- Dogecoin Reserve aims to make DOGE faster and more usable for global daily transactions.

- Active addresses dropped by 75%, despite strong market reaction to the news

Dogecoin’s price gained strong bullish momentum following an announcement by House of Doge — The newly formed corporate division of the Dogecoin Foundation.

On 24 March, the organization revealed it had established the Official Dogecoin Reserve by purchasing 10 million DOGE at market value. Seemingly, it is meant to lay a foundation for positioning Dogecoin [DOGE] as a fast, decentralized currency suitable for global payments.

The Reserve is designed to act as a liquidity buffer for merchants and users. Its function is to enable faster transaction settlement and eliminate the lag times that often hinder crypto payment adoption.

How did the markets react to the move?

Naturally, the markets responded immediately.

Between 24-25 March, DOGE surged from $0.176 to a session high of approximately $0.19158 – Representing gains of more than 8.8%.

The move broke through key resistance levels, as illustrated in a chart shared by popular analyst Ali Martinez.

In fact, the breakout formed from an ascending triangle pattern, which often precedes a continuation of bullish momentum.

That was price action though. Now, let’s talk about the numbers behind it.

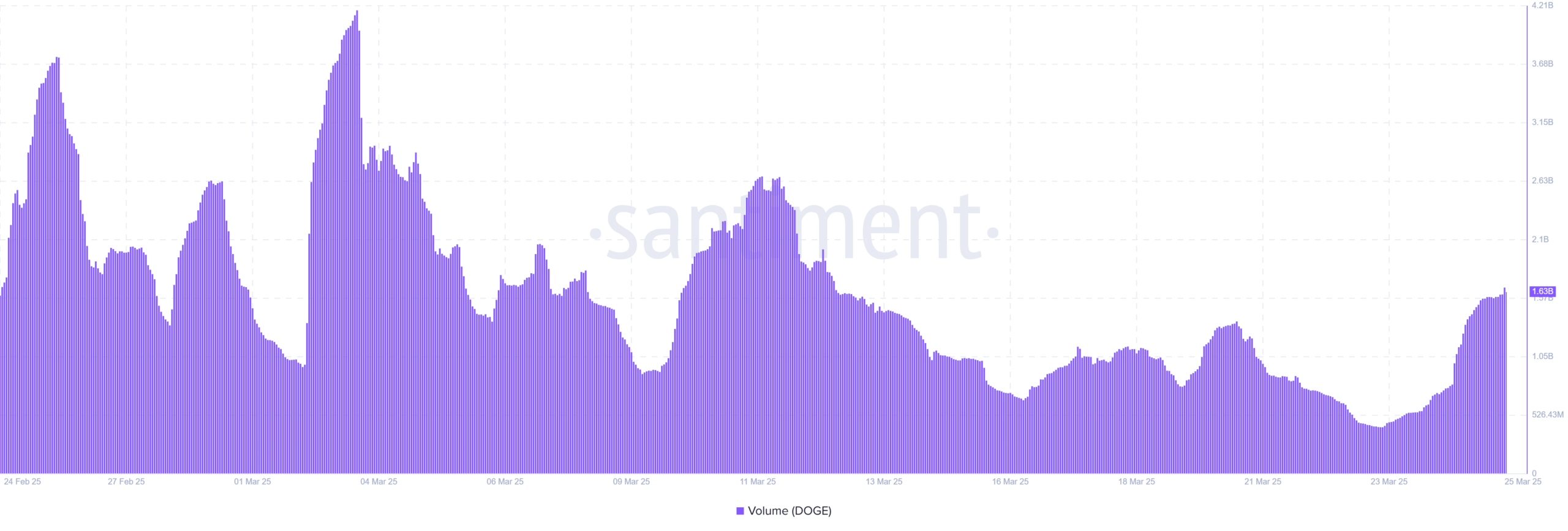

On-chain data revealed that the Reserve announcement triggered a surge in trading activity. Dogecoin’s trading volume rose from $1.07 billion on 24 March to $1.63 billion on 25 March – A 52.34% jump within 24 hours.

This sharp uptick reversed a three-week downtrend in trading activity that had seen volume fall by over 74% since early March.

