- ETH whales exited before the market crash, while those in leveraged short positions are in huge profits.

- The crash finally led Ethereum into the lower logarithmic regression trendline, a potential buy zone.

In the lead-up to the recent Ethereum [ETH] market crash, savvy whales made strategic moves to exit their positions, securing substantial profits.

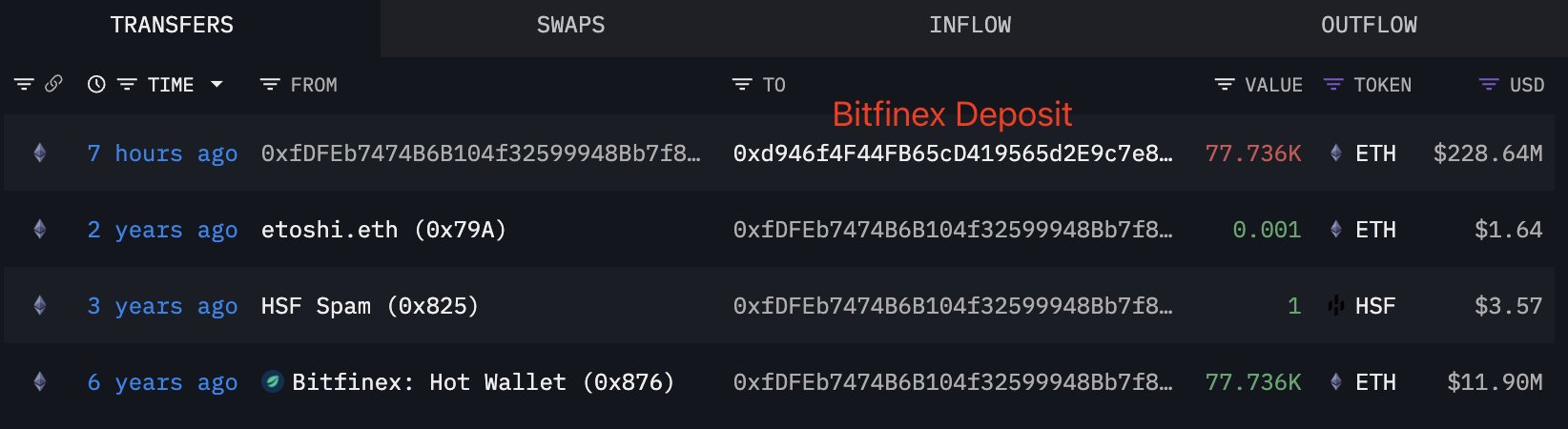

A notable Ethereum whale, dormant for six years, transferred 77,736 ETH, valued at $228.6M, to Bitfinex. This wallet had initially withdrawn the same amount for just $11.9M in January 2019, when ETH was priced at $153 per token.

Additionally, machibigbrother.eth impeccably timed the market by depositing 1,000 ETH worth $2.85M into Binance right before the crash.

This followed a previous move of 4,413 ETH worth $13.84M to the same exchange.

These maneuvers by whales highlighted their market insight and potentially amplified the crash’s impact on ETH. By pulling out significant volumes of ETH, these actions could contribute to increased selling pressure, leading to a sharper decline in ETH’s price.

These whale activities might signal cautious trading, with investors watching for similar patterns to predict future market movements.

