- Despite trailing Bitcoin ETFs, which closed 2024 with an impressive $35 billion in inflows, Ethereum ETFs have shown consistent growth.

- ETH ETFs experienced a significant surge in trading volume, with December’s figures reaching above $13 Billion.

Ethereum [ETH] ETFs achieved remarkable momentum in December, accumulating $2.6 billion in net inflows. This surge highlighted the increasing institutional interest in Ethereum as a viable investment vehicle.

In addition, ETH ETFs have shown consistent growth, even as Bitcoin’s [BTC] ETFs trailed, closing 2024 with an impressive $35 billion in inflows. This trend reflects confidence in Ethereum’s long-term potential, fueled by its robust ecosystem and expanding use cases.

Can Ethereum ETFs outperform Bitcoin ETFs in 2025?

Recent market data suggests that Ethereum ETFs could surpass Bitcoin ETFs in 2025 if certain conditions align. Analysts attribute this potential to Ethereum’s unique staking capabilities, which provide additional yield-generation opportunities for investors.

Favorable regulatory developments further position the ETFs to attract a broader institutional audience.

In November and December 2024, ETH demonstrated strong market momentum with eight consecutive weeks of inflows. This period included a record-breaking $2.2 billion inflow in the week, ending on the 26th of November, showcasing heightened investor confidence.

While BTC ETFs remain dominant, ETH ETFs are gradually narrowing the gap, indicating a shift in institutional preferences.

If Ethereum maintains its price trajectory, driven by increased network activity and technological advancements, its ETFs could emerge as top-performing assets in 2025.

Additionally, external factors, such as the growing adoption of artificial intelligence in Ethereum’s ecosystem, have bolstered its appeal.

Key challenges for Ethereum’s market ascent

For ETH ETFs to challenge BTC ETFs’ dominance, Ethereum must address key obstacles, including market dominance and competition from rival networks.

Bitcoin’s extensive brand recognition and first-mover advantage continue to draw significant inflows, leaving Ethereum with the task of building similar trust among institutional investors.

Ethereum’s current market dominance of 18.7%, as per recent data, trails Bitcoin’s 47.1%, reflecting the disparity in investor confidence.

However, analysts highlight that ETH’s market share could grow as its staking rewards become more attractive and regulatory clarity improves. Maintaining a consistent upward trajectory in ETF inflows will be crucial to closing this gap.

Another hurdle lies in Ethereum’s historical volatility, which has occasionally deterred risk-averse investors. To overcome this, these ETFs must showcase stability and resilience, particularly in response to broader market shifts.

With external factors like macroeconomic conditions and global regulatory changes, Ethereum’s ecosystem must demonstrate its ability to adapt and thrive in a competitive landscape.

Ethereum’s RSI trends indicate bullish momentum

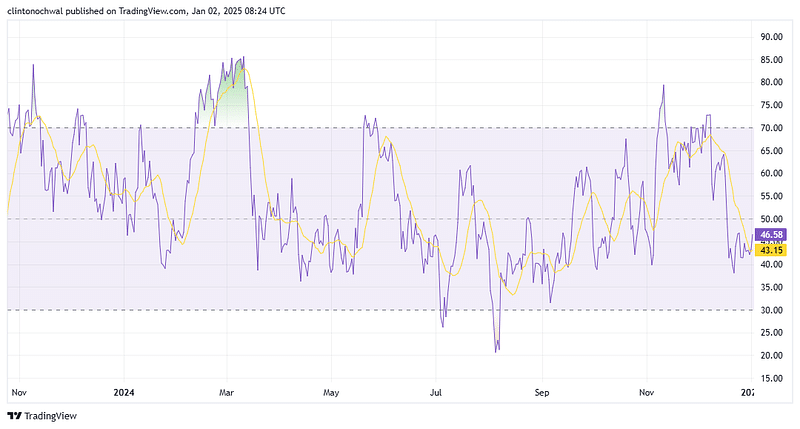

Ethereum’s Relative Strength Index (RSI), a key technical indicator, offers valuable insights into its current performance.

As of late December, ETH’s RSI stood at 68, nearing the overbought threshold of 70. This suggests strong bullish momentum but raises concerns about potential short-term corrections.

Historically, the coin’s RSI movements near the overbought zone have preceded temporary pullbacks before resuming an upward trend. Additionally, ETH’s recent ETF inflows have fueled optimism among investors, with many anticipating further RSI gains.

If Ethereum breaks through key resistance levels, its RSI could stabilize within the bullish range, reinforcing confidence in its long-term outlook.

Surging trading volume highlights…

Ethereum ETFs experienced a significant surge in trading volume, with December’s figures reaching above $13 Billion.

This growth highlights the intensifying interest among investors, driven by consistent inflows and positive market sentiment.

This surge in volume indicates robust liquidity, a critical factor for institutional investors seeking stable and scalable options. Analysts view the increased trading activity as a precursor to stronger ETF performance, as it underscores heightened confidence in Ethereum’s future.

Read Ethereum’s [ETH] Price Prediction 2025–2026

Looking ahead, Ethereum ETFs may continue to see rising volumes, particularly if ETH’s price trends remain bullish and network activity intensifies.

Coupled with the positive momentum in staking yields and regulatory support, this volume growth could position ETH ETFs as dominant market players in 2025.