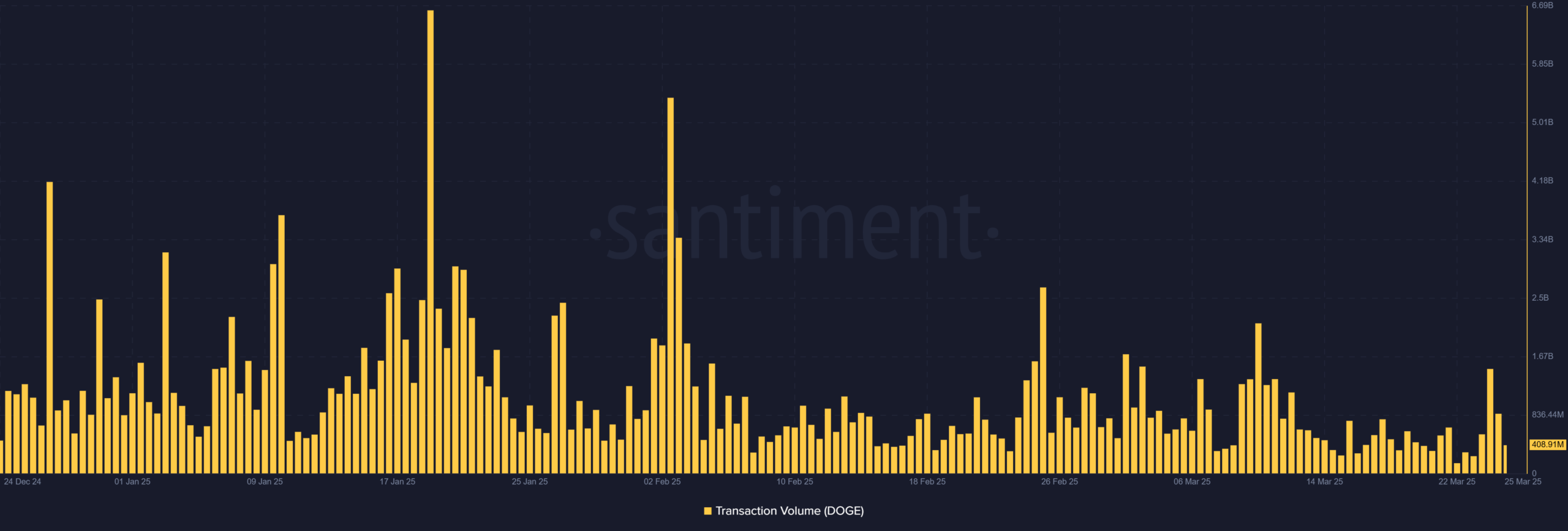

A closer look at transaction volume further validated the impact of the Reserve initiative.

Assessment of transaction volumes

On 25 March, total on-chain transaction volumes rose to 858.59 million DOGE, up from roughly 354 million DOGE the day before.

This marked a 142.8% hike, highlighting an uptick in blockchain activity as traders, speculators, and potentially new users responded to the initiative.

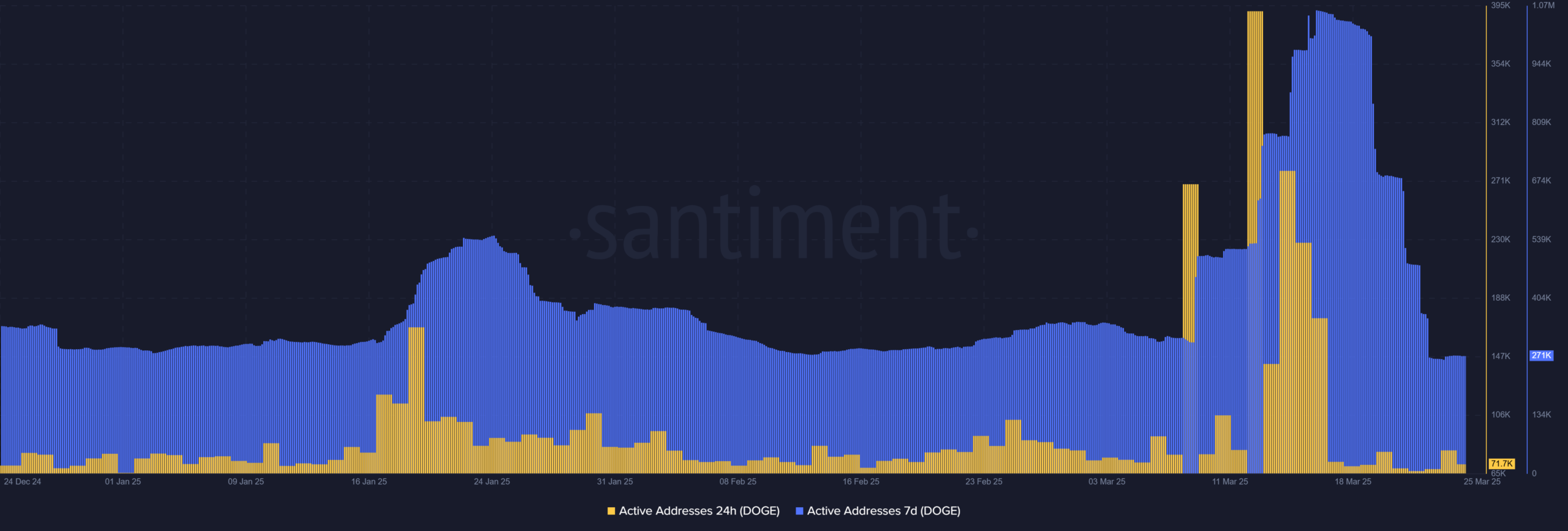

While the price and volume metrics hinted at rising enthusiasm across the board, active address data seemed to tell us a different tale.

Is Dogecoin’s momentum sustainable?

Almost a week ahead of the announcement, 24-hour active addresses peaked at 291,220 and 7-day active users hit 1.06 million. This indicated a build-up of interest, leading upto the event. However, by 25 March, both figures had fallen significantly.

Daily active addresses dropped to 73,130 – A 75% decline from peak levels. Weekly active addresses also slid to 271,520, down roughly 74% from their high.

This fall highlighted a common theme across Dogecoin’s network – It often sees event-driven bursts of activity that fade quickly. While DOGE can scale during attention spikes, the network struggles to hold sustained user engagement beyond major announcements.

In conclusion, although traders reacted positively to the Reserve news, day-to-day momentum has been impossible to sustain. To put it simply, the rapid drop in active users post-spike reinforced that sustained adoption remains an open challenge.