The Official Trump [TRUMP] team has transferred 9.089 million tokens, valued at $31.45 million, to BitGo. At press time, TRUMP was trading at $3.51, up 4.67% in the past 24 hours.

This sizable allocation shift comes during a modest price rebound. Market participants immediately noticed the transaction due to its scale.

However, custody transfers do not automatically indicate selling activity. Instead, such moves often reflect treasury restructuring or strategic repositioning.

Meanwhile, the 4.67% daily surge highlighted renewed short-term demand. Traders now question whether this rally stems from organic accumulation or reactive positioning.

Therefore, the interaction between this custody shift and broader market structure may determine TRUMP’s next decisive move.

Can TRUMP escape its descending channel?

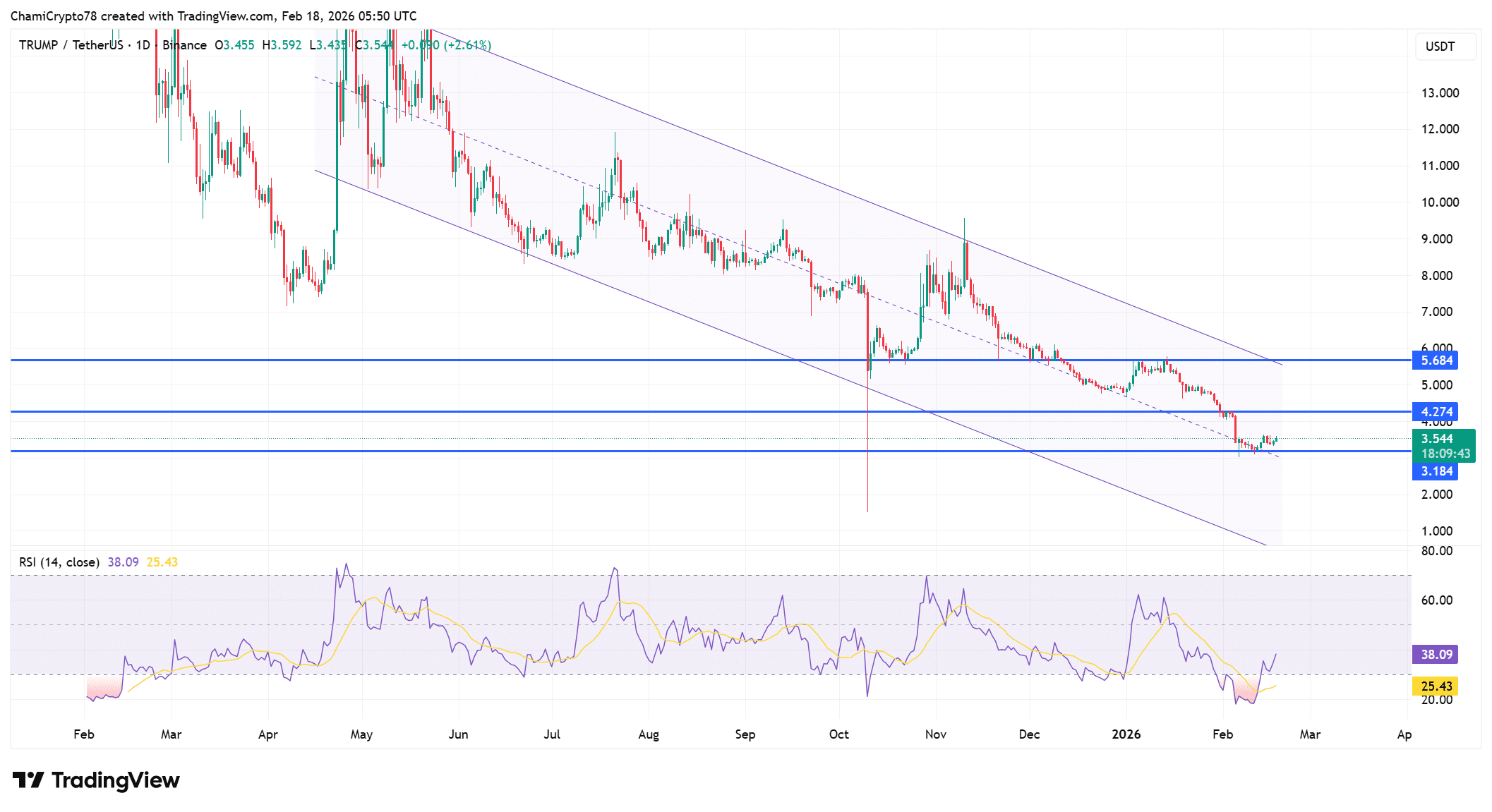

TRUMP continues to trade inside a long-term descending channel that has controlled the price since mid-2025.

The chart shows price stabilizing near the lower boundary of this structure. Horizontal support sits at $3.18, while resistance stands at $4.27 and $5.68.

Although buyers defended the lower region, the overall slope still trends downward. Therefore, bulls must reclaim $4.27 to challenge mid-channel resistance.

