- Ape’s breakout signals bullish potential, but resistance at $2.70 remains critical.

- Declining address activity could challenge sustained momentum despite positive on-chain and technical metrics.

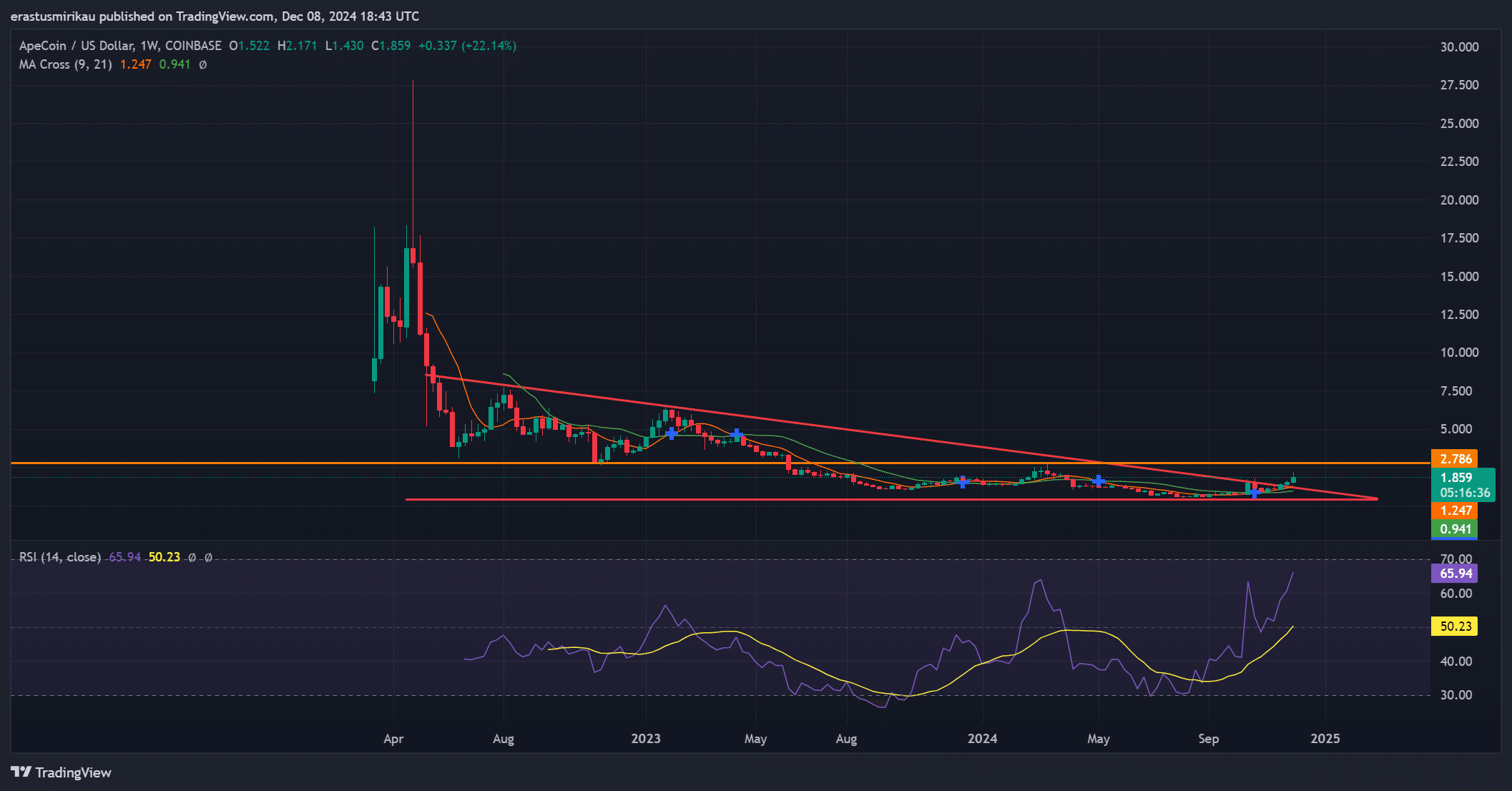

ApeCoin’s [APE] recent price breakout from a descending triangle pattern on the weekly chart has stirred market excitement, signaling a potential shift toward bullish momentum.

At press time, ApeCoin was trading at $1.86, down 2.61% in the past 24 hours, but technical indicators suggest room for further gains.

