- FLOKI has been trading within a range-bound market for the past week

- If buyers re-enter the market after the MACD flashes a buy signal, it could aid a bullish breakout

FLOKI has been under bearish pressure given that within just one month, the memecoin’s price declined by 21% on the charts. During this time, its market capitalization also dropped from $2.65 billion to $1.75 billion.

At press time, these bearish trends were still in play after losses of 1.17% in 24 hours, with the crypto trading at $0.000183. Despite this fall, FLOKI still seemed to be defending its critical support. However, a lack of buy-side pressure might just have forced the memecoin into range-bound consolidation.

FLOKI price analysis

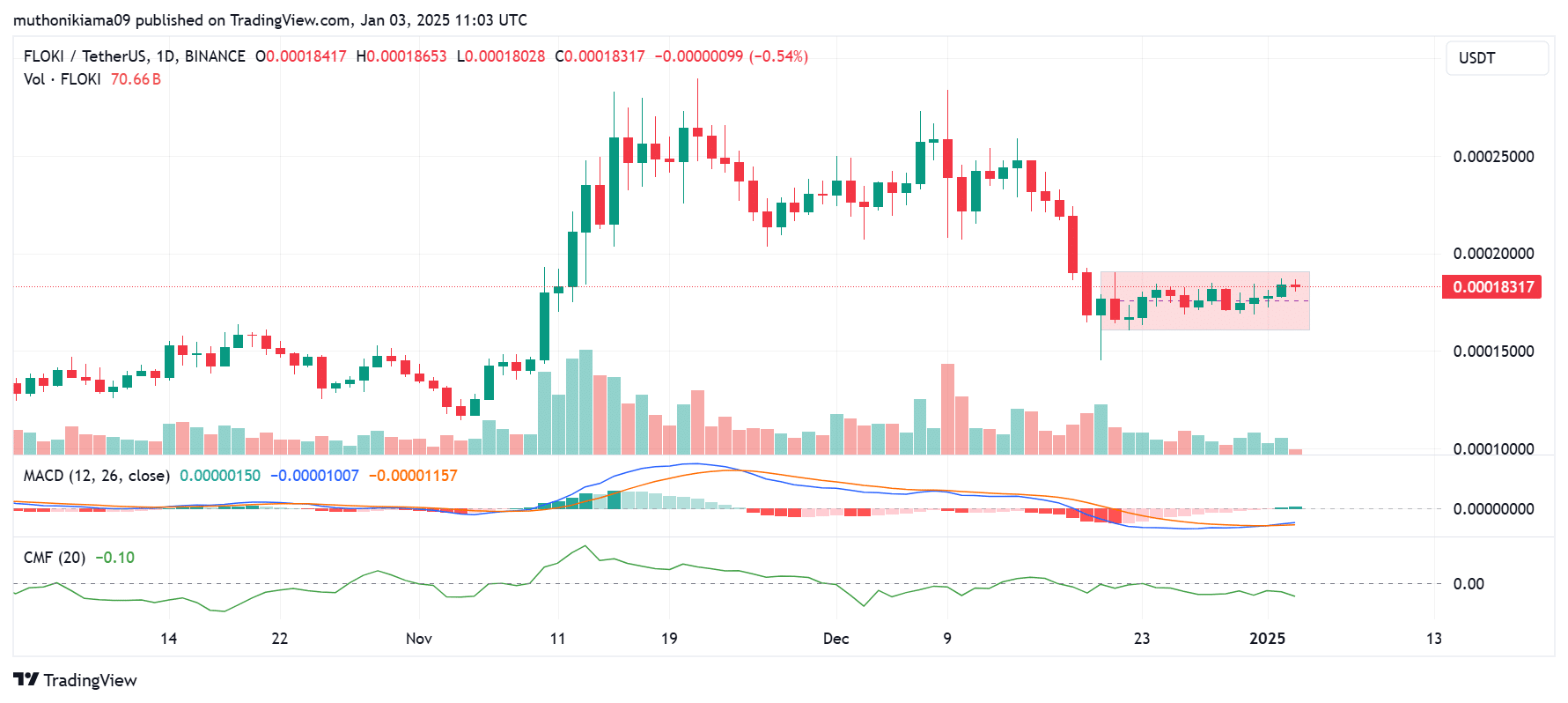

FLOKI’s price has oscillated between $0.000173 and $0.000190 over the past week. One of the factors that could be behind the lack of a clear trend is the lack of market conviction. In fact, on the one-day chart, the memecoin’s Chaikin Money Flow was negative – A sign that selling pressure was high.

