- Current audit practices leave critical gaps, where unseen risks can emerge minutes after audits conclude.

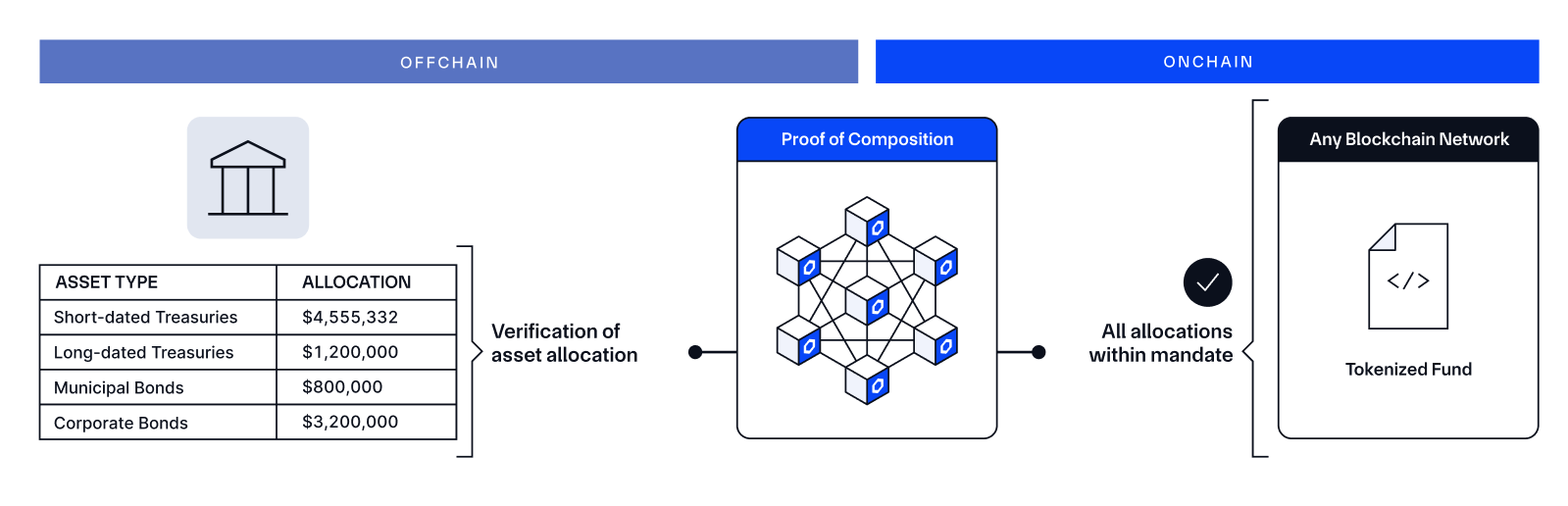

- Proof of reserves provides real-time verification of asset backing, while proof of composition ensures transparency into what assets are held and in what proportions—together reducing the risk of fraud and insolvency.

- If the U.S. wants to lead in onchain finance, it must adopt technologies that enforce transparency and accountability on a continuous basis.

For the United States financial system to maintain its position as the central hub of global asset creation as finance moves from online to onchain, it must continue to offer the most trusted and attractive financial assets.

The lack of real-time transparency makes financial markets vulnerable to failures such as the 2008 global financial crisis, where the risks in opaque mortgage-backed securities were obscured and financial contagion spread across global markets. Blockchain technology can prevent systemic vulnerabilities and create a more stable, reliable financial system by enabling the creation of assets that are transparently verifiable by regulators, financial institutions, and investors.

If the U.S. is looking to be the global hub of blockchain asset issuance, it needs to enable assets that are transparent, verifiable, and highly resistant to fraud.

Delayed Reserves Reporting Causes The “Gap” Problem

Financial audits occur monthly or quarterly, creating a gap where discrepancies or outright fraud can go undetected mere seconds after they are completed. This lack of collateral transparency has resulted in billions of dollars of losses.

Proof of reserves provides real-time transparency into the value of the reserves backing any financial asset, helping ensure that financial markets are not just verifiable at single points in time but remain verifiable every second of every day.

Proof of reserves can also be used to place technological limitations on tokenized assets to ensure that more assets cannot be created without sufficient collateral—for example, by including a line of code preventing additional stablecoins or tokenized assets from being minted unless sufficient fiat currency or treasury securities are part of reserves. This allows users to continuously verify reserves in real time and provides regulators with insight into issuers’ compliance with reserve requirements.

Traditional Funds Are “Black Boxes” That Carry Hidden Risks

Current methods of financial reporting fail to provide accurate insights into the assets that compose a fund, portfolio, or balance sheet holdings, leading to situations where reserves may appear to have a low risk profile but actually contain high-risk assets. Real-time verification is also a challenge. In the U.S., funds are typically only required to report positions quarterly and have up to 45 days post quarter-end to file, meaning their publicly disclosed holdings can be up to 135 days old.

Proof of composition addresses these issues by ensuring in real-time that financial asset reserves are composed of the right assets in the correct proportions, preventing fraudulent or highly risky reserve management. This allows funds to maintain strategic confidentiality while still providing verifiable assurance that their composition aligns with the fund’s predefined characteristics.

For example, proof of composition can be applied to a tokenized treasury fund to verify that the yield custodian’s holdings only include on-the-run U.S. government bonds as opposed to riskier assets like corporate debt instruments. This level of transparency would have been particularly useful in events like the SVB collapse, where investors lacked visibility into the composition of long-duration bonds that exposed the bank to excessive interest rate risk. By analyzing vintage data embedded within the proof of composition, users could have identified the concentration of these long-duration bonds and protected themselves sooner.

Real-Time Financial Integrity Powered By Chainlink

Chainlink helps bring enhanced transparency and verifiability to financial products and strategic digital asset reserves. As the largest provider of onchain proof of reserves infrastructure, Chainlink enables real-time monitoring of assets—helping to close visibility gaps that traditional auditing and reporting processes leave open.

By integrating verifiable data directly into financial assets, Chainlink allows for continuous assurance that reserves are sufficiently collateralized and composed of the right instruments. This not only reduces systemic risk but also gives regulators and institutions the tools they need to maintain financial stability.

Whether it’s enhancing transparency for stablecoins, tokenized funds, or digital asset reserves, Chainlink provides the infrastructure to help secure the future of global onchain financial systems. Join industry leaders who trust Chainlink Proof of Reserve to secure billions in onchain assets. Reach out today.