Data shows the Correlation between Bitcoin and S&P 500 has declined to zero recently, a sign that BTC is no longer attached to the stock market.

Bitcoin Correlation To S&P 500 Has Witnessed A Plunge Recently

In a new post on X, the market intelligence platform IntoTheBlock has discussed about the trend in the Correlation between Bitcoin and S&P 500. The “Correlation” here refers to an indicator that keeps track of how tied together the prices of any two given assets are.

When the value of this metric is positive, it means the price of one of the assets is reacting to movements in the other by traveling in the same direction. The closer is the indicator to 1, the stronger is this relationship.

On the other hand, the metric being under the zero mark implies that while there is also some correlation present between the assets in this case, it’s a negative one. This suggests that the charts are moving in the opposite direction to each other. For this zone, the extreme point is -1, corresponding to the tightest relationship.

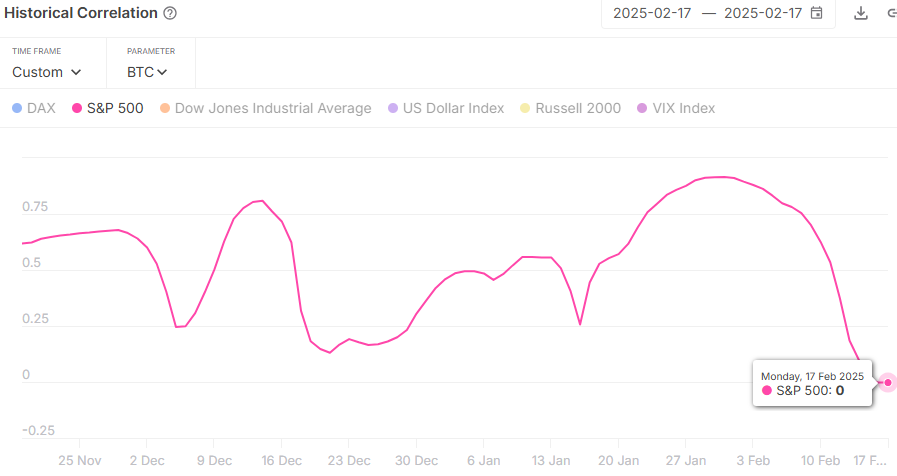

Now, here is the chart for the Correlation shared by the analytics firm, which shows the trend in the metric’s value for Bitcoin and S&P 500 over the last few months:

As displayed in the above graph, the Correlation between Bitcoin and S&P 500 rose close to the 1 mark during January, which means the prices of the two were showing a strong positive relationship.

Since peaking at the start of this month, though, the indicator has observed a sharp downward trajectory, and its value has today come down to exactly zero. Such a value implies there is no correlation whatsoever present between the assets. In statistics, the variables are said to be independent in this scenario.

The Correlation can be a useful indicator to watch for when an investor wants to diversify their holdings. Assets that have a close relationship may not be worth investing in at the same time, but ones that have a low value of the metric can make for smart diversification options. As it is currently, the S&P 500 could provide something different to Bitcoin investors and vice versa.

“The last time we saw such a low correlation was on November 5th, 2024, just before Bitcoin soared past the 100k mark,” notes IntoTheBlock. With BTC free from the stock market once more, it’s possible that the cryptocurrency could show a big move this time as well. It only remains to be seen, however, how long the coin can stay away from the influence of traditional assets.

BTC Price

Bitcoin has continued its recent trend of consolidation during the last few days as its price is still locked around the $96,000 level.