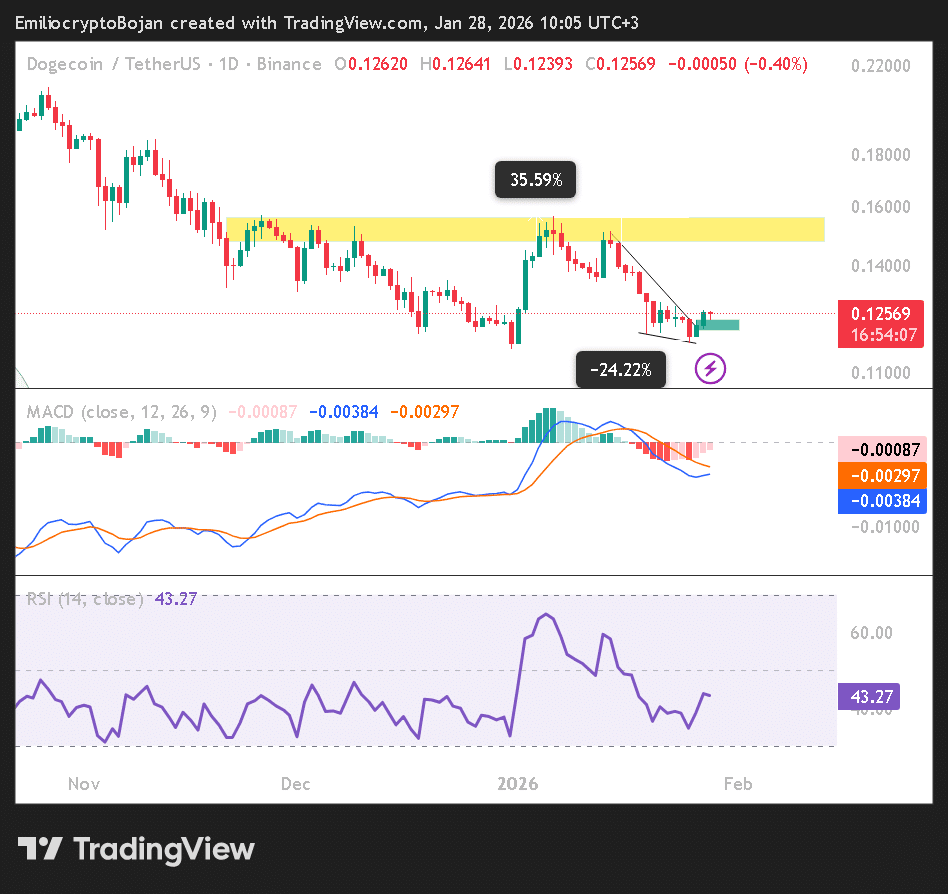

Dogecoin broke out of a downtrend after a 24% correction earlier this month. After peaking at $0.155 on the 6th of January, the price failed to hold those levels and retraced.

Even so, the pullback did not erase January’s gains, following a 35.59% surge. The MACD remained in negative territory but showed early recovery signs as the MACD line approached the signal line.

That setup left traders focused on key reclaim levels.

A daily close above $0.128 could have shifted short-term control back to the bulls. Holding above $0.12 remained critical to preserving upside structure.

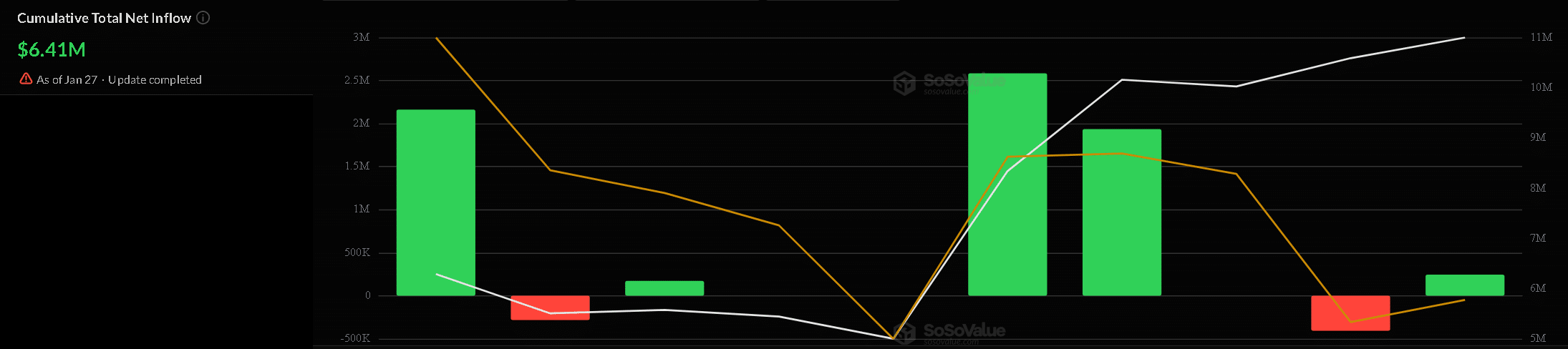

Dogecoin ETF inflows stayed muted

Dogecoin-linked exchange-traded funds (ETFs) saw limited investor interest, with just $6.41 million in Cumulative Net Inflows despite a $20.6 billion market cap.

