BONK jumped 11.5% in 24 hours to $0.0000057189 as trading volume exploded 157%, disrupting its prolonged downtrend structure. The market cap was $632.66M at press time, reflecting renewed speculative appetite.

Additionally, the Open Interest climbed 13.4% to $7.63M, signaling expanding derivatives participation. This move does not unfold quietly.

Price now breaks above a key technical structure while exchange flows and funding data reveal deeper positioning shifts. Momentum begins to rebuild, yet leverage increases simultaneously.

The market now faces a pivotal inflection point. Does this breakout signal genuine structural recovery, or will rising speculative pressure trigger sharp volatility?

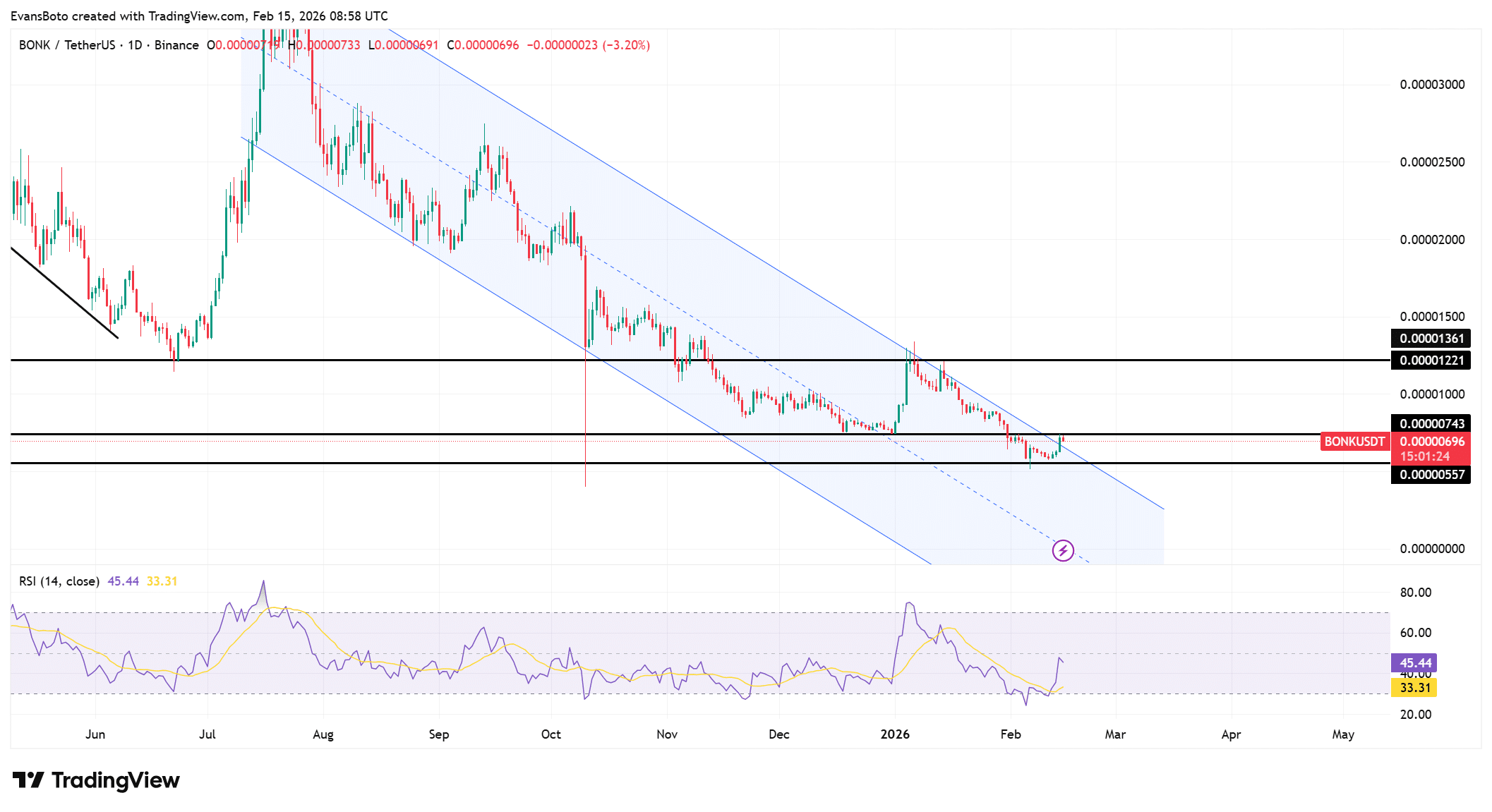

BONK price action

BONK has pushed decisively above the upper boundary of its descending channel on the daily chart. That breakout changes short-term structure immediately.

