- Binance altcoin outflows reflect rising accumulation, hinting at long-term investor confidence.

- IP, FORM, and MKR outperform BTC despite the latter’s dominance holding above 63%.

Altcoins are witnessing large-scale withdrawals from Binance, raising questions about what investors are preparing for.

Ethereum [ETH], Chainlink [LINK], and Maker [MKR] are among the top tokens seeing consistent outflows.

These movements suggest whales are shifting their assets from exchanges to personal wallets, a typical sign of long-term accumulation.

Interestingly, these withdrawals continued even without a confirmed altcoin season.

This strong offloading trend could reflect quiet positioning ahead of a broader market rotation from Bitcoin [BTC] to altcoins.

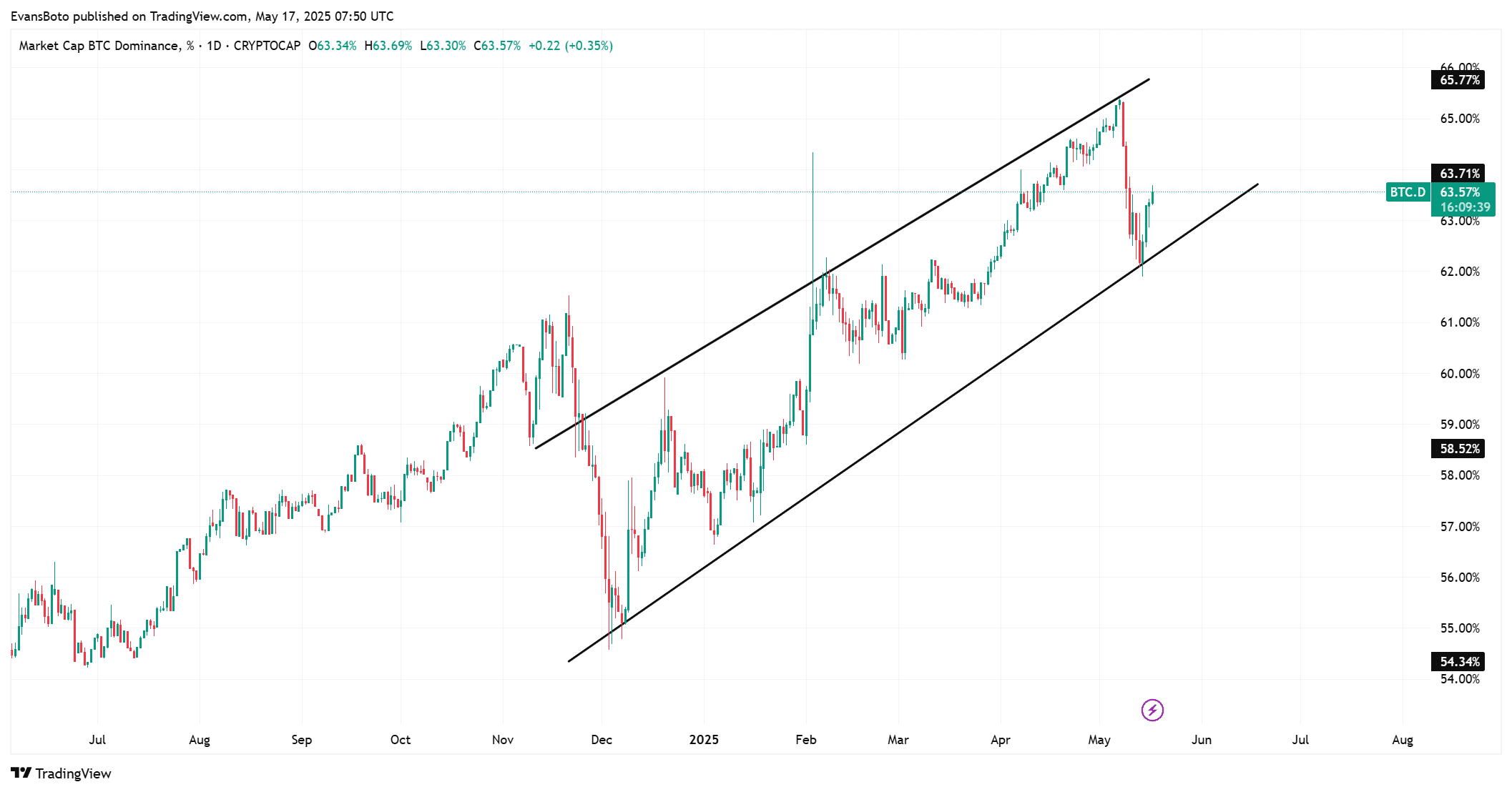

Will Bitcoin dominance hold its uptrend?

Bitcoin’s dominance recently dropped from 65.81% and found support near 63.44%, maintaining its broader ascending channel.

However, this sharp rejection at the top of the range has sparked speculation that the market could be preparing for a rotation. The dominance rebound does reflect short-term BTC strength.

