Key Takeaways

Why did FARTCOIN fall by 13%?

$44.7 million derivative outflows and 6.47% Open Interest decline fueled liquidations and position closures.

Can bulls still push Fartcoin higher?

OI-Weighted Funding Rate at 0.0046% and chart support near $0.73 suggest chances of a rebound.

Fartcoin [FARTCOIN] dropped 13%, at press time, in the last 24 hours as capital outflows weighed on both Spot and Derivatives markets.

This notable decline came as the memecoin market sector continued to weaken, reflected by a 4.5% dip in performance on the Artemis chart.

Both of the aforementioned markets have largely contributed to the poor performance so far.

However, AMBCrypto noted that despite the ongoing volatility, there were signals that a bullish scenario could still emerge in this stormy market environment.

Capital flight forces FARTCOIN lower

As mentioned above, capital outflows from the Derivative and Spot markets drove FARTCOIN’s losses in the past 24 hours, and here’s what AMBCrypto analyzed.

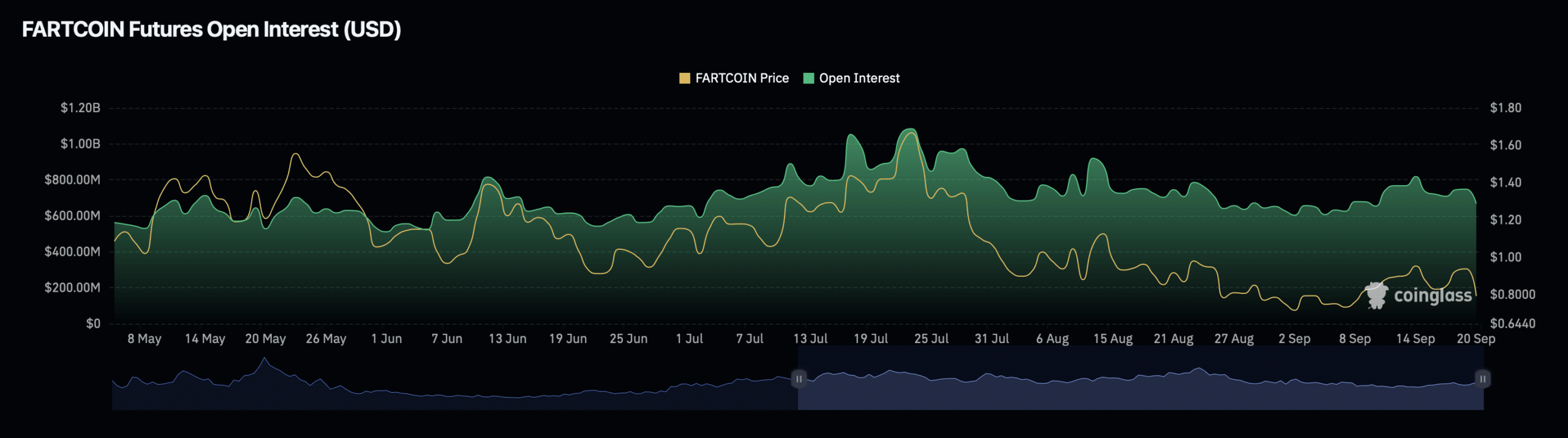

$44.7 million was withdrawn from FARTCOIN contracts, following a 6.47% decline in Open Interest during the same period, per CoinGlass.

That alignment suggested long liquidations and widespread position closures as traders attempted to limit further losses.

Speaking of the Spot market next, AMBCrypto observed that after nine straight days of consistent buying, FARTCOIN saw its first sell-off.

Total sales reached $675,000 at the time, likely indicating profit-taking rather than a broader market-wide sell-off.

Context still remains bullish for price

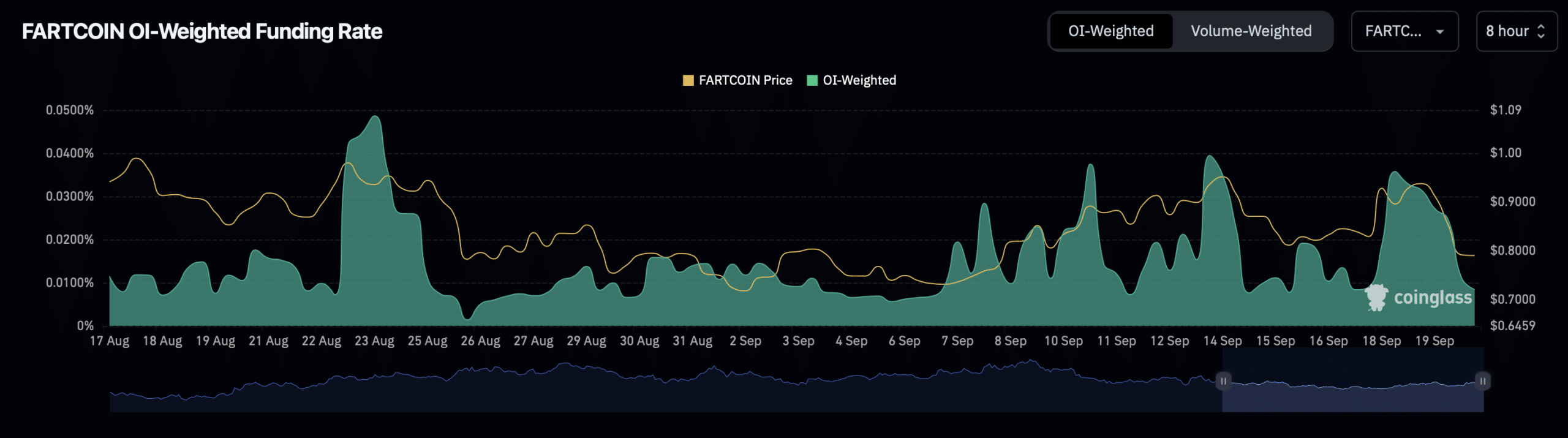

Despite these losses, CoinGlass data placed the OI-Weighted Funding Rate at 0.0046%, as of writing, meaning long traders continued paying fees to hold positions.

