- Whale profit-taking, negative sentiment, and outflows signal weakening confidence in FARTCOIN.

- Long liquidations dominate as bulls fail to defend key levels near $1.02.

Fartcoin [FARTCOIN] saw a major shift in market dynamics as a whale offloaded $2.3M worth of tokens, shaking confidence across traders and triggering cascading effects.

A whale sold 2.18M FARTCOIN just two months after buying in, securing a ~$251K profit. This strategic profit-taking came at a time when investor sentiment was already fragile.

The large selloff not only added direct sell pressure, but also likely triggered panic among smaller holders, setting off a bearish reaction across exchanges.

Did the Binance.US listing euphoria wear off too fast?

Despite a 66% spike in volume to $373 million following the Binance.US listing, investor sentiment has turned sharply negative.

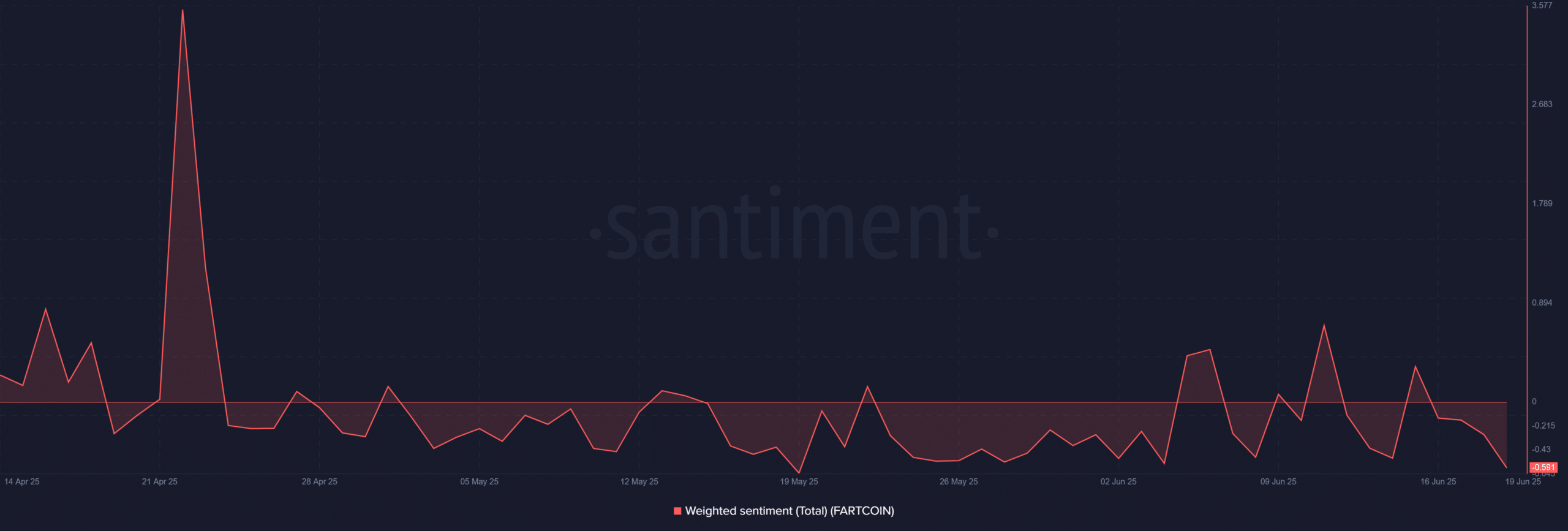

Weighted Sentiment has fallen to -0.59, showing that confidence has weakened significantly.

While the listing initially fueled speculative buying, it failed to sustain long-term optimism. As excitement fades, traders appear to be shifting to a more defensive stance.

The sentiment dip now aligns with increased volatility and fading momentum, suggesting that hype-driven rallies may no longer be enough to keep prices elevated.

