- Dogecoin’s trading volume surged significantly, testing crucial support levels amid market uncertainty.

- Technical indicators show mixed signals, with reduced market participation and declining Open Interest.

Dogecoin [DOGE] has recently witnessed a significant increase in trading volume, with over 1 billion tokens exchanged in just 24 hours.

This surge has caught the attention of many market participants, raising questions about the underlying reasons and the potential impact on Dogecoin’s price.

DOGE price action: Will the price hold or drop further?

At press time, Dogecoin was trading at $0.1962, down by 2.02% over the past 24 hours. The price had consolidated within a symmetrical triangle, testing crucial support levels near $0.1971 and $0.1815.

This consolidation points to market indecision as traders wait for a clear breakout signal.

If the price breaks below these support levels, a further downside could be seen. However, if Dogecoin holds these levels, it may rally toward higher resistance zones, signaling a possible buildup of bullish momentum.

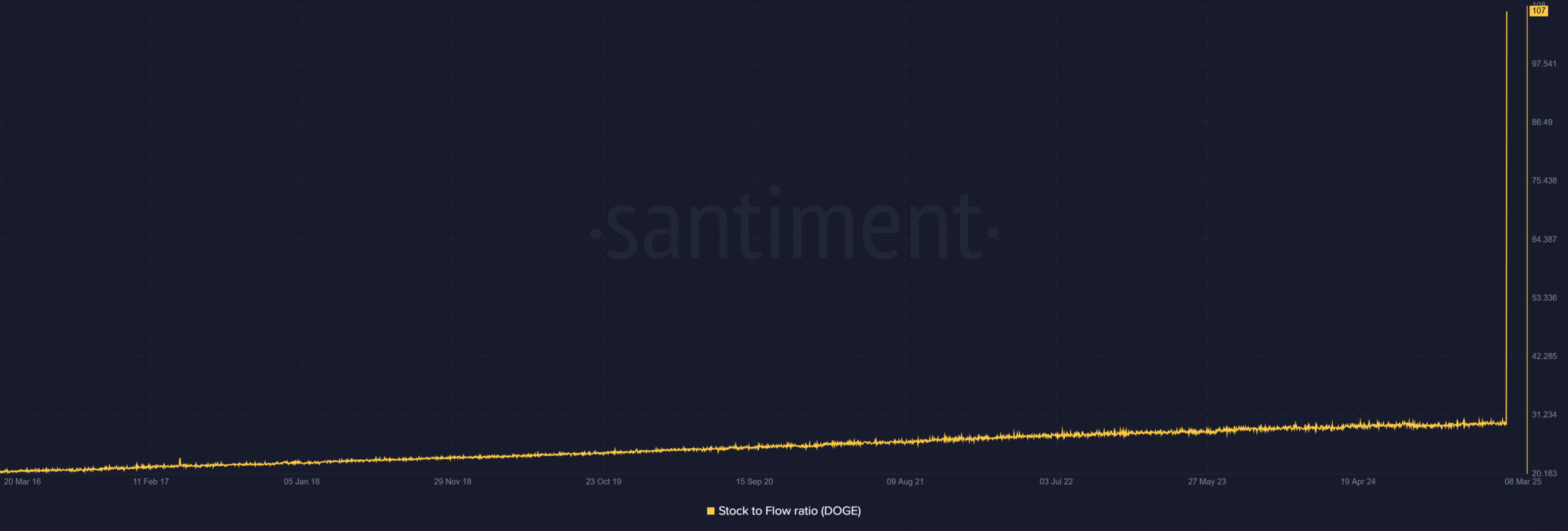

What does Dogecoin’s stock to flow ratio tell us?

Dogecoin’s stock to flow ratio has spiked to 157.52, following a prolonged period of consolidation around 30. This rise suggests the market may be pricing in increased scarcity, potentially forecasting a future surge in price.

The sharp increase could reflect a shift in sentiment, signaling that traders are expecting more demand. However, this ratio alone doesn’t guarantee an immediate upward move.

Can DOGE maintain momentum?

