- Dogecoin whales’ activity correlated with price spikes and volatility.

- Recent whale movements could signal a strategic accumulation or a pump attempt.

Over the weekend, Dogecoin [DOGE] whales made a noteworthy move, collectively acquiring a massive 160 million DOGE.

This significant purchase has raised eyebrows, prompting speculation about its potential impact on Dogecoin’s price.

The timing and scale of these acquisitions have fueled questions: Are these whales attempting to drive short-term market movements, or are they positioning themselves for long-term gains?

As Dogecoin continues to capture attention in the meme coin space, the behavior of its largest holders could offer valuable insights into its future price action.

Whale activity: A month in review

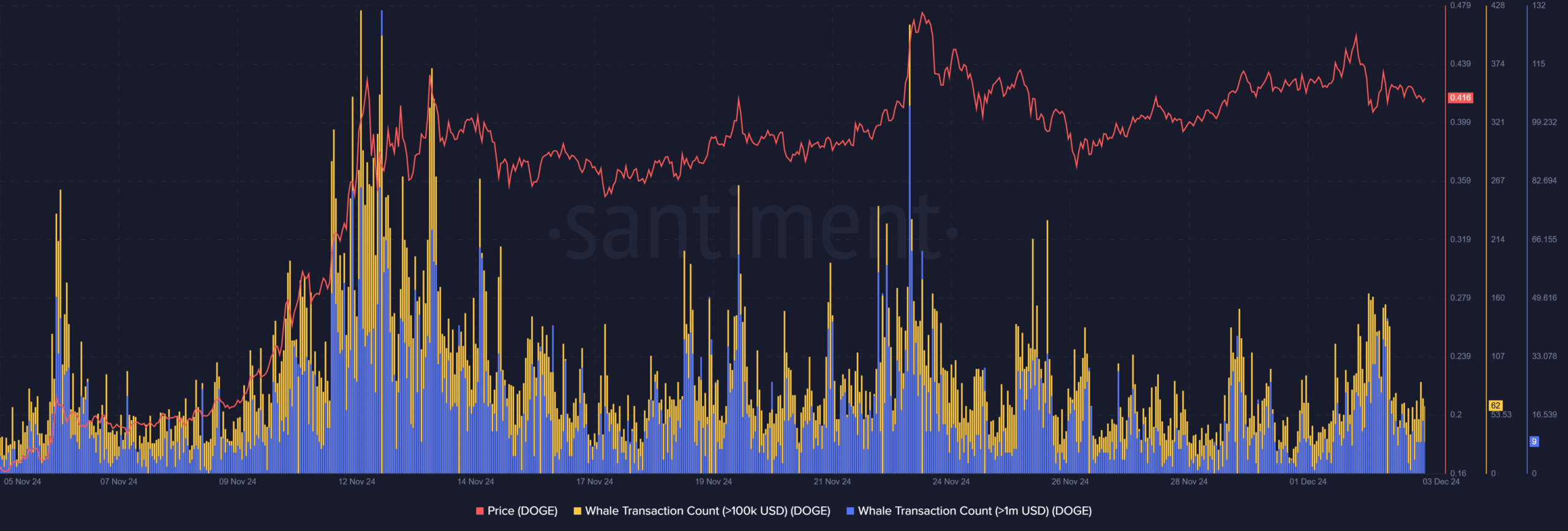

In the past month, Dogecoin’s whale activity has surged significantly, as evidenced by the growing number of transactions exceeding $100,000 and $1 million.

The data revealed a direct correlation between these large transactions and price volatility. Notably, the mid-November spike in whale transactions coincided with Dogecoin’s climb from $0.28 to a peak of $0.44.

This trend puts the spotlight on the critical role of whale movements in shaping DOGE’s short-term trajectory.

During periods of increased activity, whales appear to amplify market momentum, both upward and downward. However, as the transaction frequency cooled toward the end of November, DOGE’s price stabilized near $0.41.

