The global adtech market is exploding, scaling from $828.6 billion in 2024 to a projected $1.86 trillion by 2031, with real-time bidding alone expected to balloon from $18.8 billion to $92.6 billion by 2033. But as the industry processes billions of daily bid requests, audience segments, and campaign optimizations, adtech companies are facing a silent profit killer: data egress fees.

What began as manageable transfer costs has quietly evolved into one of the largest, most overlooked expense categories in adtech operations, often rivaling or exceeding actual compute spending. The problem? Public cloud providers have engineered their pricing models to make scaling painfully expensive, and most adtech companies only discover this trap after months of accumulating bills.

This is where bare metal infrastructure fundamentally changes the game.

The Hidden Tax Nobody Talks About

Traditional adtech operations on public clouds seem deceptively simple at first: spin up instances, process bids, ship data. But the economics tell a darker story.

Every single action in an adtech ecosystem generates data movement that triggers egress charges:

-

Real-time bidding systems constantly exchange bid requests and responses with demand-side platforms (DSPs), supply-side platforms (SSPs), and ad exchanges

-

Campaign performance data flows to multiple reporting dashboards and analytics platforms

-

Audience segments synchronize across data management platforms (DMPs), customer data platforms (CDPs), and attribution partners

-

Creative assets are distributed globally to ad servers and delivery networks

-

API integrations with dozens of partners pull reporting data, push conversion signals, and stream performance metrics