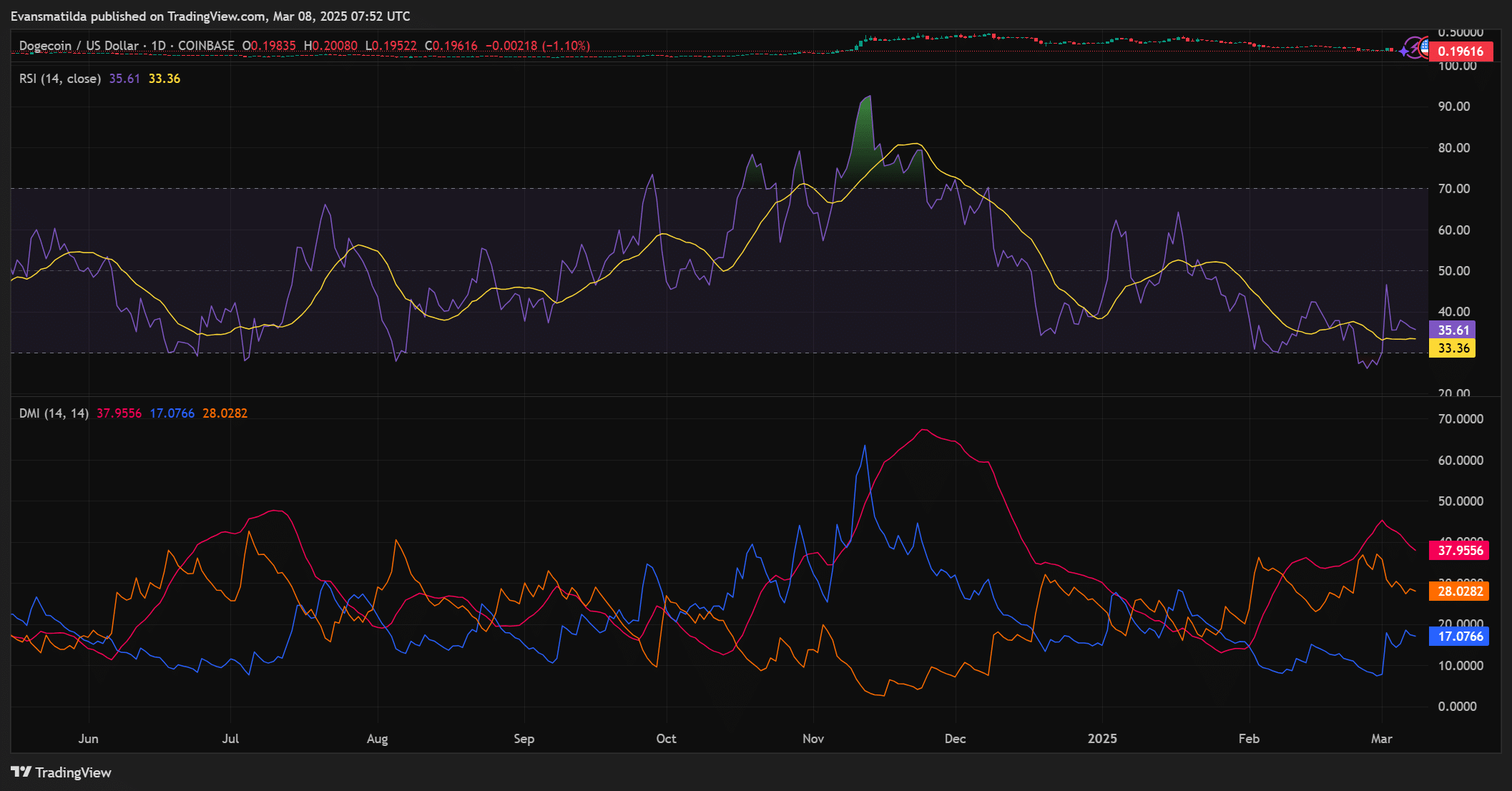

Dogecoin’s technical indicators showed mixed signals. The Relative Strength Index (RSI) stood at 35.61, just above the oversold zone, suggesting that DOGE might be primed for a short-term rebound.

However, the Directional Movement Index (DMI) pointed to a slight bearish trend, with +D at 17.1 and -D at 28.0.

Additionally, the Average Directional Index (ADX) stands at 37.9, indicating that the current trend is strengthening.

While the RSI suggests potential for a rebound, the DMI and ADX indicate that downward pressure could persist, making caution key for traders.

