What is the problem with Web3? Web3 was supposed to be the next great leap after the mobile era—a decentralized digital revolution where users would own their data, bypass middlemen, and participate directly in the financial and creative systems of the internet. For a while, it felt like we were on the right track. DeFi protocols were booming, millions were onboarding into crypto, and the dream of an open, user-governed web seemed within reach.

But somewhere along the way, the revolution derailed. The innovations at the heart of crypto and DeFi were suffocated by hype, bad design, centralizing forces, and regulatory whiplash. Instead of doubling down on decentralization and user empowerment, the tech industry scattered—chasing half-baked metaverse ideas, trendy AI tools, and VC-fueled experiments that failed to live up to their promises.

So why is Web3 not popular today? And is there still hope for Web3’s original mission? How Web3 failed to deliver on its promises is a question that still lingers, as the vision of a truly decentralized internet continues to struggle against centralized forces.

A Recap of What Made Crypto and DeFi Revolutionary

Let’s rewind to the golden years.

Bitcoin, launched in 2009, emerged as a direct response to the 2008 financial crisis — a bold attempt to reimagine trust in finance. Unlike traditional currencies backed by central banks and governments, Bitcoin introduced a decentralized, peer-to-peer system built on a fixed supply and immutable code. It shifted the foundation of trust from human institutions to cryptographic proof, offering a financial system where transparency and predictability replaced opacity and control.

The next seismic shift came with Ethereum in 2015. More than just digital money, Ethereum introduced smart contracts — self-executing code that could automate complex agreements without the need for intermediaries. This innovation didn’t just enhance the blockchain; it opened the door to a fully decentralized financial ecosystem. Known as DeFi, or Decentralized Finance, this space enabled anyone with an internet connection to lend, borrow, trade, and earn interest — all without banks or traditional brokers.

By 2021, DeFi reached a fever pitch. Total Value Locked (TVL) skyrocketed past $170 billion, as users around the world began to participate in this new financial frontier.

It felt like more than a trend — it was the rebirth of finance: open to all, permissionless by design, and truly global in scope.

Key Vulnerabilities Exposed During the Web3 Expansion

As crypto entered the mainstream, the concept of Web3 quickly evolved from a grassroots movement into a global trend, attracting the attention of tech venture capitalists, celebrities, and major corporations. Why is Web3 not popular despite its promising beginnings?

What began as a vision for a decentralized, user-empowered internet rapidly became a playground for speculation and hype. NFT prices soared, not because of their utility or cultural significance, but due to celebrity endorsements and the illusion of scarcity. Projects like Pixelmon raised tens of millions—$70 million, in that case, only to deliver underwhelming results that exposed the lack of real innovation behind many initiatives.

The foundational principle of Web3—decentralization—was soon undermined. A significant number of so-called Web3 platforms were still reliant on centralized infrastructure, controlled by opaque governance models, and sustained by venture capital funding that prioritized profit over community empowerment. In theory, DAOs were meant to democratize decision-making, but in practice, they often devolved into plutocracies, where voting power was concentrated in the hands of token-rich whales rather than the wider community.

While the rhetoric of a decentralized future persisted, the reality painted a different picture. Massive VC injections, corporate rebrands and superficial celebrity affiliations turned Web3 into more of a marketing buzzword than a revolutionary shift. The irony was hard to ignore—Web3, which had promised to wrest power from centralized authorities, had instead become a tool for them to further entrench their dominance.

The Tension Between Decentralization and Centralized Influence

Web3 was championed as the antidote to centralized power—an era where users would reclaim control over their data, assets, and digital lives. Evangelists promised a decentralized internet governed by communities, not corporations. But in reality, the vision fell short. Instead of dismantling traditional power structures, Web3 often ended up reinforcing them under a new banner.

Despite being built on decentralized infrastructure, many major Web3 platforms continued to rely on legacy gatekeeping mechanisms. Venture capital firms, like Andreessen Horowitz (a16z), poured vast sums into early-stage projects, securing significant influence through preferential token allocations. In the case of Uniswap, for instance, a16z reportedly holds at least 55 million UNI tokens — a sizable share of the total supply.

Private token sales to insiders became the norm, sidelining the very users Web3 claimed to empower. What was framed as a decentralized utopia began to look eerily familiar: a market dominated by a select few, while retail investors drawn in by promises of equity and ownership were often the last to realize they held the weakest hand.

Perhaps the most unsettling part was how the language of decentralization was co-opted as a branding tool. Behind the scenes, centralization quietly reasserted itself, leaving many to question…is Web3 dead?

How poor UX, scalability issues, and security gaps took hold

The promise of Web3 was bold and visionary—a decentralized, user-empowered internet. But in practice, it often delivered an experience that was clunky, confusing, and risky. The Web3 user experience, in particular, remained stuck in what felt like the Stone Age. Take crypto wallets, for instance. For newcomers, opening a wallet could feel like stepping into a high-tech command center without a manual. Originally designed by and for developers during the early days of DeFi, these tools haven’t evolved much in the years since. Their interfaces often resemble relics from 2016, complete with awkward design choices, poor navigation, and little to no user guidance. While seasoned users might have learned to work around these flaws, beginners are left fumbling through unfamiliar jargon, prone to making easily avoidable mistakes. Even experienced users aren’t spared—slow load times, buggy interfaces, and frustrating transaction failures are still part of the experience. Worse yet, losing a seed phrase could mean losing everything, with no recourse.

