- Cortex’s volume surged as its price dropped by over 54% on the charts

- If the trend reversal solidifies itself, CTXC could see a breakout

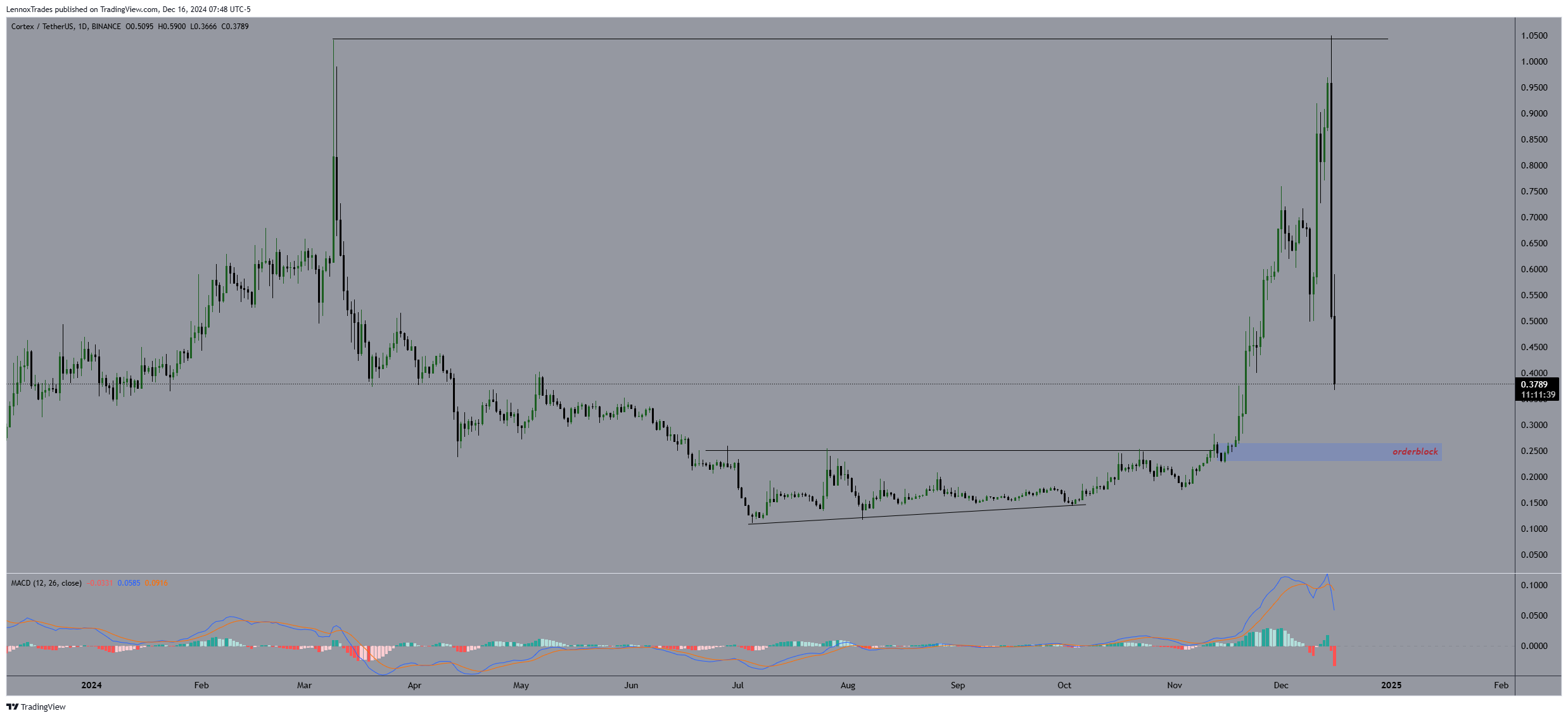

Cortex (CTXC) crypto’s trading volume rose sharply while its price itself declined significantly on the charts. In fact, CTXC’s volume spike was a 4x, in comparison to previous weeks. This was alongside a sharp price drop from a high of approximately $1.05 to a low near $0.37, constituting a fall of around 45%.

CTXC’s ‘orderblock’ at $0.25 historically acted as both support and resistance and at the time of writing, the price seemed to be approaching there. This zone triggered a modest rebound, suggesting some resistance to further declines on the charts.

Despite the bearish trend, however, the hike in volume accompanying the price drop indicated accumulative activities by traders anticipating potential value.

The MACD indicator pointed to a close convergence and a potential bullish crossover, hinting at possible upward momentum. If this trend reversal solidifies itself, CTXC could register a breakout.

This suggested what the critical area for this potential rally could be if CTXC can sustain itself above the $0.40 resistance level. This is likely to pave the way for a more significant recovery.

