- Ethereum average active addresses surged to 670K.

- ETH’s recent decline exposed Trump’s WLFI to a $14.9M unrealized loss.

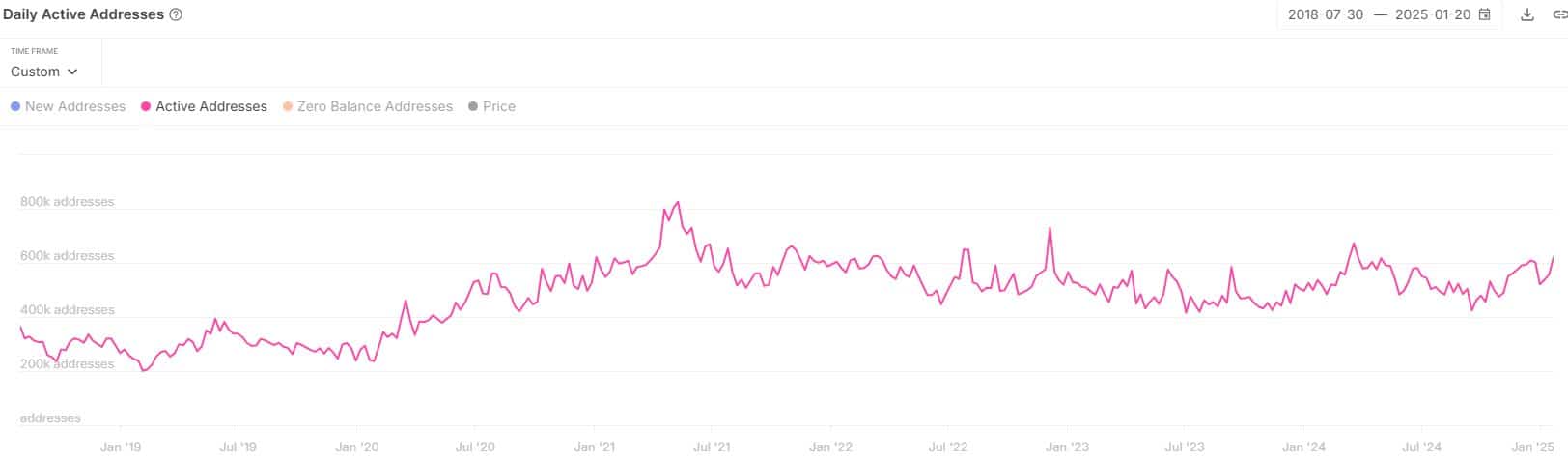

Ethereum’s [ETH] active addresses have surged 37% and surpassed March 2024 highs, signaling increased network activity in early 2025.

Per blockchain analytics firm IntoTheBlock, the network addresses soared to 670K last week, compared to over 400K in March 2024.

“The average number of active Ethereum addresses surpassed 620k last week, the highest since March 2024!”

Although a single entity can open several addresses and dilute the metric, the steady growth suggests massive adoption of the network.

Big players driving DeFi activity?

