- PEPE’s October rally remains one of its most notable price movements, representing a 227% hike in price

- To determine if PEPE is positioned for a similar rally, its current technical setup is worth analyzing

In a recent market commentary, analysts hinted at the possibility of a 100% upside in Pepe [PEPE], drawing parallels with its October breakout pattern.

Notably, 2024 marked a breakout year for the memecoin, after it posted remarkable 1,435% year-over-year gains – Surging from its New Year opening price of $0.0000013. By doing so, it closed the year with exponential returns.

At press time, however, PEPE was trading 61% below its Q1 2025 opening, reflecting broader market corrections. Still, its current 1-day chart structure closely mirrors the late October consolidation range, characterized by compressed price action.

Historically, this pattern has preceded a sharp breakout, with the same seeing PEPE skyrocket by 227%, peaking at $0.00002597 on 14 November.

As a result, speculations are swirling around whether the memecoin could be ready for a similar breakout in the near term. A repeat rally, perhaps?

Breakdown of PEPE’s fundamental setup

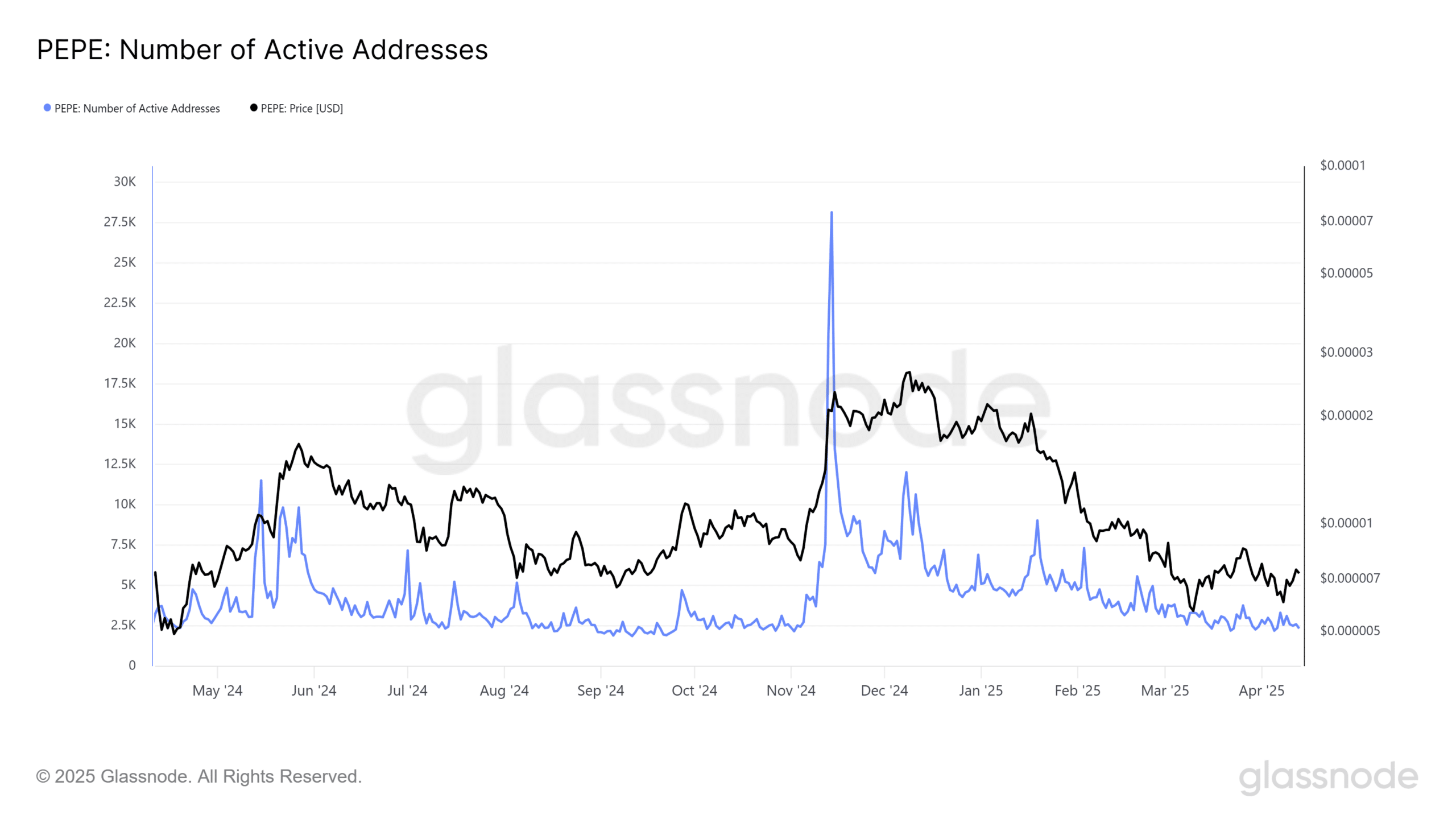

Interestingly, active addresses on the PEPE network averaged 2,500 prior to a significant surge to 20,500 in mid-November, aligning with the token’s parabolic price movement.

Historically, such an uptick in on-chain activity has been a leading indicator of bullish momentum.

However, current network metrics remain relatively flat, with active addresses at 2,587 – Mirroring previous consolidation phases before breakout events.

In other words, this could mean a similar accumulation pattern that preceded a significant price shift previously. .

Despite the lack of concrete confirmation, PEPE’s speculative rally potential might be a double-edged sword. Particularly when considering derivative market data.

For instance – Coinglass data indicated that despite muted on-chain activity and a lack of clear accumulation signals in spot market volume, Open Interest (OI) on PEPE Futures has risen sharply.

In fact, it surpassed November’s levels with a near 5% uptick, with the same pegged at $301.48 million at press time.

Consequently, PEPE’s 20% weekly gains may be at risk of triggering liquidation cascades, especially on long positions, due to the absence of dip-buying support. This would put short-sellers in control, highlighting the need for cautious risk management.

While historical patterns seemed to hint at a potential breakout, the crypto market relies on hard data, not coincidences. PEPE’s gains have been driven by leveraged liquidity rather than organic buying, making this rally vulnerable to a sharp reversal.