- WIF’s price fell after Sphere denied any advertising deal, sparking transparency concerns

- Bitcoin’s market influence and whale accumulation could shape WIF’s volatile price action

Memecoins are no strangers to hype-driven marketing, with Dogwifhat (WIF) recently leaning into it too. However, what started as an ambitious crowdfunding campaign to showcase WIF on the Las Vegas Sphere has turned into a controversy, one that has shaken investor confidence.

Dogwifhat’s Las Vegas Sphere campaign

The Dogwifhat (WIF) community launched a crowdfunding initiative in early 2024, raising nearly $700,000 to display the token’s logo on the Las Vegas Sphere. This marketing push initially drove excitement and pushed WIF’s price to an all-time high of $4.83 in March 2024.

Community doubts and official denial

As months passed without confirmation from Sphere’s management, skepticism within the WIF community grew. On 28 January 2025, Dogwifhat’s official X (formerly Twitter) account reignited discussions with a post stating, “Officially confirmed. Viva hat Vegas,” accompanied by an edited image hinting at a Q1 2025 event.

However, the post was later edited to remove the phrase “officially confirmed,” further fueling speculations.

On 31 January though, a spokesperson for Sphere publicly denied any agreement with Dogwifhat, stating,

“There was and is no plan for Dogwifhat to appear on the Exosphere, and we are distressed they are using our name for fraudulent purposes.”

This revelation led to an immediate backlash, raising concerns over transparency and the legitimacy of WIF’s campaign organizers.

In response, Dogwifhat’s team asserted that they had been negotiating through intermediaries due to their decentralized nature. They assured contributors that funds would be refunded if the advertisement did not materialize, emphasizing that there has been no intent to deceive investors.

WIF whale accumulation and future outlook

Despite the ongoing turbulence, however, notable investors remain bullish. On 29 January, prominent crypto investor Ansem accumulated 915,828 WIF tokens for $1.2 million USDC, marking his first purchase in three months. This, coupled with approximately $2 million in short liquidations, briefly supported WIF’s price before the broader market sell-offs resumed.

Looking ahead, analysts remain divided on WIF’s prospects. Some projections suggest the token could rally to $4.01 in February 2025 – Representing a potential 233% upside. However, investors should remain cautious with prevailing market skepticism and lingering questions around the Sphere controversy.

Market reactions – A rollercoaster ride

Despite the controversy, WIF registered a temporary rally after the misleading announcement, surging by 34.7% to $1.34. However, following Sphere’s public denial, WIF retraced its gains, shedding nearly 10% of its value.