Still, historical patterns show that altcoin rallies often begin when BTC dominance fails to make new highs. Therefore, if this recovery weakens, it could be the first sign of capital flowing back into altcoins.

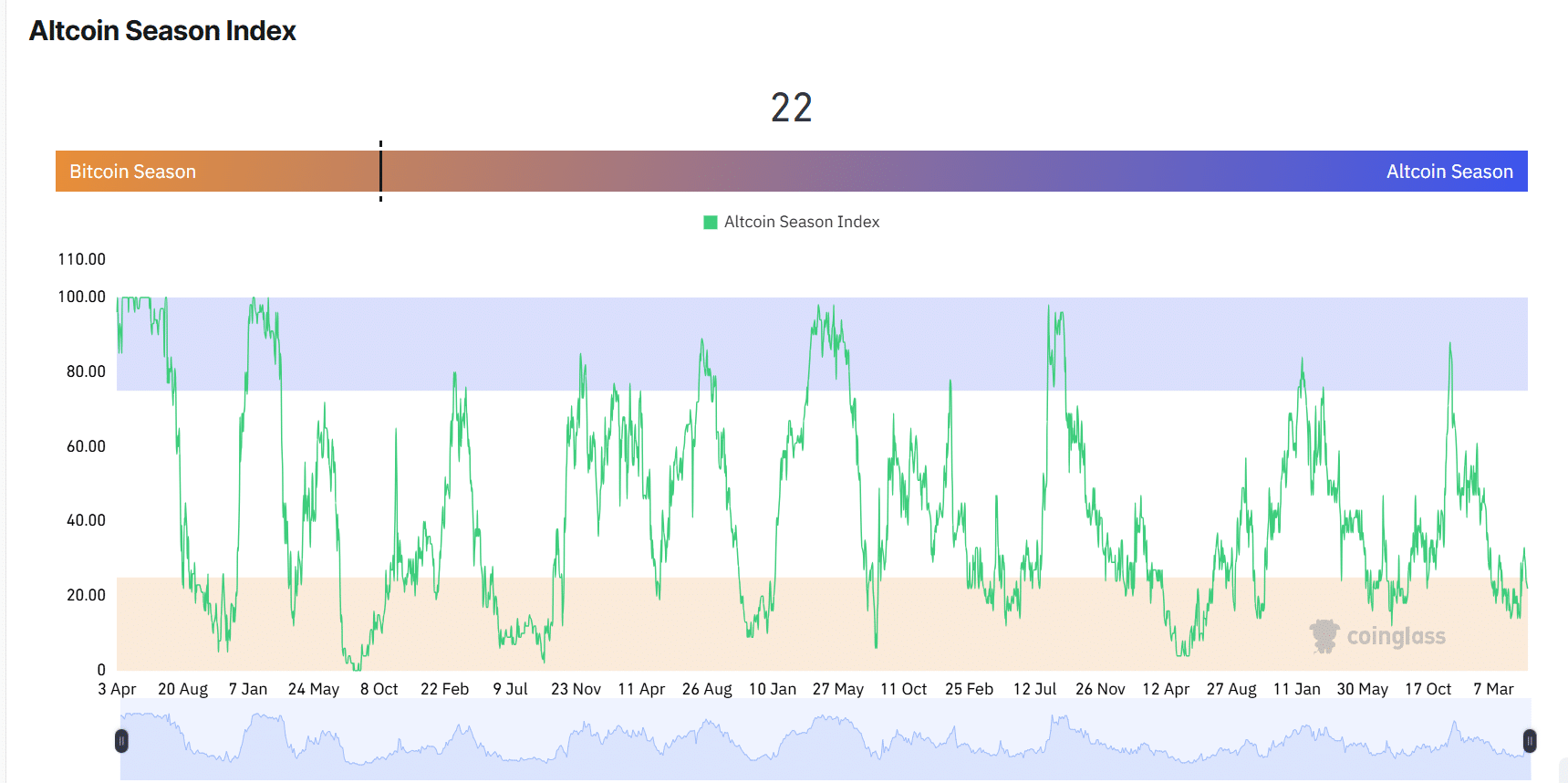

Can the altcoin season index confirm the shift?

The current Altcoin Season Index remained low at 22, clearly indicating a Bitcoin season. However, the index has started to rise from previous lows, hinting at building altcoin momentum.

While not yet within the altseason zone, repeated altcoin accumulation and recent performance gains point toward early-stage sentiment changes.

Historically, the index lags behind wallet flows and price performance. This early movement suggests the market is transitioning and could soon break out of Bitcoin dominance.