The behavior suggests strategic positioning by whales, potentially ahead of another breakout.

Whether this indicates an impending rally or calculated accumulation depends on broader market conditions and sentiment in the coming weeks.

Dogecoin price dynamics

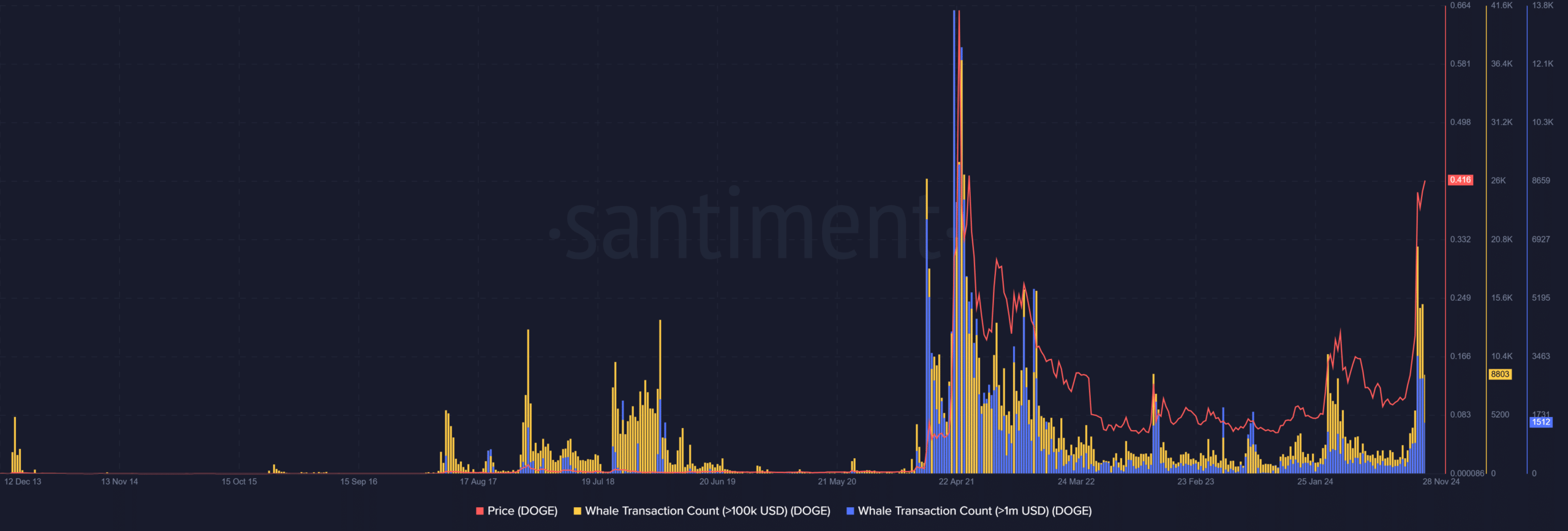

Dogecoin’s history revealed a strong relationship between whale activity and dramatic price movements. The 2021 peak, marked by a surge in transactions exceeding $1 million, corresponded with DOGE’s meteoric rise to $0.74.

This spike demonstrated how concentrated buying pressure can drive parabolic rallies, fueled by retail speculation following the whales’ lead.

Subsequent years, however, revealed the flipside: periods of low whale activity coincided with prolonged price stagnation, underlining the role of large holders in sustaining market momentum.

The recent resurgence in whale transactions echoes similar pre-rally phases from 2020 and 2021, suggesting a potential breakout.

Yet, the data also highlights the risks of over-reliance on whales, as abrupt sell-offs have historically triggered cascading corrections.

Additionally, Dogecoin’s lack of fundamental utility beyond speculation raises concerns about its ability to sustain prolonged bullish trends.

Without consistent retail engagement, even significant whale positioning may fail to spark lasting momentum.