- Cardano’s price drop is paired with stagnant user engagement and a cooling derivatives market.

- Fading interest in ADA signals declining relevance, as the market shifts toward faster, newer assets.

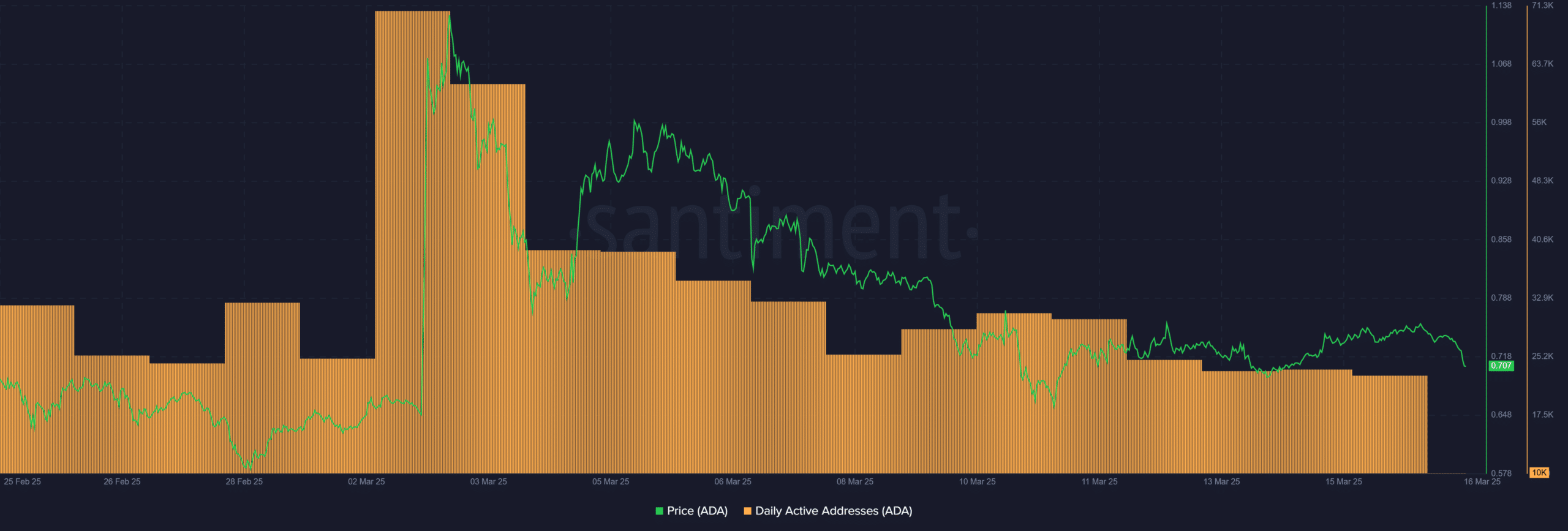

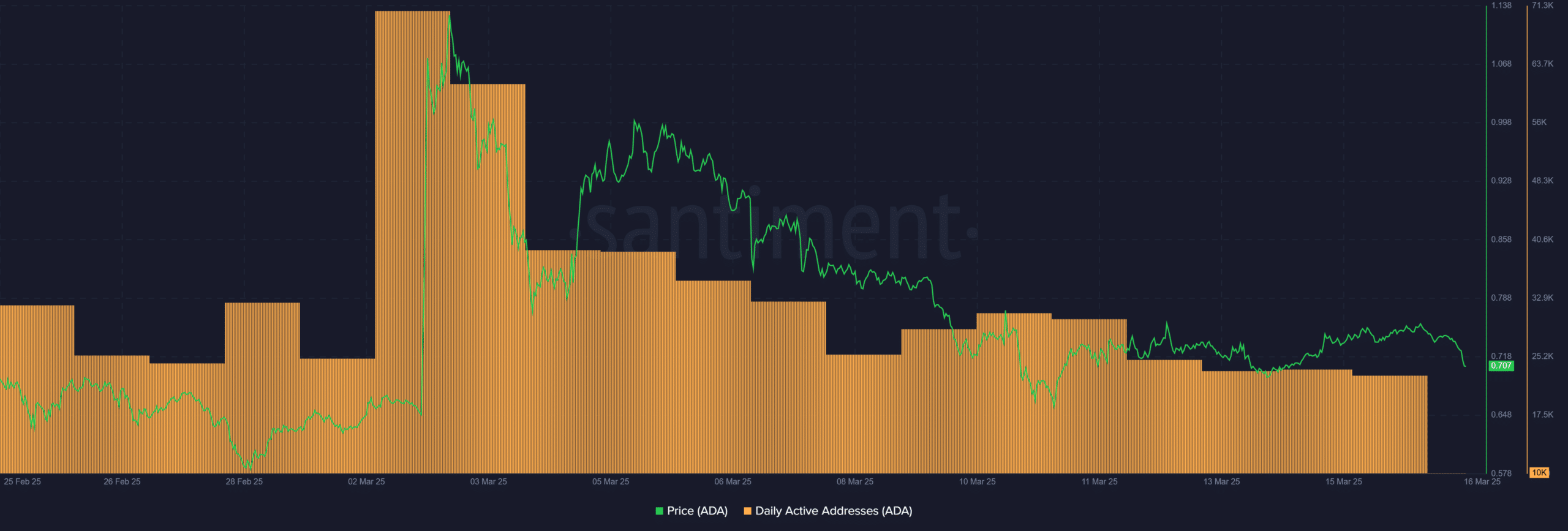

