Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

On-chain data shows the Ethereum whales have sold the asset recently, while key holders on the Bitcoin network have accumulated instead.

Ethereum Whales Have Sold Into The Latest Rally

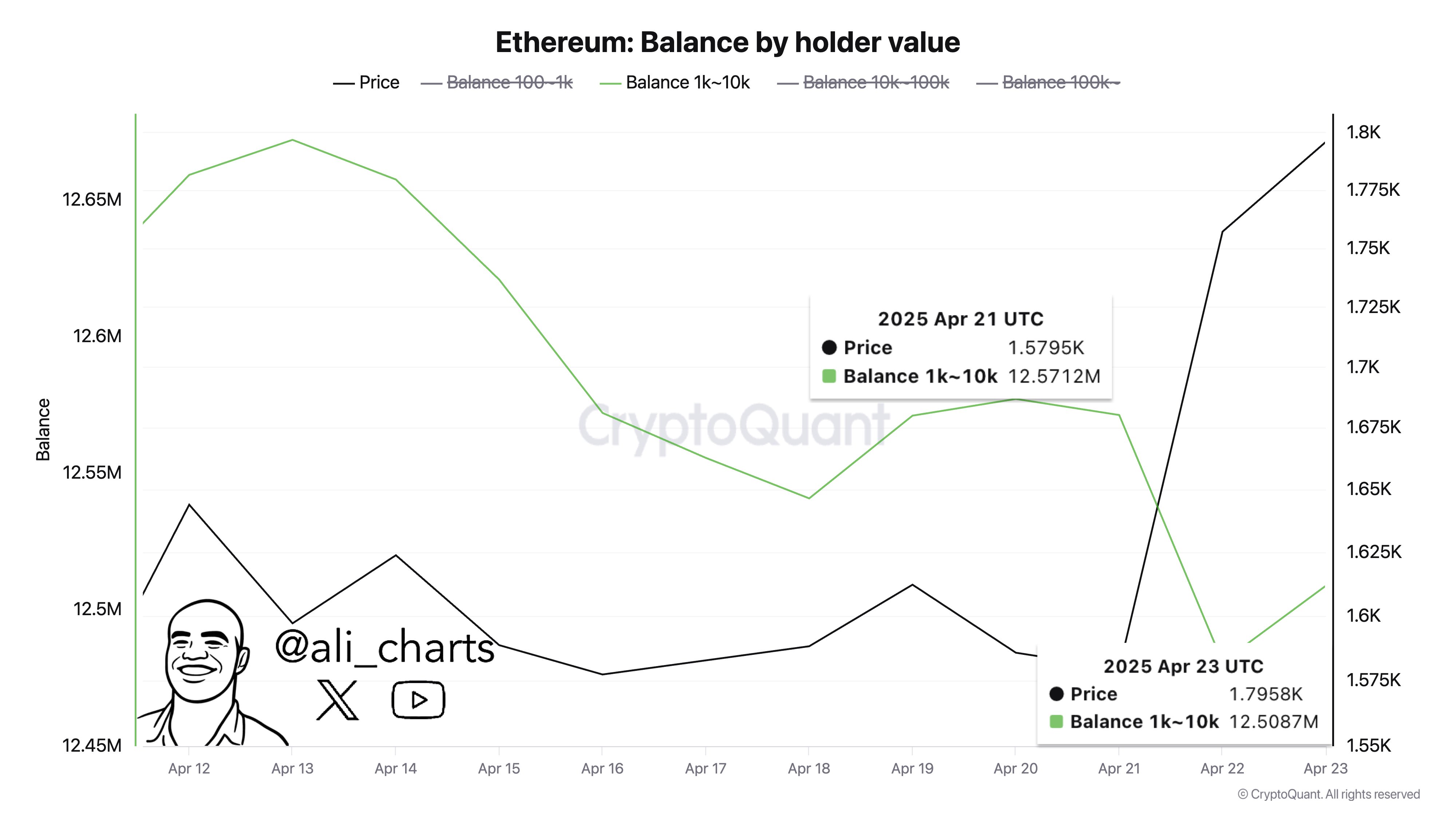

As explained by analyst Ali Martinez in a new post on X, the Ethereum whales have participated in selling recently. The “whales” here refer to the ETH entities holding between 1,000 and 10,000 ETH.

At the current exchange rate, this range converts to $1.8 million to $18 million. While these bounds don’t cover the largest of holders in the sector, they do still contain some of the key investors.

Related Reading

Here is the chart shared by the analyst that shows the trend in the combined balance of these Ethereum whales over the over the past ten days or so:

As displayed in the above graph, the Ethereum whales have seen their supply go through a net decline recently. During this selloff, these investors offloaded more than 63,000 ETH (about $113.5 million) inside a 48-hour window.

