- ETH’s leverage has surged to $10B in two months.

- Historical trends indicated high leverage could negatively impact ETH’s value.

Despite Q1 being historically bullish for Ethereum [ETH], the altcoin’s massive $10B leverage could expose it to liquidation risks and cap upside potential.

Andrew Kang, Co-Founder of crypto VC firm Mechanism Capital, projected ETH could remain range-bound ($2K-$4K) due to this leverage risk. He stated,

“$ETH has added $10b+ in leverage since the election. This unwind will be painful, but $ETH won’t go to zero. It will simply range from $2k to $4k for a very long time”

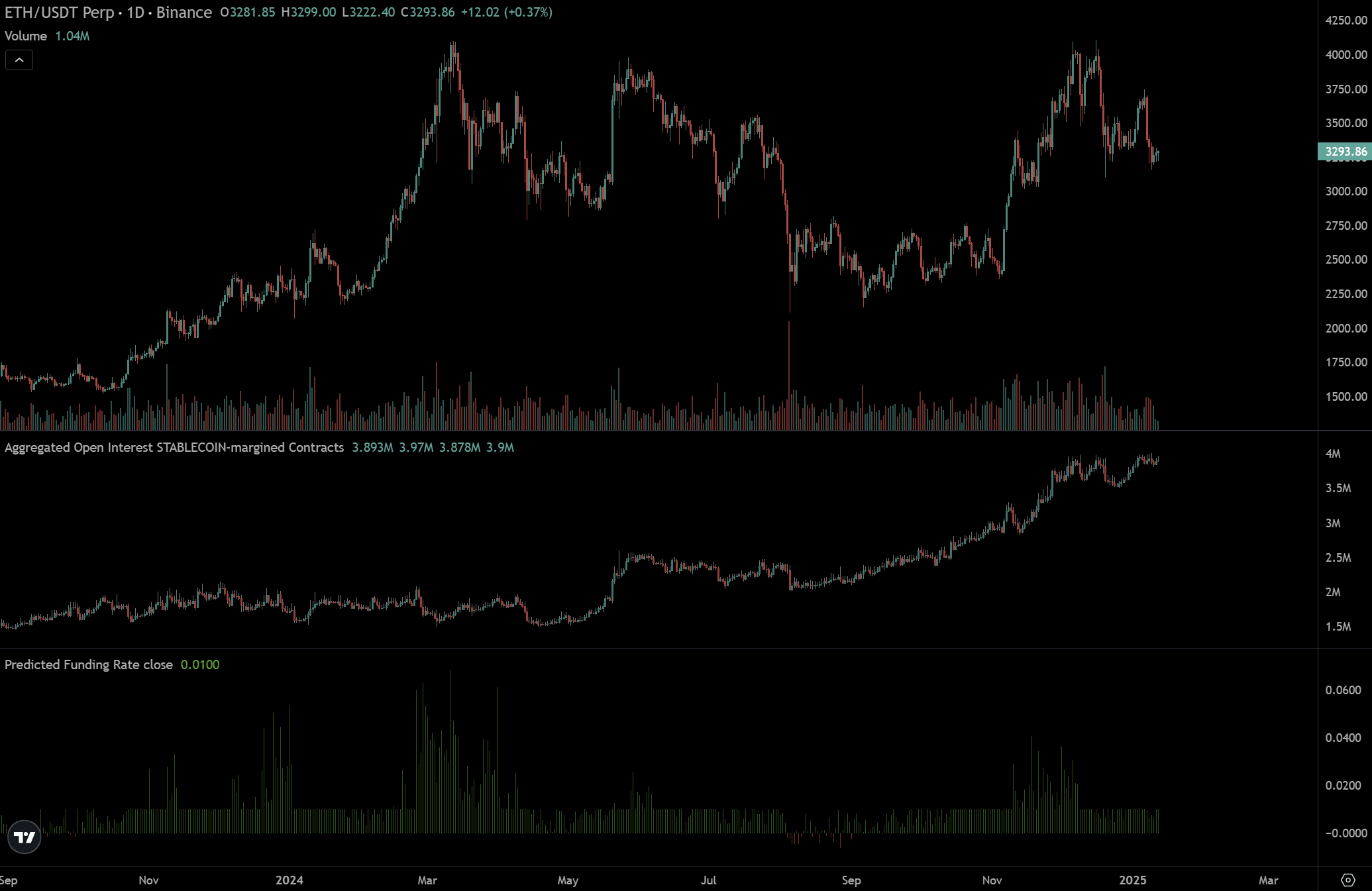

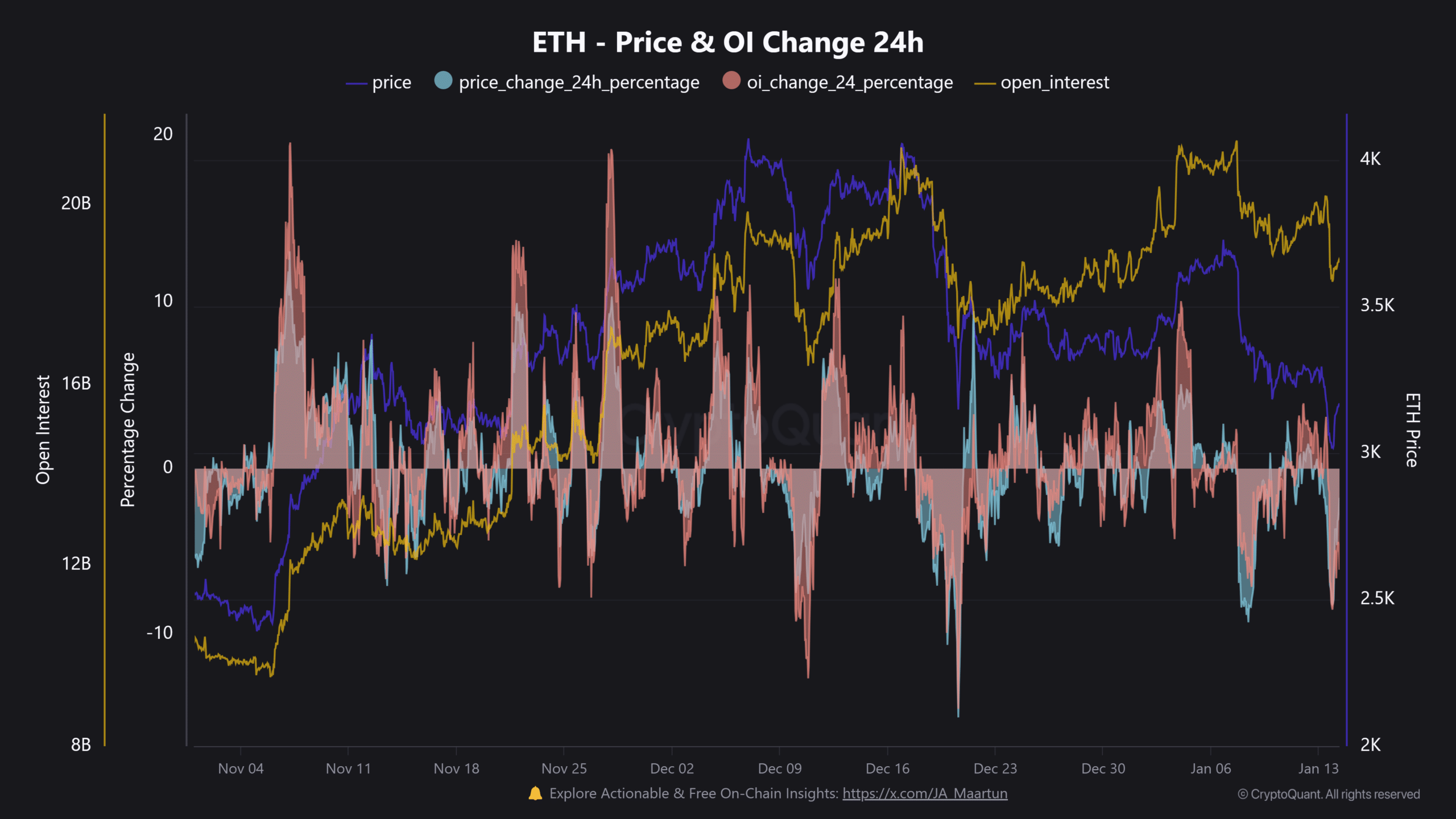

Before the US elections, ETH leverage (borrowed asset for speculative trading) stood at $9B. It shot up to over $19B in December.

Afterward, the sharp price decline liquidated several positions and dragged ETH to around $3.1K.

Will leverage derail ETH’s upside?

Kang added that the ETH ‘basis trade’ driven by CME Futures had little impact on the massive leverage since it was ‘delta-neutral’—every ETH bought in the spot market is shorted in the Futures market. Instead, he blamed speculative traders for the excessive leverage.

The historical ETH-leverage-driven pump confirmed Kang’s concerns. In most cases, whenever leverage Open Interest increased more than price during the rally, a pullback and local top followed.

