- FLOKI was likely to see a short-term pullback before rallying toward the next Fibonacci retracement level.

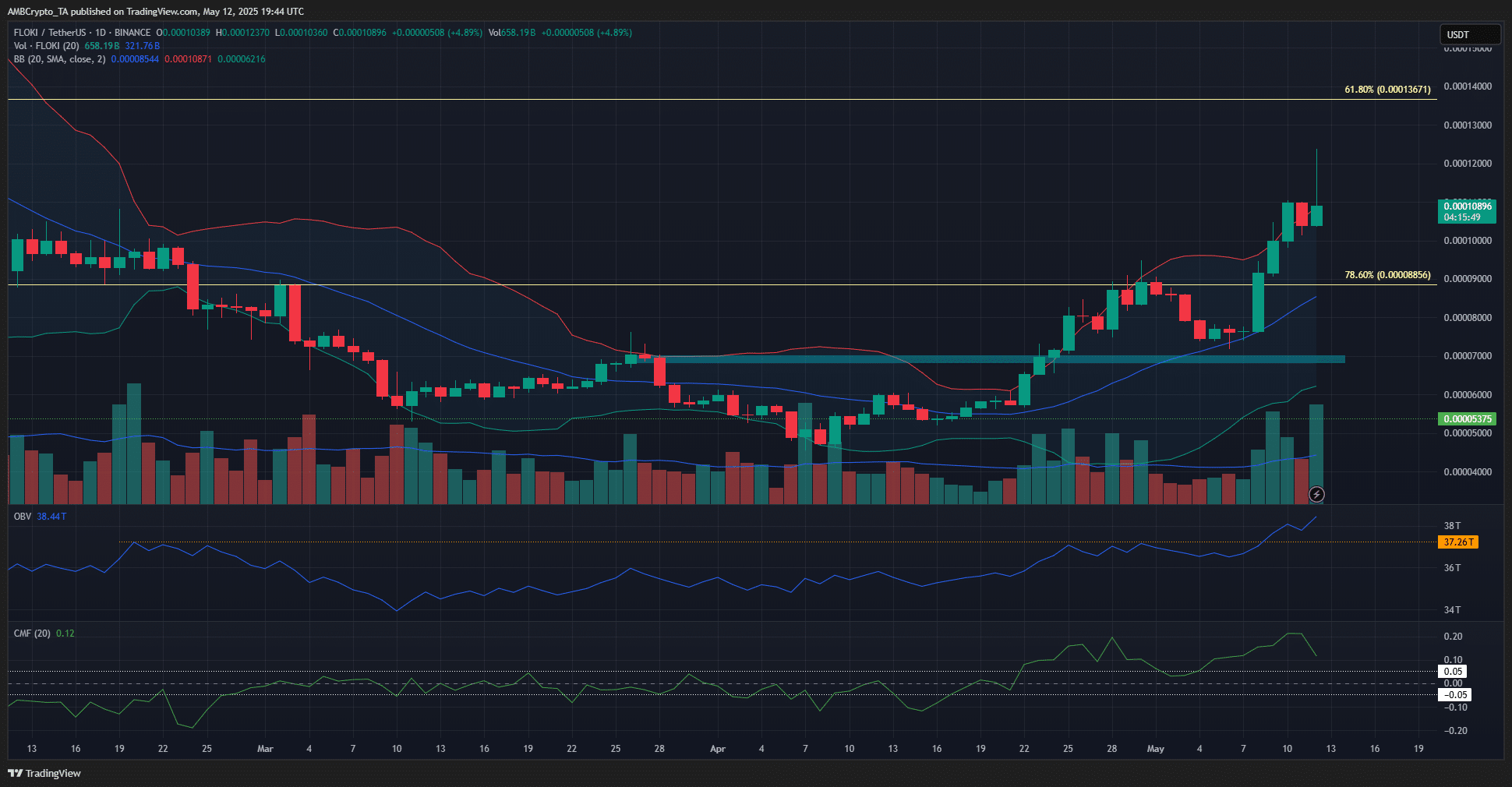

- The bullish structure on the 1-day timeframe after the prolonged downtrend in 2025 was hugely encouraging for buyers.

FLOKI [FLOKI] witnessed a 107% increase in its daily trading volume, according to CoinMarketCap data at press time.

During this time, there was high volatility, with a 17% rally to local highs at $0.000123 followed by a nearly 10% drop to $0.000109.

This short-term volatility and the liquidation heatmap hinted at the chance for a deeper pullback for the meme coin.

For investors and traders with a longer time horizon, FLOKI has a bullish outlook, helped by the swift Bitcoin [BTC] gains in May.

