Cryptocurrency and equities markets entered a “new phase of the trade war, amid ongoing tariff escalations between the United States and China.

Global trade war concerns intensified on April 15 after the White House published a fact sheet announcing that Chinese imports would be hit with tariffs of up to 245%.

The penalties include a “125% reciprocal tariff, a 20% tariff to address the fentanyl crisis, and Section 301 tariffs on specific goods, between 7.5% and 100%,” according to the White House.

Crypto, tech stocks and other “expensive assets” have entered a “new phase” of the global trade war in response to the latest escalation, according to Aurelie Barthere, principal research analyst at crypto intelligence platform Nansen.

“We are now in a new phase of the trade war, with the focus on high-added-value sectors, Tech (and Pharma), and the zeroing in on US-China,” the analyst told Cointelegraph, adding:

“Until and IF we see a resolution of the US-China conflict (one leader picks up the phone and gives some concessions to the other), we are facing highly correlated risk assets.”

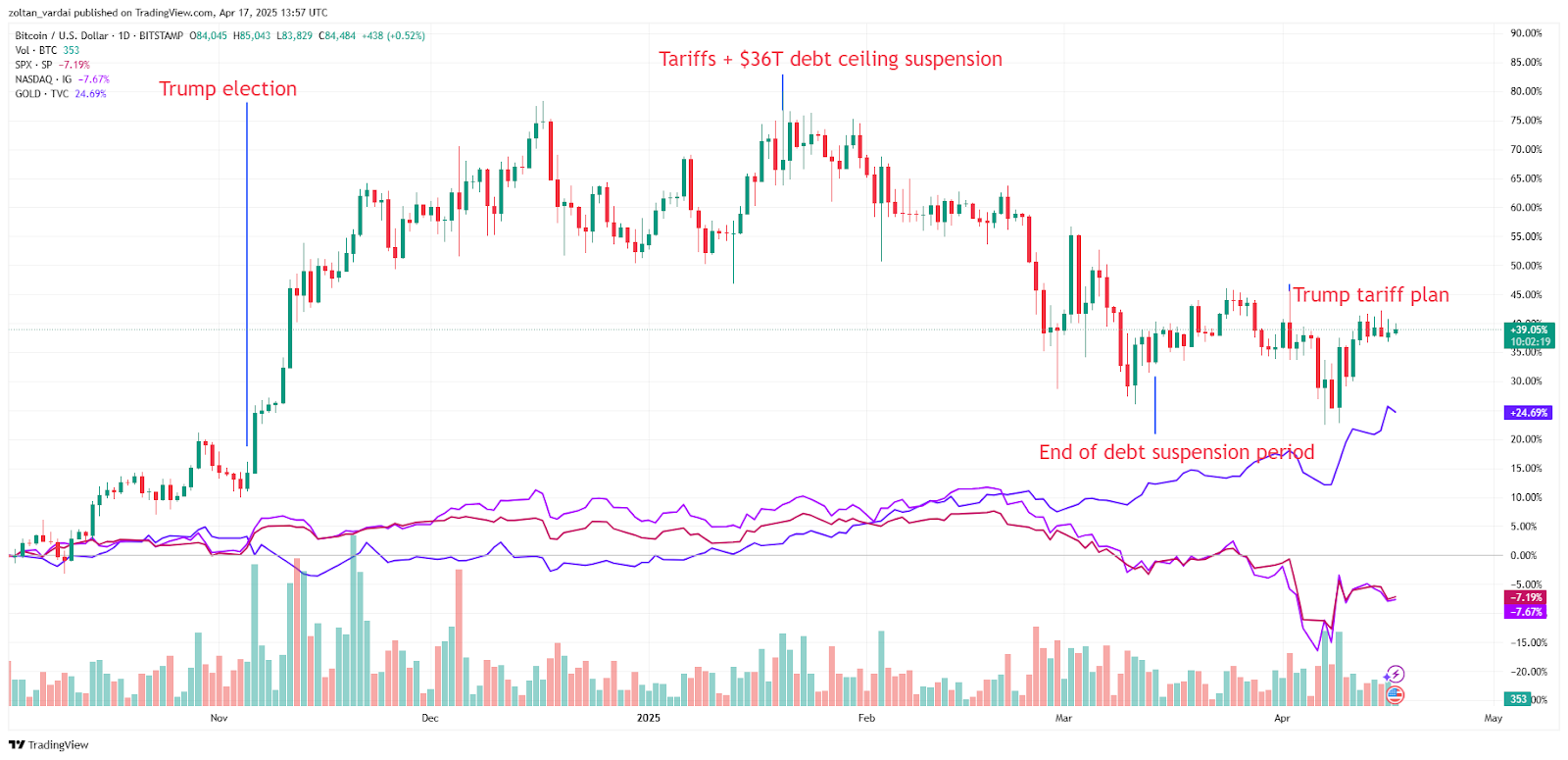

“I also think this situation is negative for non-US equities,” Barthere said. US equities and crypto have been “highly correlated” since November 2024, which increased to the downside during the current market correction, as “investors de-risk, especially expensive assets,” she added.

Related: Bitcoin’s safe-haven appeal grows during trade war uncertainty

The recovery of global equities and cryptocurrency markets hinges on the tone of global tariff negotiations, with a 70% chance to bottom by June 2025 before recovering, Nansen analysts previously predicted.

China recently appointed a new chief trade negotiator, Li Chenggang, a former assistant commerce minister during the first administration of US President Donald Trump.

Chenggang is characterized as a “very intense” negotiator experienced in dealing with US officials, Reuters reported on April 16, citing an unnamed source in Beijing’s “foreign business community.”

Related: Trump’s tariff escalation exposes ‘deeper fractures’ in global financial system

Eyes on Powell’s next move

As tariff tensions increase alongside inflation-related concerns, all eyes are now on US Federal Reserve Chair Jerome Powell’s upcoming speech during the next Federal Open Market Committee (FOMC) meeting on May 6.

“Markets were on edge for any signal that the Fed might delay rate cuts due to sticky inflation or heightened geopolitical risk,” analysts from Bitfinex exchange told Cointelegraph, adding that if Powell leans hawkish, risk assets like Bitcoin could see downside:

“A neutral or balanced tone may calm markets more than they already have over the past week with some signficant recoveries across many risk assets and particularly crypto where many lower market cap assets have moved 30–40% off the lows.”

“Crypto is reacting to macro news not because fundamentals have changed, but because positioning is thin and confidence is sensitive,” the analysts added.

Magazine: Bitcoin ATH sooner than expected? XRP may drop 40%, and more: Hodler’s Digest, March 23–29