Stablecoins aren’t the only place investors store dry powder during a risk-off market. Historically, memecoins have played a role in sidelining capital, as investors rotated into them to offset losses in high-cap assets.

However, over the past few cycles, this trend has shifted dramatically. The memecoin market cap has declined by nearly $10 billion in the last 30 days, aligning with the total crypto market, which has shed $330 billion.

In short, instead of attracting capital, memecoins have fallen alongside the rest of the market. Liquidity hasn’t rotated within crypto; it has moved out, with investors shifting to alternative assets to hedge against the FUD.

Nothing illustrates this better than the DOGE/BTC ratio.

Since the October crash, the pair is down 30%, consolidating below the 0.000002 level and failing to reclaim structure. That weakness against Bitcoin [BTC] points to fading speculative demand for Dogecoin [DOGE].

Simply put, traders didn’t rotate into memecoins for a quick high-beta bounce during the risk-off move. The bid just wasn’t there. The bigger question now: Is this just a temporary cooldown, or the start of a deeper structural shift in risk appetite?

Confidence cracks in the memecoin trade

You can’t trade memecoins without confidence.

The logic is simple: Trading in these assets is high-risk, and executing a position requires more than just interest. Instead, traders need solid conviction in the asset’s potential before committing capital.

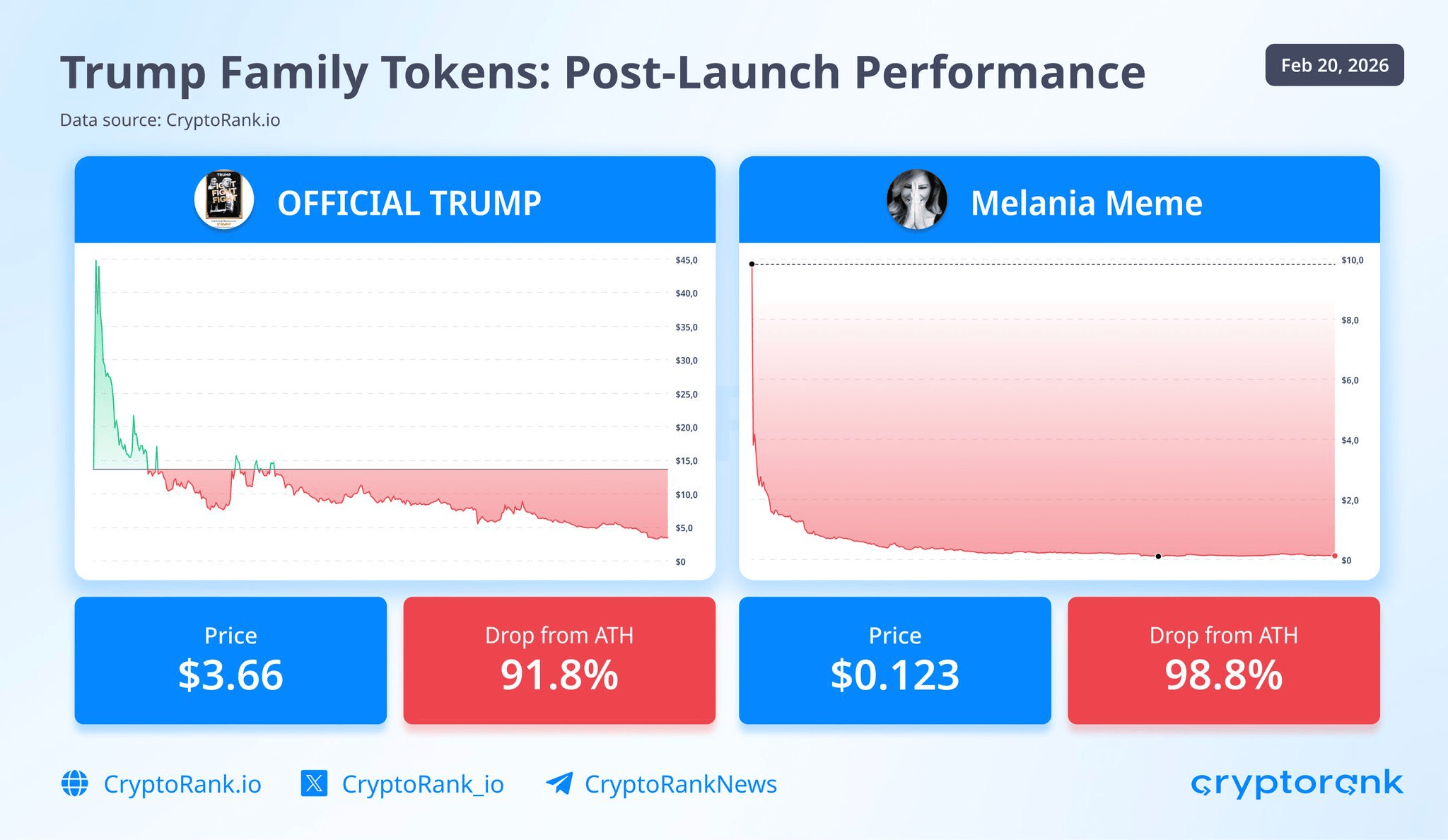

But recent CryptoRank data shows that memecoin trading has taken a hit. The launch of Official Trump [TRUMP] and MELANIA [MELANIA] coins seems to have spooked retail investors, slowing speculative flows and shaking the market’s usual high-beta dynamics.

Looking at the numbers, Trump family–linked memecoins TRUMP and MELANIA have collapsed 92% and 99% from their all-time highs, with insiders reportedly pulling over $600 million through fees and token sales.

The result? Retail holders are now facing more than $4.3 billion in losses, while $2.7 billion in insider tokens remain locked until 2028. In other words, the downside has landed on everyday investors, while insiders maintain tight control over future liquidity.

In this environment, the usual rotation into memecoins isn’t happening.

Instead, investors are clearly leaning toward safer alternative assets, leaving speculative flows thin. This helps explain why retaining capital in the crypto market during periods of FUD has become an uphill battle.

Final Summary

- Memecoins have failed to attract capital during the risk-off period, with the market losing nearly $10 billion as liquidity moves out to safer assets.

- TRUMP and MELANIA coins have collapsed, leaving retail holders with $4.3 billion+ in losses, highlighting concentrated insider control and weakening confidence in the memecoin market.