This metric, which combines Open Interest with the Funding Rate, helps determine whether the market is bullish or bearish by showing where the majority of capital leans.

Notably, however, Derivative Volumes showed more selling pressure, with a reading of 0.91. A level below 1 signals that selling volume outweighs buying.

Yet, exchange-level splits told a different story: Binance and OKX posted strongly bullish readings at 1.5 and 4.4, respectively.

Bullish configuration on the chart

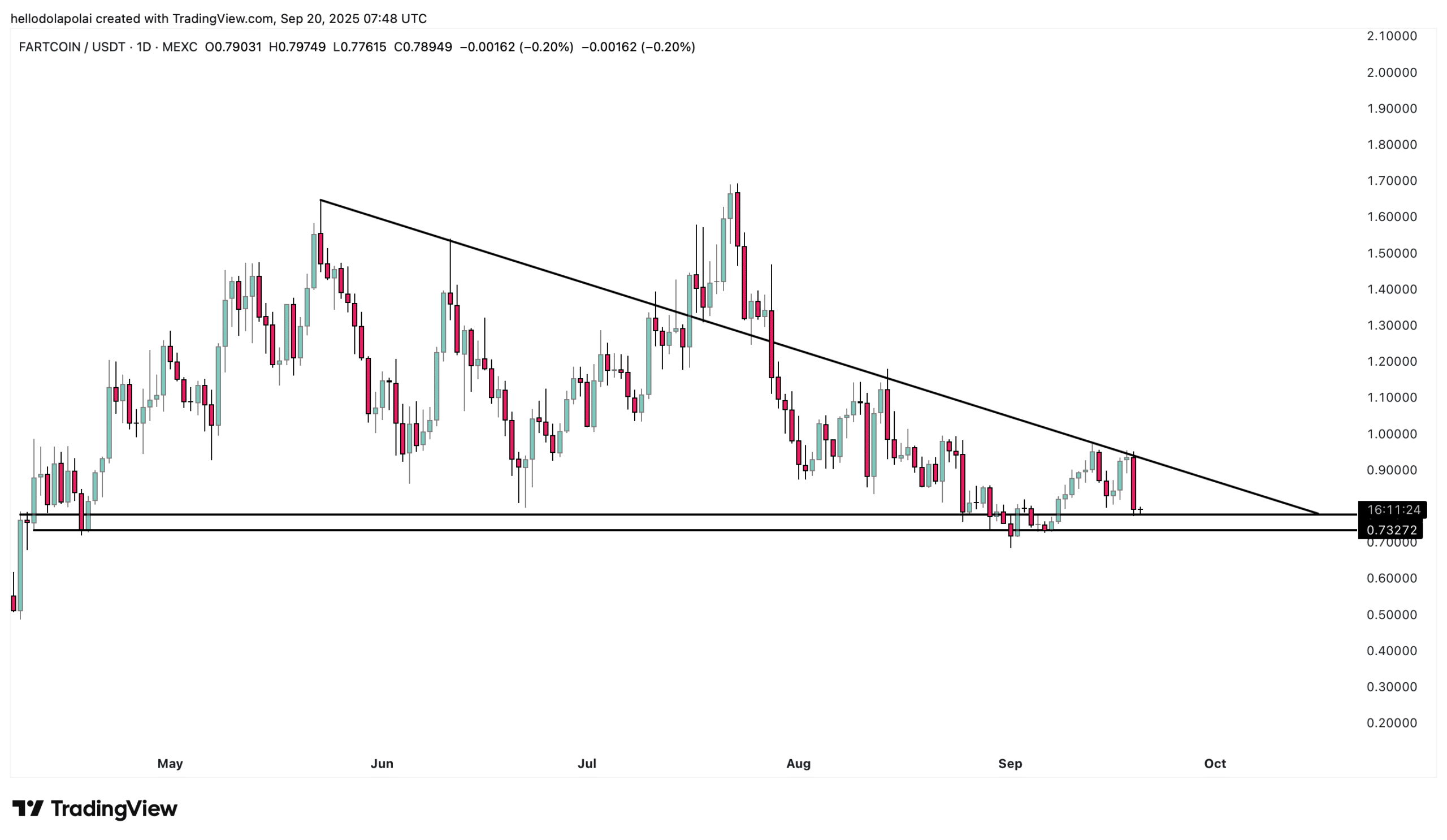

Analysis of the 1-day chart showed that a rally could be forming in the market. FARTCOIN tested a demand zone near $0.73.

That move with the demand zone highlighted on the chart with black lines. This could provide the necessary push for price recovery.

On the broader outlook, the structure forming on the chart remained bullish. A rally and a successful breach of the diagonal resistance line would confirm this perspective, based on historical patterns.

If spot selling slows and long positioning holds, a rally toward higher levels may follow. That outcome would mark a shift from the recent liquidation-driven decline.