A crypto whale who allegedly manipulated the prize of the Jelly my Jelly (JELLY) memecoin on decentralized exchange Hyperliquid still holds nearly $2 million worth of the token, according to blockchain analysts.

The unidentified whale made at least $6.26 million in profit by exploiting the liquidation parameters on Hyperliquid.

According to a postmortem report by blockchain intelligence firm Arkham, the whale opened three large trading positions within five minutes: two long positions worth $2.15 million and $1.9 million, and a $4.1 million short position that effectively offset the longs.

Source: Arkham

When the price of JELLY rose by 400%, the $4 million short position wasn’t immediately liquidated due to its size. Instead, it was absorbed into the Hyperliquidity Provider Vault (HLP), which is designed to liquidate large positions.

Related: Polymarket faces scrutiny over $7M Ukraine mineral deal bet

In more troubling revelations, the entity may still be holding nearly $2 million worth of the token’s supply, according to blockchain investigator ZachXBT.

“Five addresses linked to the entity who manipulated JELLY on Hyperliquid still hold ~10% of the JELLY supply on Solana ($1.9M+). All JELLY was purchased since March 22, 2025,” he wrote in a March 26 Telegram post.

The entity continues selling the tokens despite Hyperliquid freezing and delisting the memecoin, citing “evidence of suspicious market activity” involving trading instruments.

The JELLY token’s collapse is the latest in a series of memecoin scandals and insider schemes looking to capitalize on investor hype.

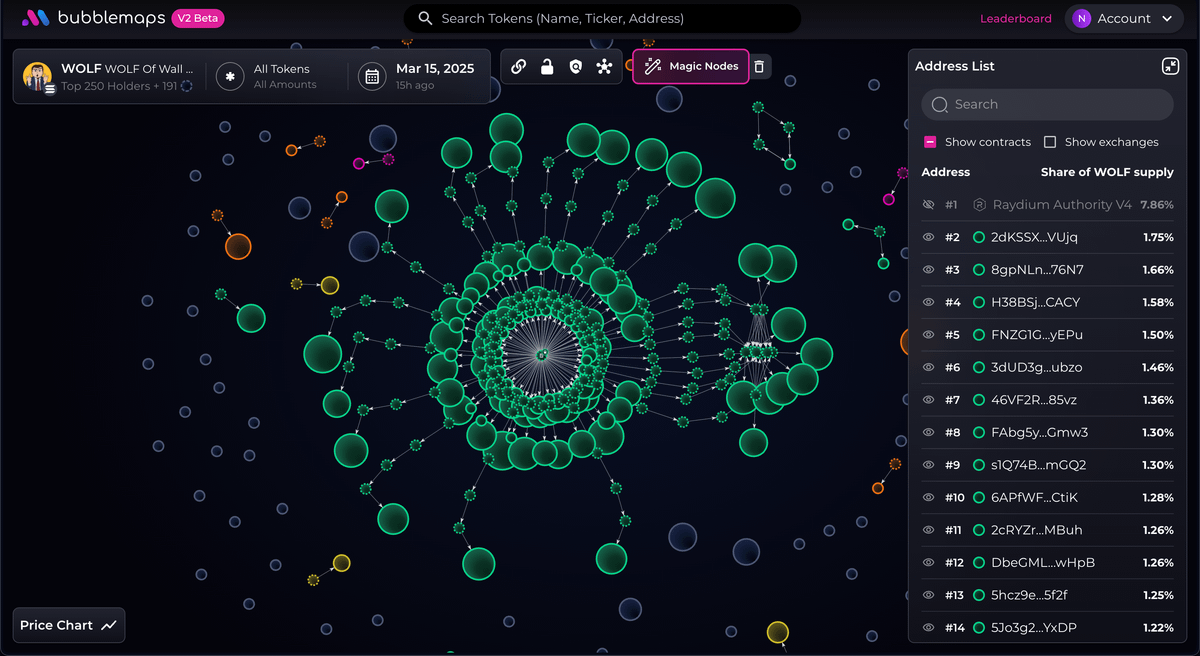

Source: Bubblemaps

The exploit occurred only two weeks after a Wolf of Wall Street-inspired memecoin — launched by the Official Melania Meme (MELANIA) and Libra (LIBRA) token co-creator Hayden Davis — crashed over 99% after launching with an 80% insider supply.

WOLF/SOL, market cap, 1-hour chart. Source: Dexscreener

Related: Polymarket whale raises Trump odds, sparking manipulation concerns

Lessons from the JELLY memecoin meltdown: “Hype without fundamentals”

“The JELLY incident is a clear reminder that hype without fundamentals doesn’t last,” according to Alvin Kan, chief operating officer at Bitget Wallet.

“In DeFi, momentum can drive short-term attention, but it doesn’t build sustainable platforms,” Kan told Cointelegraph, adding:

“Projects built on speculation, not utility, will continue to get exposed — especially in a market where capital moves quickly and unforgivingly.”

While Hyperliquid’s response cushioned short-term damage, it raises further questions about decentralization, as similar interventions “blur the line between decentralized ethos and centralized control.”

The Hyper Foundation, Hyperliquid’s ecosystem nonprofit, will “automatically” reimburse most affected users for losses related to the incident, except the addresses belonging to the exploiter.

Magazine: Memecoins are ded — But Solana ‘100x better’ despite revenue plunge