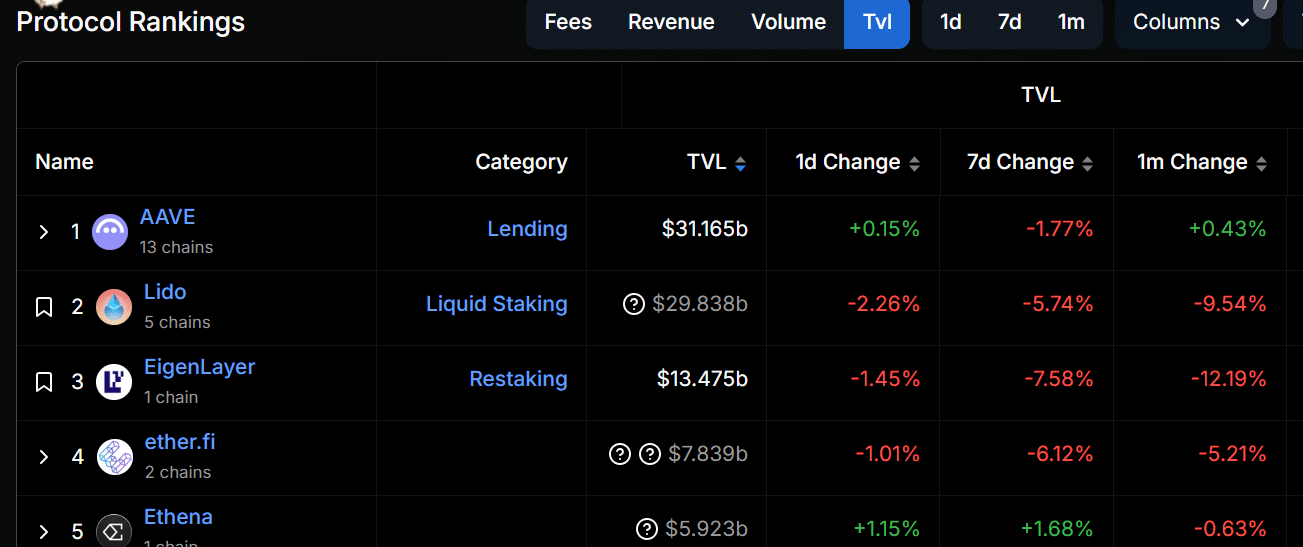

Over the same period, ETH’s TVL (total value locked) jumped from $65B to $98B before retreating to $84B at press time.

For context, TVL tracks the amount of locked funds across the DeFi ecosystem.

For Ethereum, the lending platform Aave and liquid staking platform Lido commanded the highest share of the chain’s TVL. The two platforms accounted for over $60B of the ETH’s TVL.

Since they are institutions’ favorites, one could assume that big players are behind the surge in network activity.