Downside pressure builds

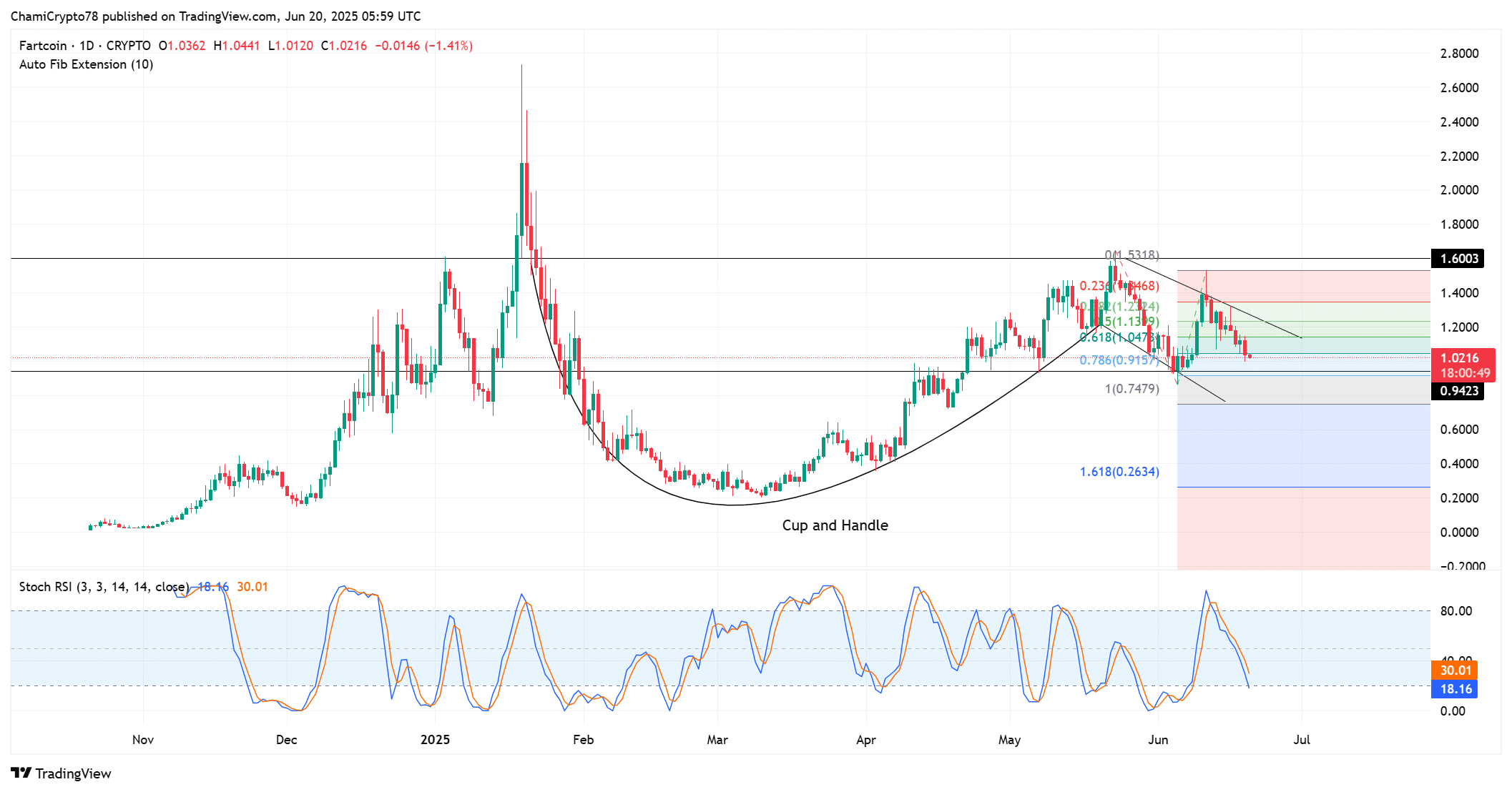

FARTCOIN was trading near $1.02 at press time, slipping below previous support zones as bearish momentum grows.

Notably, the broader price structure still followed a textbook cup and handle formation, but the handle appeared to be losing strength.

Despite oversold signals on the Stochastic RSI, bulls have not mounted a strong defense.

The price is beginning to compress in a narrow range, hinting at potential indecision or exhaustion. If demand fails to return soon, sellers may find room to push lower.

Why is FARTCOIN flowing out of exchanges?

