $0.26 and $0.28, which had denser liquidity clusters.

After clearing liquidity between $0.20 and $0.24, the price rallied sharply to the upside. The same could be anticipated for the current setup, which is denser.

A run on either side of the liquidity clusters could amplify gains or revert them to losses.

Triggering orders around $0.28 would result in a short squeeze, while those at $0.26 would result in a long squeeze.

Therefore, SIREN was in an upward rally, but caution was warranted due to the fact that bot trading was dominating the token. Again, liquidity was building on both sides while a reversal pattern was forming.

Final Summary

- Nansen data showed a single wallet buying over $100,000 worth of SIREN within two hours, helping push the price sharply higher.

- The $0.26–$0.28 range has emerged as a critical liquidity pocket, according to the three-day Liquidation Heatmap.