- TRON’s USDT supply climbed to an all-time high, marking a significant milestone in the blockchain’s growing dominance

- High CEX activity on TRON may be a sign of the blockchain’s strategic positioning within the market

TRON’s USDT supply has climbed to an all-time high, marking a significant milestone in the blockchain’s growing dominance. As more investors and traders migrate their liquidity to TRON, its role in the broader crypto ecosystem will only strengthen.

The hike in USDT supply is a sign of rising transaction volumes and deeper DeFi integration. Simultaneously, TRON’s on-chain activity has surged too, with active addresses increasing and downside risk declining.

Rise of TRON’s trading influence

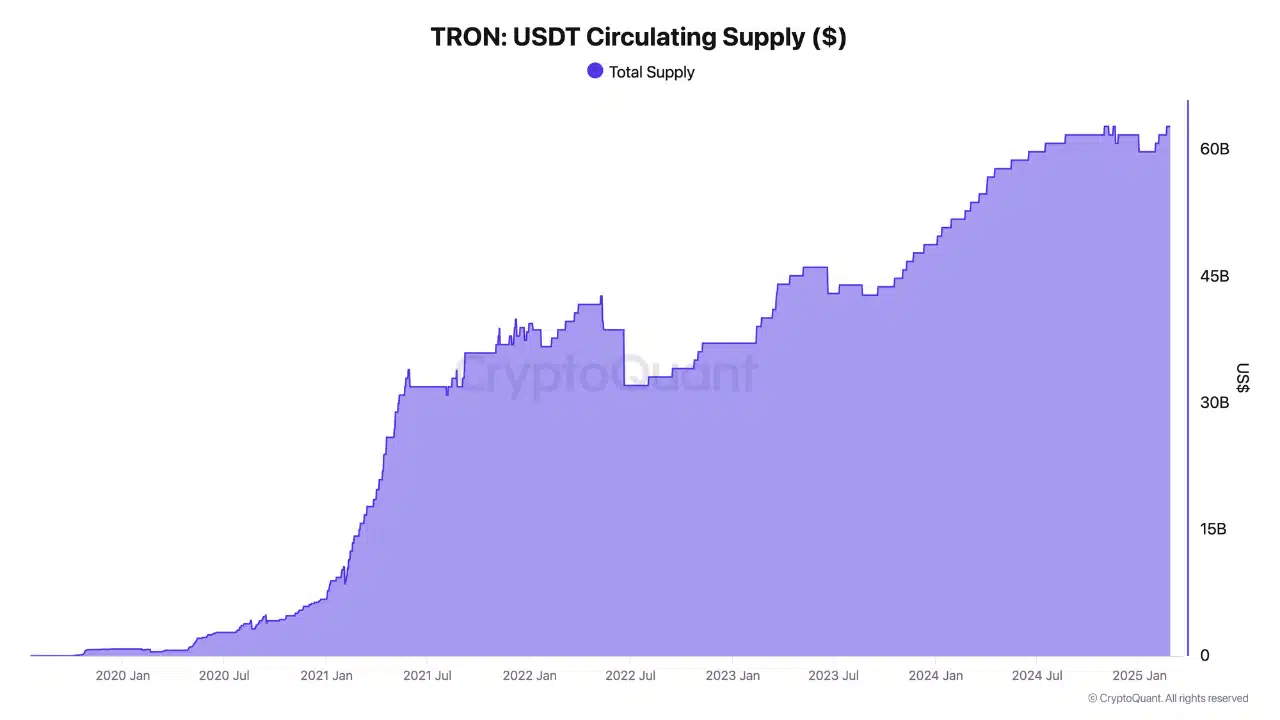

USDT’s supply on TRON has expanded significantly, surpassing historical levels. Such an uptick usually reflects heightened adoption, with traders favoring it for its efficiency and low transaction costs.

As a result, it has become a preferred network for stablecoin transactions, rivalling Ethereum in daily volume. The growth in supply could mean sustained demand for USDT on TRON, reinforcing its role as a key player in the crypto-financial infrastructure.

Additionally, the expansion of TRON’s USDT circulation seemed to highlight strong DeFi participation. Investors leverage USDT liquidity for staking, lending, and yield farming across its-based platforms.

With total supply exceeding 60 billion USDT, TRON has cemented itself as a fundamental layer for stablecoin transactions, providing a reliable settlement network for users worldwide.