Scalability wasn’t much better. Major blockchains like Ethereum consistently buckled under high demand. During peak periods, gas fees became prohibitively expensive, sometimes topping $100 for a single transaction. This effectively priced out the average user, particularly those Web3 was supposed to empower.

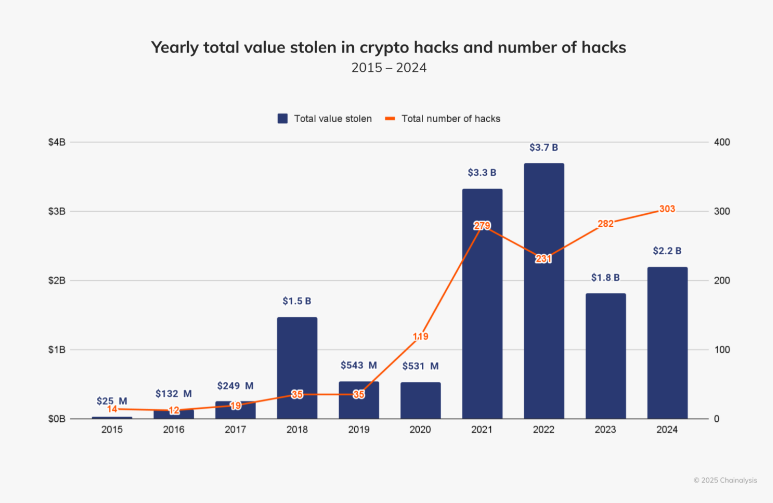

Then came the security gaps — persistent, costly, and confidence-shattering. Hacks, exploits, and protocol failures became almost routine. In 2024, stolen funds totalled $2.2 billion, up 21% from the previous year, while the number of incidents rose from 282 in 2023 to 303 in 2024.

These breaches not only drained user funds but also eroded public trust, reinforcing the perception that Web3 was too dangerous for everyday use.

For all its grand talk about building a “better internet,” the Web3 industry overlooked basic elements of usability, affordability, and safety. This neglect alienated mainstream users and gave regulators and sceptics all the ammunition they needed to label the space as chaotic, immature, and unready for mass adoption.

Regulatory challenges worsened by a lack of focus on fundamentals

As DeFi and Web3 began to gather real momentum, regulatory challenges swiftly emerged—less like a careful scalpel and more like a sledgehammer. The U.S. Securities and Exchange Commission (SEC) launched a wave of aggressive enforcement actions, classifying numerous tokens as unregistered securities and sending a chilling message across the industry. The collapse of Terra’s UST stablecoin, which many had long viewed as a ticking time bomb due to its unsustainable yield model, only intensified global scrutiny and eroded public trust.

Then came the implosion of FTX—a centralized exchange that falsely branded itself as part of the decentralized Web3 movement. Though FTX had nothing to do with DeFi, its high-profile failure handed regulators the perfect excuse to clamp down broadly on the entire crypto ecosystem. Rather than engaging with innovators to craft thoughtful, future-proof policies, many regulators opted for reactionary crackdowns, discouraging responsible builders and driving promising projects offshore.

Amid this wave of external pressure, the Web3 community struggled with its own internal shortcomings. A lack of strong self-regulation and public education left the space vulnerable to criticism and incapable of effectively defending its legitimacy. As a result, the focus on innovation was overshadowed by legal uncertainty, stalling progress at a crucial time.

Reviving and strengthening the core: what’s still possible

Despite the chaos and setbacks, not all is lost in the world of Web3. Beneath the layers of speculation and hype, the original ideals that made crypto and DeFi so revolutionary still hold strong—and in many ways, they’re more relevant than ever. Decentralized infrastructure is not only functioning but actively improving. Networks like Ethereum, Solana, and Layer 2 solutions such as Arbitrum and Optimism continue to scale and evolve, pushing the boundaries of what’s possible.

Innovations like zero-knowledge proofs and modular blockchains, with projects like Celestia leading the charge, are transforming how we think about privacy, scalability, and transparency—all coexisting without compromise. Meanwhile, real-world asset tokenization is no longer a distant vision. Major institutions, including BlackRock, are now exploring on-chain financial products, signalling a growing institutional interest in blockchain’s practical utility.

Even in social media, the tide is turning. Community-led efforts like Lens Protocol and Farcaster are reimagining digital platforms, moving away from surveillance capitalism and toward user-owned, decentralized networks.

To truly revive and strengthen Web3’s core mission, the industry must refocus on its foundational values. That means prioritizing genuine decentralization over flashy tokenomics, designing for everyday users instead of just crypto-native insiders, and adopting a security-first mindset with open-source protocols and rigorous audits. It also requires engaging with regulators, not to surrender the vision, but to advocate for clarity and fairness without compromising core ideals. There’s still a path forward—if the space is willing to return to its roots and build with purpose.

Disclaimer: This piece is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you would like to read more articles like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”