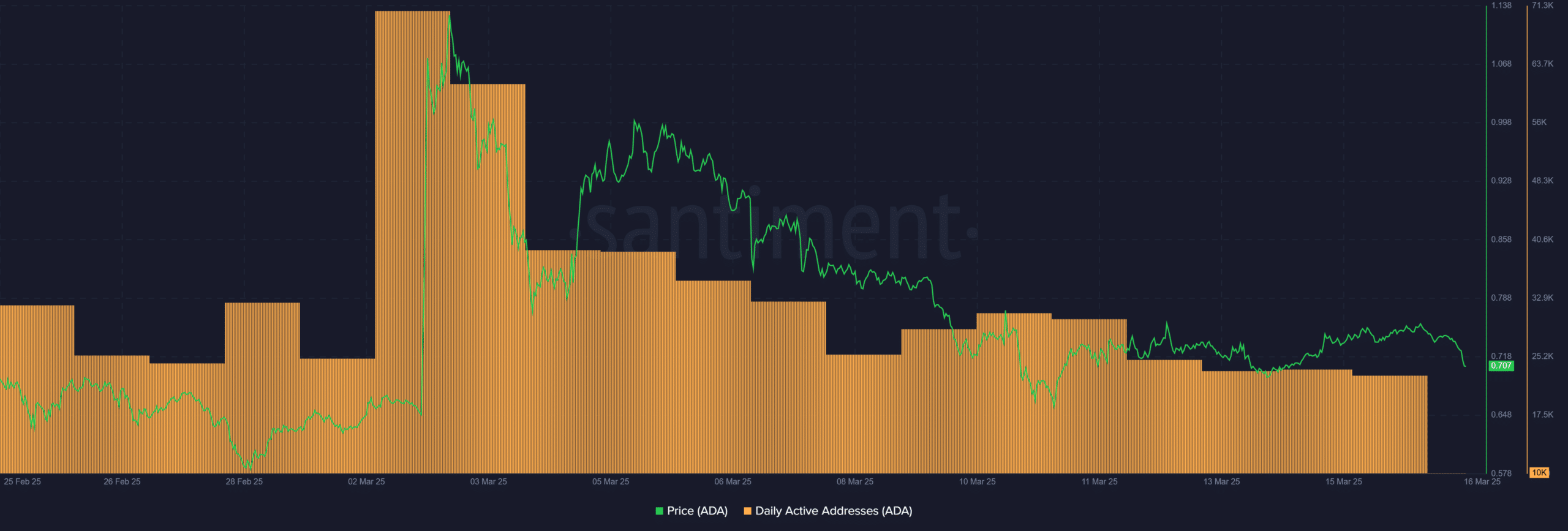

Cardano [ADA] is slipping — and not just in price. The network has shed over 9% in the past week, but what’s more telling is the stall in daily active addresses, even as other altcoins show signs of revival.