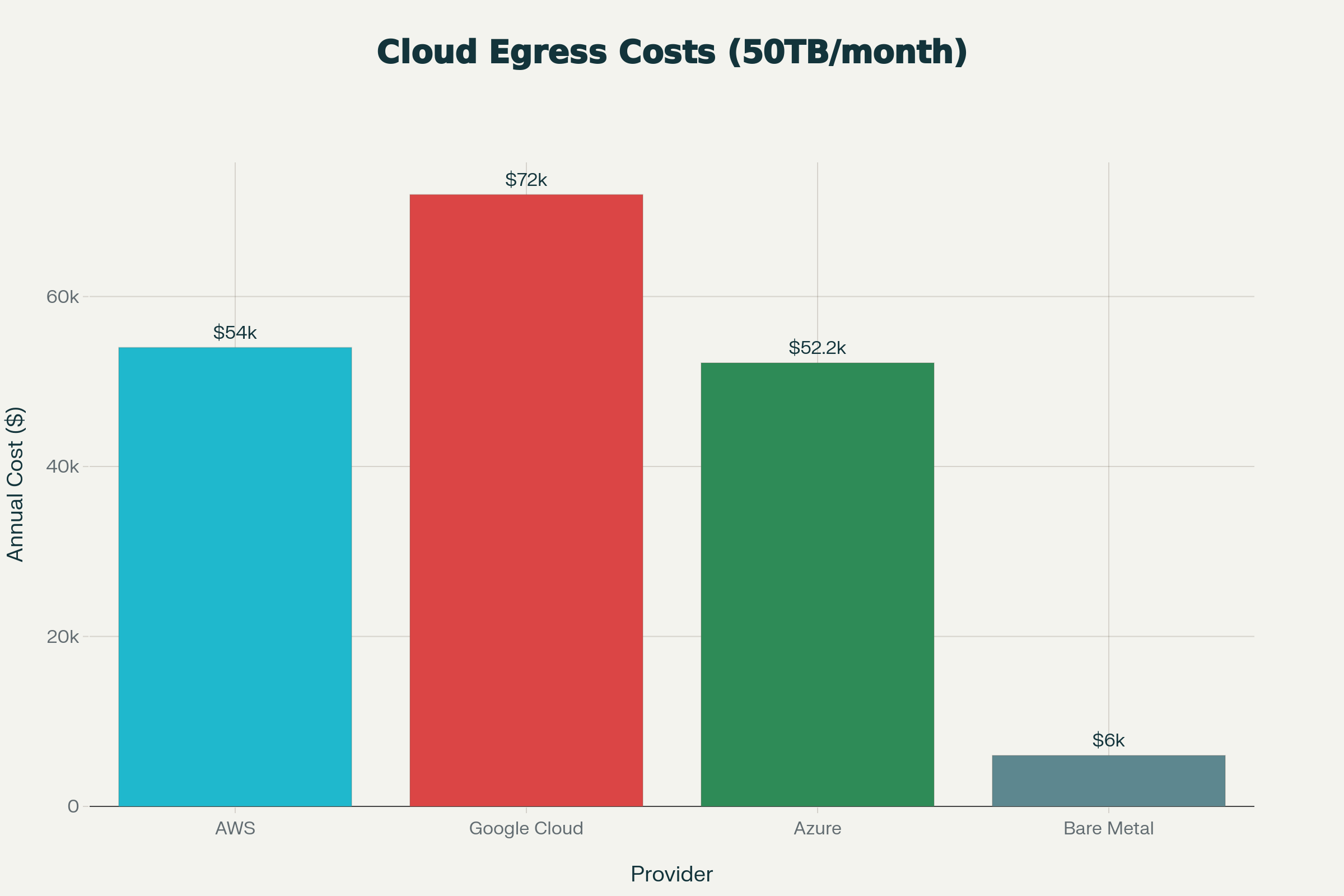

For a mid-tier DSP processing 50TB of monthly data transfer, here’s what the math looks like:

| Cloud Provider | Monthly Cost | Annual Cost |

| AWS | $4,500 | $54,000 |

| Google Cloud | $6,000 | $72,000 |

| Azure | $4,350 | $52,200 |

| Bare Metal | $500 | $6,000 |

That’s an $48,000 annual difference on egress alone, and that’s just one infrastructure component. Now scale that across dozens of integrations, multiple teams, and automated data pipelines, and the numbers become astronomical.

A real case study proves this point with stunning clarity. PowerLinks, a programmatic ad platform processing billions of impressions monthly, was paying $200,000 per month in infrastructure costs. The company was running 450 servers to deliver 20–80 queries per second (QPS) of throughput.

After comprehensive optimization and migration to a cloud-neutral bare metal architecture, their infrastructure bill dropped to $8,000–$10,000 per month, a 95–96% reduction. The company simultaneously reduced server count to just 10 while scaling throughput from 20–80 QPS to over 1 million QPS. This isn’t theoretical savings; it’s the real-world result of choosing the right infrastructure foundation.

Why Public Cloud Egress is Such a Profit Assassin

Cloud providers don’t make their pricing opacity a bug; it’s a feature. Here’s why:

Tier-Based Pricing Creates Unpredictability

AWS charges $0.09 per GB up to 10TB/month, then $0.085/GB for the next 40TB. Google Cloud starts at $0.12/GB for the first TB, dropping to $0.08/GB after 10TB. Azure sits at $0.087/GB for the first 10TB.

The tiers sound reasonable individually, but when you’re operating at scale, processing hundreds of terabytes monthly, these tiny per-gigabyte increments compound into six-figure line items that weren’t budgeted.

The Egress Compounds Every Integration

An adtech company integrating with 30 partners isn’t just paying for the primary data transfer. Each API call to pull reporting data, each sync job updating audience segments, and each attribution data export triggers separate egress charges. These “minor” integrations often account for 60% of total egress spend because they scale invisibly, rarely showing up in cost monitoring dashboards until the quarterly bill arrives.

No Visibility Until It’s Too Late

Most cloud bills are Black Boxes of complexity. By the time a team realizes egress charges have spiraled, they’re already locked in. Switching providers means expensive data migration (another egress charge), re-architecting applications, and vendor lock-in penalties.

A data analytics firm using Google BigQuery for client reporting initially paid $150/month in egress fees. Within six months, as client volumes grew, that ballooned to $2,800/month, representing 25% of their total cloud spend. That trajectory is the adtech story in miniature.

