- HBAR’s 10% hike was contrary to the broader market’s pullback

- If bullish sentiment continues to prevail, HBAR could head to $0.25

While most of the crypto market saw a slight pullback during the last trading session, Hedera [HBAR] emerged as one of the few assets maintaining its upward trajectory. Over the last 24 hours alone, HBAR gained significant traction by climbing by 27% on the charts. All while other altcoins struggled to hold their positions.

HBAR’s price action – Sustained gains in a weak market

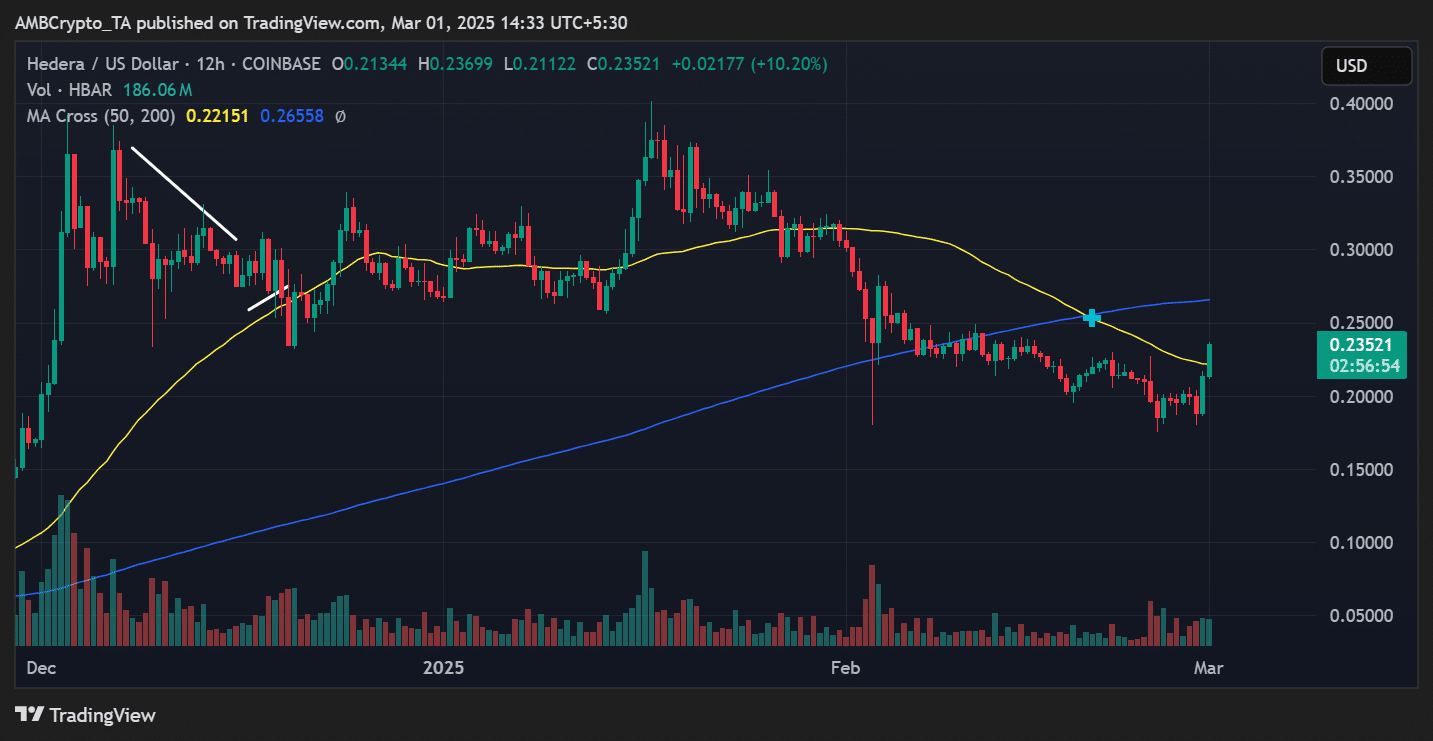

HBAR’s latest price movement highlighted its strength against the broader market’s downturn. At the time of writing, it was trading at $0.235, having surged past resistance levels that had previously limited its upside.

This bullish push seemed to be in line with a break above the 50-day moving average – A signal often associated with further gains when supported by rising trading volume.

The price chart indicated that if the uptrend continues, HBAR could target $0.25, which would be in line with previous resistance levels. A failure to sustain press time levels, however, could see a retest of support around $0.22. This is where its 50-day moving average lay at press time.

On-chain volume – Strong activity behind the rally?