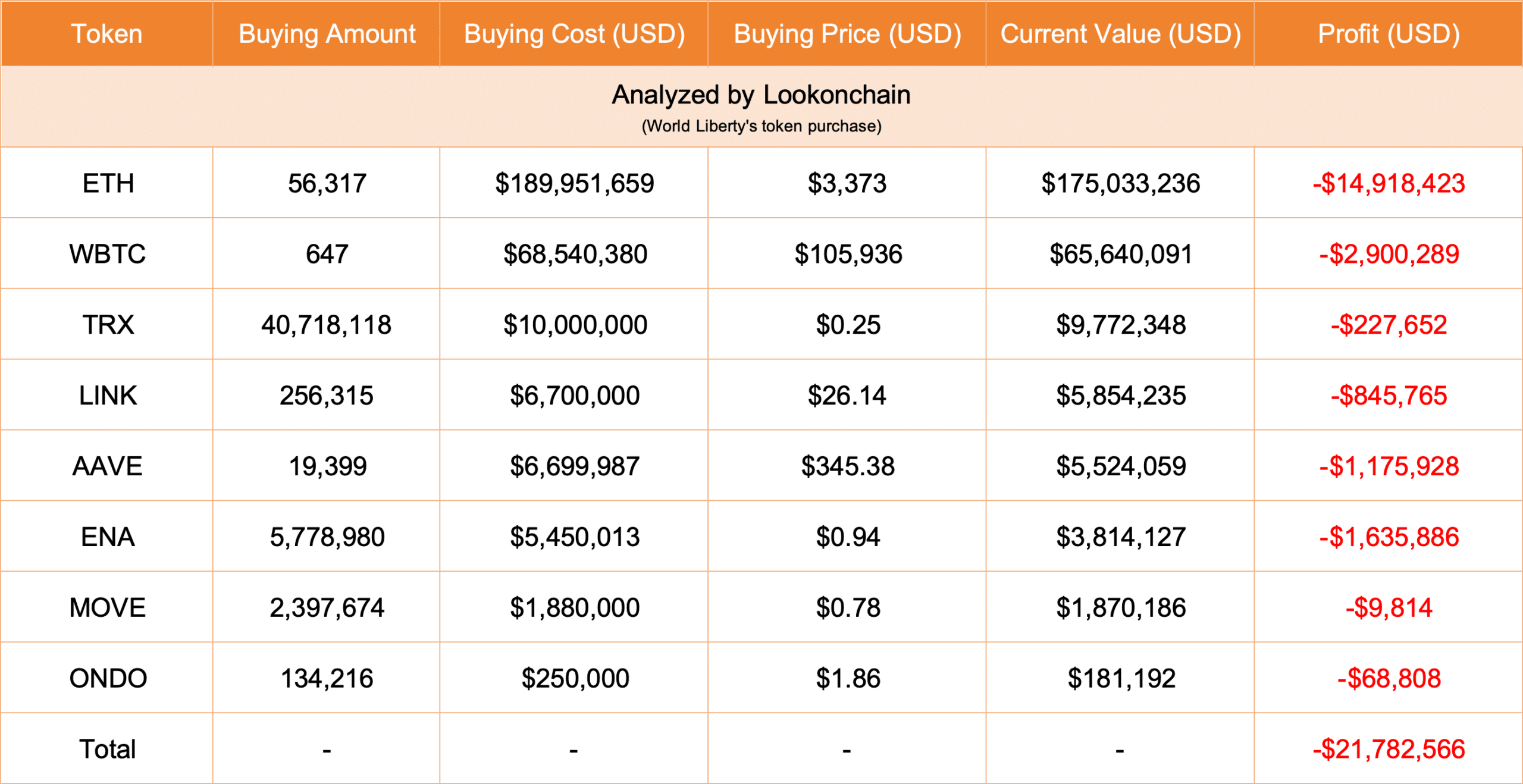

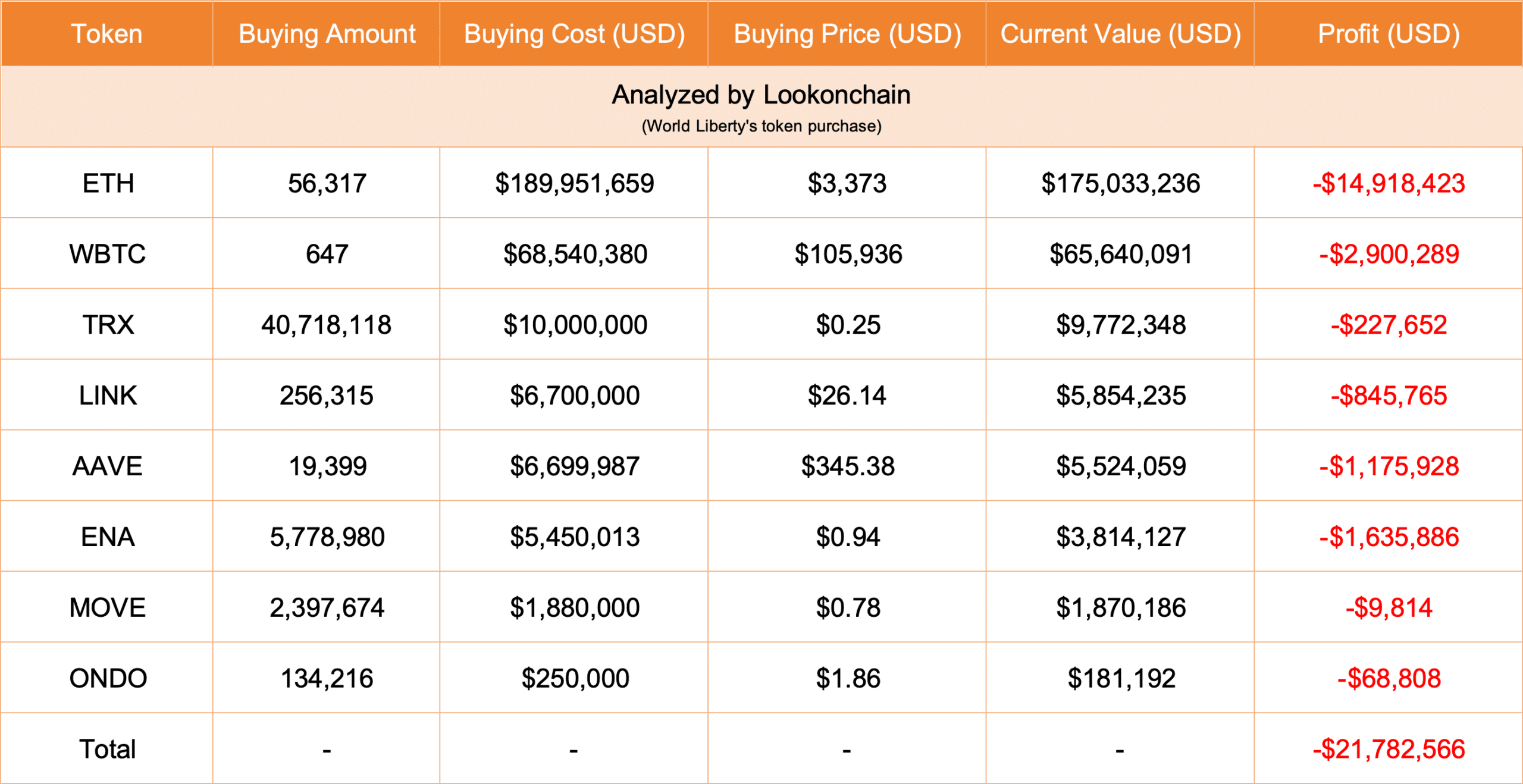

That said, President Trump’s World Liberty Finance (WLFI) has been one of the recent aggressive buyers of ETH. However, ETH’s recent 8% decline to $3K exposed the firm to a massive unrealized loss worth $14.9M.

