- 70 million ADA tokens moved among whales, sparking speculation and price movements.

- Grayscale’s ADA Spot ETF application could fuel institutional interest and impact ADA’s price trajectory.

In the last 96 hours, over 70 million Cardano [ADA] tokens have shifted hands among whales, igniting a flurry of speculation. This surge in whale activity comes on the heels of Grayscale’s application for the first-ever Cardano Spot ETF.

With institutional interest now on the table, the big question looms: Are these whale movements connected to the potential ETF launch? And what impact might this have on ADA’s price?

Cardano whales on the move

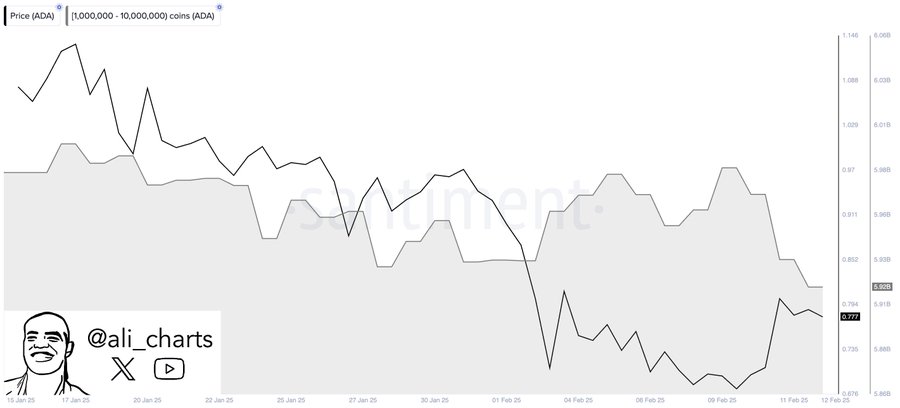

Technical analyst Ali Martinez reports that over 70 million ADA tokens have been moved by whales in just 96 hours.

On-chain data reveals significant shifts in holdings among addresses with 1 million to 10 million ADA, coinciding with a broader price decline.

While such movements often signal institutional positioning, the question remains: Are whales accumulating ahead of a potential price surge, or is this redistribution a sign of selling pressure?

Given Grayscale’s Cardano Spot ETF filing, these large transfers could point to strategic positioning by major players. If accumulation is the driving force, ADA’s price could stabilize or rebound.

Conversely, continued selling pressure could lead to further downside.

Paving the way for a Cardano Spot ETF

Grayscale Investments is advancing in the altcoin ETF market, seeking regulatory approval through NYSE Arca for a spot Cardano ETF.

If the SEC approves this, it would be Grayscale’s first standalone ADA investment vehicle, providing both institutional and retail investors with Cardano exposure without the complexities of direct ownership.

The fund will have ADA assets under the custody of Coinbase Custody Trust Company, with BNY Mellon Asset Servicing managing administrative operations.

This filing indicates a growing interest in crypto investment products beyond Bitcoin and Ethereum. If approved, Cardano could strengthen its presence in institutional portfolios.

Implications for ADA’s price

Recent whale movements have sparked both short-term and long-term speculation about Cardano’s price trajectory.

In the short term, ADA’s price has shown signs of recovery, climbing to $0.8173 as whale activity reignites buying pressure. With the RSI at 46.92, ADA is nearing neutral momentum after an oversold phase. The MACD also indicates a potential bullish crossover.

If buying momentum continues, ADA could test key resistance near $0.90, with a breakout possibly pushing the price toward $1.00. However, a rejection of resistance could lead to consolidation in the short term.

Looking ahead, Cardano’s long-term price action will be shaped by the ETF application and broader market sentiment.

If the ADA spot ETF is approved, it could attract institutional capital, pushing ADA beyond $1.20 and possibly into the $1.50–$2.00 range by 2025.

With whales accumulating and institutional interest growing, ADA’s price could see sustained upside, although macroeconomic factors and market volatility will remain key risk factors.