The high demand for FLOKI could make for another 22% rally

FLOKI presented a bearish order block at $0.0000695, formed by the lower high formed in March.

Highlighted in cyan, this area was breached in April and nearly retested as a demand zone a week ago. The move beyond this area meant it was now a bullish breaker block.

This bullish structure break and the sustained rally in May came alongside increased demand for FLOKI. The OBV has broken above the local highs formed in February and retested unsuccessfully in April.

Similarly, the CMF was well above +0.05 to indicate strong capital inflows to the market.

FLOKI had been in a downtrend since mid-December.

The rally past the bullish breaker block and the heightened demand meant that the 61.8% Fibonacci retracement level, plotted based on the November rally, was the next bullish target.

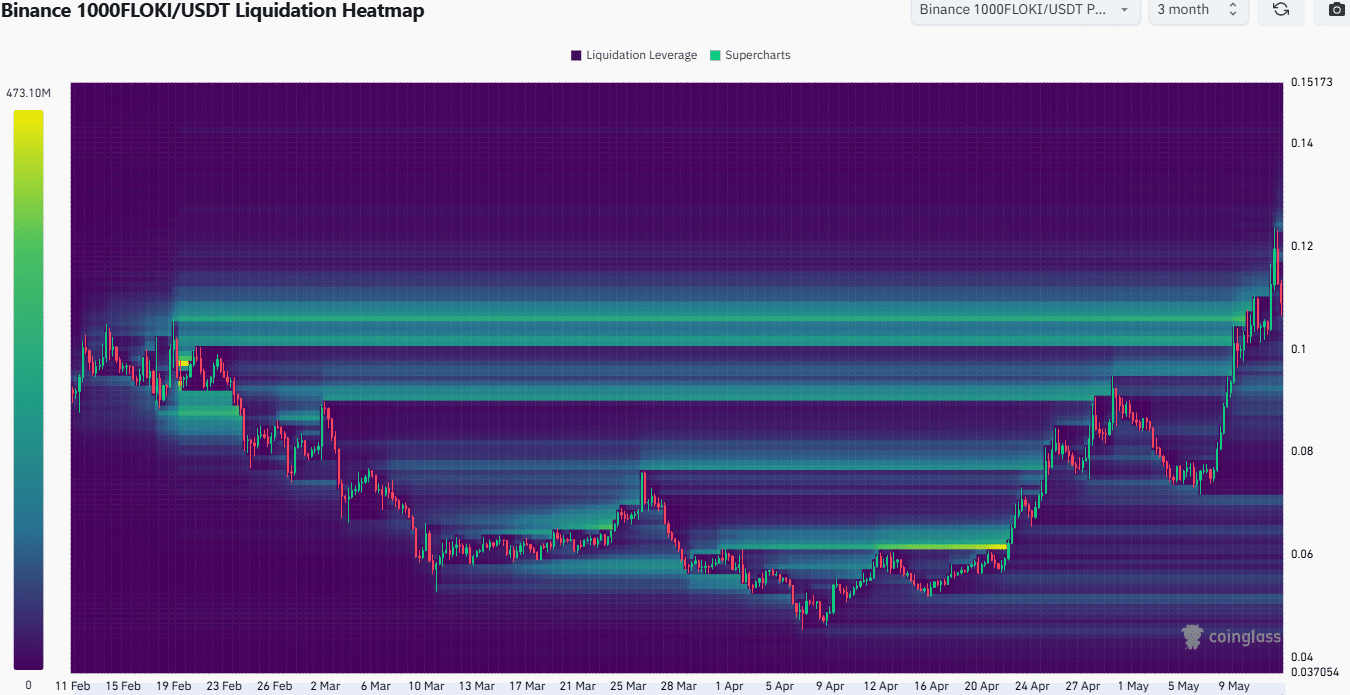

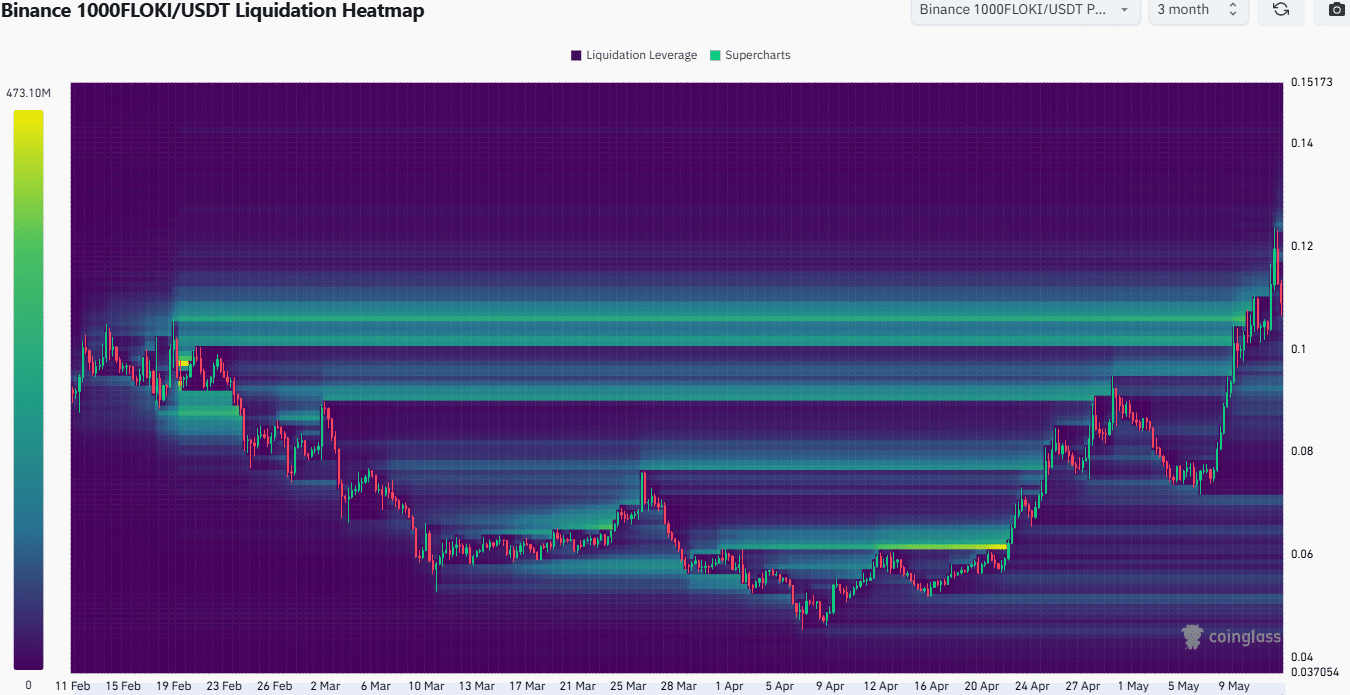

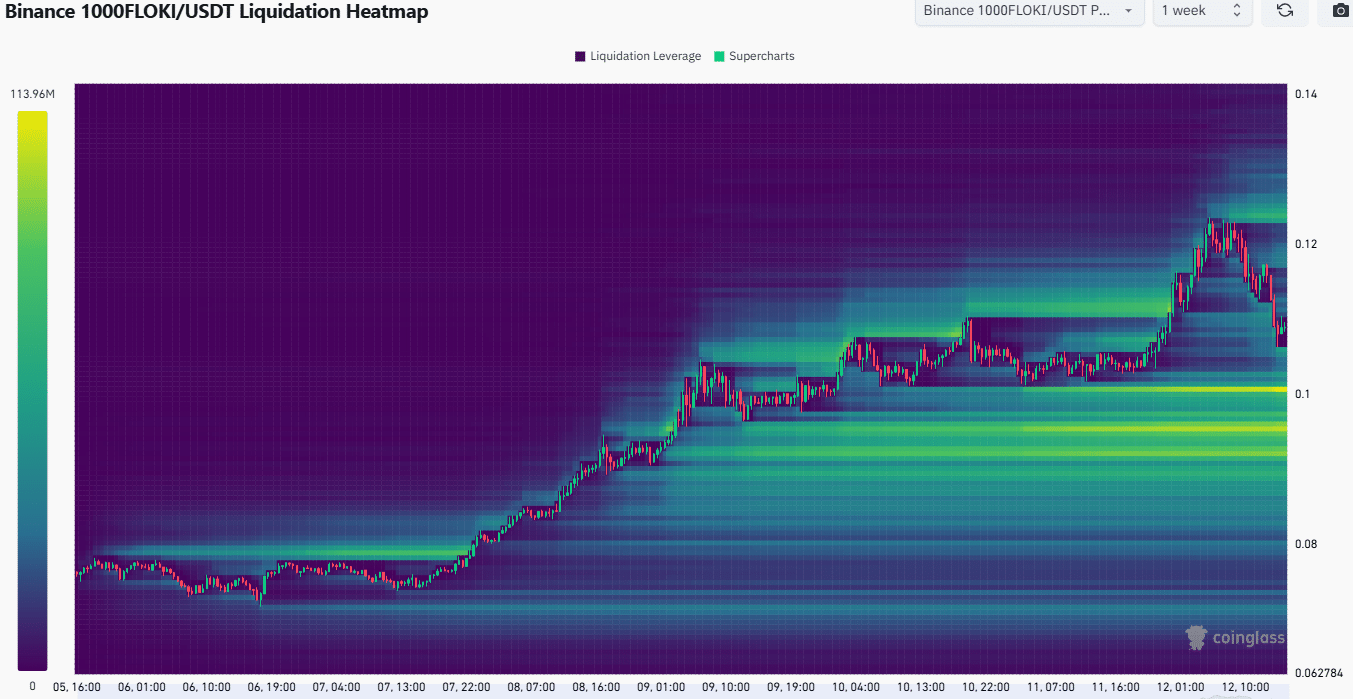

Source: Coinglass

The 3-month liquidation heatmap highlighted the build-up of liquidation levels around the $0.000107 area, the highs from February. This magnetic zone has successfully pulled prices higher.