The RSI stood at 65.94, reflecting strong momentum, while a bullish moving average crossover, where the shorter MA has surpassed the longer MA, confirms an upward trajectory.

However, with a critical resistance level at $2.70 looming, the path ahead remains uncertain.

APE on-chain data shows mixed signals

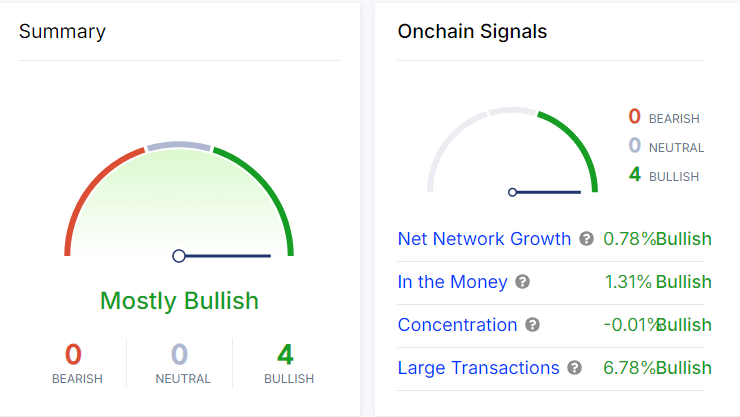

On-chain metrics provide a nuanced perspective on APE’s outlook. Net network growth shows a modest 0.63% bullish signal, and large transactions are up 2.45%, highlighting interest from significant players.

Additionally, concentration among holders reveals a minor bullish tilt of -0.03%. However, the “in the money” metric remains neutral at 0.42%, suggesting a lack of decisive sentiment.

Therefore, while on-chain signals lean bullish, they reflect caution, emphasizing the need for sustained momentum.

