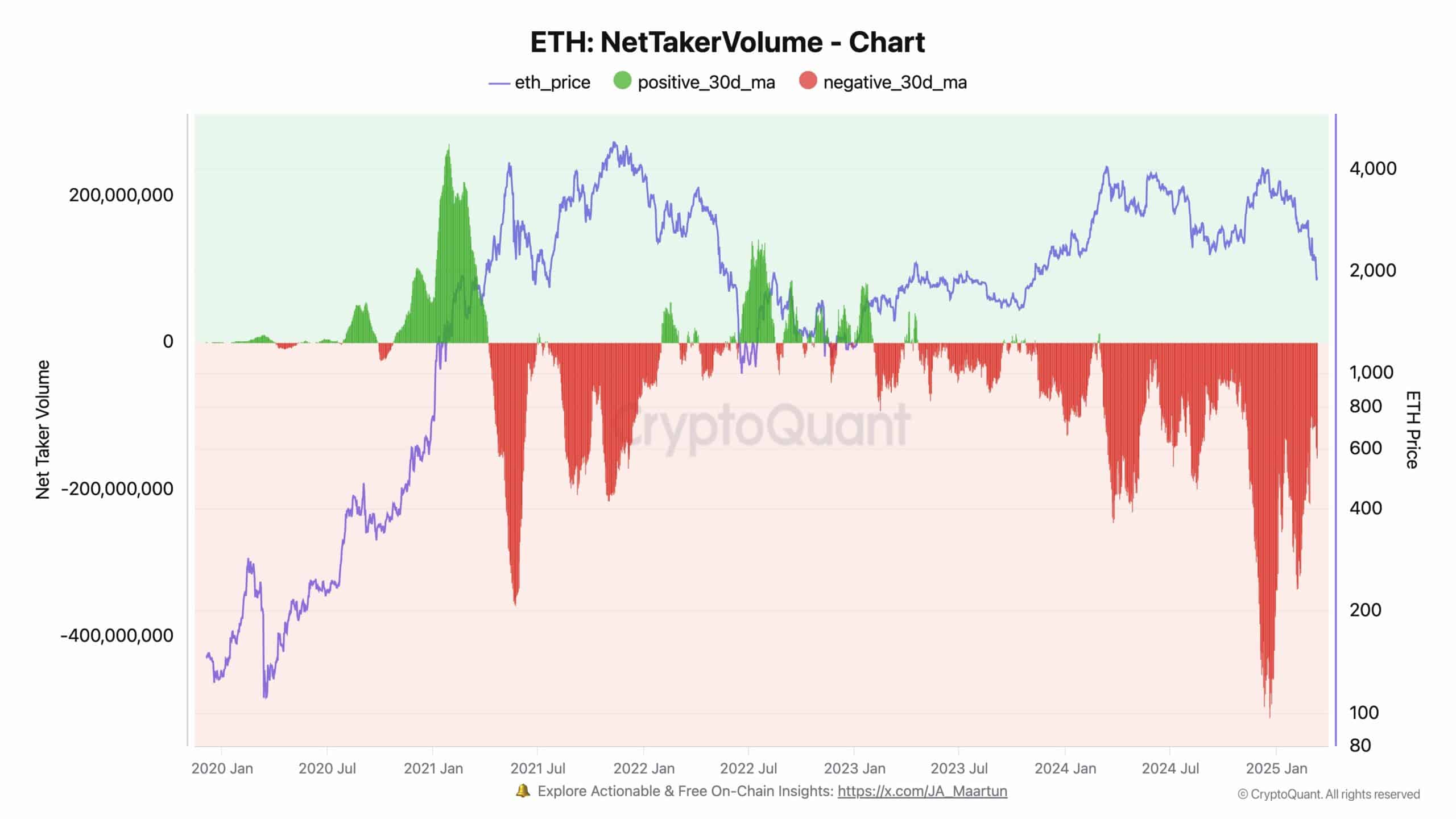

- Ethereum’s net taker volume remained deep in the red, signaling sustained sell pressure over the past few months.

- Despite the selling pressure, the total number of ETH holders continued to increase, suggesting strong accumulation.

Ethereum [ETH] has witnessed a prolonged period of active selling pressure, with net taker volume indicating sustained negative momentum over the past few months.