On the 27th of January 27, the ETFs registered $246K in inflows, bringing the total for January to $4.07 million, surpassing the combined inflows of November and December 2025.

Even so, flows remained modest, leaving uncertainty around whether institutional demand meaningfully shifted.

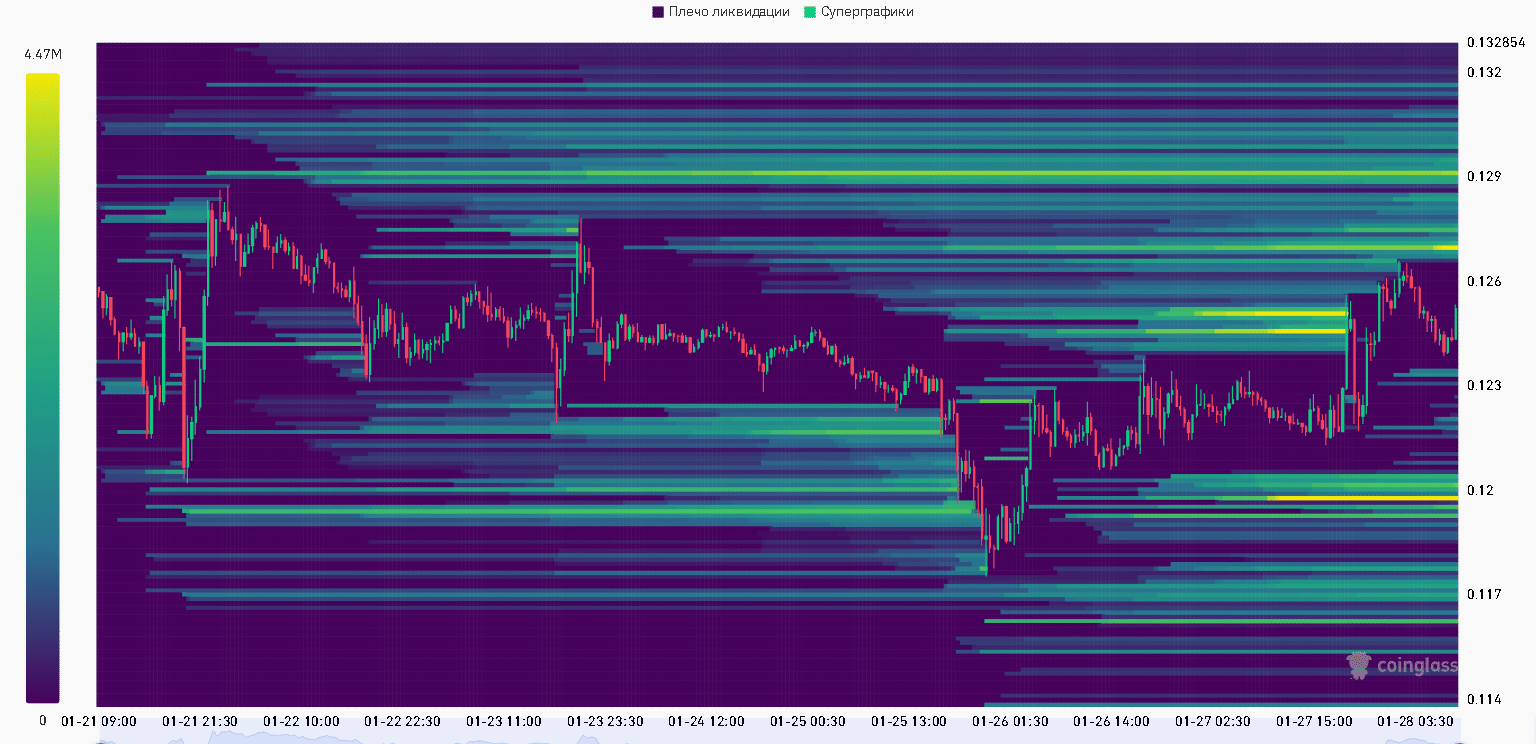

Liquidity clusters moved overhead

Dogecoin [DOGE] had nearly cleared all downside liquidity, with clusters forming above $0.129, showing strong potential for an upward move. Traders were watching closely for any signs of liquidity hunting, which could trigger a short squeeze.

If price cleared the $0.129–$0.132 range, short positions could have faced forced covering. That scenario might have accelerated upside momentum if follow-through buying appeared.

That move aligned with traders closely monitoring liquidity behavior rather than spot volume expansion.

Gold relationship returns to focus

Historically, Dogecoin had remained stagnant during Gold’s mania phase, only to surge once Gold entered a period of stagnation.

According to prominent analyst Trader Tardigrade, this cyclical relationship had been evident from 2015 to 2021, where Dogecoin outperformed Gold during Gold’s cooling-off periods.

As Gold showed signs of stagnation again, Dogecoin seemed poised to enter its own “mania phase.” With its price showing signs of recovery, the potential for a breakout above resistance levels seemed more likely.

If the historical pattern held, sentiment rotation could have favored DOGE over traditional hedges.

Final Thoughts

- Dogecoin’s downtrend break shifted short-term momentum, keeping $0.12 as the key structural support. Liquidity positioning suggested upside potential if resistance zones broke.

- ETF inflows stayed limited, but market structure improvements left traders watching for confirmation above $0.132.