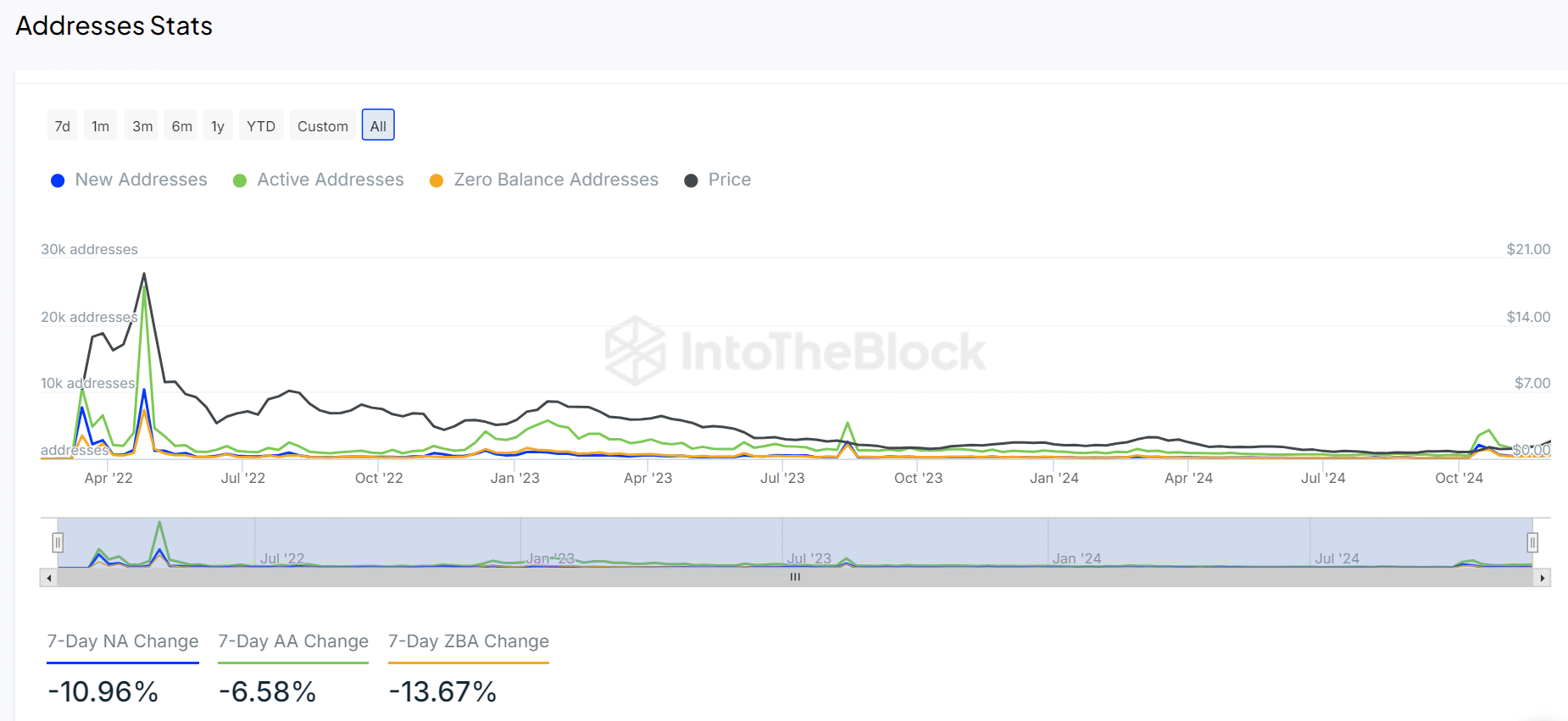

Address activity drops significantly

Address activity metrics, however, raise concerns about the ecosystem’s engagement. Over the past seven days, new addresses have fallen by 10.96%, while active addresses dropped by 6.58%.

Furthermore, zero-balance addresses decreased by 13.67%, reflecting declining activity across the board. This downturn in address participation could challenge Ape’s ability to sustain its breakout unless investor interest rebounds.

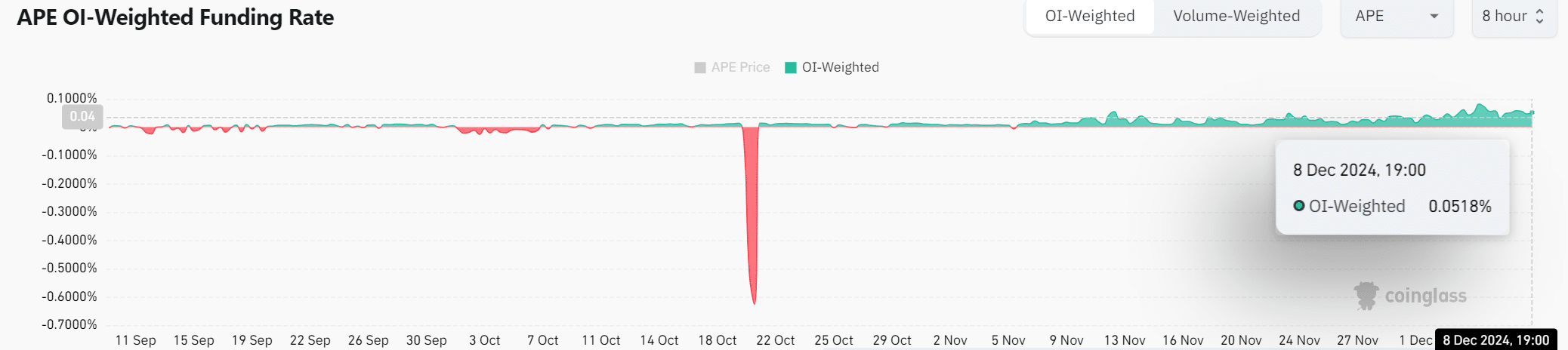

APE derivatives market remains cautiously optimistic

In the derivatives market, Ape’s OI-weighted funding rate currently stands at 0.0518%. This indicates a neutral to slightly bullish sentiment among traders, with no significant bearish pressure evident.

However, the lack of overwhelming bullish sentiment suggests that traders remain cautious, awaiting stronger catalysts to drive a decisive rally.

While Ape’s breakout from the descending triangle pattern and bullish technical indicators suggest a strong upward potential, several factors could determine the sustainability of this momentum.

The resistance at $2.70 remains a significant hurdle, and the recent decline in address activity, with drops in new, active, and zero-balance addresses, raises concerns about long-term investor engagement.

Read ApeCoin’s [APE] Price Prediction 2024–2025

On-chain and funding rate metrics show mixed but cautiously optimistic signals, highlighting the need for sustained participation from both retail and institutional investors.

Therefore, Ape’s ability to maintain its bullish trajectory depends on overcoming these challenges, breaking key resistance levels, and fostering a more active and engaged ecosystem.