From the chart, it’s visible that the distribution from this cohort has coincided with ETH’s recovery rally. This could indicate that these large investors have been capitalizing on the profit-taking opportunity.

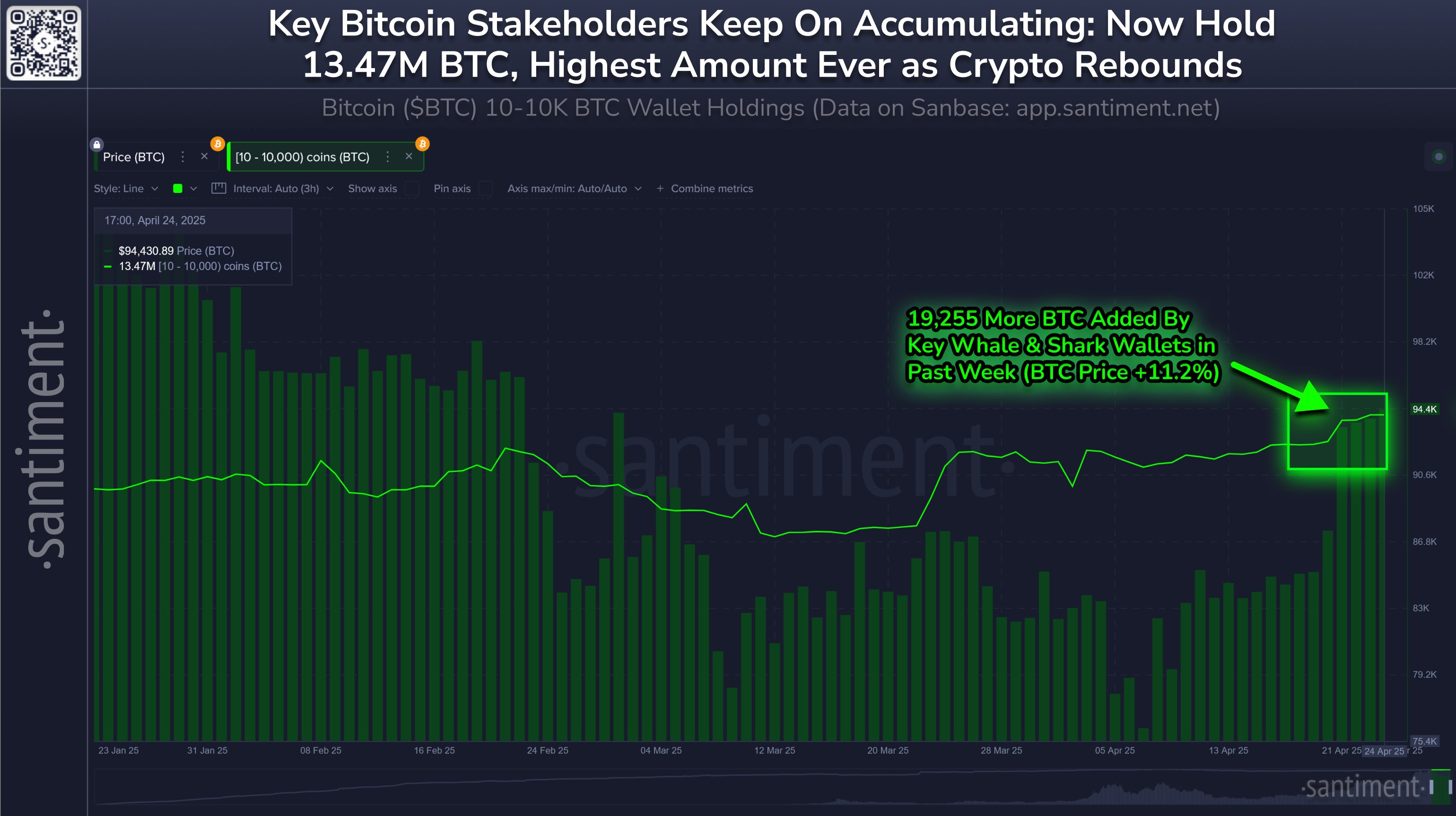

While the key investors of ETH may have taken profits, the same isn’t true for that of BTC. As the on-chain analytics firm Santiment has discussed in an X post, the trend has been that of accumulation for BTC recently.

In the chart, the analytics firm has attached the data related to the supply of the Bitcoin holders carrying between 10 ($946,000) and 10,000 BTC ($946 million). This range is broader than the one for ETH and includes two key investor cohorts: sharks and whales.

These investors have collectively added a total of 19,255 BTC to their wallets alongside the price rally. Thus, it would appear that the key holders of the cryptocurrency are supportive of the recovery run.