TRON’s growing role in digital transactions

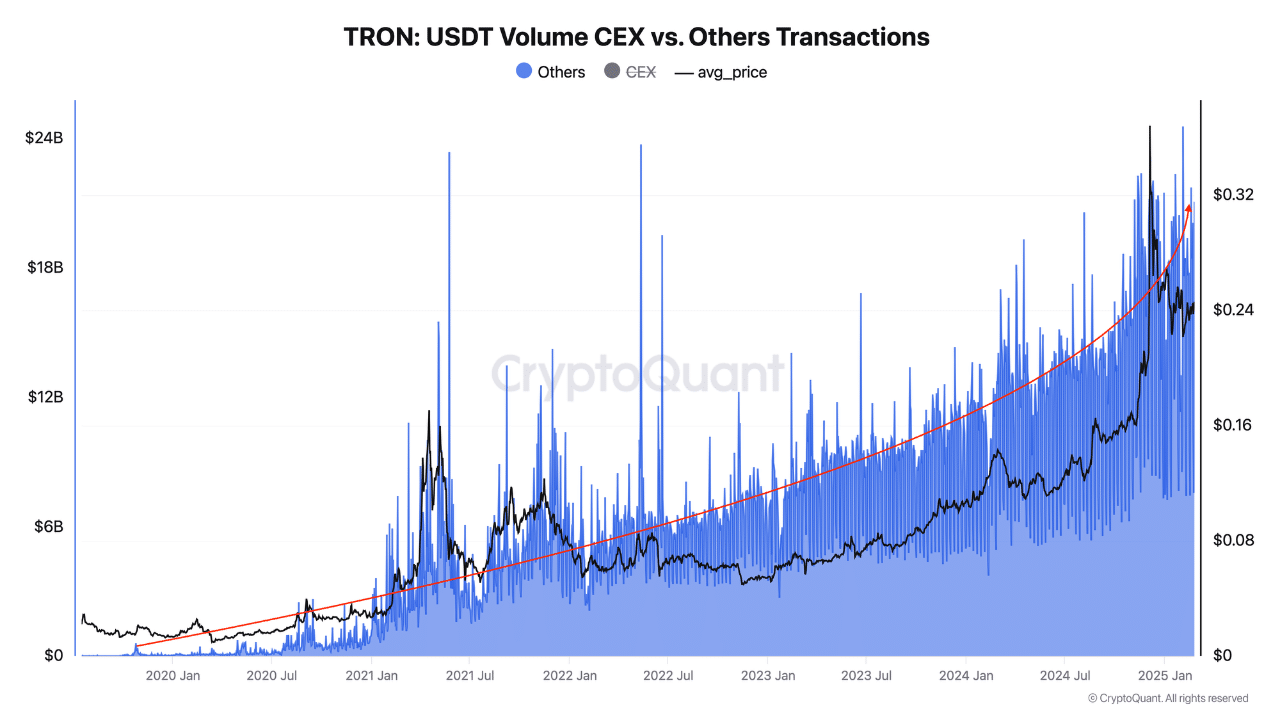

An analysis of USDT volume on TRON-based centralized exchanges (CEXs) has skyrocketed as well. In 2020, for instance, daily volumes ranged from $50 million to $500 million. At the time of writing, however, they had exceeded $4 billion.

This exponential growth hinted at TRON’s increasing relevance in crypto trading. As users execute transactions at scale, TRON’s infrastructure has proven resilient, offering rapid confirmations and low fees.

High CEX activity on TRON could also allude to the blockchain’s strategic positioning within the market. The uptick in volume means traders have been shifting from traditional chains to TRON, benefiting from its seamless transfer capabilities.

A thriving community of active participants

Furthermore, on-chain USDT transaction volume has outpaced centralized exchange volume by nearly fivefold, reinforcing TRON’s decentralized character. This surge could mean that traders and institutions are moving significant liquidity within TRON’s blockchain, favoring its security and efficiency.

Also, the strong on-chain transaction activity implied a hike in DeFi adoption and peer-to-peer transfers. As CeFi and DeFi continue to converge, TRON’s ability to handle high transaction volumes efficiently makes it a prime candidate for broader financial applications.