Price traded around $0.00000696 after reclaiming the 0.00000557 support zone. However, the 0.00000743 level now acts as the first immediate pivot.

If bulls defend this area, momentum could expand toward 0.00001221, where prior supply previously capped rallies. Above that, 0.00001361 stands as the next structural ceiling.

Unlike previous relief bounces, this move clears channel resistance rather than stalling beneath it. As a result, the technical bias shifts from pure continuation to potential reversal territory.

The RSI read 45.44 after rebounding from deeper oversold territory near the low 30s. This shift signaled early momentum repair rather than full bullish expansion.

A move above 50 would confirm stronger upside control. Nevertheless, this rebound already reflects a clear change in internal pressure.

Instead of persistent downside compression, BONK now shows gradual strength rebuilding beneath the surface.

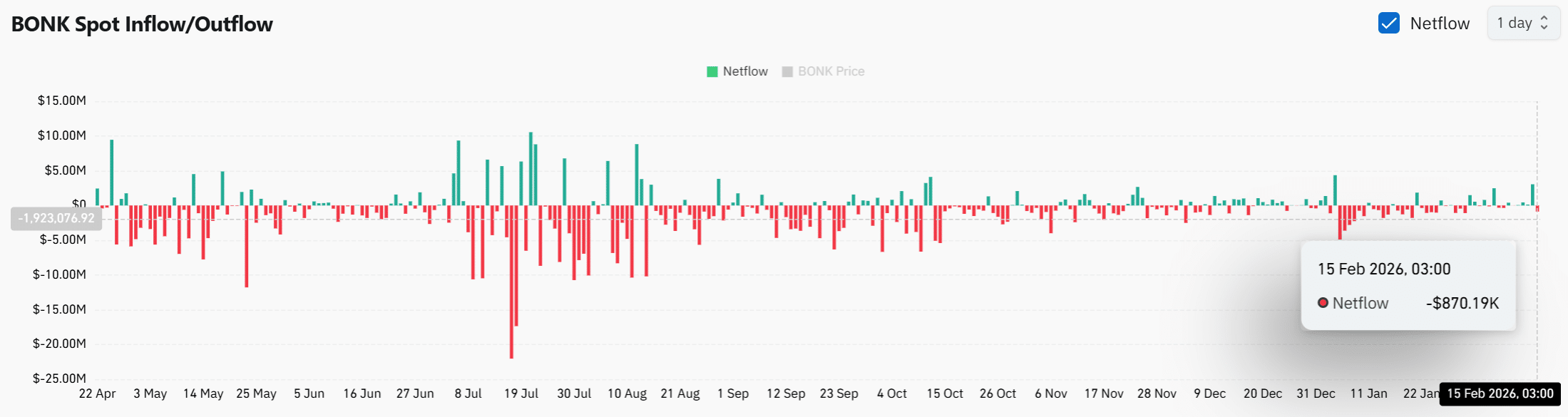

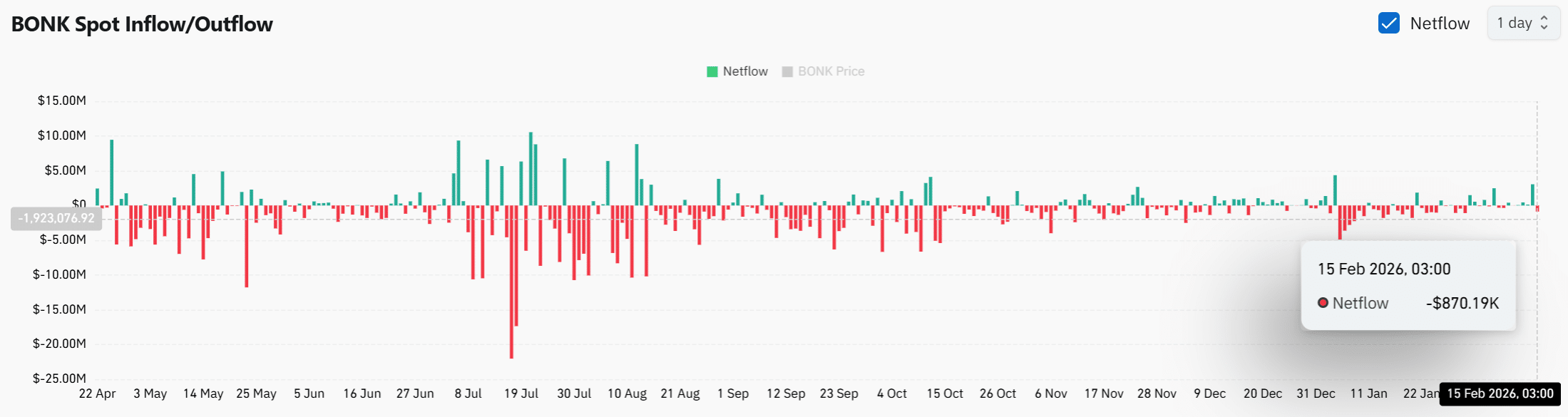

Exchange outflows hint at quiet accumulation

Spot netflows remain negative across multiple sessions, and the latest reading shows roughly -$870K leaving exchanges. The pattern signals continued token withdrawals rather than deposit-driven selling.

Throughout recent weeks, red bars have dominated the inflow/outflow chart. Even during price weakness, traders removed BONK from centralized platforms.

This behavior reduces immediate sell-side liquidity. While outflows alone do not guarantee upside, they often precede supply tightening phases.

In contrast to panic inflows that precede breakdowns, BONK’s flow profile suggests holders prefer custody over liquidation. Therefore, structural pressure does not align with aggressive distribution.