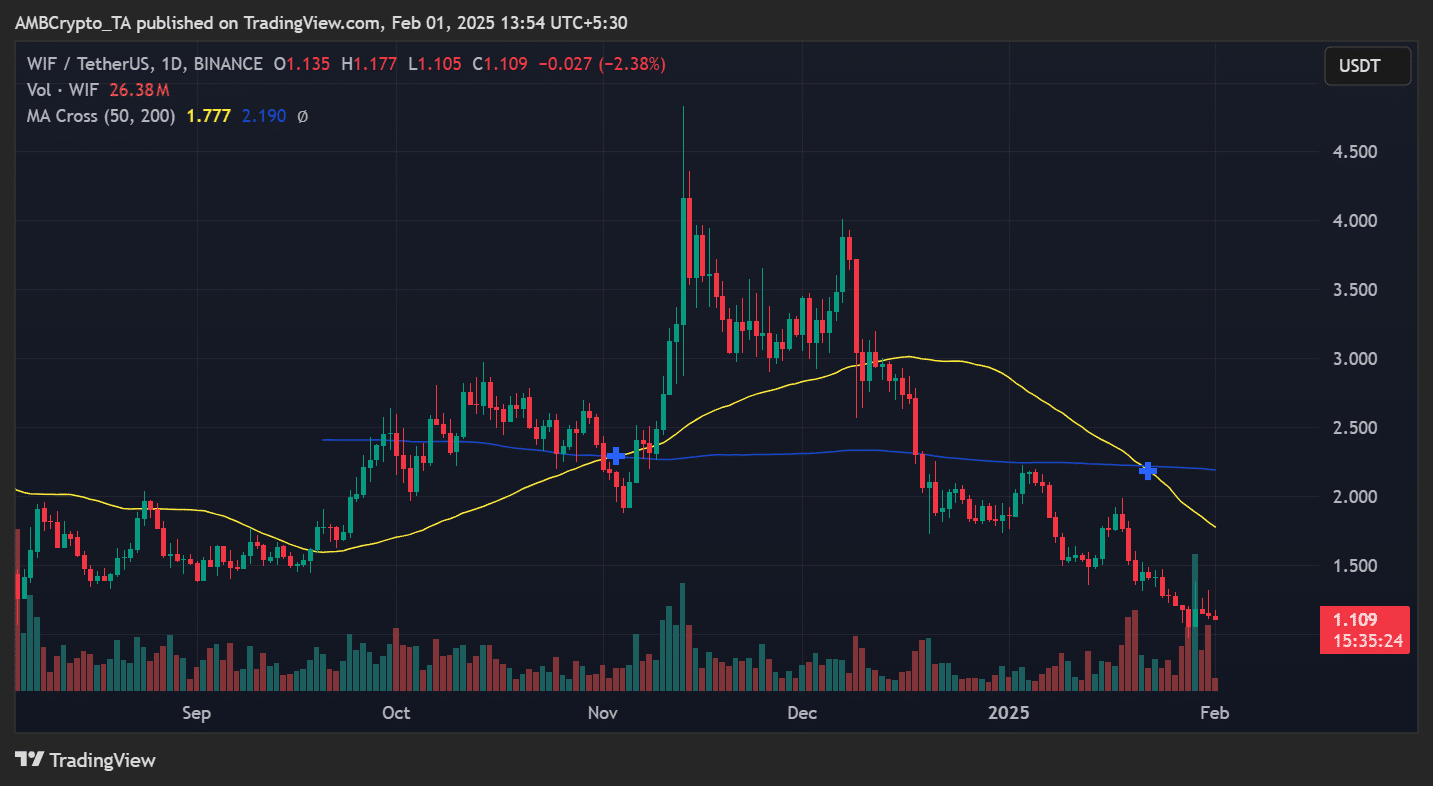

At the time of writing, the token was trading at $1.109 – Marking a 2.38% intraday decline. The broader market trend seemed bearish too, with WIF down by 76.9% from its peak.

Technical analysis

The attached price chart indicated that WIF was trading below both its 50-day and 200-day moving averages – A classic bearish indicator. The moving average cross, with the 50-day at 1.777 and the 200-day at 2.190, hinted at sustained downward momentum.

Additionally, the hike in selling pressure was evident across the altcoin’s recent trading volumes, further reinforcing bearish sentiment.

Traders’ sentiment – Long/short ratio analysis

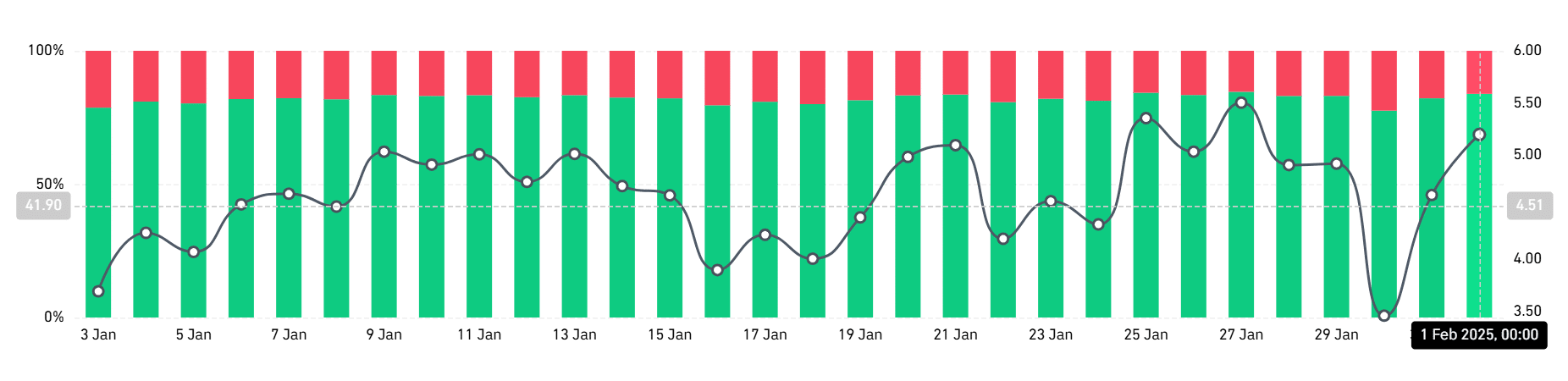

The Binance WIFUSDT Long/Short (Accounts) Ratio chart highlighted shifting trader sentiment in the wake of the Las Vegas Sphere controversy. The data pointed to fluctuating long and short positions – A sign of uncertainty among traders.

At the start of the observed period, the long/short ratio was relatively stable and hovered around 41.90, suggesting that long positions dominated market sentiment. However, a downtrend soon emerged, coinciding with WIF’s declining price action.

Notably, as selling pressure rose, the long/short ratio registered some volatility, with a marked dip followed by a sharp rebound.

By 01 February 2025, the ratio had dropped significantly before recovering to 4.51 – A sign that short positions briefly overtook long positions before bullish sentiment returned.