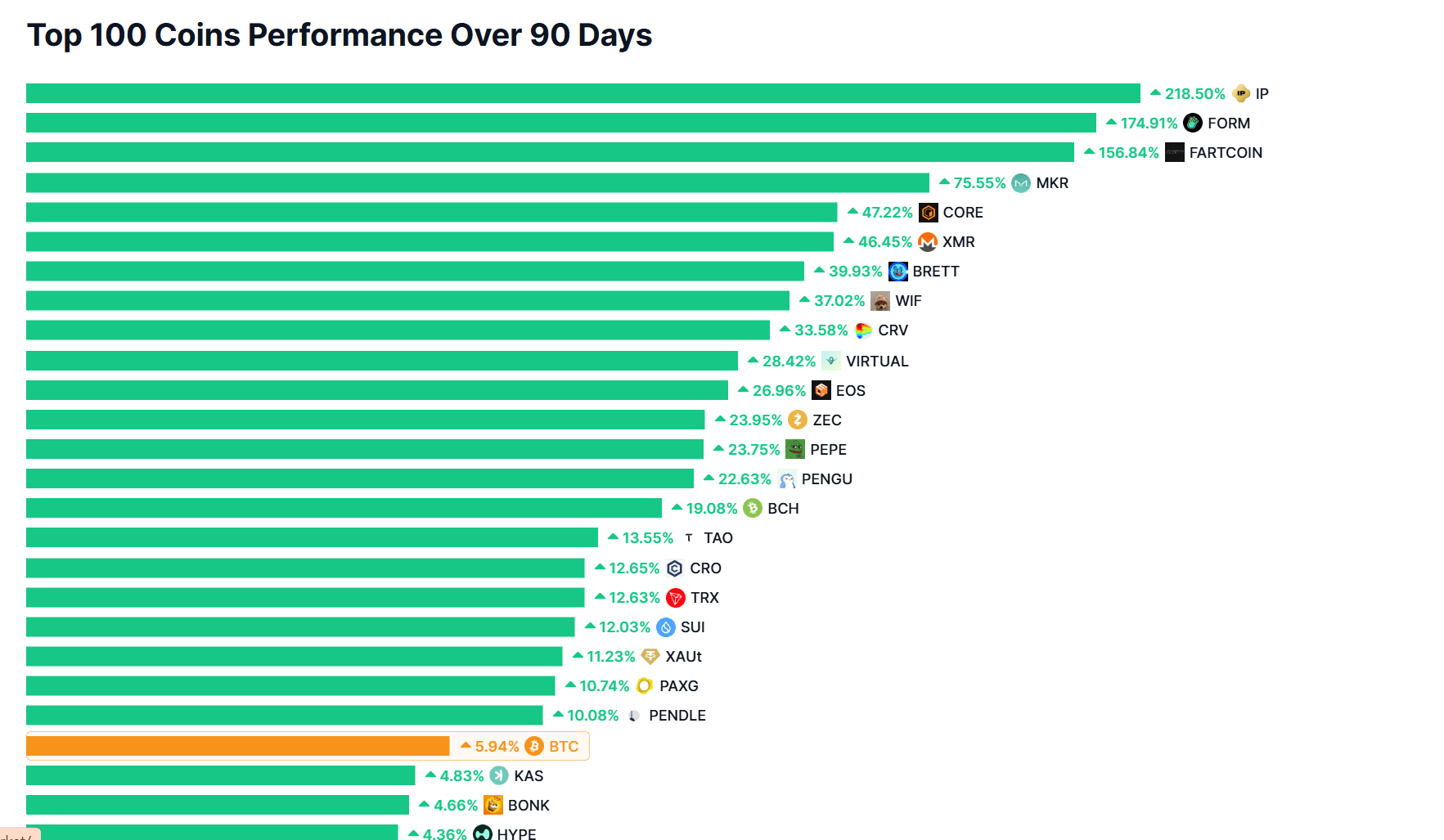

Altcoins crushing Bitcoin’s returns

Despite Bitcoin gaining 5.94% in the last 90 days, several altcoins have posted explosive gains. Story [IP] surged by 218%, FORM jumped 174%, and Maker [MKR] rose over 75%.

Even memecoins like Pepe [PEPE] and PENGU outpaced Bitcoin with double-digit growth. This outperformance shows that investor risk appetite is increasing, especially outside BTC.

Therefore, while BTC dominance looks stable on the chart, actual price action shows that altcoins are already leading in terms of returns.

Flows, dominance, and performance divergence

The market presented an unusual divergence. Binance outflows indicated that large holders were accumulating altcoins.

At the same time, BTC dominance held firm within an uptrend, while altcoin returns surged. These mixed signals suggested that the market was in a transitional phase.

Therefore, traders should not rely solely on dominance metrics but also watch accumulation trends and price performance.

This divergence may soon resolve in favor of altcoins, especially if Bitcoin dominance drops below support.

Ultimately, the accumulation trends, price outperformance, and early movement in the altcoin season index all point toward an upcoming shift.

If BTC dominance fails to break its current highs and altcoins maintain momentum, a broader rotation could unfold rapidly. Investors are quietly preparing.