Spheron AI approaches infrastructure with a simple rule: scale should not punish you. That starts with a pricing model that folds bandwidth into the base cost instead of charging unpredictable egress fees.

Every bare metal server on Spheron AI includes a generous bandwidth allowance as part of the monthly rate. The price you see is the price you pay. No tiered billing. No hidden markups. No calculators.

The result is stability. Budgets stay predictable. Infrastructure scales without anxiety. You know exactly what your systems cost before you deploy them.

Yes, bare metal typically requires higher upfront capital expenditure for hardware procurement compared to cloud instances that let you spin up instantly. But here’s where the narrative breaks: When you run the numbers over 12–36 months for stable, high-volume adtech workloads, bare metal’s fixed pricing structure crushes cloud’s metered model.

Beyond egress, adtech teams on public clouds face:

-

Data transfer between regions (another per-GB charge for failover or multi-region redundancy)

-

API calls exceeding free tiers (DynamoDB, Lambda invocations, and BigQuery queries all add charges)

-

Support tiers (AWS Premium Support can run $15,000+/month for enterprise SLAs)

-

Reserved instance complexity (requiring purchasing commitments months in advance and managing underutilization)

Bare metal strips away these layers. You get dedicated hardware, full control, predictable network allowances, and the ability to deploy exactly what your infrastructure needs without padding for cloud provider profit margins.

With bare metal, you’re not paying extra for every architectural decision. Need to replicate data for redundancy? No egress charge. Setting up multi-region failover? No per-GB tax. Running daily reporting exports? No shocking bills.

This freedom enables adtech teams to build infrastructure around business logic, not around avoiding AWS bill shock.

Why This Matters Now

The adtech industry is at an inflection point. With programmatic advertising expected to grow at 22.8% annually through 2030, reaching $2.75 trillion, the infrastructure supporting this explosion must scale efficiently.

Companies that lock themselves into cloud egress economics are effectively paying a 10x tax on their data operations. That’s the margin they don’t recover, innovation budgets they don’t fund, and competitive ground they cede to rivals who’ve already made the shift.

For small RTB platforms processing 5TB monthly, the annual difference is $4,800. For large ad networks moving 500TB monthly, it’s $480,000+ annually. That’s not a rounding error, that’s reinvestment capital.

Making the Move

The transition to bare metal isn’t risk-free. Unlike cloud, where infrastructure scales on demand, bare metal requires upfront planning and acceptance that hardware capacity is provisioned, not elastic. For startups with unpredictable traffic, the cloud’s flexibility might be worth the egress tax.

But for established adtech operations with predictable, high-volume workloads, DSPs, SSPs, data platforms, ad networks, bare metal’s transparent pricing and eliminated egress charges represent one of the clearest ROI opportunities in infrastructure.

The math is brutally simple: eliminate the 10x egress tax, redeploy that capital toward product, and watch your margin profile shift dramatically.

Adtech companies aren’t leaving money on the table anymore. They’re building on it.

-

The global adtech market is expanding from $828.6B to $1.86T by 2031, intensifying infrastructure cost pressures.

-

Public cloud egress charges ($0.087–$0.12/GB) create hidden six-figure expenses for mid to large-scale adtech operations.

-

Real-world case studies (like PowerLinks) demonstrate 95–96% cost reductions by moving from cloud to optimized bare metal infrastructure.

-

Bare metal’s 20TB included egress eliminates the primary cost driver plaguing cloud-based adtech teams.

-

For adtech companies moving 50TB+ monthly, bare metal typically delivers $48,000–$480,000 in annual savings on egress alone.

-

Infrastructure costs that seemed inevitable on public cloud are actually optimization opportunities when properly architected on bare metal.

The adtech industry doesn’t have an infrastructure crisis. It has a pricing crisis. Bare metal rewrites those economics, and forward-thinking companies are capitalizing on it now.