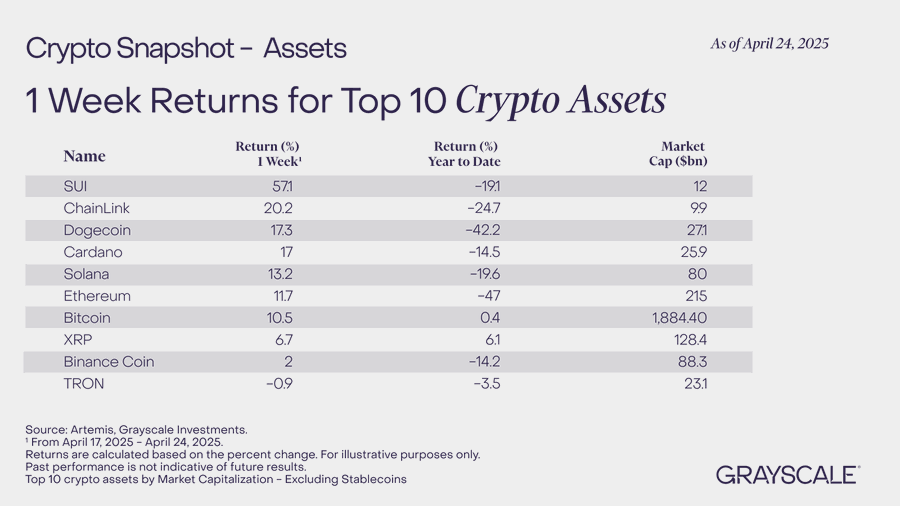

- Bitcoin and XRP posted gains, while Ethereum and Dogecoin dragged Grayscale portfolios lower over the year.

- Memecoins like Dogecoin lost appeal, with the sector declining 44.3% year-to-date.

The crypto market regained momentum following a prolonged downtrend, with its press time valuation going to $2.96 trillion. Remarkably, it hovered just $40 billion shy of its previous peak of $3 trillion.

Crypto assets such as Bitcoin [BTC], Ethereum [ETH], Ripple [XRP], and Dogecoin [DOGE] have maintained their positions in the market, contributing to the market’s growth.

However, Grayscale, an institutional investment platform for traditional finance investors, revealed that only a few of these top assets have been profitable.

Could this be the moment smart money rewrites its playbook?

A recent Grayscale report comparing several of its crypto holdings shows that BTC and XRP have turned a profit, while ETH and DOGE have contributed to losses.

According to the report, Ethereum and Dogecoin slumped 47% and 42.2%, respectively, over the past year.

Meanwhile, Bitcoin and XRP delivered gains of 0.4% and 6.1%, cementing their positions as top performers.

This type of market sentiment often dictates potential market movements, as retail and other institutional investors use it as a guide to decide where to channel their next investments.

AMBCrypto, meanwhile, has analyzed why these individual assets rank as either top performers or underperformers within Grayscale’s portfolio.

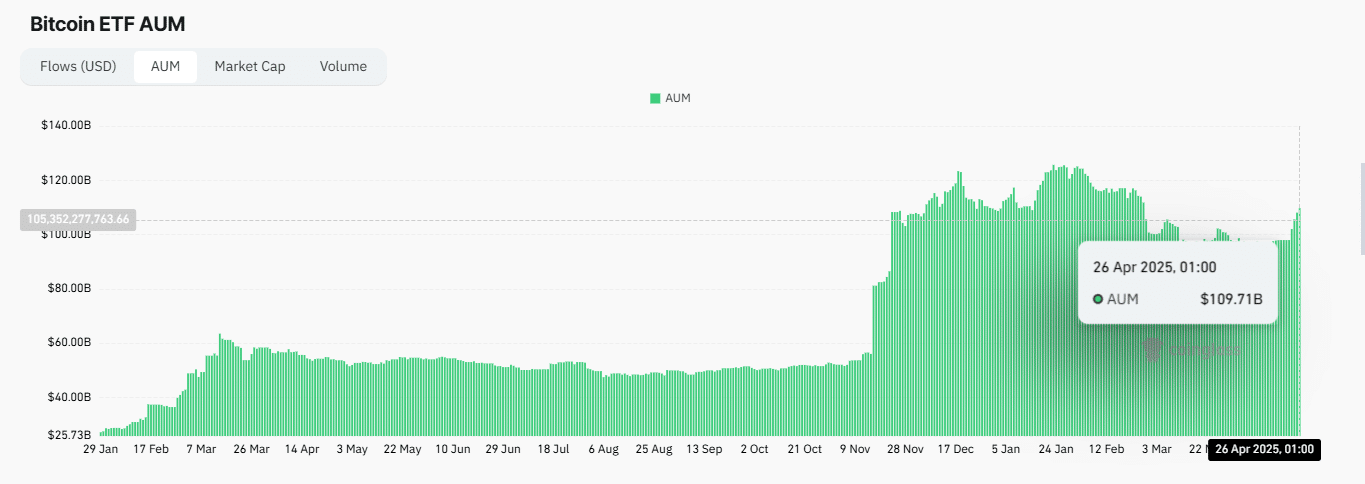

Bitcoin has remained a major point of attraction in the crypto market.

Over the past few months, it has drawn heightened institutional interest, particularly following the approval of Spot Bitcoin Exchange-Traded Funds (ETFs), which now boast a total asset under management (AUM) of $110.3 billion, according to CoinGlass.

