- PEPE whale offloaded $6.52M worth of PEPE, with a cost basis of $0.00000832

- Will more whales follow suit if the support breaks?

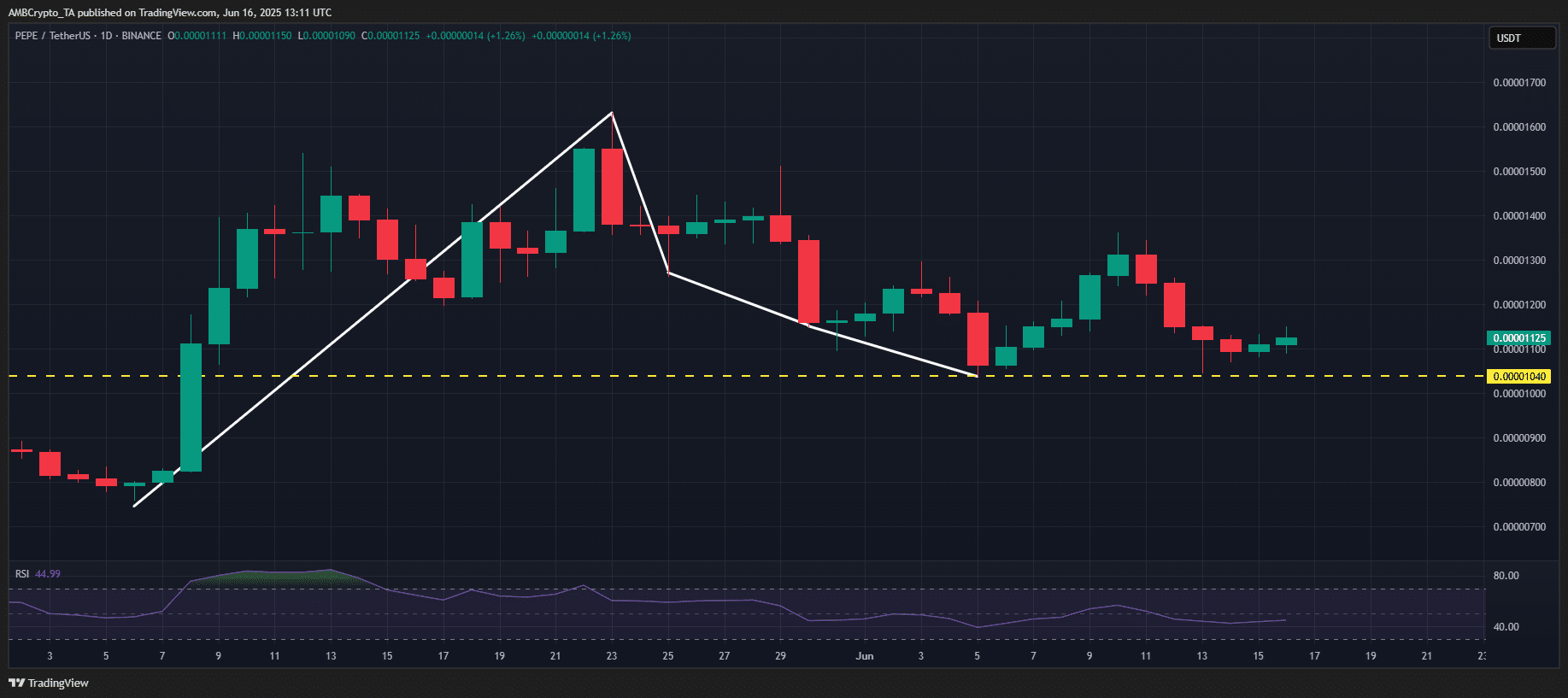

A month ago, PEPE’s drop to $0.000007 triggered a sharp accumulation phase, igniting a 36% rally that propelled the price to a four-month high.

Despite a recent cooldown, the memecoin remains around 57% from that peak, keeping a large portion of participants in the green. With 87% of its supply held by the top 1% of addresses, it’s clear that whales are still sitting on healthy unrealized profits.

However, that also raises the stakes. At the time of writing, PEPE’s structure was leaning on a fragile support zone. And, if it gives way, profit-rich whales could start offloading. Not out of fear, but to lock in gains before FOMO fades.

Sure, the $0.000010-level has sparked solid dip-buying twice, but we’re yet to see a convincing bounce. A breakdown here wouldn’t just form a fourth lower low, it could also trigger whale profit realization.

Whale distribution emerges as PEPE tests structural limits

In fact, whale activity is already flashing early warning signs.

SpotOnChain tracked a key move where a whale deposited 595.2 billion PEPE, worth $6.52 million, into Binance. It secured a $1.57 million profit (+32%) after riding the last accumulation cycle.

More critically, the whale’s cost basis at $0.00000832 seemed to reinforce AMBCrypto’s thesis – Short-term whales are rotating out as price momentum stalls near local highs.

This isn’t random profit-taking. Instead, it’s calculated, coming right as PEPE struggles to reclaim its range highs.

However, the catch is – The position isn’t fully closed. 104.4 billion PEPE worth $1.15 million remains in another wallet, holding $320k in unrealized gains. In turn, putting PEPE’s $0.000010 support under pressure.

The coming sessions are pivotal. A confirmed lower low below this level could trigger whale rotation, not out of panic, but to preserve tightening margins.

Therefore, chart vigilance is critical. This is where smart money decides whether to hold or hit the exits.