Related Reading

Naturally, this could imply the Bitcoin rally may have more chances of being sustainable than the Ethereum one. That said, things can change quickly in the digital asset sector, so the trend related to the large entities of both might be worth keeping an eye on.

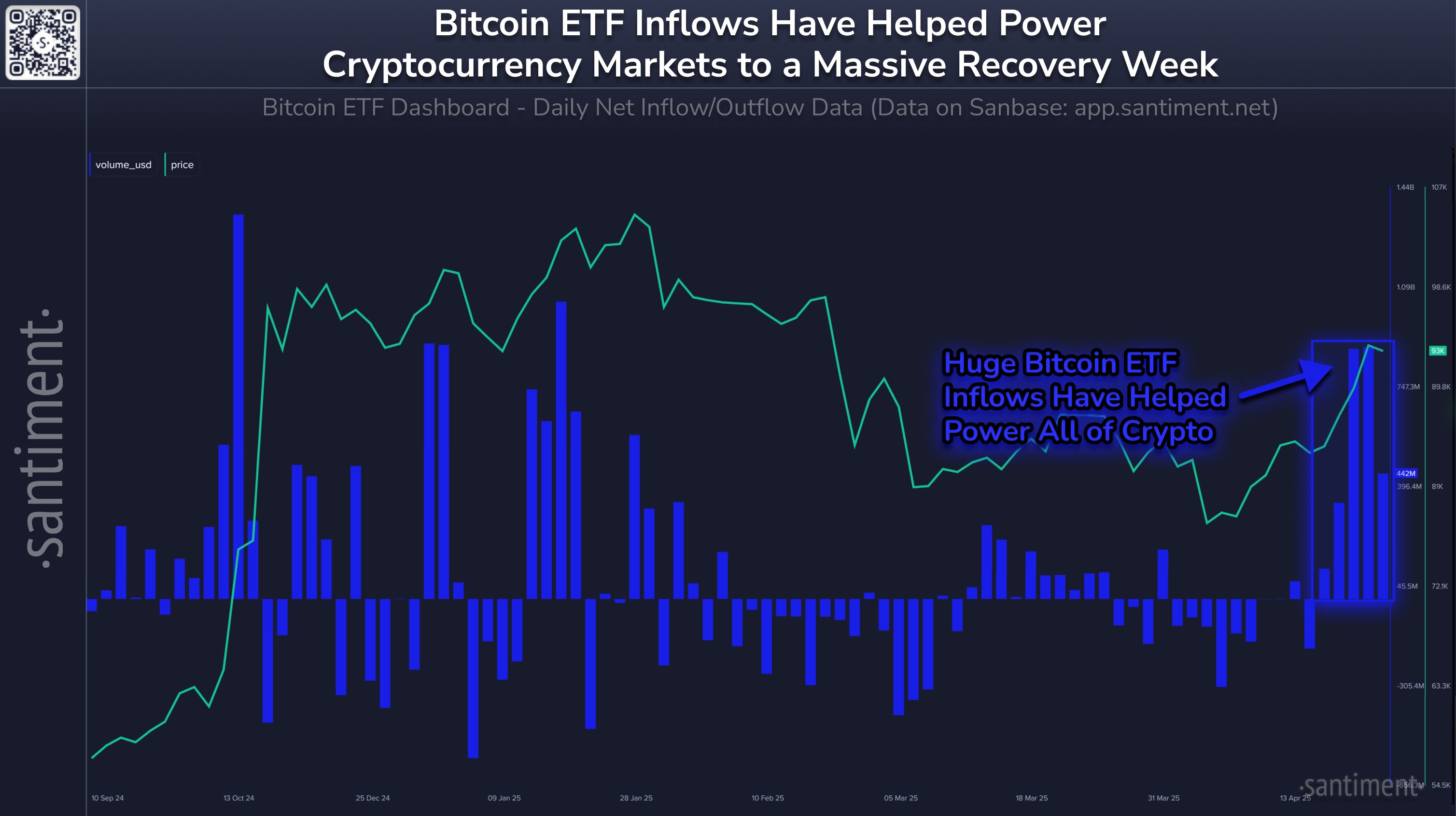

Speaking of accumulation, BTC is currently witnessing high inflows into the spot exchange-traded funds (ETFs), as Santiment has pointed out in another X post.

From the chart, it’s visible that the recent ETF inflows are the largest in months. As the analytics firm notes,

As Bitcoin has recovered as high as $95.8K today, we are seeing the highest week of net inflows to BTC ETF’s since the week before Trump’s inauguration in mid-January. Institutions like Blackrock have played a large part in the crypto-wide bounce traders were waiting for.

ETH Price

At the time of writing, Ethereum is trading around $1,800, up more than 12% in the last week.

Featured image from Dall-E, Santiment.net, chart from TradingView.com