- Cardano’s circulating supply increased as older coins moved, signaling a blend of profit-taking and long-term accumulation.

- What will it take for ADA to hold above $1?

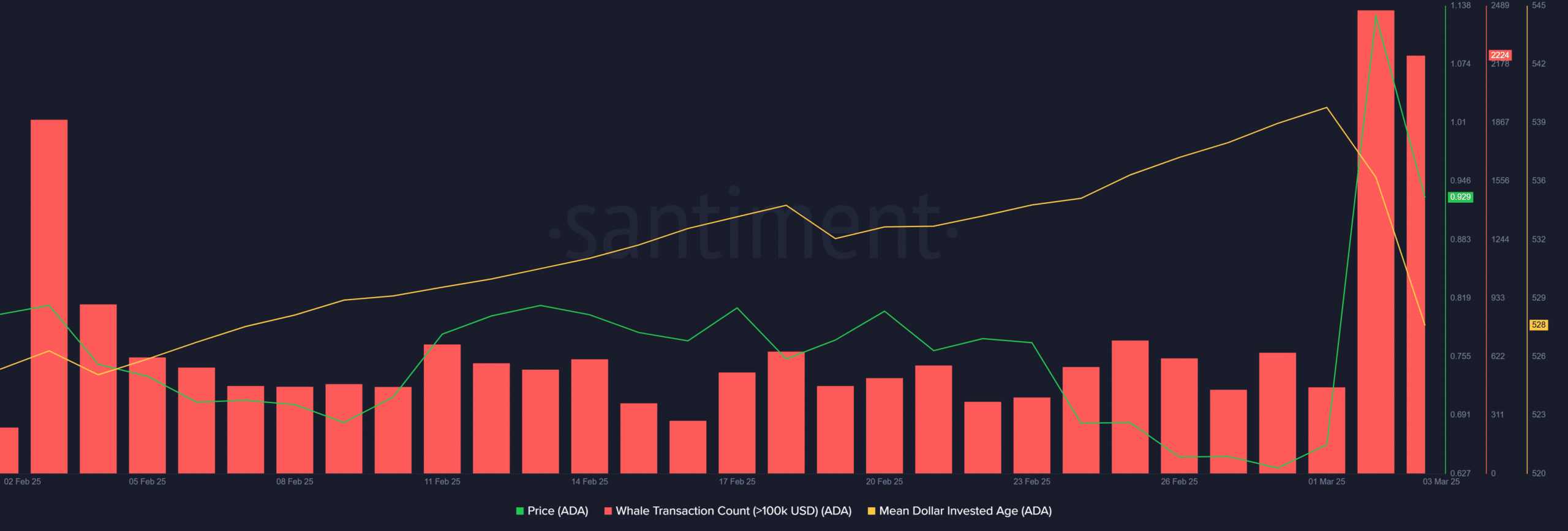

Cardano [ADA] surged to $1.13 amid peak whale activity, recording 2,645 transactions over $100K – the highest in three months. This strategic accumulation followed ADA’s historic 72.15% single-day rally.

However, ADA struggles to hold above $1, now trading at $0.94 despite a 4.77% crypto market rebound and Bitcoin’s bullish recovery.

Santiment data highlighted a decline in ADA’s average wallet age, signaling increased token circulation. Is this a sign of profit-taking or a strategic repositioning for long-term accumulation? AMBCrypto investigated.

Cardano’s price volatility exposed

Despite whale transactions reaching a three-month high, Cardano struggled to hold above $1, coinciding with a sharp decline in Mean Dollar Invested Age (MDIA).

A falling MDIA suggests increased token circulation, indicating that older coins are being moved – a potential sign of profit-taking or redistribution.

However, this MDIA dip aligned with a surge in Total Value Locked (TVL) on Cardano’s DeFi platforms, jumping from $397.98M to $573.3M in just two days.

This suggests that rather than exiting, investors are redeploying capital into staking, reinforcing a long-term accumulation strategy.

Yet, TVL remains well below its $800M post-election peak, indicating significant unstaking activity that aligned with ADA’s decline below its $1.25 election high – pointing to aggressive profit-taking.