Following Donald Trump’s inauguration, discussions around a federal Bitcoin strategic reserve resurfaced, further fueling institutional appetite.

For XRP, its growth has been influenced by the team’s approach to reaching a settlement with the U.S. Securities and Exchange Commission (SEC) over a years-long legal battle on whether XRP is a security.

In addition, Ripple’s focus on growth, including the launch of its own stablecoin, as well as several acquisitions and partnerships, has played a significant role in its market rally.

Liquidity outflow dampens ETH and memecoin’s trajectory

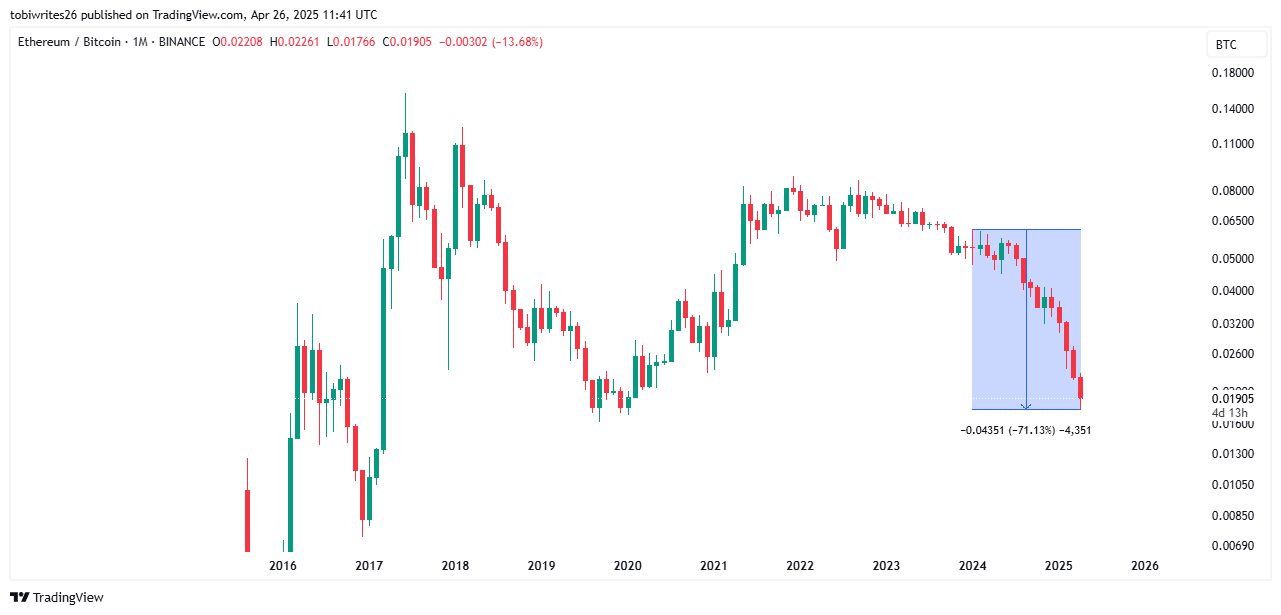

However, Ethereum failed to keep pace.

Ethereum, the second-most valuable crypto asset with a market capitalization of $217.4 billion, has underperformed. Although it showed positive growth in the past, it has recently lost appeal among investors.

The ETH/BTC chart, which tracks liquidity inflow and outflow between the two assets, shows that Ethereum has recorded significantly less liquidity compared to Bitcoin, with its dominance dropping 70% since January 2024.

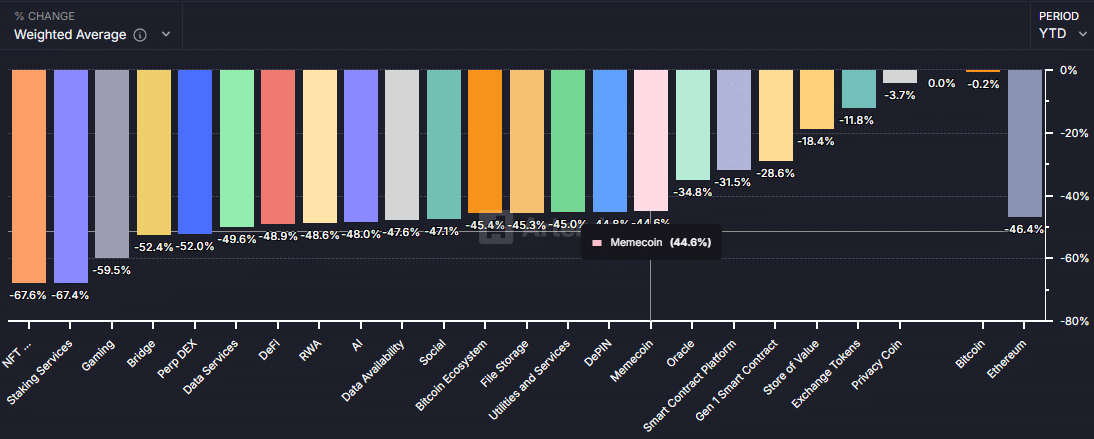

On top of that, memecoins like Dogecoin struggled to attract new capital.

According to Artemis data, the memecoin sector shrank by 44.3% year-to-date as investors fled toward more stable assets.

According to Artemis data, the overall memecoin market has declined by 44.3% year-to-date, as investors have shifted to either stable assets or other cryptocurrencies.