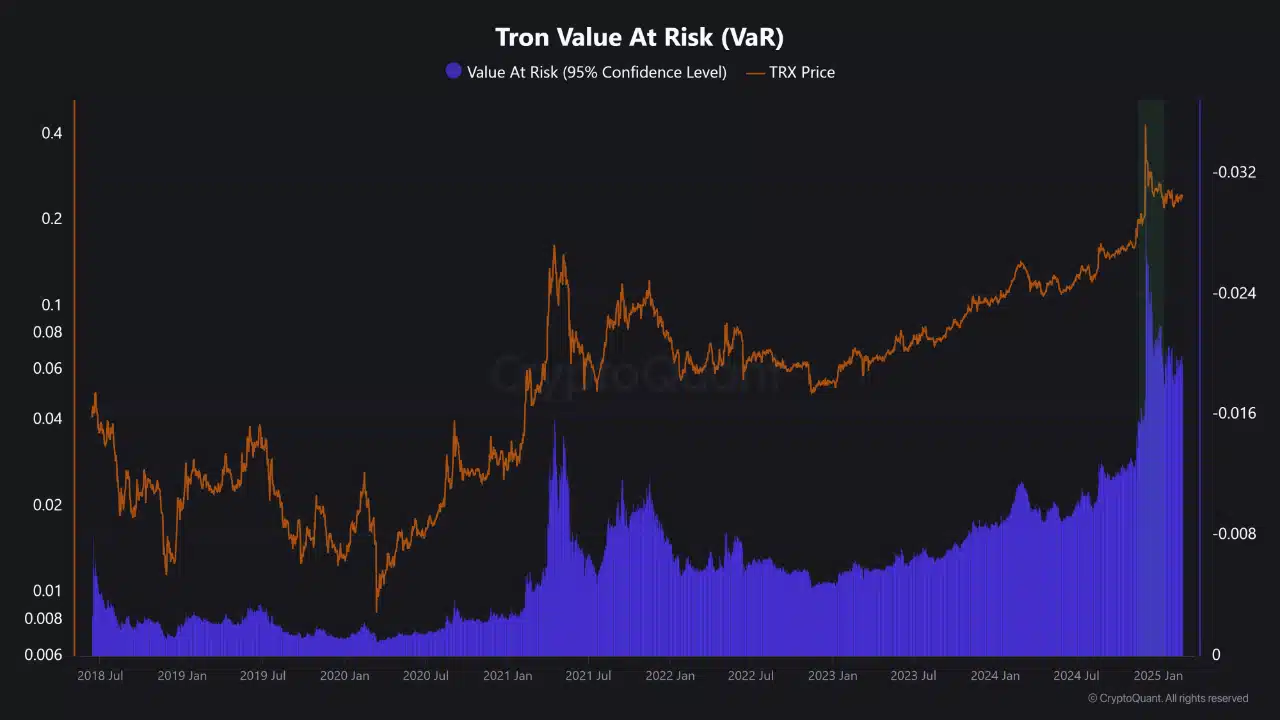

TRON’s active addresses and value at risk

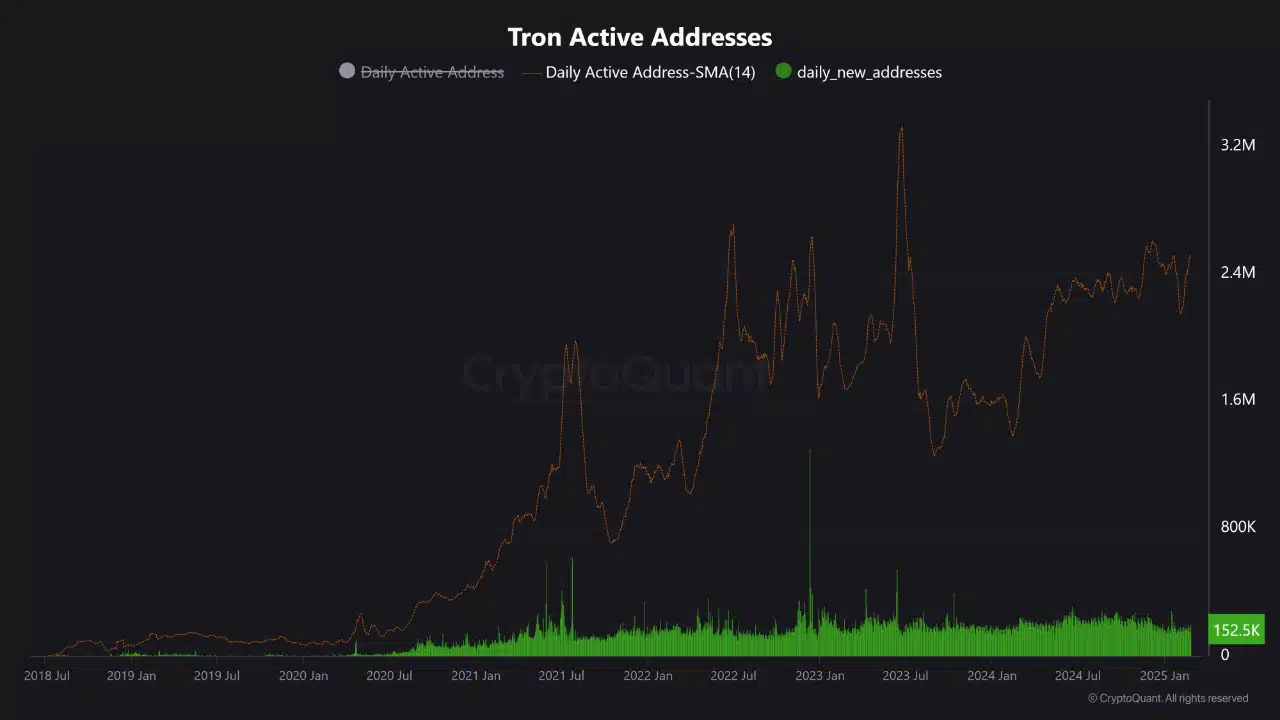

Finally, TRON’s daily active addresses have surged on the charts, indicating higher user engagement and stronger network fundamentals. The 14-day SMA of active addresses, for instance, underlined consistent growth at press time – A sign of long-term adoption.

Simultaneously, new addresses have continued to emerge, reinforcing TRON’s expanding user base.

Meanwhile, TRON’s Value at Risk (VaR) declined, reducing potential downside risk. This trend alluded to a maturing market structure, one where higher network activity stabilizes price movements.

Hence, despite occasional volatility, TRON’s resilience may be evident. Especially since lower VaR implies greater investor confidence and lower susceptibility to sharp corrections.