Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Data shows the Bitcoin futures market has seen a massive deleveraging event recently. Here’s what this reset could mean for BTC, based on past trends.

Bitcoin Open Interest Has Gone Through A Crash Recently

As pointed out by an analyst in a CryptoQuant Quicktake post, the BTC Open Interest has seen a retest recently. The “Open Interest” refers to an indicator that keeps track of the total amount of futures positions related to Bitcoin that are currently open on all derivatives exchanges.

Related Reading

When the value of this metric rises, it means the investors are opening up more positions on the market. Generally, the total leverage present in the sector goes up when this happens, so this kind of trend can lead to more volatility for the asset.

On the other hand, the indicator going down implies the futures users are closing up positions or getting forcibly liquidated by their platform. As leverage decreases following such a trend, the market can act in a more stable manner.

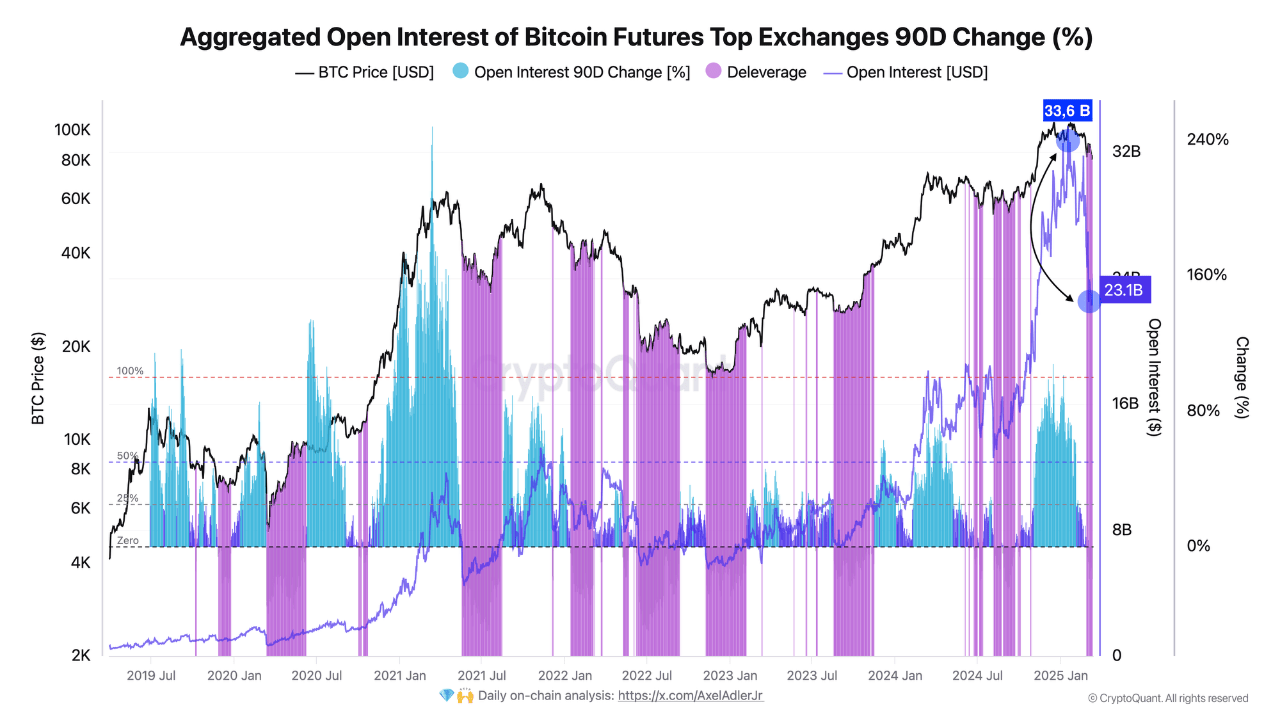

Now, here is the chart shared by the analyst, that shows the trend in the Bitcoin Open Interest, as well as its 90-day percentage change, over the last few years:

As displayed in the above graph, the Bitcoin Open Interest shot up to a new all-time high (ATH) of $33.6 billion back in January. Interestingly, this peak in the indicator coincided with the ATH in the price itself.

As mentioned before, a rise in the Open Interest can lead to volatility for the cryptocurrency. The reason behind this lies in the fact that a mass liquidation event, popularly known as a squeeze, can become more probable to occur when the market is overleveraged.

In such an event, a sharp swing in the price triggers a large amount of simultaneous liquidations, which end up acting as fuel for the move itself, thus elongating its length. This unleashes a cascade of further liquidations. The volatility emerging out of an increase in the Open Interest can, in theory, take Bitcoin in either direction. During the earlier bull rally, the Open Interest increase was accompanied by bullish momentum.

From the chart, it’s visible, however, that the indicator reached a turning point around the time of the aforementioned peak. As bearish momentum took over Bitcoin following the ATH, it was now the turn of the bulls to get liquidated. The massive long squeezes that the price legs down induced helped to further the price decline, explaining its sharpness.

Related Reading

Today, the Open Interest is down to just $23.1 billion, with the indicator’s 90-day change sitting at a notable low of -14%. In the chart, the quant has highlighted the previous deleveraging events where the metric plummeted in a similar manner.

“Looking at historical trends, each past deleveraging like this has provided good opportunities for the short to medium term,” notes the analyst. It now remains to be seen whether this cooldown in the futures market will be enough for Bitcoin to see a rebound or not.

BTC Price

At the time of writing, Bitcoin is trading at around $83,500, up 1% in the last 24 hours.

Featured image from Dall-E, CryptoQuant.com, chart from TradingView.com