Source: LookOnChain

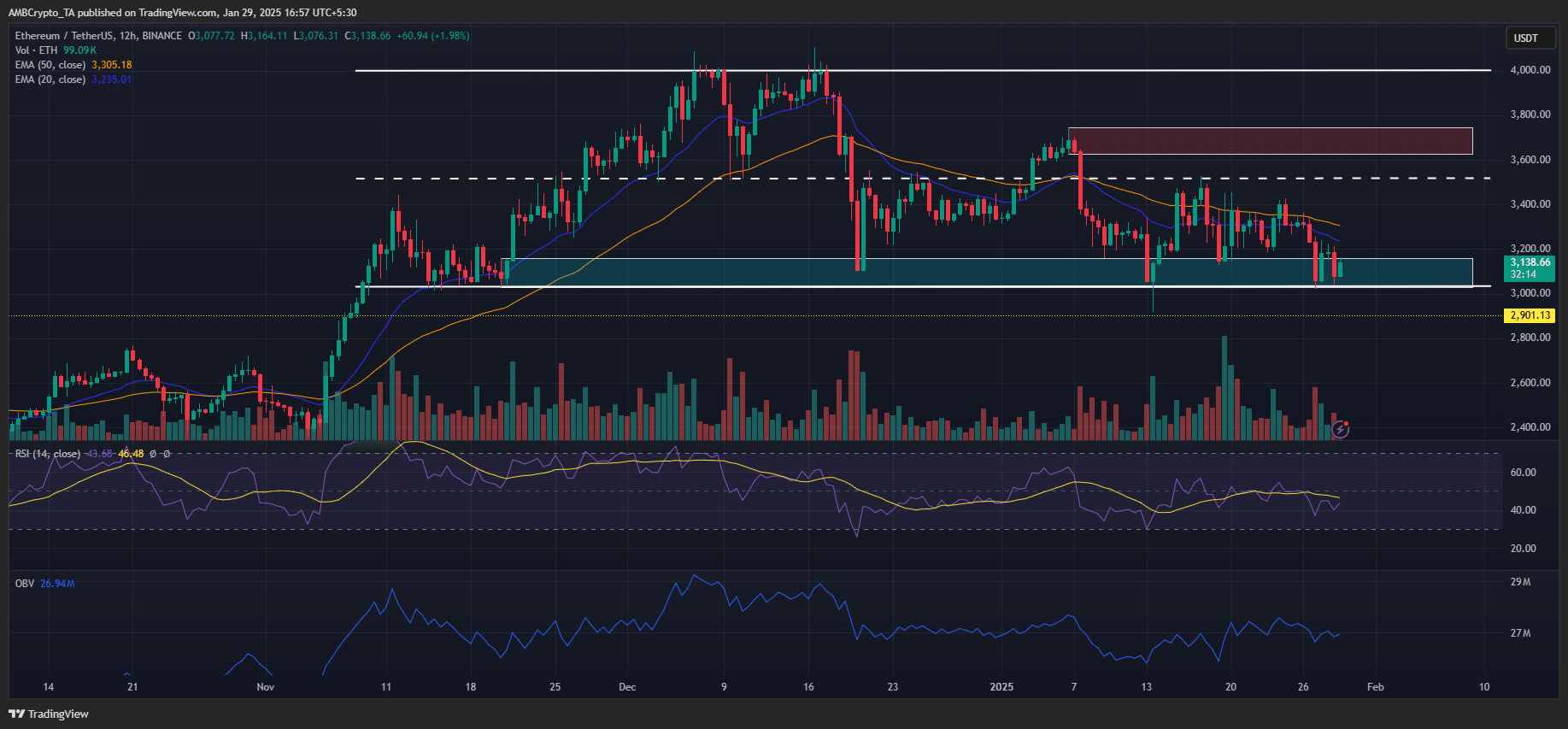

In the meantime, the ETH price has been in a bearish trend but has managed to defend the $3K support zone.

However, since it has been retested the support several times, a downside breach couldn’t be overruled, especially if bearish sentiment persists post-FOMC meeting.

On the flipside, a reversal could lift ETH to the mid-range of $3.5K or the resistance area (red) at $3.6K-$3.7K.