Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

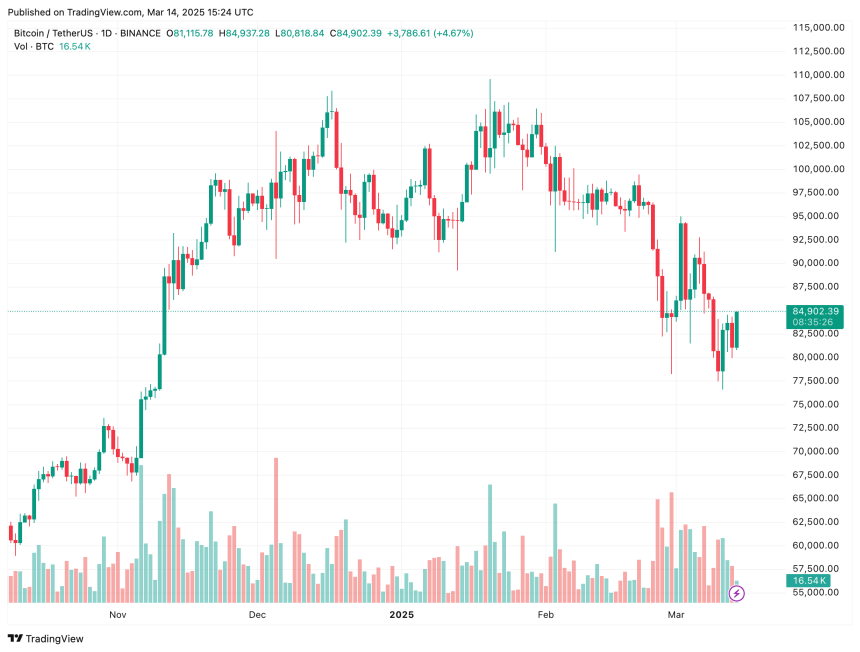

As Bitcoin (BTC) struggles amid the latest crypto market pullback – failing to decisively break past the $84,000 resistance – gold (XAU) continues its impressive rally, soaring to a record high of $3,000 per ounce on March 14.

Bitcoin Gets Outshined By Gold

2025 has started on a shaky note for the world’s largest cryptocurrency. BTC is down over 10% year-to-date (YTD), falling from approximately $94,000 on January 1 to around $84,000 at the time of writing. On the flip side, gold has surged nearly 13% in the same period.

Related Reading

Market analyst Northstar shared the following chart on X yesterday, illustrating the BTC-to-gold ratio over the past 12 years. According to the chart, BTC is beginning to break below a critical support line that has held strong for more than a decade.

If Bitcoin sustains price action below this support line for several weeks or months, it could signal the end of the current crypto bull run. BTC’s underperformance against gold is also evident in the contrasting capital flows into BTC and gold exchange-traded funds (ETFs).

According to data from the World Gold Council, US-based spot gold ETFs have attracted inflows exceeding $6 billion YTD. Globally, spot gold ETFs have seen more than $23 billion in inflows.

Meanwhile, data from SoSoValue indicates that US-based spot BTC ETFs have experienced nearly $1.5 billion in net outflows YTD. This sharp contrast in capital movement reflects a shift in investor strategy from risk-on to risk-off assets.

Several factors may explain investors’ growing aversion to risk-on assets, including US President Donald Trump’s new trade tariffs, the US Federal Reserve’s (Fed) hawkish monetary policy, and the recent stock market rout.

Is The Crypto Bull Run Over?

BTC’s underperformance relative to gold casts doubt on the longevity of the current crypto bull market. The total crypto market cap has shed over $600 billion since the start of the year, now standing at approximately $2.8 trillion.

Related Reading

Renowned gold advocate Peter Schiff argues that BTC has already been in a bear market for the past three years. In an X post, Schiff stated:

One Bitcoin now buys 27.7 ounces of gold. At its peak in 2021, one Bitcoin bought 36.3 ounces of gold. That means that in terms of gold, which is real money, the price of Bitcoin has fallen by 24%. So Bitcoin has been in a stealth bear market for the past three and a half years.

That said, positive macroeconomic developments could still turn the tide in BTC’s favor. For example, US inflation appears to be cooling, which may pressure the Fed to pivot toward quantitative easing and boost market liquidity – a potential boon for risk-on assets.

Likewise, a breakdown in the US dollar index could reignite optimism for assets like stocks and cryptocurrencies. At press time, BTC trades at $84,902, up 3.8% in the past 24 hours.

Featured image from Unsplash, charts from X and TradingView.com