The crypto derivatives market experienced a historic surge in 2024, with perpetual futures trading volumes skyrocketing to an all-time high.

According to CoinGecko’s latest report, the total trading volume on the top 10 centralized perpetual exchanges reached $58.5 trillion in 2023, doubling from $28 trillion.

This growth shows the increasing popularity of perpetual futures contracts, which allow traders to maintain positions indefinitely without expiration dates.

However, despite this significant market expansion, Binance, the dominant force in the perpetuals sector, saw its market share slip from 43% in January to 34% in December.

Binance’s Waning Grip on the Perpetuals Market

Despite its position as the largest centralized exchange, Binance’s dominance in the perpetuals market continued to erode throughout 2024.

The exchange, which once held an unassailable lead, faced mounting competition from other CEXs, particularly Bybit, OKX, and Bitget.

Throughout the year, Binance’s total trading volume increased, but its market share steadily declined.

In Q4 alone, the top 10 centralized perpetual exchanges recorded $21.2 trillion in trading volume, a 79.6% increase from Q3’s $11.8 trillion.

Binance led the sector with a 34% market share in December, a steep drop from the 43% dominance it enjoyed at the start of the year. This came after a reported 39.5% dominance in October 2024.

One of the most notable developments was the rise of Coinbase International, which entered the top 10 list for the first time after experiencing a dramatic fourfold increase in its trading volume.

This indicates a shift in trader preferences as newer and more competitive platforms continue to gain traction against established giants like Binance.

The competition is not just limited to centralized exchanges. Decentralized perpetual exchanges also saw substantial growth, posing an additional challenge to Binance’s dominance.

The Rise of Decentralized Perpetual Exchanges

The decentralized perpetual trading sector also experienced a meteoric rise in 2024, with total trading volumes reaching $1.5 trillion, representing a 138.1% increase from the $647.6 billion recorded in 2023.

A standout performer in this space was Hyperliquid (HYPE), which capitalized on the success of its HYPE airdrop to capture a dominant market share.

By Q4, Hyperliquid controlled more than 55% of DEX perpetual trading volumes, reaching a peak of 66% in December.

In contrast, dYdX, the previous market leader, experienced a dramatic decline. Once holding 73% of the market in January 2023, dYdX’s share had dwindled to just 7% by December 2024.

Meanwhile, Jupiter, built on Solana, emerged as the second-largest decentralized perpetual exchange, though Solana itself accounted for only 15% of the total decentralized perpetual trading volume.

Bitcoin’s Dominance in Open Interest and the Rise of Solana

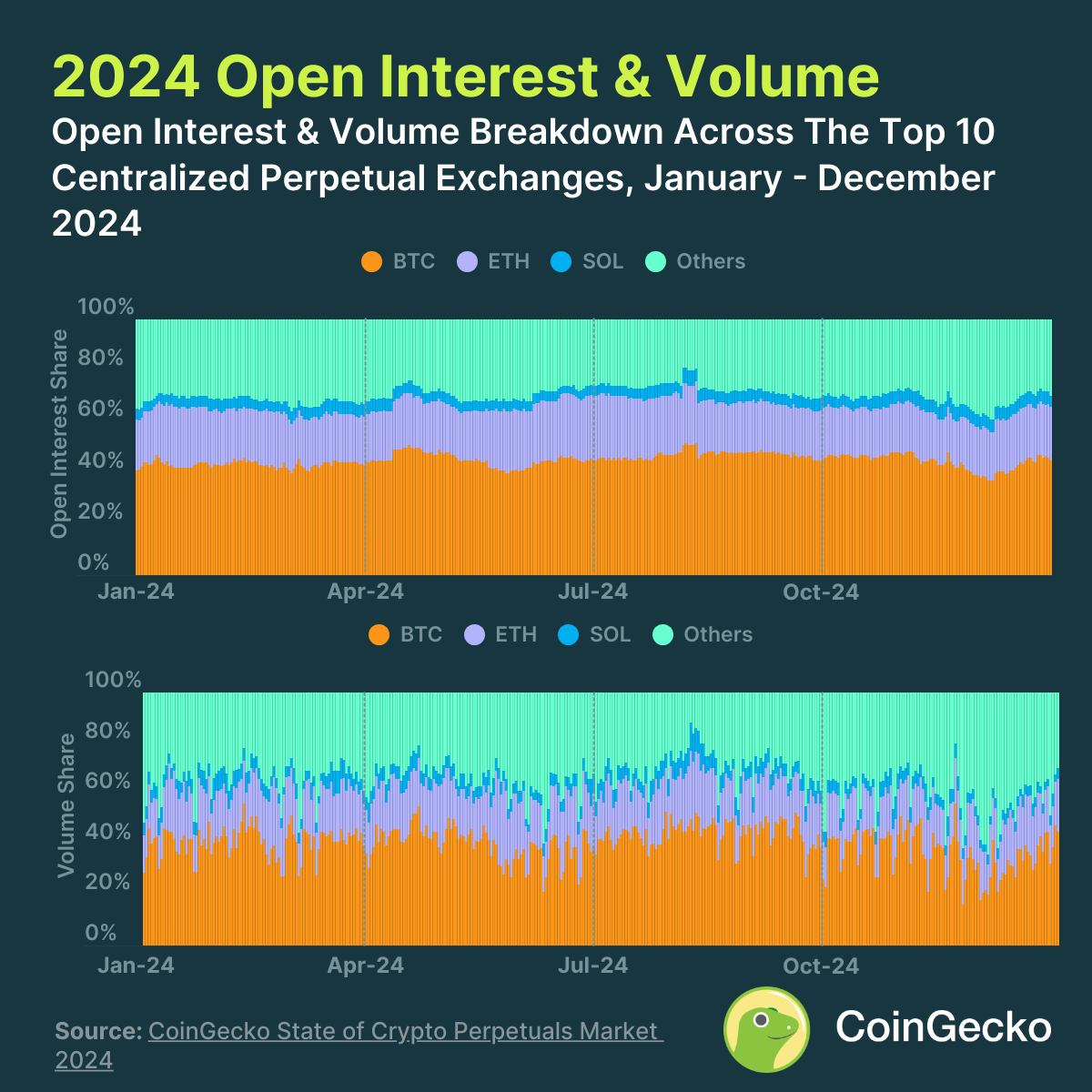

Bitcoin remained the primary asset for perpetual trading in 2024, consistently accounting for around 45% of open interest on the top 10 centralized exchanges.

According to CoinGecko, open interest across these exchanges surpassed the $100 billion milestone for the first time on November 22, 2024, sustaining this level through the end of the year.

This marked an increase from the $59 billion recorded on October 1 and the $31.2 billion seen at the beginning of the year.

The surge in open interest was partly driven by macroeconomic factors, particularly the November U.S. presidential elections.

Donald Trump’s victory bolstered bullish sentiment across the crypto market, leading to increased trading activity and leveraged positions in perpetual futures.

Solana blockchain also saw a notable surge in trading volume following the booming celebrity meme coin launches.

Looking forward, 2025 started quite bullish but has since gone back to 2022 lows due to the sudden economic reformation President Donald Trump is doing.

However, many top leaders and analysts believe 2025 could be the most bullish year for crypto because of favorable regulations surrounding it now due to the current pro-crypto administration.

The post Crypto Perpetuals Trading Doubles to $58.5T in 2024 While Binance’s Market Share Declines 20% appeared first on Cryptonews.