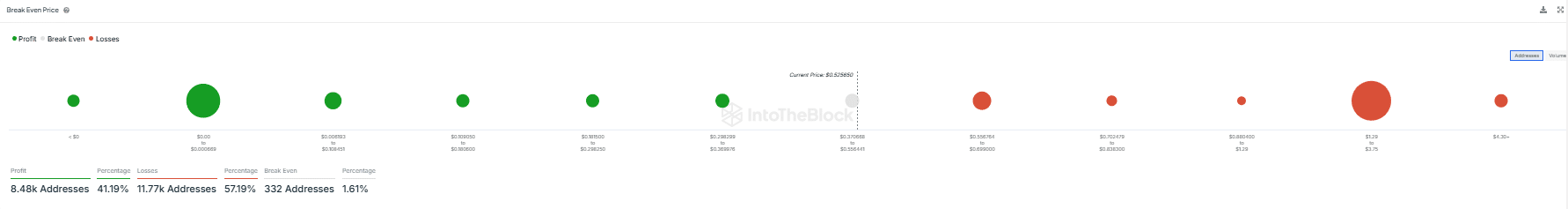

Profitability at break even price

CTXC’s distribution of addresses based on their profitability, relative to the break-even prices, saw 41.19% in profits. These addresses entered the market at $0.385250.

On the contrary, 57.19% of addresses faced losses with the price points at $0.40 and above up to $0.50, where the largest losses were concentrated. The addresses at break-even were just 1.61%, indicated minimal trading activity.

The future market behavior of CTXC could pivot around these levels as addresses in losses could decide to sell if the price approaches their entry points, potentially capping upward price movements.

Conversely, sustained upward trends might convert more addresses to profitability, encouraging a more bullish sentiment in the Cortex market.

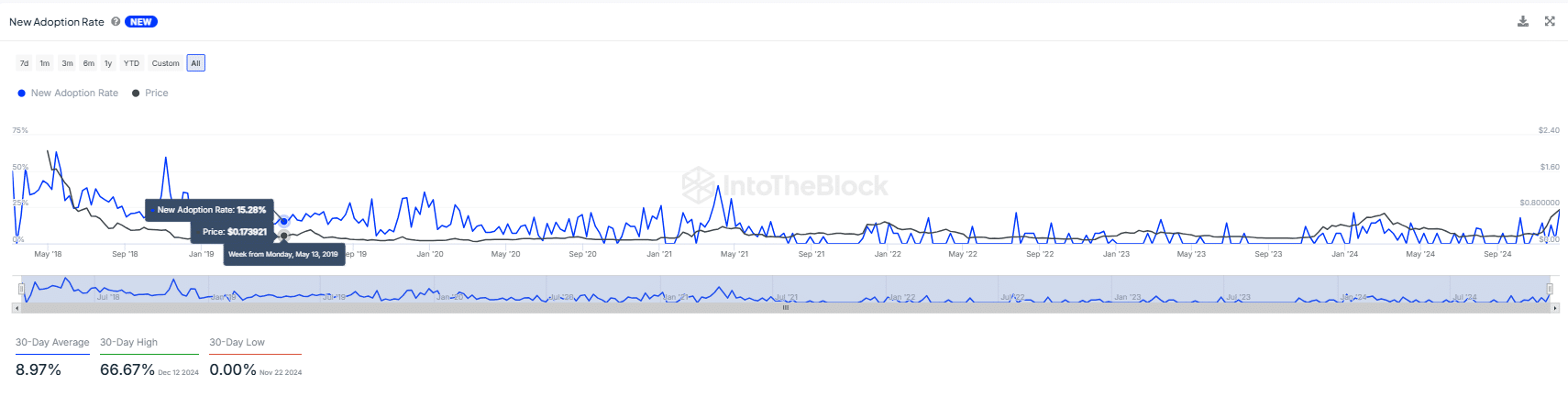

CTCX new adoption rate

New adoption rate of Cortex saw a notable spike in May 2018, reaching nearly 50%, coinciding with a price peak of approximately $0.30. This trend demonstrated that high adoption rates previously propelled price surges, although this connection lessened over time.

Subsequent spikes in adoption throughout 2019 and 2020 showed a similar, albeit more insignificant, impact on the price. This pointed to diminishing returns from new adoption surges on the asset’s price.

By 2024, the adoption rate has steadied around 8.97%, significantly lower than its previous highs. Also, it did not correspond to any notable price changes, as the price stabilized at around $0.80.

This pattern indicated that while early surges in adoption significantly influenced Cortex’s price, the effect has waned. Likely due to market maturation or reduced responsiveness to adoption changes.

If the adoption rate continues to increase, its previous impact on the price suggested that future price movements could no longer correlate strongly with new adoption rates. By extension, this hinted at a decoupling of user growth from direct price incentives.