With Open Interest and Funding Rates offering little momentum, the data points to a deeper problem: fading user engagement and a lack of conviction from traders, raising questions about ADA’s relevance in the evolving Layer 1 landscape.

Cardano’s network use shows no signs of life

Despite ADA’s sharp 9% weekly drop, the more troubling signal lies in Cardano’s on-chain stagnation.

As the chart shows, daily active addresses have hovered near the 10K mark since the 6th of March — failing to rebound even during brief price upticks.

This flatline in user activity suggests that network participation isn’t just cooling off — it’s plateauing.

Source: Santiment

Unlike rival Layer 1s that are seeing modest recoveries in user interaction, Cardano’s engagement metrics remain stuck, highlighting a lack of organic demand.

With no visible uptick in new or returning users, this trend raises red flags about real-world utility and user retention.

Open Interest drops, bearish bets grow

Source: Coinglass

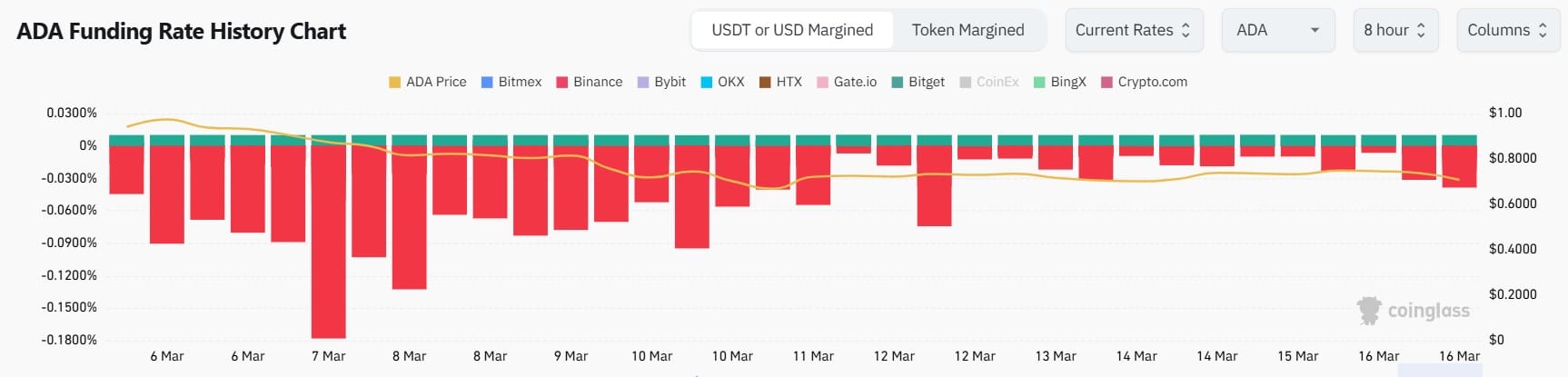

Cardano’s derivatives market is signaling a marked decline in trader conviction. Open Interest in ADA Futures has fallen by nearly 30% since the 3rd of March, sliding from over $1.2 billion to under $900 million.

This cooling interest coincides with a notable dip in ADA’s price, reflecting traders’ growing reluctance to take on leveraged positions.