Without that reclaim, sellers retain structural dominance. Furthermore, repeated compressions near channel support often precede volatility expansions.

If price breaks below $3.18, downside pressure could accelerate toward the channel’s lower extension. However, sustained strength above $4.27 would weaken the broader bearish structure.

At press time, the RSI rebounded from near-oversold territory and hovered around 38. This recovery suggests buyers have started re-entering after aggressive selling pressure.

Earlier dips toward the 30 zone reflected exhaustion among sellers. Now, the indicator pushes upward but remains below the neutral 50 level.

This positioning shows momentum recovery without full bullish confirmation. However, previous RSI rebounds inside this channel triggered short-term relief rallies.

Therefore, traders may interpret the current move as early stabilization rather than a confirmed reversal.

If RSI continues rising toward 45–50, momentum strength could build further. Until then, the bounce represents potential recovery within a broader bearish framework.

Netflows hint at supply repositioning

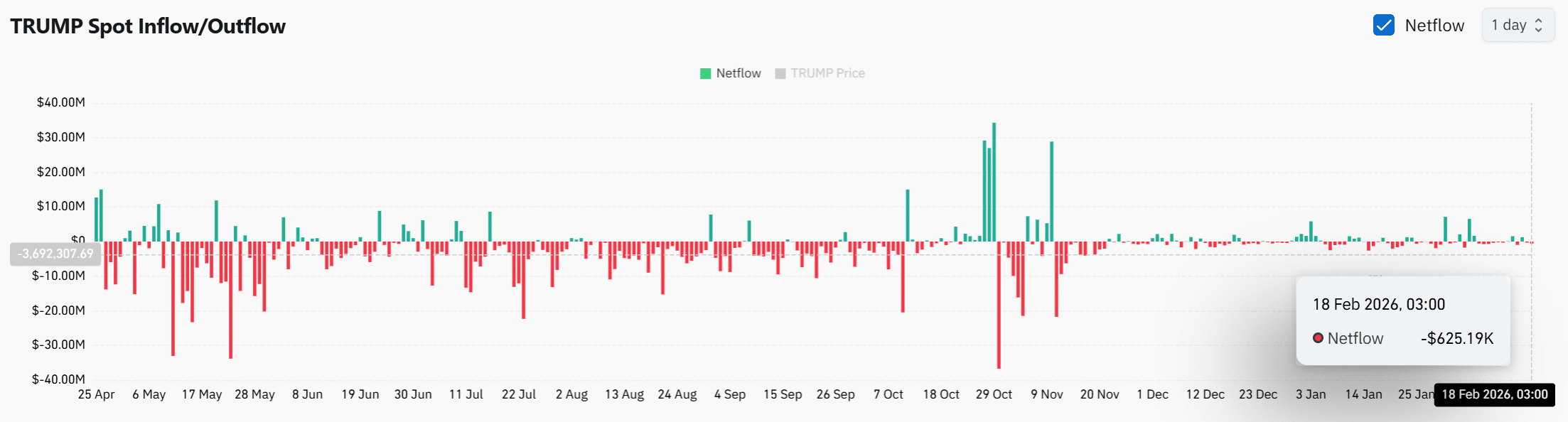

Spot netflow data showed a mild exchange outflow of approximately -$625K on the latest reading as of writing.