Source: CoinGlass

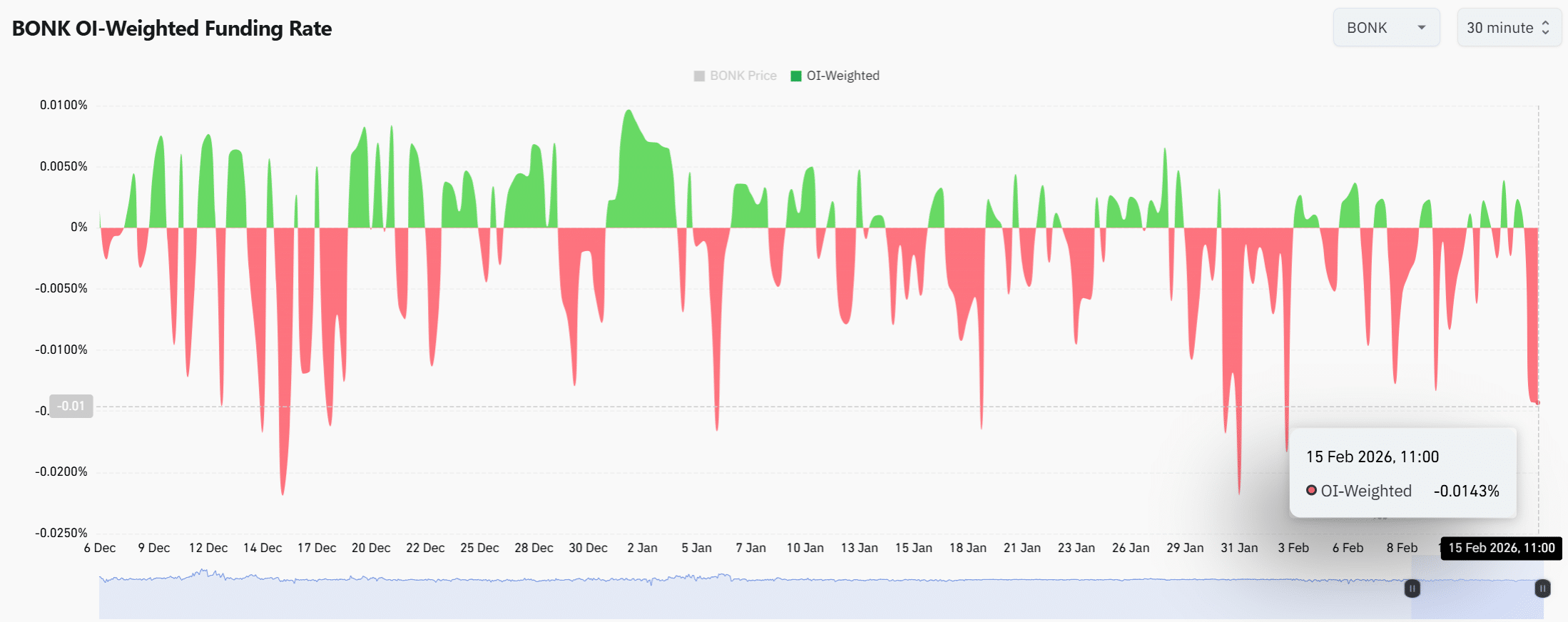

Crowded shorts face growing pressure

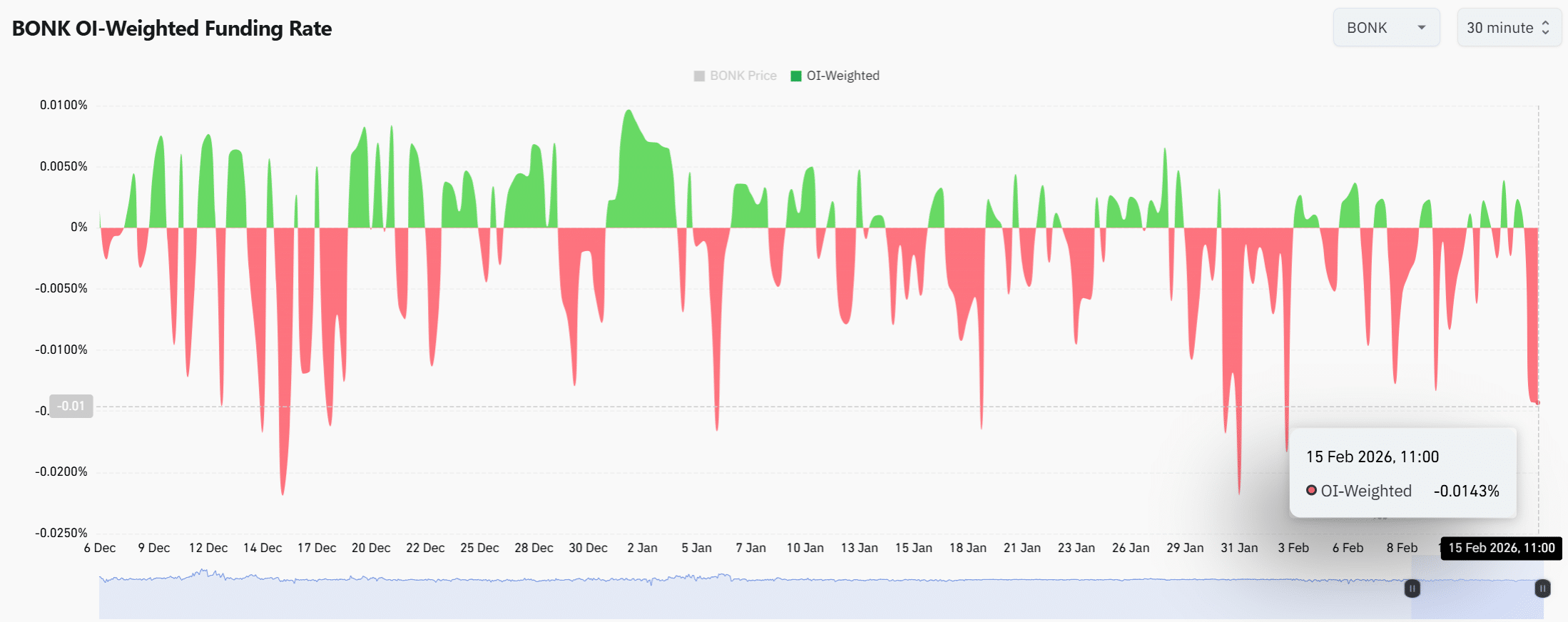

The OI-Weighted Funding printed -0.0143% at the time of writing, reflecting persistent negative bias in derivatives markets. Shorts now pay longs to maintain positions.

At the same time, Open Interest rose 13.4% to $7.63M, showing expanding participation. This combination revealed crowded short positioning building during the breakout.

When funding stays negative while price climbs, imbalance intensifies. If upside continues, forced short covering could accelerate volatility.

The failure to sustain momentum would validate those bearish bets. For now, derivatives traders lean heavily short, even as price structure improves.

Source: CoinGlass

To sum up, BONK has broken its descending channel while RSI strengthens, exchange outflows persist, and funding remains negative.

Structure now favors upside continuation. However, rising Open Interest and crowded shorts inject volatility risk.

If price defends the reclaimed support zone, momentum could extend higher. If not, leverage unwinds quickly.

At present, the technical shift carries weight, but derivatives positioning will determine whether this breakout evolves into sustained recovery.

Final Summary

- Structural breakout shifts short-term bias, but follow-through must confirm conviction.

- Crowded shorts could accelerate upside, yet failure may trigger sharp unwinds.