Despite the negative CMF, however, the green volume histogram bars suggested that buyers have also been active. The tussle between buyers and sellers could be behind the lack of significant gains or dips that forced FLOKI to consolidate.

On the charts, the Moving Average Convergence Divergence (MACD) line formed a buy opportunity after crossing above the Signal line. Furthermore, the histogram bars seemed to have flipped green, indicating that buyers have been becoming active.

If buying pressure continues to rise and outpaces the selling pressure, it could support a bullish breakout for FLOKI from this consolidation range.

Derivatives market sees mild recovery

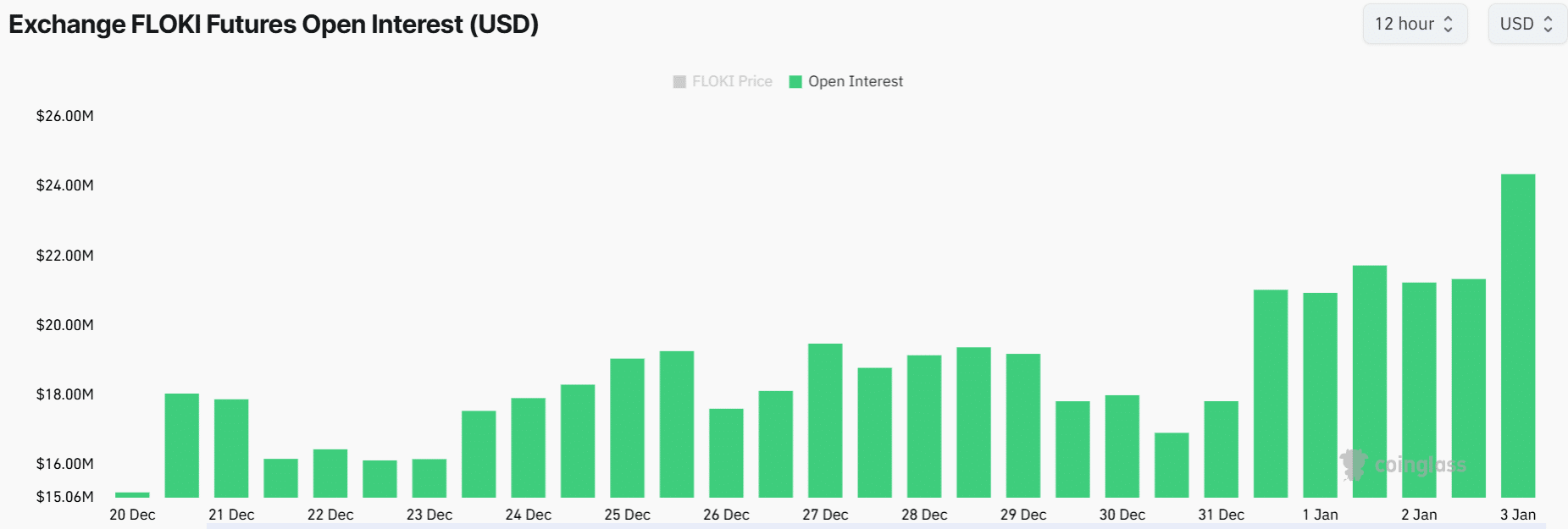

A spike in Open Interest and derivative trading volumes tends to cause volatile price movements that in turn, support strong trends. Earlier this week, FLOKI’s Open Interest stood at $16M.

