- ETH staking deposits hit an all-time high, now accounting for 28.5% of the circulating supply, reflecting strong investor confidence.

- The announcement of ETH’s inclusion in the U.S. Crypto Reserve may have fueled increased staking demand and institutional interest.

Ethereum [ETH] staking has reached an all-time high, with the number of ETH deposits into staking contracts surging significantly. This increase has sparked questions about its driving forces and underlying factors.

With staking now representing a significant portion of Ethereum’s circulating supply, it is crucial to examine whether this trend is linked to recent price changes or external factors influencing the market.

Ethereum staking hits record highs

The number of ETH 2.0 deposits has climbed to its highest level ever. According to the analysis of Glassnode data, the total deposits have now surpassed 1.95 million ETH, marking a steady increase over the past few months.

This spike comes amid a period of heightened interest in Ethereum’s staking ecosystem, reflecting growing investor confidence in Ethereum’s long-term potential.

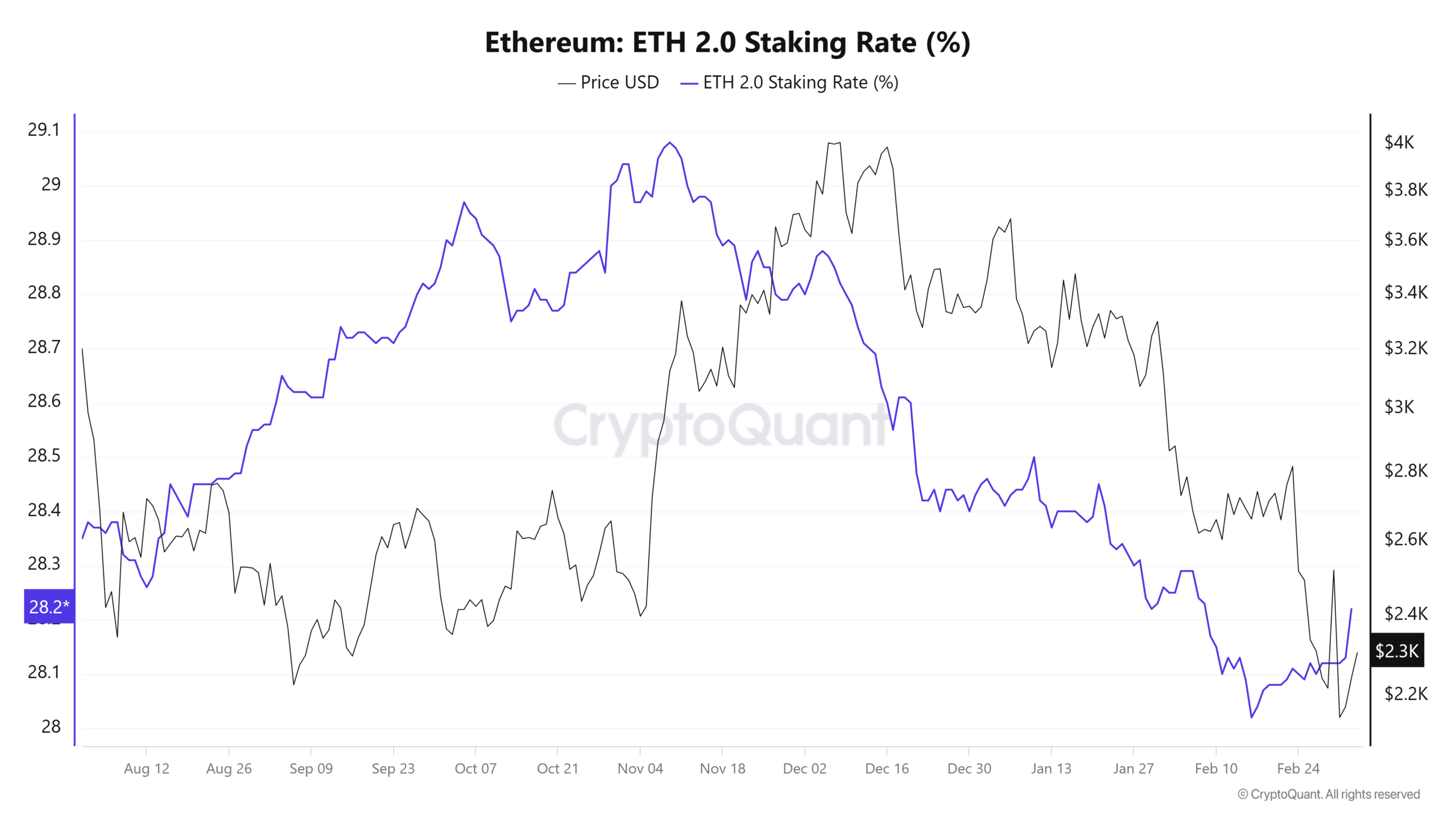

Alongside the rise in staking deposits, the Ethereum 2.0 staking rate has also grown, now sitting at approximately 28.5% of ETH’s circulating supply, based on CryptoQuant’s latest data. The chart shows how staking percentages have been increasing in tandem with Ethereum’s price fluctuations.

This data confirms that an increasing number of ETH holders are locking their assets into staking contracts instead of keeping them liquid for trading.

How price movements align with staking growth

Ethereum’s price has experienced significant fluctuations in recent weeks. The trading session as of this writing showed ETH at $2,305, up 2.85% from the previous day.

The 12-hour price chart indicated a gradual recovery from February’s correction, with ETH maintaining support above $2,200 and attempting to reclaim higher resistance levels.

The Accumulation/Distribution metric showed a steady rise in holdings, reinforcing the idea that long-term holders are staking more ETH instead of selling.

This suggests that investors remain confident in Ethereum’s value proposition, particularly in light of the growing adoption of staking mechanisms.

What’s behind the staking surge?

Several factors contribute to the rising ETH staking trend, including Ethereum’s economic incentives, market conditions, and external policy developments.

One of the most notable catalysts was the announcement that Ethereum would be included in the U.S. Crypto Reserve. The Reserve is part of the government’s new strategic digital asset holdings.

This decision has fueled speculation that ETH could see increased institutional demand, further adding to its credibility as a long-term investment.

Additionally, the Ethereum network’s staking rewards remain attractive, encouraging more investors to lock in their holdings for yield.

With ETH 2.0’s full transition to proof-of-stake (PoS), staking has become a core component of Ethereum’s ecosystem, offering users a reliable way to generate passive income.

What’s next for ETH staking?

The surge in ETH staking reflects growing investor confidence in Ethereum, with over 28.5% of its circulating supply locked in contracts.

This tightening of supply-side liquidity could have long-term effects on price volatility as demand adjusts to reduced availability.

Ethereum’s price movements, institutional interest, and staking incentives are key factors influencing this upward trend.

If ETH stabilizes above critical support levels and staking rewards remain appealing, the percentage of staked ETH may rise further. Now part of the U.S. Crypto Reserve, Ethereum gains legitimacy at both national and institutional levels, reinforcing its significance.

Therefore, monitoring the evolution of staking is crucial for investors, as it could play a central role in Ethereum’s price trajectory and market dynamics.