- MOODENG showed a bullish falling wedge pattern, with key support at $0.35 and targets up to $0.93.

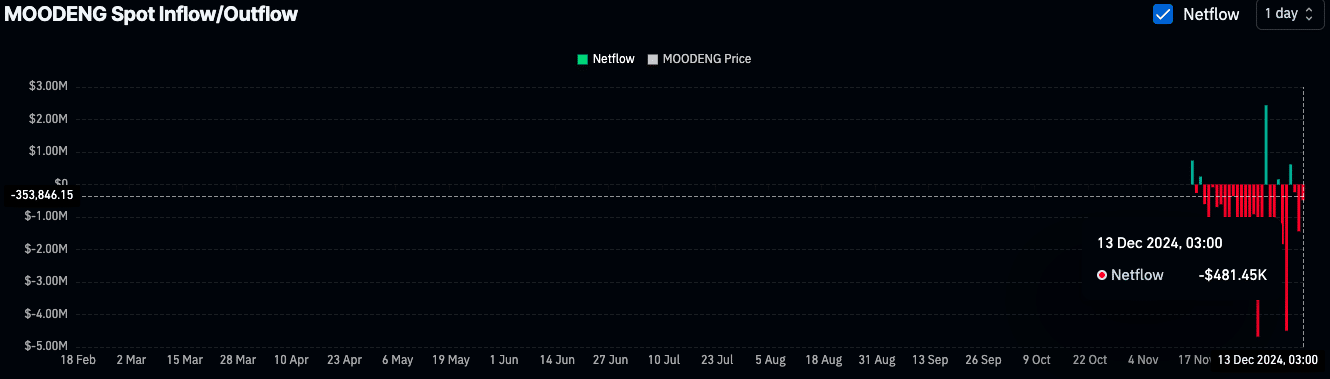

- Net outflows of $481K signaled investor accumulation, reducing sell-side liquidity for potential price growth.

Moo Deng [MOODENG] dropped 2.07% in the last 24 hours. At press time, the coin was trading at $0.3876.

Its 24-hour trading volume stands at $133.7 million. Over the past week, the token has fallen by 15.97%.

MOODENG’s market cap is $383.5 million, and its circulating supply is 990 million tokens. In the past 24 hours, its price ranged between $0.3797 and $0.4042.

Over the past 7 days, it ranged between $0.3232 and $0.5358. Since reaching its all-time high of $0.6804 on the 15th of November 2024, MOODENG has retraced by 43.3%.

Despite recent declines, analysts are optimistic about a potential bullish breakout. A falling wedge pattern on the chart suggests the current downtrend could reverse, leading to a sharp price recovery.

Bullish falling wedge and key support levels

MOODENG’s price movement shows a falling wedge, a chart pattern that often signals a potential reversal.

This pattern is characterized by declining highs and lows converging toward a single point, typically indicating a weakening downtrend and growing potential for an upward breakout.

An analyst highlighted $0.35 as a crucial support level. This zone has held firm several times, preventing further declines and serving as a key accumulation area.

According to Rose Premium Signals, the next major move will depend on breaking the upper wedge trendline.

“A breakout above the wedge suggests a bullish continuation with strong upside potential,” the analyst stated.

Projected price targets following a breakout include $0.56, $0.74, and $0.93. The $0.93 level, in particular, is seen as a challenging resistance that could determine whether further gains are possible.

Market sentiment and exchange activity

Market data showed a 31.53% drop in trading volume, now at $414.98 million. Open interest has also decreased by 6.52%, sitting at $139.12 million.

These figures suggest reduced market participation, though investor sentiment remains mixed.

Coinglass data indicates a net outflow of $481.45K from exchanges on the 13th of December, continuing the trend of heightened outflows since November.

These outflows suggest accumulation by investors, reducing the number of tokens available for sale. Increased demand paired with reduced sell-side liquidity could support future price growth.

The token has also been making headlines for its listing on OKX, one of the largest crypto exchanges. Speculation about a potential Binance listing has further fueled excitement among investors.

Historical performance and targets

Analysts are comparing MOODENG’s current setup to historical patterns. Similar falling wedge setups in other assets have led to sharp price recoveries.

Read Moo Deng [MOODENG] Price Prediction 2024-2025

As accumulation trends continue and market sentiment stabilizes, traders are watching closely. MOODENG’s ability to hold key support and break through resistance levels will determine if it can reach its ambitious price targets.