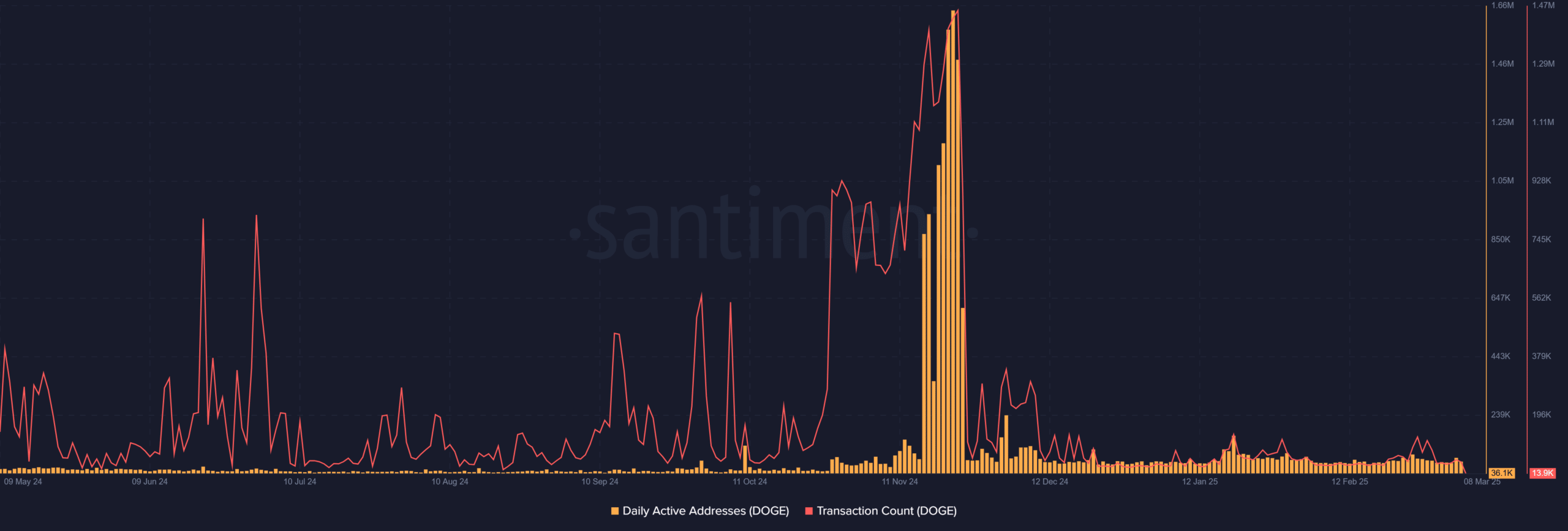

Decline in daily active addresses and transaction count

Dogecoin has also seen a decline in daily active addresses, now at 36.1K, and a drop in transaction count to 13.9K. This reduction points to decreased market participation, signaling a lack of conviction among traders.

However, while this could be a temporary lull, prolonged inactivity might result in downward pressure on the price, as fewer market participants could lead to reduced volatility.

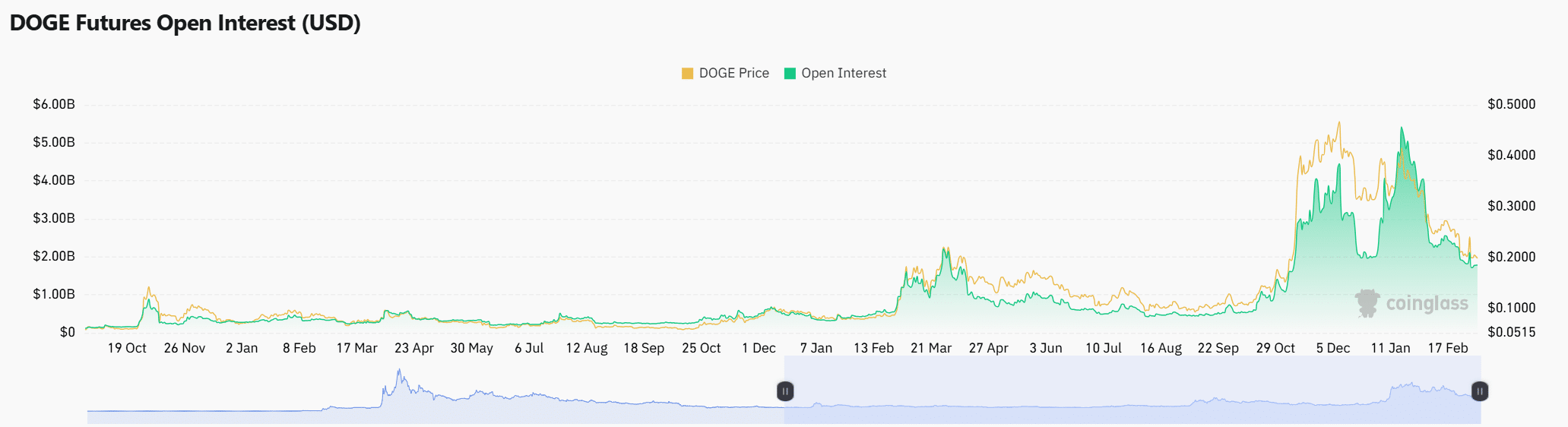

Does Dogecoin have the market confidence?

Dogecoin’s Open Interest has decreased slightly by 0.02% to $1.76 billion, suggesting reduced confidence in the short-term market outlook.

With fewer traders opening new positions, this indicates a cautious approach, possibly due to uncertainty around price direction.

This decline may limit Dogecoin’s ability to maintain any bullish momentum in the near future.

Conclusion

The recent surge in Dogecoin’s trading volume is significant, but it is not yet enough to suggest sustained upward momentum.

With key technical indicators showing mixed signals and reduced market activity, the price could either hold at current support levels or drop further.

Traders should remain cautious and wait for a clearer directional signal before making further moves.