- DOGE faces mounting selling pressure in the face of short to mid-term holders capitulating

- 400 million DOGE inflows to Binance hinted at fading conviction across the board

About 400 million DOGE hit Binance as Dogecoin [DOGE] dropped back to its $0.17 support level from a month ago. With DOGE still nursing a 31% drop from its May highs, this move could be smart money looking to break even.

Now the big question is – Are they ready to exit, or will FOMO keep them holding?

That’s likely what’ll decide if DOGE can hold $0.17 or if it ends up slipping below it.

Same playbook, different cycle – DOGE runs into the sell wall

A closer look at on-chain data revealed that 30% of DOGE addresses are now holding at a loss, with acquisition prices sitting above the press time spot of $0.18.

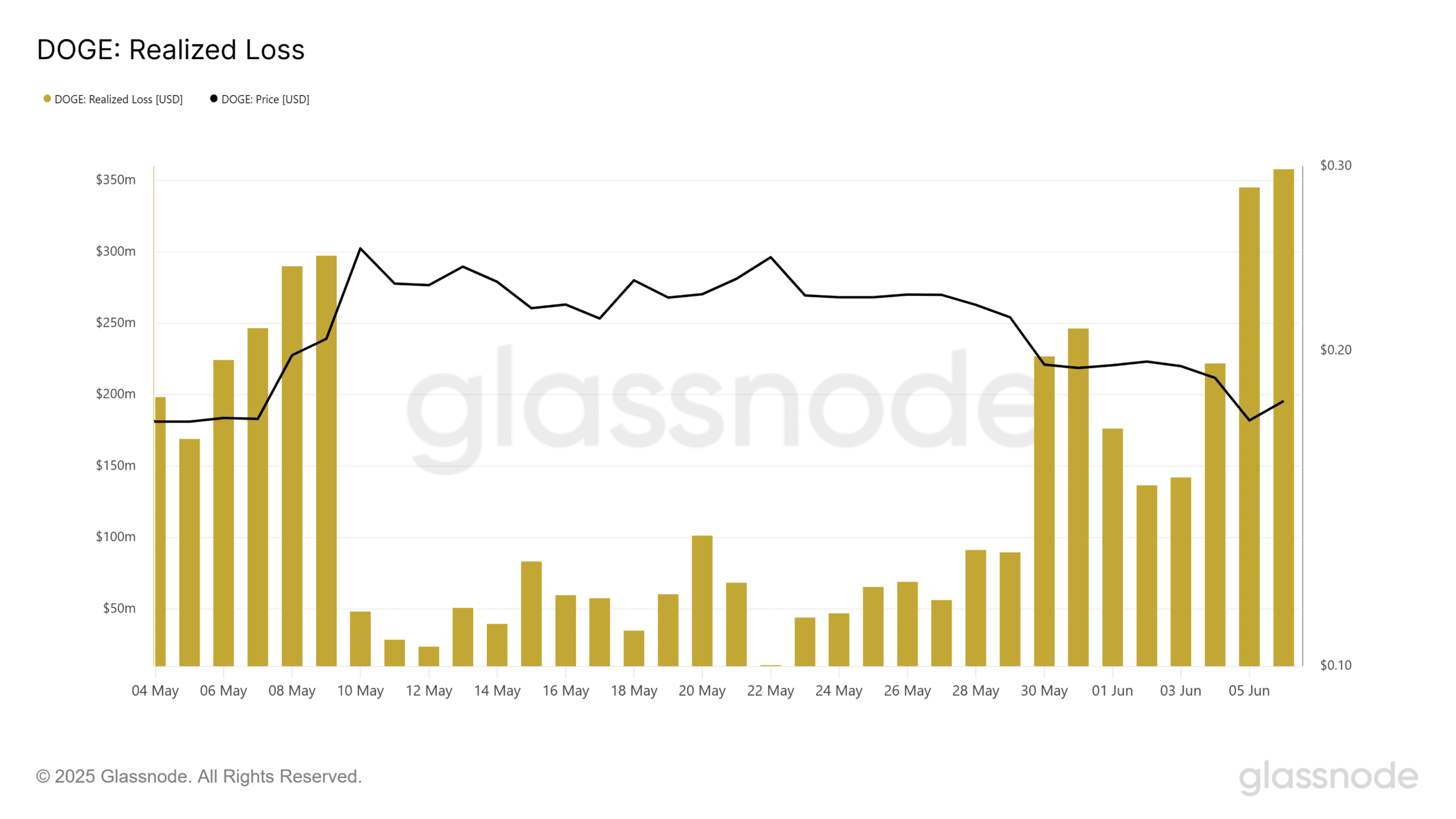

More critically, since DOGE broke below the $0.20 support, HODLers have begun capitulating. In fact, over $800 million in realized losses were recorded in the last three days alone.

This wave of losses coincided with DOGE’s drop to $0.1680, signaling growing sell pressure.

The 400 million inflow into Binance only strengthens the idea that holders are preparing to sell into strength—if any remains.

However, it’s not the diamond hands flinching. It’s the short to-mid-term holders feeling the pressure.