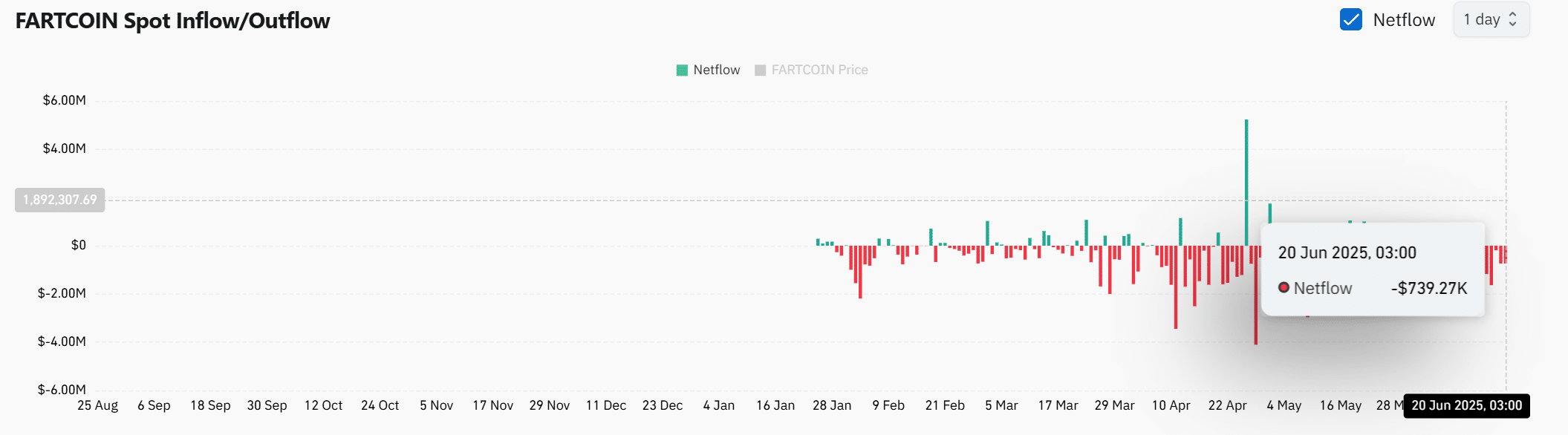

On-chain data revealed that spot exchange netflows recorded a -$739K outflow on the 20th of June, reflecting a steady movement of FARTCOIN into centralized platforms.

These sustained outflows suggest rising sell-side pressure, especially when coupled with recent whale exits. Thus, holders are positioning for liquidation rather than accumulation.

As traders continue to move assets into exchanges, it becomes increasingly difficult for bullish momentum to rebuild without a shift in fundamentals or sentiment.

Bears appear to win

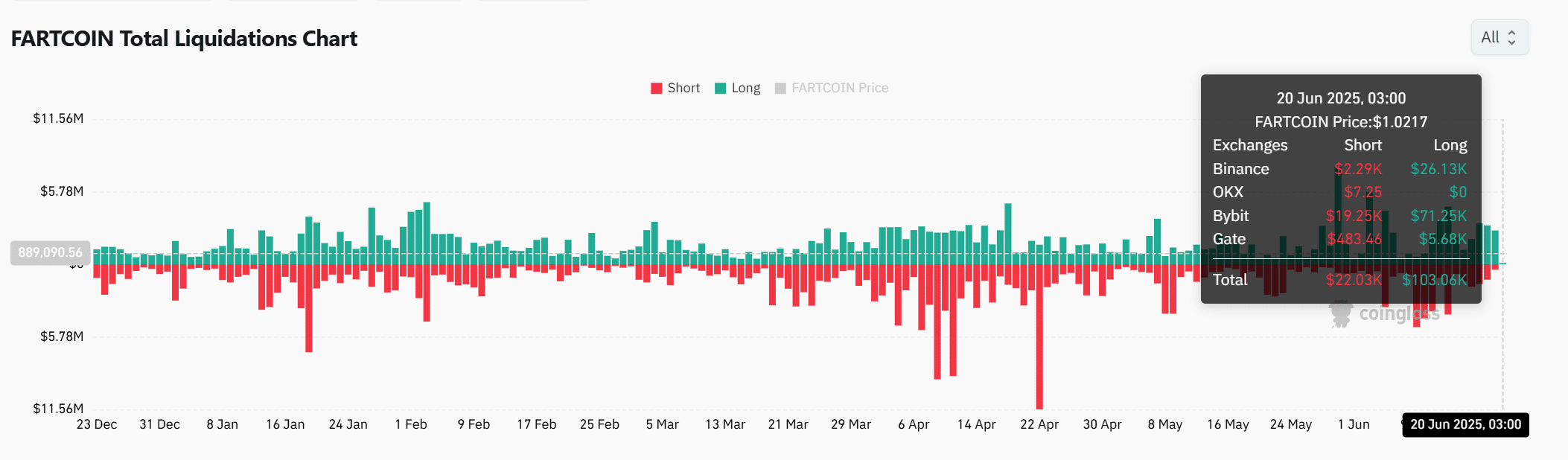

Liquidation data confirmed that bulls were taking the heavier hits. On the 20th of June, long liquidations surged to $103K, while shorts accounted for just $22K.

Bybit alone saw over $71K in long liquidations, revealing aggressive long exposure being unwound. This imbalance shows that leveraged traders are consistently betting on the upside too early.

However, with volatility remaining high and directional conviction weakening, both sides now face increased risk. For bulls, the repeated liquidations could further deter confidence in short-term rallies.

FARTCOIN’s outlook remains uncertain amid whale exits, negative sentiment, and mounting long liquidations pressure the market.

While the cup and handle structure still holds technically, fading momentum and exchange outflows raise the risk of breakdown. Bulls must act quickly to regain control before sellers dominate.

Without renewed confidence or buying activity, the asset could test lower supports, leaving the door open for further downside in the short term.