Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum is at a critical juncture as it approaches the $2,700 level, widely viewed as the next key resistance that bulls must overcome to confirm a bullish setup. This comes as Bitcoin broke above its all-time high yesterday, pushing the crypto market into a new phase that could unleash substantial gains across altcoins. For Ethereum, this moment could define the next leg of its recovery rally.

Related Reading

Since early May, ETH has surged over 55%, fueled by renewed investor confidence, broader market strength, and increasing capital rotation from Bitcoin into large-cap altcoins. The sentiment is shifting, and Ethereum’s ability to lead the charge will likely influence the pace of altseason.

Glassnode data highlights the improving fundamentals behind the move. In May, Ethereum reclaimed its Realized Price at $1,900—putting the average holder back in profit after a long stretch in the red. Price has also climbed above the True Market Mean at $2,400, historically seen as a reliable bullish signal. However, a clear break above $2,700 remains essential to validate this trend and attract further momentum-driven capital. Whether ETH can deliver that confirmation will shape how quickly the altcoin market gains traction in the wake of Bitcoin’s breakout.

Ethereum Holds Strong As Altcoin Momentum Builds

Ethereum is leading the altcoin charge as investors position themselves for what many expect to be a massive rally in the coming weeks. After months of volatility, ETH has reasserted its strength by reclaiming key technical and on-chain levels. Since crossing back above the $2,200 mark, Ethereum’s price structure has leaned decisively bullish, forming higher lows and consolidating around a critical resistance zone near $2,700.

Bulls remain firmly in control, and Ethereum is once again being looked to as the benchmark for broader altcoin sentiment. In a market environment now defined by Bitcoin’s recent breakout above all-time highs, ETH is well-positioned to benefit from capital rotation into high-cap altcoins. To fully validate a bullish continuation, however, Ethereum must break above and hold the $2,700–$2,900 range.

Glassnode on-chain data adds another layer of bullish conviction. In May, Ethereum broke above its Realized Price at $1,900, putting the average holder back in profit—a milestone that typically signals renewed investor confidence. ETH has also moved above its True Market Mean at $2,400, a key historical metric that aligns with strong accumulation phases.

However, the final hurdle lies at the Active Realized Price, currently near $2,900. Reclaiming that level would not only confirm a major structural breakout but also signal that recent buyers are holding strong and that confidence has returned at scale. Until then, ETH remains in a powerful setup, but the next few sessions will be critical for confirming whether the altcoin market’s leader is ready to drive the next leg higher.

Related Reading

ETH Price Tests Major Resistance

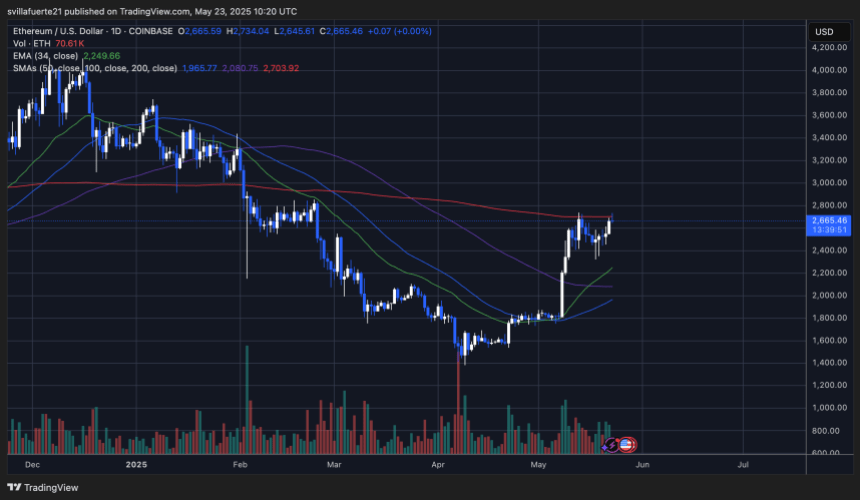

Ethereum continues to push higher, with price currently consolidating around the $2,665 mark after briefly touching $2,734. The daily chart shows ETH holding a clear uptrend since early May, with higher lows and strong buying volume supporting the move. All key moving averages are sloping upward, with the 34 EMA currently at $2,249 and the 50 SMA at $1,965—both well below the current price, reinforcing bullish structure.

The most immediate technical challenge lies at the 200-day SMA, marked at $2,703. This long-term indicator has acted as dynamic resistance in previous cycles and will be critical to watch. A daily close above this level could trigger a breakout and confirm a broader bullish continuation, possibly opening the door toward reclaiming the $2,900–$3,000 region.

Related Reading

Volume has picked up slightly on recent green candles, signaling growing demand, but the test of the $2,700 zone could invite short-term profit taking. Support is seen around $2,445 (100 SMA) and $2,080 (close to the True Market Mean), which would likely act as a cushion if a pullback occurs.

Featured image from Dall-E, chart from TradingView