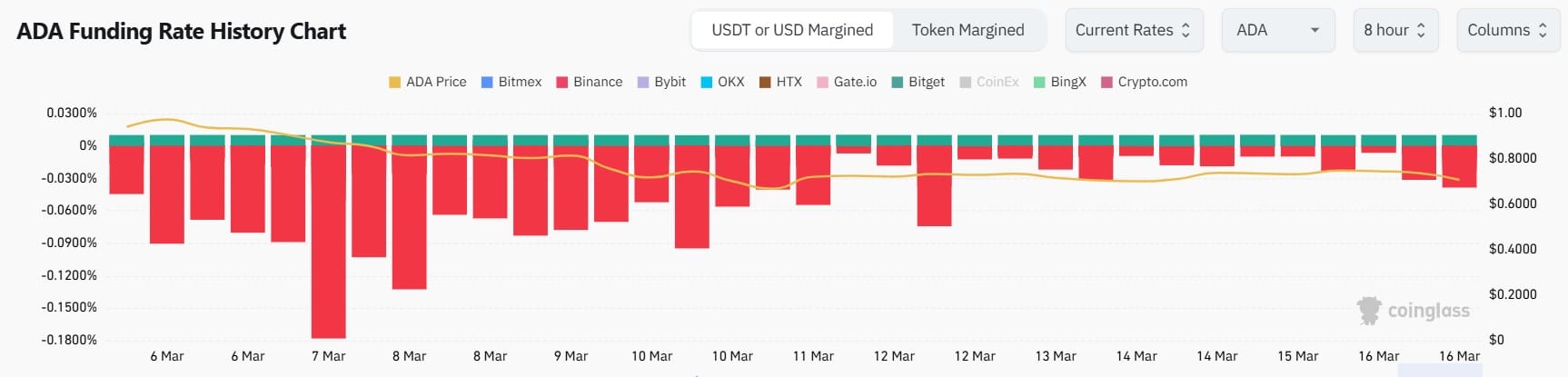

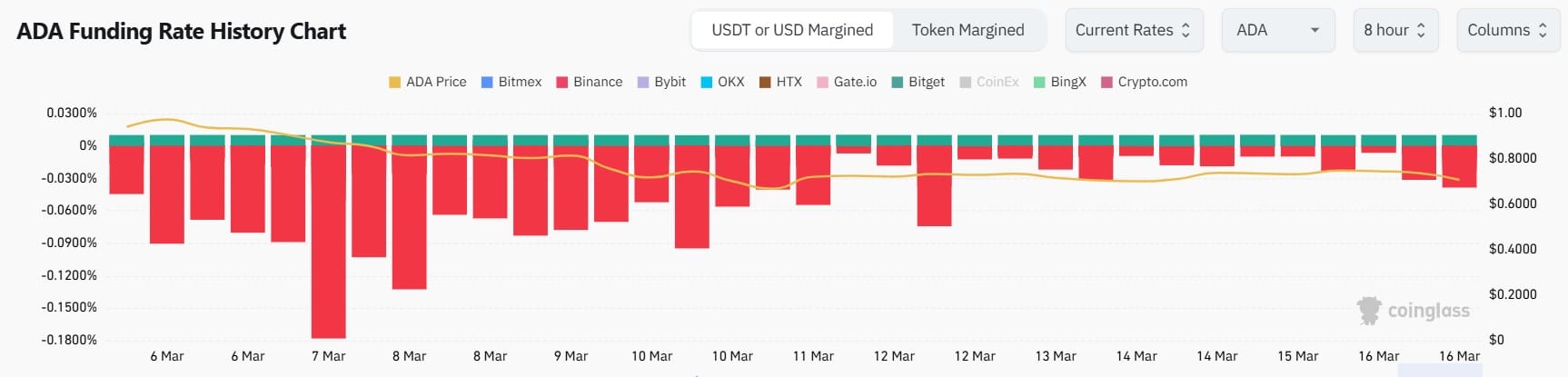

Source: Coinglass

More tellingly, Funding Rates across major exchanges like Binance and Bybit have remained consistently negative, with several plunges below -0.10%.

This suggests short positions are dominating, as traders are paying a premium to maintain bearish bets.

Together, the drop in Open Interest and persistent negative Funding Rates reveal a market leaning more toward defense than recovery — casting doubt on ADA’s near-term upside.

Futures data paints a cautious picture

Cardano’s derivatives market is flashing signs of fatigue.

Open Interest in ADA Futures has dropped from over $1.2 billion on the 3rd of March to under $900 million, while Funding Rates across Binance and Bybit remain deeply negative — evidence of sustained short pressure.

But this isn’t just about ADA.

As capital rotates into Base, memecoins, and AI tokens, ADA’s sideways drift feels systemic. Cardano has seen this before: spikes in TVL and user activity that quickly vanish post-hype.

With no major catalyst imminent — aside from the coming partner chains initiative and slow DeFi integrations — ADA risks becoming sidelined.

Once a retail darling, it looks like Cardano now occupies the role of a legacy chain struggling to reclaim relevance in a market obsessed with speed and novelty.