This trend suggests aggressive sell-side dominance, typically associated with declining market confidence or broader risk-off sentiment.

Despite this, the number of ETH holders continues to climb, raising questions about whether long-term investors are accumulating amid the sell-off or if a price reversal is on the horizon.

Ethereum’s persistent sell pressure

Data from CryptoQuant highlighted an extended phase of aggressive selling, with net taker volume showing deep red values.

This means that sell orders have dominated buy orders, reflecting a bearish grip on Ethereum’s market structure.

Historically, such prolonged negative taker volume precedes major corrections or capitulation events, which could lead to further downside if the trend persists.

Source: X

Looking at past cycles, ETH has experienced similar phases of intense selling pressure, followed by a reversal when buying momentum re-emerges.

However, the current trend appears more extended, suggesting that investor sentiment remains cautious despite broader crypto market developments.

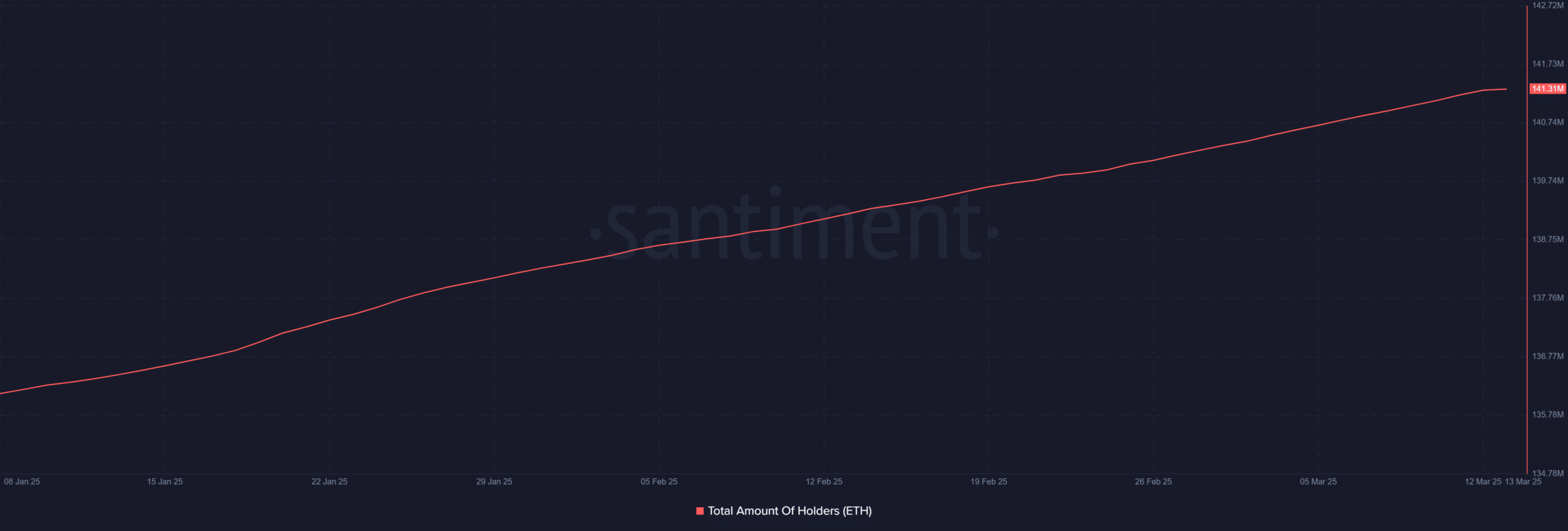

ETH holders continue to grow

While Ethereum’s price struggles, the number of holders has been steadily increasing.

On-chain data from Santiment showed that total ETH holders had reached approximately 141.31 million, marking consistent growth despite the price slump.

This suggests that while short-term traders have been exiting their positions, long-term investors continue to see value in accumulating ETH at current levels.

One possible explanation for this divergence is that institutional and whale investors are gradually acquiring Ethereum while retail traders capitulate.

This accumulation pattern could set the stage for a potential recovery if sell pressure subsides and broader market conditions improve.

