It’s no secret that Ethereum’s performance has been tame compared to Bitcoin since the start of this cycle. However, this trend became most apparent at the start of the year when ETH’s price fell toward the $3,000 mark while BTC continued to move sideways above $100,000.

When the Bitcoin price eventually lost the $100,000 level in the first quarter, the value of Ethereum had already fallen close to $2,000. While the premier cryptocurrency has reached a new all-time high in recent days, the “king of altcoins” faces significant resistance around $2,800.

Will Divergence Lead To Revaluation Of Investment Strategies?

The rate of both assets’ price growth in the past few weeks and months provides an insight into the declining relationship between Bitcoin and Ethereum. In a recent Quicktake post on the CryptoQuant platform, on-chain analyst Carmelo Aleman shared that a decoupling has occurred between the world’s two largest cryptocurrencies.

Aleman defined correlation in his post:

Correlation is a statistical measure of the relationship between two variables. In financial analysis, it helps determine whether two assets tend to move in the same direction (positive correlation), in opposite directions (negative correlation), or independently (near zero).

Historically, Bitcoin and Ethereum have always maintained a strong positive correlation — usually above 0.7. This long-term trend explains why most of BTC’s movements were often mirrored by the price of Ethereum over the past few years.

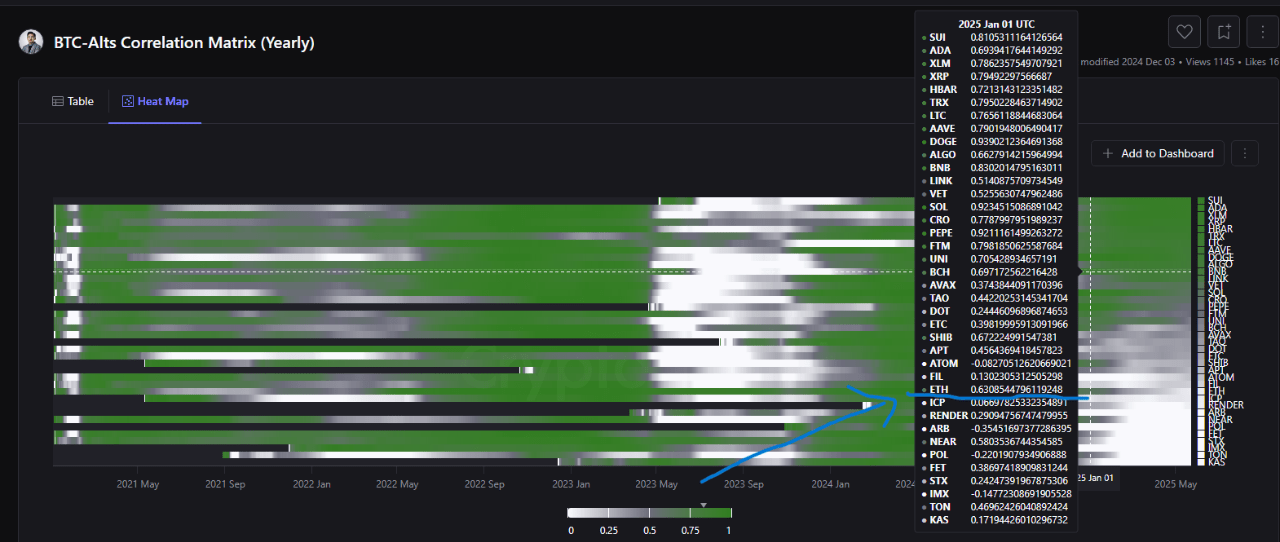

Source: CryptoQuant

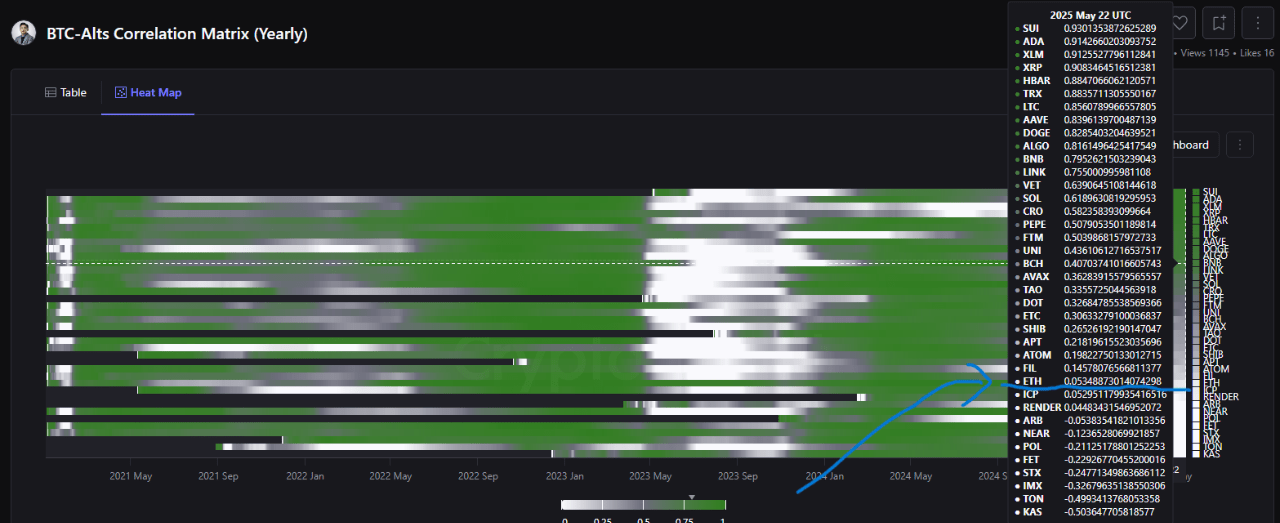

Aleman, however, noted that a decoupling has occurred between the top two assets since start of this year. Data from the BTC-Alts Correlation Matrix (Yearly) shows that the correlation was 0.63 on January 1, 2025 before falling to 0.05 by May 22, 2025.

Source: CryptoQuant

From an investment perspective, this major divergence breaks one of the crypto market’s most consistent patterns, leading to a reevaluation of strategies based on Bitcoin-Ethereum correlation. “It also adds uncertainty for investors, who can no longer expect ETH to follow BTC,” Aleman added.

The on-chain analyst said:

Portfolio models, risk strategies, and return forecasts must now adapt. This may also reflect how Ethereum is becoming driven by its own internal factors—like protocol upgrades, regulation, or DeFi—indicating growing independence.

Aleman also mentioned that this shift means Ether and related assets are at an increased risk of missing out on bull markets. This effect is largely seen in 2025 where the Bitcoin price has climbed, while the value of ETH and other Ethereum-related altcoins has often stalled or declined.

Bitcoin And Ethereum Price

As of this writing, Bitcoin and Ethereum are valued at around $107,450 and $2,507, respectively. While the BTC price climbed by more than 5% this past week, ETH’s value is up by less than half of that in the same period.

The price of BTC against ETH on the daily timeframe | Source: BTCETH chart on TradingView

Featured image from iStock, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.