Whales push ETH to the lower logarithmic regression trendline

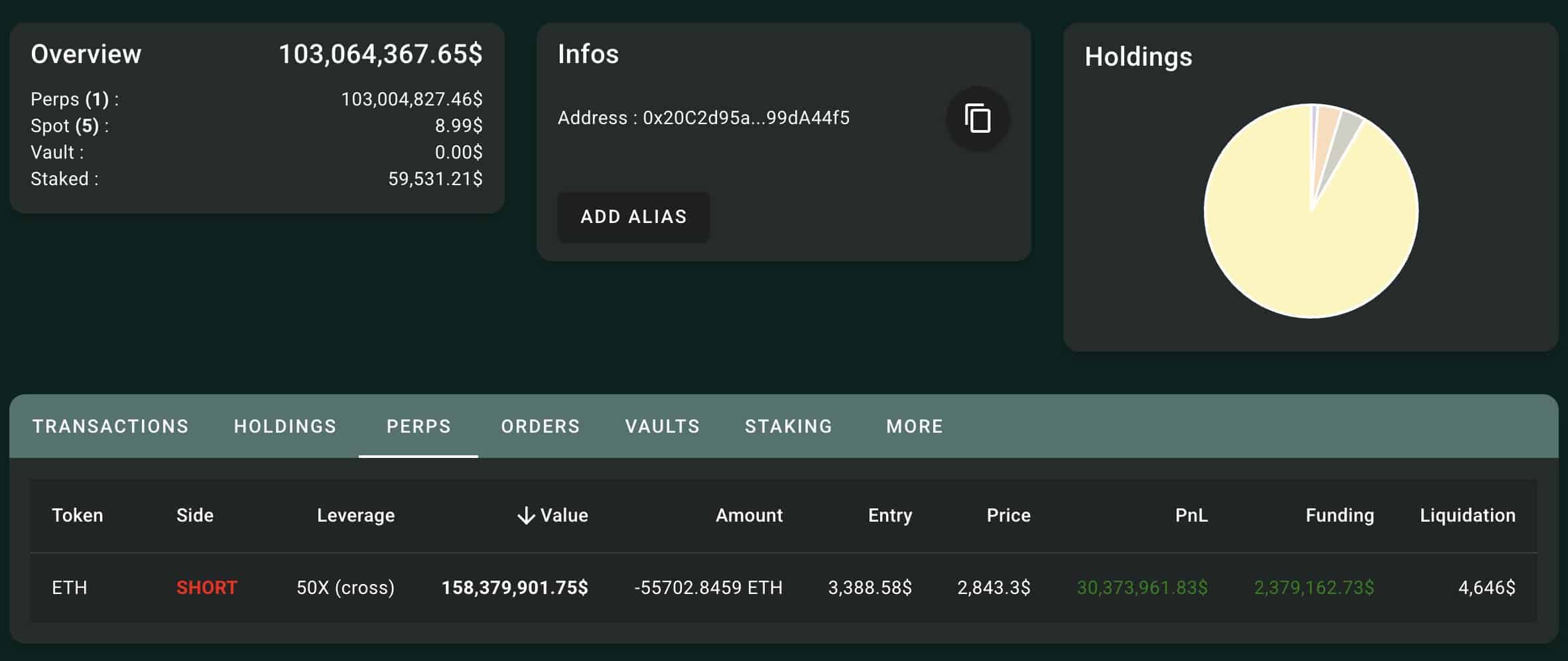

As the ETH price fell, a whale who shorted ETH using 50x leverage saw their unrealized profit soar past $30M. This aggressive short position likely intensified the downward pressure on ETH’s price.

By betting heavily against ETH, the whale’s large leveraged trade could have triggered significant liquidations of long positions.

This further drove the price down. Such high leverage means even small price movements could lead to substantial market impacts.

Traders should likely remain vigilant for similar whale maneuvers, as these can foreshadow or even precipitate sharp market corrections.

This manufactured price crash by ETH whales led the altcoin into a logarithmic regression pattern.

Historically, Ethereum moved above the midline of this channel during peak bull runs, as seen in late 2021 when it surged towards $4,000.

However, recent trends show a decisive shift. By June 2024, ETH approached the lower boundary of this trend, indicating a bearish phase with a gradual descent to a support level near $1,750.

This lower trendline interaction often signifies a pivotal area where the market reassesses Ethereum’s value. The current positioning at approximately $2,526 aligns with historical supports that have previously catalyzed notable rebounds.

If ETH maintains stability above this lower boundary, a resurgence towards mid-channel levels around $3,500 could follow. Conversely, failing to hold this line may exacerbate selling pressures.

Read Ethereum’s [ETH] Price Prediction 2025-26

This could drive prices towards deeper supports at $1,200, reflecting extended market corrections.

Such delicate balance indicates the critical nature of current levels in shaping Ethereum’s medium-term market dynamics.