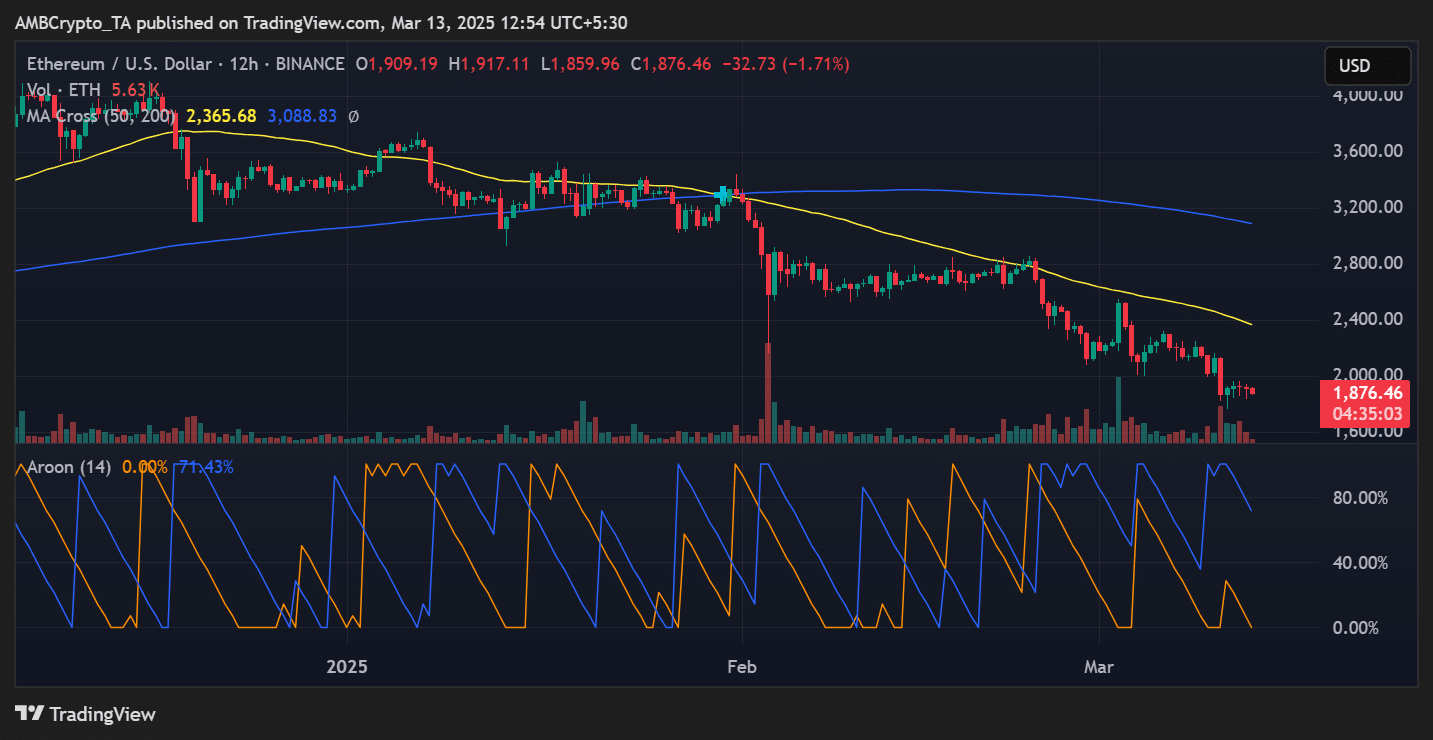

Price outlook: Will ETH find support?

Ethereum was trading at $1,876 at press time, having suffered a steady decline over the past few weeks. Key support levels to watch included $1,850, which has historically served as a crucial demand zone.

If selling pressure intensifies, Ethereum could test the $1,750 region, a level that previously acted as a strong accumulation zone.

Conversely, if ETH manages to stabilize and reclaim the $2,000 mark, it could trigger a shift in sentiment.

The Aroon indicator, which measures trend strength, currently signals weakness, suggesting that ETH is still in a downtrend.

However, a breakout above the 50-day moving average [2,365] would indicate renewed bullish momentum.

Conclusion

Ethereum’s market remains under selling pressure, as evidenced by sustained negative net taker volume.

However, the steady increase in ETH holders signals that some investors view the current price range as an accumulation opportunity.

While downside risks persist, a shift in sentiment or easing sell pressure could position ETH for a recovery.

Traders should watch key support and resistance levels closely, as Ethereum’s next move will likely dictate broader market sentiment.