This was evident in early November and late December. They both escalated ETH liquidations.

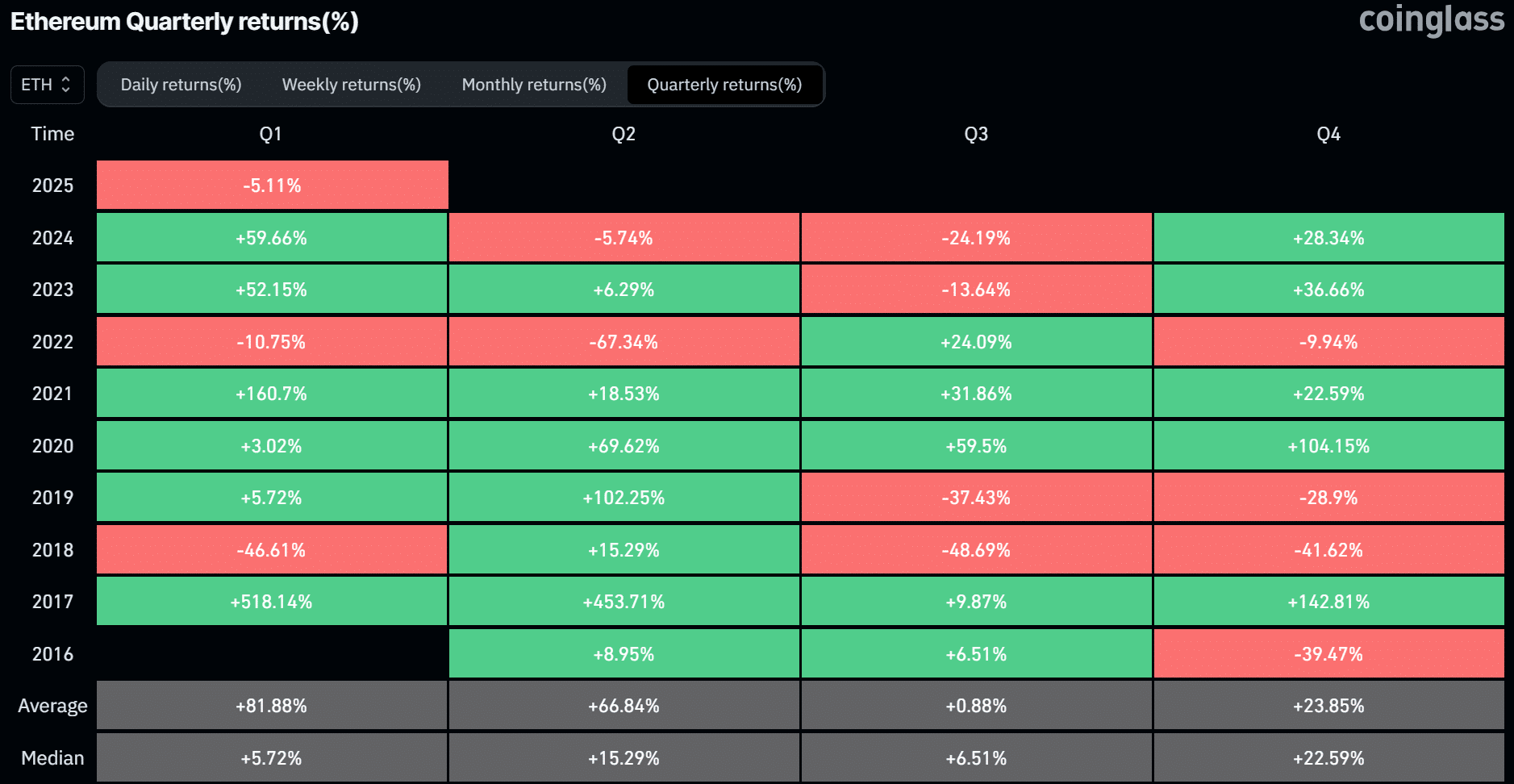

In fact, on the 20th of December, ETH recorded over $300M of liquidations, and long positions dominated the losses. That said, Coinglass data revealed that Q1 has always been ETH’s strongest performer, with an average of 81% gain.

Out of the past seven years, ETH closed only two quarters (Q1s) in the red. Simply put, if historical trends repeat, ETH could record significant gains in Q1 2025.

However, the lurking liquidation risk could cap the upside expectation. At press time, ETH was back above $3K after a sharp drop to $2.9K following Monday’s bearish move.