However, it has since surged to $24M on the charts.

This hike indicated that speculative interest has been rising again, which could spike volatility. Despite this hike though, the OI was still down by 50% from its mid-December levels.

Key levels to watch

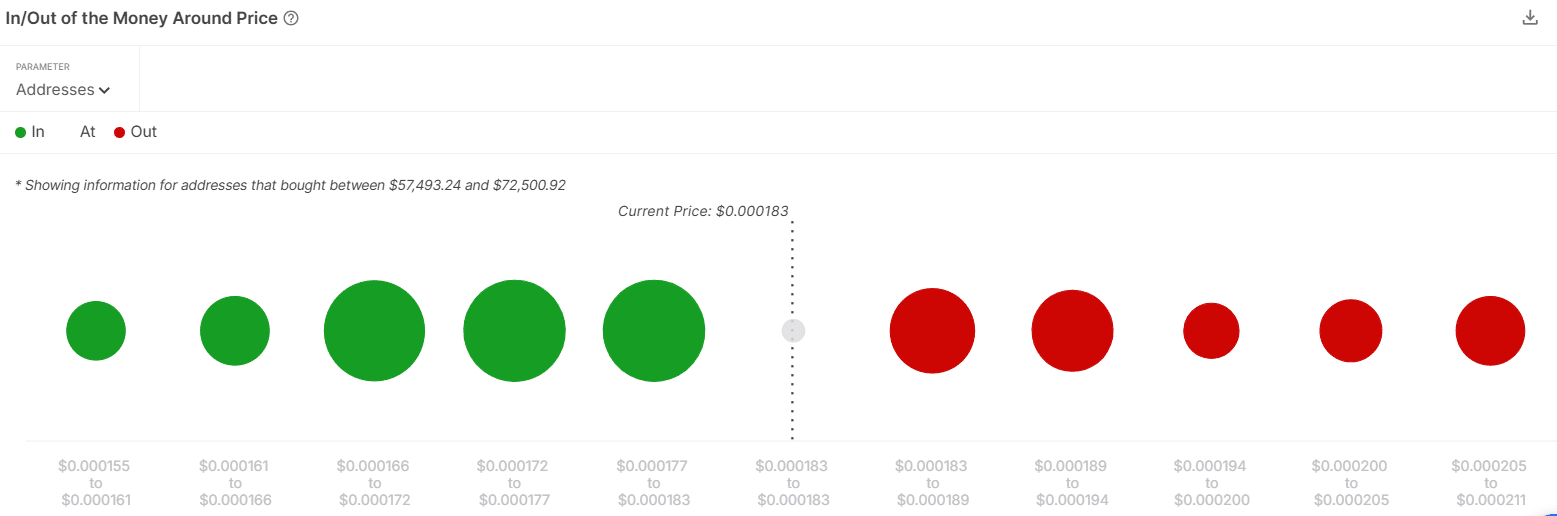

The In/Out of the Money Around Price (IOMAP) metric suggested that FLOKI was stuck between a supply zone and a demand zone.

According to IntoTheBlock, 2,090 addresses purchased 354B FLOKI tokens at an average price of $0.000180. This price could act as a strong support level if buyers view it as an ideal entry point.

On the other hand, a crucial supply zone lay above the press time price at $0.000186 where 1,250 addresses bought 70B tokens. This zone is a strong resistance level due as these traders could choose to sell once they become profitable.

Will FLOKI break from consolidation?

For FLOKI to break out of the consolidation range, there needs to be a fresh uptick in buying activity and interest from speculative traders. If this happens, it could allude to strong market conviction that could create a positive sentiment.

However, if buyers remain hesitant and FLOKI falls below the demand zone, it could lead to a bearish breakout. At the same time, a breakout past the resistance at the supply zone could trigger a bullish recovery.