Still, TVL’s sharp rebound – despite a broader market correction in high-cap assets – suggests sustained confidence in future gains.

Keeping an eye on this trend will reveal whether HODLing sentiment holds strong in the days ahead, as Cardano nears the critical $1 resistance once again.

What’s next for ADA?

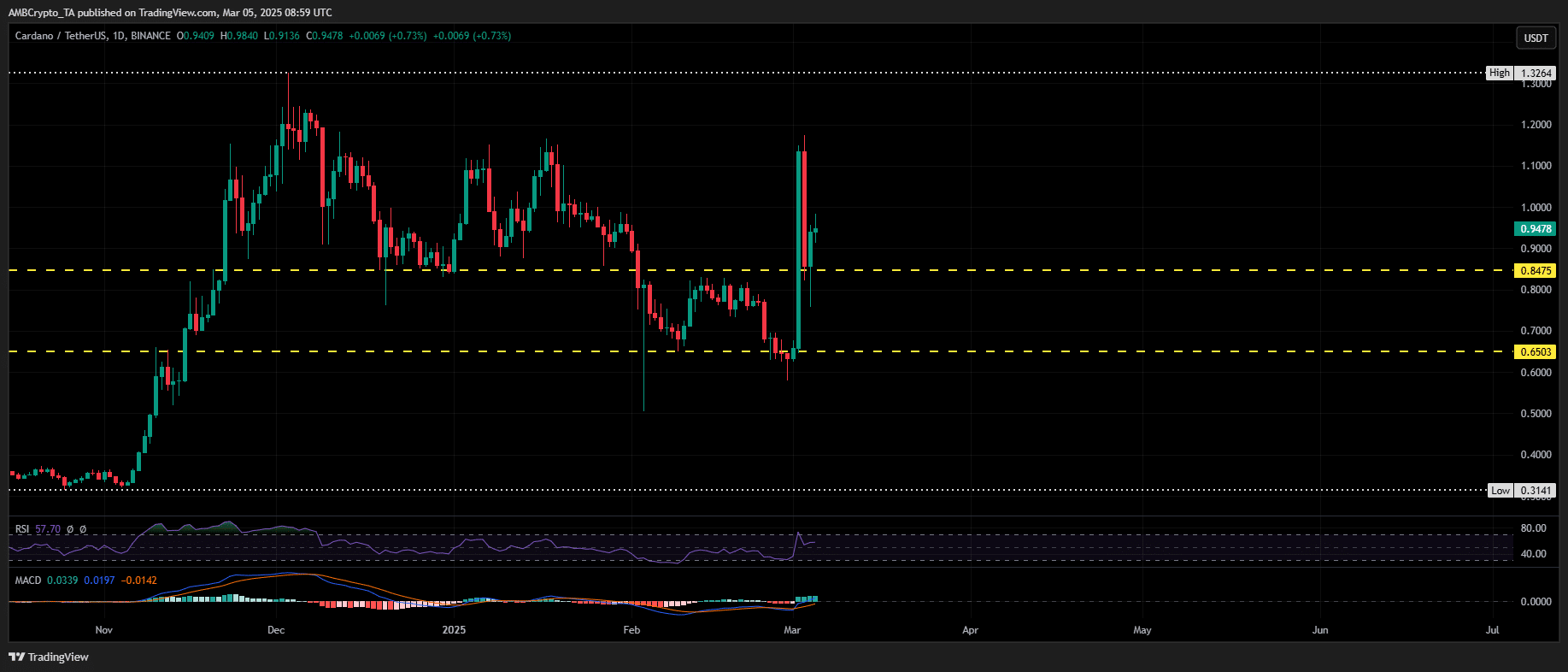

Since its post-election peak, Cardano has formed three lower lows, establishing key demand zones at $0.80 and $0.60.

Its short-term trajectory hinges on broader market trends – if momentum weakens, a pullback to $0.85 support is likely. However, the current bullish market structure suggests a potential breakout above $1.

The challenge lies in sustaining this level, as trading volume has dropped from $7B to $5B in two days, with $1.14 standing as a major resistance zone.

Further, whale transactions are declining, adding to selling pressure. Unless volume, whale activity, and TVL rebound, Cardano’s ability to hold above $1 remains weak.