A Coinbase report revealed that the crypto exchange is the largest node operator on the Ethereum network, controlling 11.42% of the total staked Ether.

In a performance report, Coinbase said it had 3.84 million Ether (ETH), worth about $6.8 billion, staked to its validators. The exchange said that, as of March 3, it has 11.42% of the total staked ETH.

Anthony Sassano, host of The Daily Gwei, said that Coinbase’s stake makes the exchange the “single largest node operator” in the network.

Sassano added that while the staking platform Lido is bigger as a collective, each node operator has a much smaller percentage share.

Source: Anthony Sassano

Related: 83% of institutions plan to up crypto allocations in 2025: Coinbase

Coinbase validator uptime and participation rate at 99.75%

Coinbase also shared that it exceeded its target for validator uptime, which indicates the percentage of time when validators are operational. It also had a similar figure for its participation rate, a metric that indicates how well validators perform their consensus duties.

Coinbase also reported that its validators had an average uptime of 99.75%. Coinbase said they outperformed their target of 99% uptime without compromising security standards.

The exchange attributed the performance to an upgrade implemented in 2024, which allowed the exchange to keep validators running while performing beacon node maintenance.

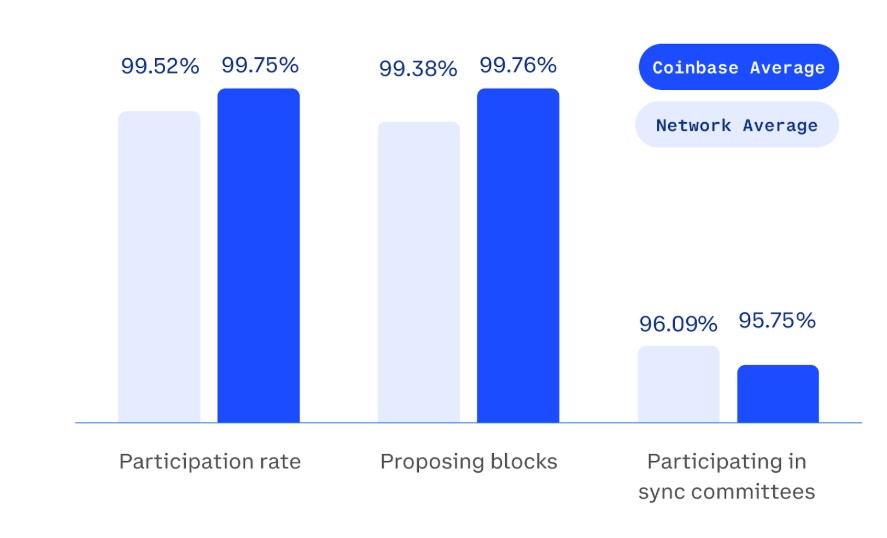

Meanwhile, Coinbase validators’ participation rate is also at 99.75%. This exceeds the network average of 99.52%. In addition, the Coinbase average for signing and submitting blocks produced by their MEV relays is 99.76%, higher than the network average of 99.38%.

While Coinbase operates a centralized exchange platform, the company said it distributes its validators across several regions to “help maintain a truly distributed and decentralized Ethereum blockchain.” The exchange said its validators operate in Japan, Singapore, Ireland, Germany and Hong Kong.

Coinbase validator average performance versus Ethereum network averages. Source: Coinbase

Ether surges above $2,000 on March 20

Coinbase’s recent report was followed by a surge in ETH prices as ETH accumulation addresses started stockpiling significantly.

7-day ETH price chart. Source: CoinGecko

On March 2, Ether hit a weekly high of $2,060.73, surging by 12.3% in seven days. On March 19, the asset’s daily trading volume reached $17.4 billion as its price surpassed $2,000.

The surge comes as ETH price sentiments turned bearish. On March 11, Yuga Labs’ vice president of blockchain suggested that ETH could drop as low as $200 in a prolonged bear market.

Magazine: Memecoins are ded — But Solana ‘100x better’ despite revenue plunge