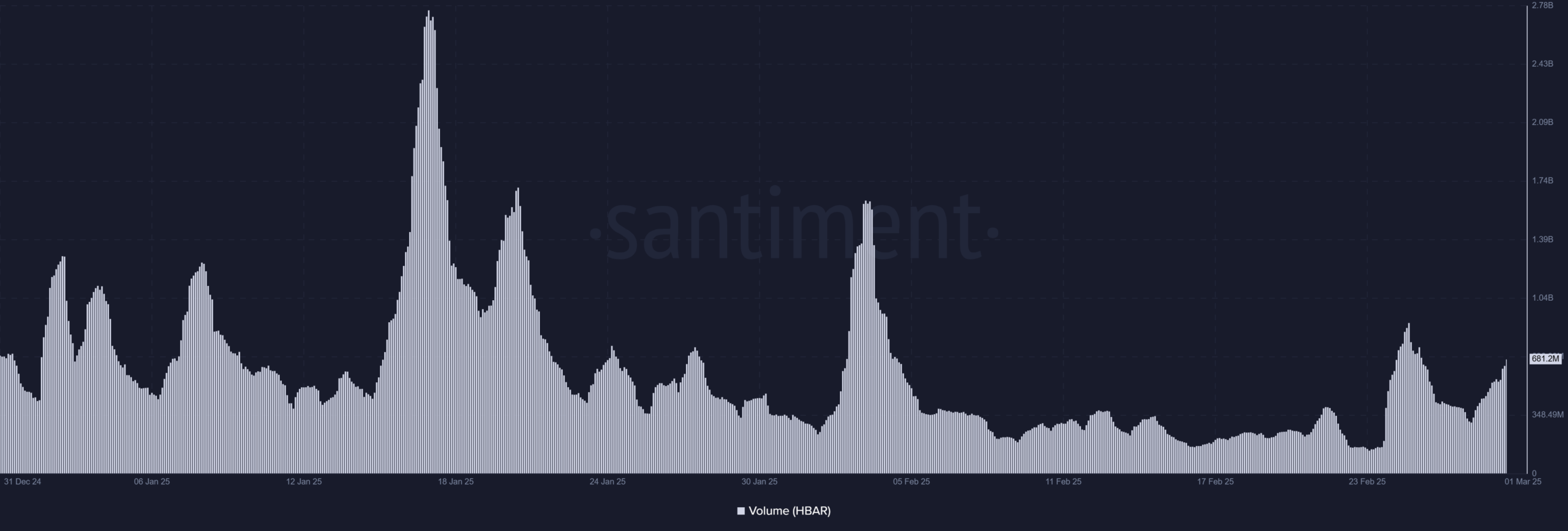

On-chain volume trends offer a deeper perspective on HBAR’s price action. A rise in trading volume typically indicates greater investor interest, strengthening the price movement.

Recent Santiment data highlighted that HBAR’s volume surged past 681.2 million – Reflecting a notable hike in trading activity.

This volume uptick suggested that market participants are actively engaging with HBAR, reinforcing its bullish outlook. If volume remains high, the likelihood of sustaining the uptrend increases too.

Open Interest – More liquidity flowing into HBAR?

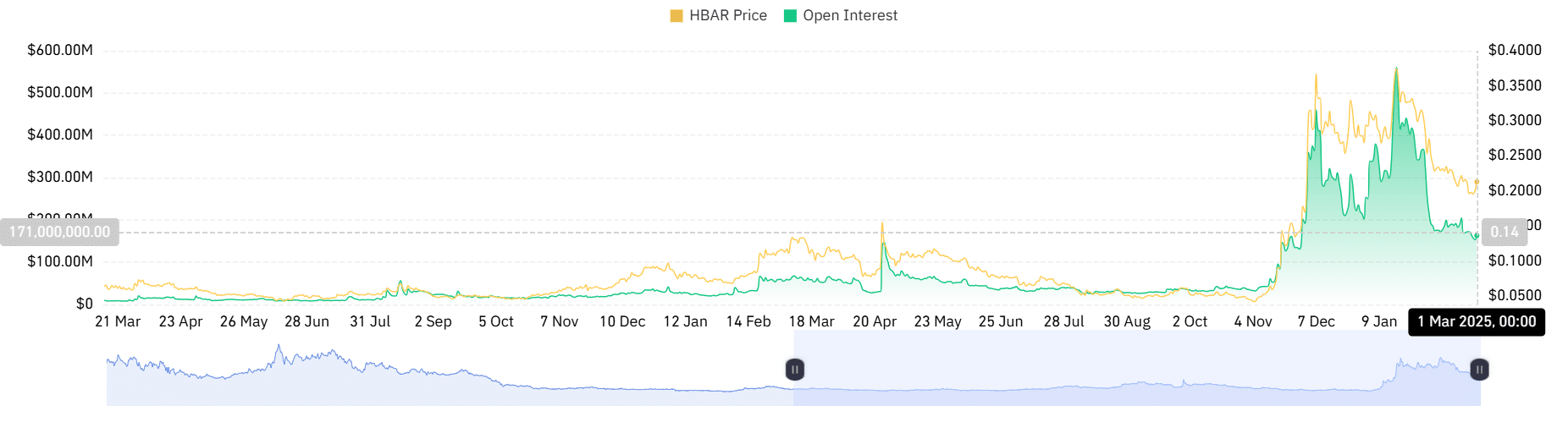

Another important on-chain metric to consider is Open Interest [OI] – A metric that tracks the total number of outstanding derivative contracts.

Rising Open Interest is often a sign that more capital is entering the market, which can lead to stronger price trends. If OI increases alongside the price, it could allude to confidence among traders and the potential continuation of the trend.

HBAR’s Open Interest saw a slight spike, which means more traders are taking positions in the asset. This also means that speculative interest in HBAR remains strong. At the time of writing, it was around $163 million.

However, if Open Interest begins to decline while the price remains elevated, it could signal weakening momentum and an increasing risk of reversal.

Will HBAR maintain its strength?

HBAR’s ability to sustain gains while the broader market pulls back is an impressive feat, driven by positive on-chain activity, a volume surge, and rising Open Interest. If bullish sentiment continues, HBAR could push towards $0.25 as its next key resistance.

However, traders should watch for any decline in volume or Open Interest. Especially as these could signal a slowdown in momentum.

Maintaining support above $0.22 will be crucial in confirming whether this breakout has long-term potential or if a retracement is on the horizon.

![Hedera [HBAR] defies market trend – All you need to know about altcoin’s 27% hike!](https://yeek.io/wp-content/uploads/2025/03/Hedera-HBAR-defies-market-trend-All-you-need-to.webp.webp)