This modest outflow contrasts with earlier periods of heavy inflows and outflows. Large spikes in October and November coincided with heightened volatility.

Now, flows appear more contained, suggesting calmer positioning. However, the recent BitGo custody transfer introduces a structural supply shift outside exchange order books.

If tokens remain in custody, circulating liquidity could tighten. On the other hand, future redeployment could quickly increase sell-side pressure.

Therefore, traders must monitor whether netflows expand meaningfully in the coming sessions. For now, exchange activity reflects neutrality rather than aggressive distribution.

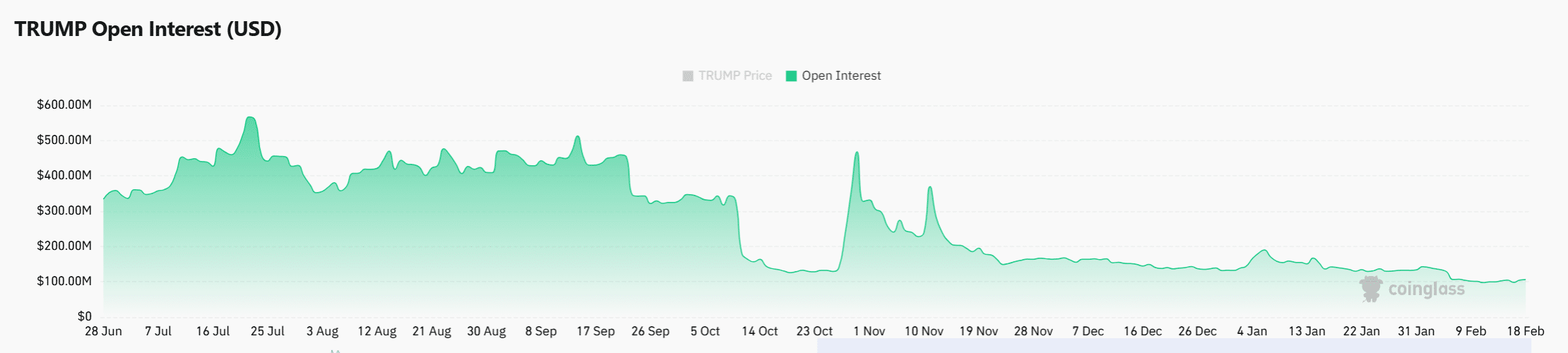

Open Interest climbs as leverage builds

At the time of writing, Open Interest (OI) has increased by 6.10%, reaching $109.41 million, signaling fresh leveraged participation.

This rise suggests traders are building positions despite compressed price action. When OI rises alongside stabilization near support, volatility often follows.

However, direction depends on positioning bias. If longs dominate while price remains weak, liquidation risk could intensify.

Conversely, heavy short positioning could fuel a squeeze if buyers push above resistance. The chart shows tightening price movement near key support, which often precedes expansion.

Therefore, the growing $109.41 million in OI amplifies the probability of a sharp move. Market structure now combines technical compression with expanding leverage.

So what comes next for TRUMP?

TRUMP stands at a structural crossroads near $3.54 support. The BitGo transfer reshapes supply perception, while RSI recovery hints at early stabilization.

However, the descending channel still dictates the broader direction. Rising OI suggests traders anticipate volatility.

If buyers defend $3.18 and reclaim $4.27, upside continuation could unfold. Otherwise, failure at support could accelerate movement toward the channel’s lower boundary.

Final Summary

- Buyers show early strength, but they must reclaim resistance to shift structure decisively and invalidate the broader descending trend.

- Rising leverage increases breakout probability, yet weak structure could punish overconfident positioning near key support.