In true DOGE fashion, the “buy low, sell the pump” crowd capped the rally, once again steering DOGE into a familiar speculative cycle. In turn, pushing a chunk of addresses underwater.

Short-term distribution squeezes profit margins

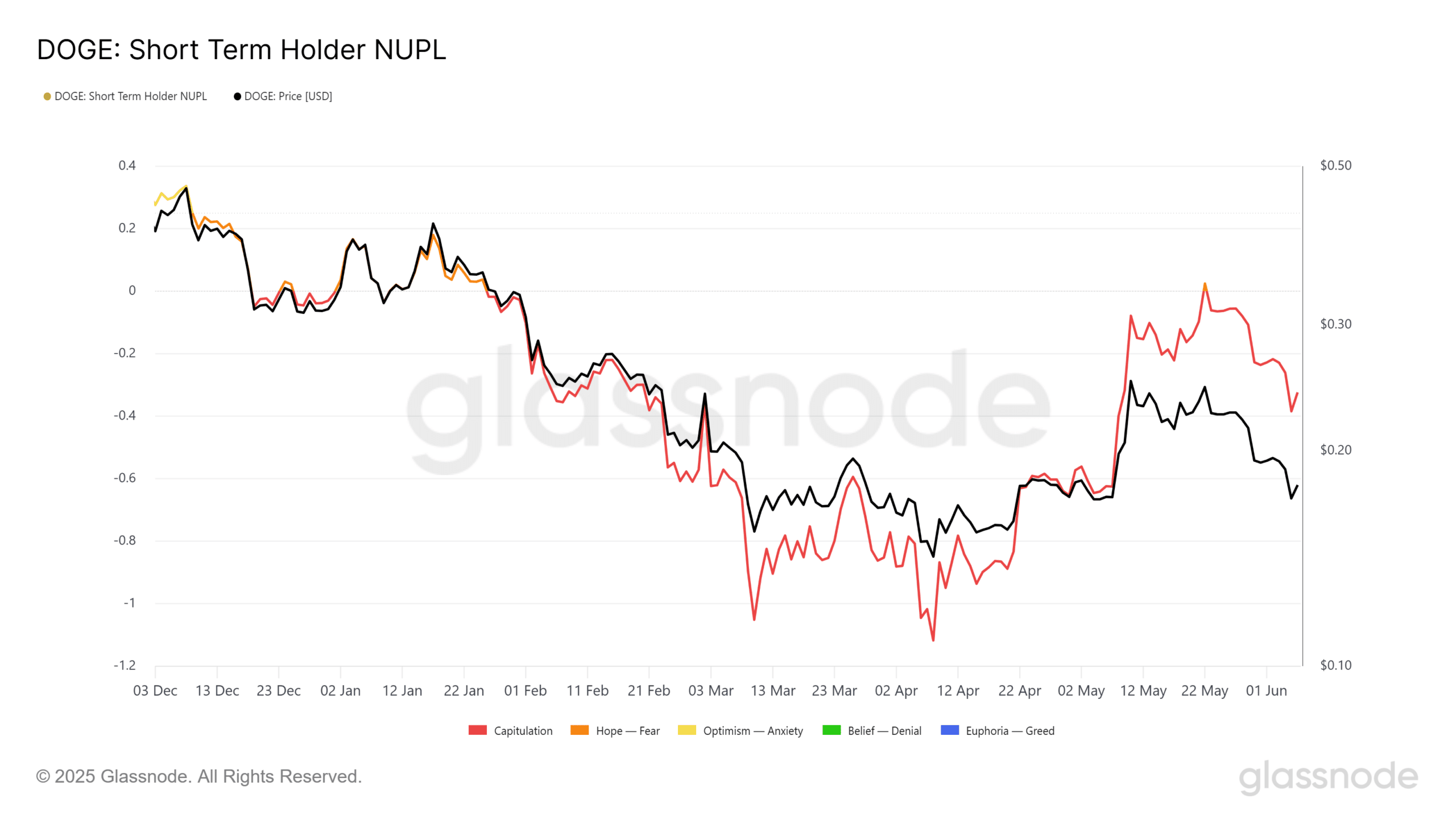

As Dogecoin tested the $0.25 resistance level, the Short-Term Holder NUPL flipped negative, signaling a full capitulation phase in this cohort.

Such a capitulation has intensifed downside pressure, forcing DOGE below the critical $0.20 support level. It has also compressed profit margins, while triggering a broader erosion of holder conviction.

In fact, the HODL Waves seemed to reinforce this picture too. The 3–6 month cohort’s share of Dogecoin supply surged from 10% in March to 15.53% at the rally’s peak.

Right on cue, this cohort started trimming their bags, locking in profits, or exiting near breakeven. Their share has since dropped to 12.4% – A clear sign of distribution pressure kicking in.

In short, as short-term holders wave the white flag, the wider DOGE crowd is getting forced into realizing those losses.

Unless Dogecoin breaks free from this bubble, pushing past $0.25 is going to stay tough. That leaves the $0.17 support dangerously exposed.