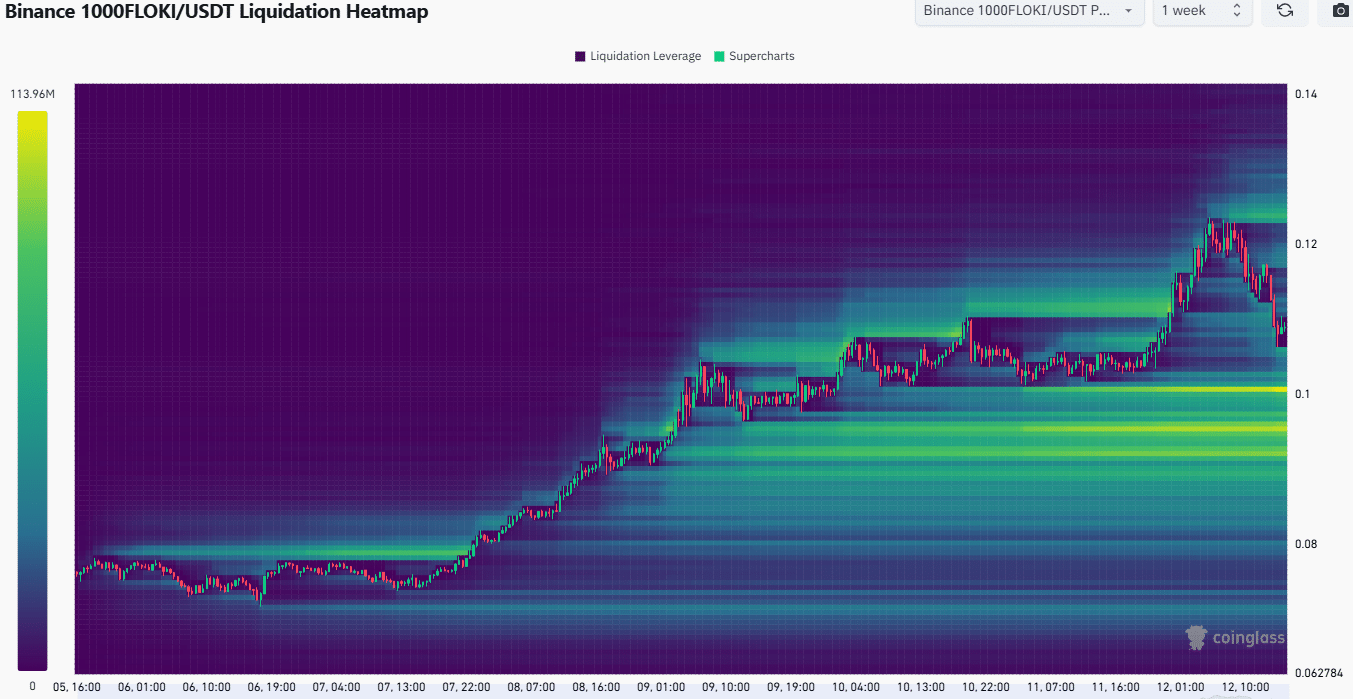

Source: Coinglass

Zooming in, the 1-week liquidation heatmap showed where the next price move could go. The $0.0001 and $0.000092-$0.000095 area was found to be liquidity clusters that could be swept in the coming days.

A dip to these levels would likely see a bullish reaction. Traders and investors can be prepared for this possibility while keeping an eye on Bitcoin, just in case its trend turns bearish and adversely affects FLOKI.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion