- Shiba Inu’s price structure was bearish, with the local lows emerging as attractive short-term price targets

- A divergence or reversal signal on the lower timeframes, combined with greater demand, might be necessary for a trend reversal

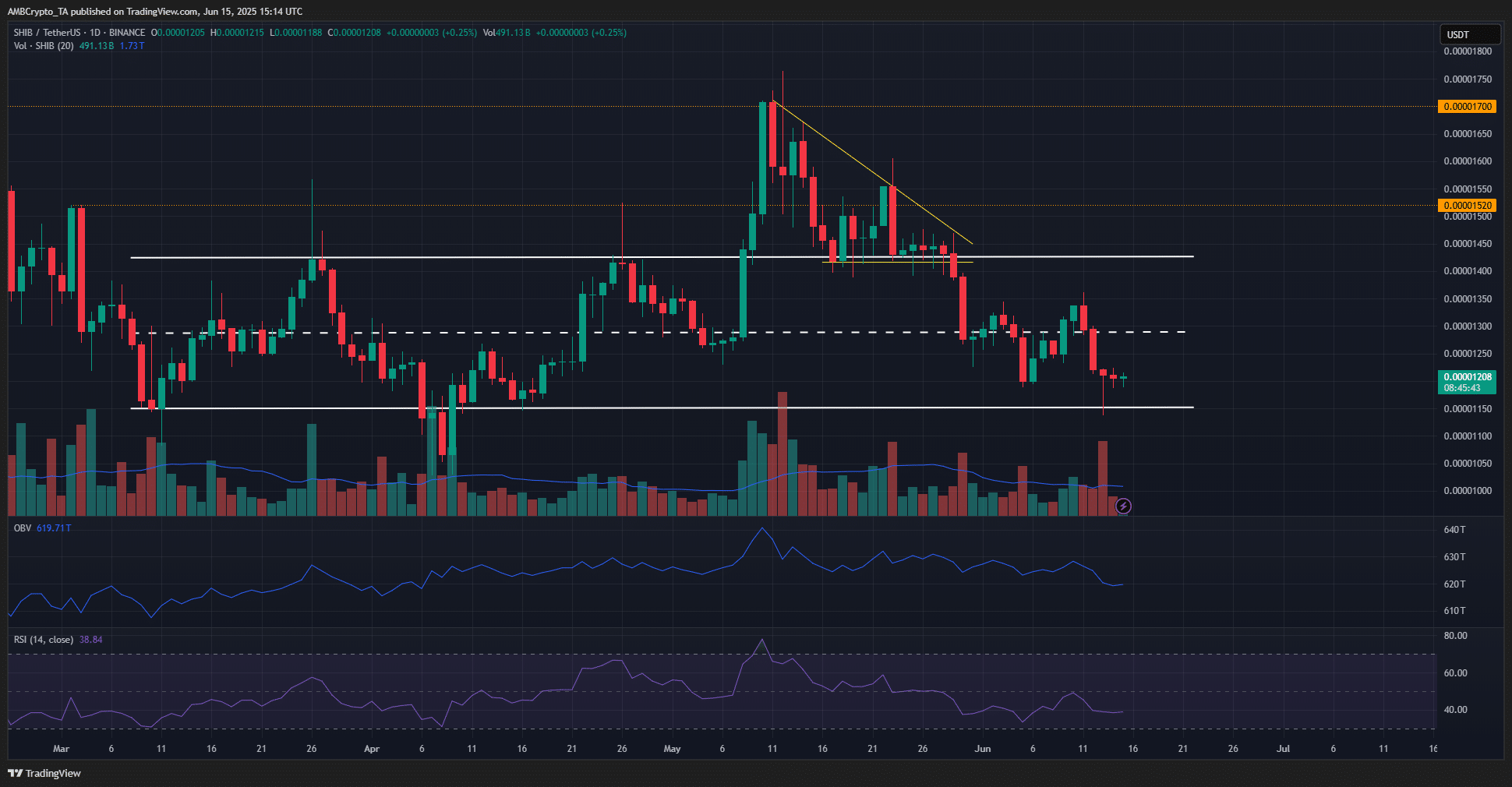

Since March, Shiba Inu [SHIB] has traded within a range that reached from $0.0000115 to $0.0000142. After recording a successful breakout in the first half of May, the memecoin fell below the $0.0000152 support. In doing so, it formed a descending triangle pattern.

An analysis from AMBCrypto pointed out that this pattern would likely be accompanied by a downward price move. This has come to pass, and the lows of the range have been tested. Where is SHIB likely to go next?

Shiba Inu to sink towards the next cluster of liquidation levels?

The picture from the technical analysis was not bright or bullish for SHIB bulls. After losing the $0.0000152-level as support, it retested the same as resistance, demarcating a supply zone. The market structure has been bearish since late May, and this has not changed.

The RSI has been below neutral 50 over the past three weeks, confirming the structural diagnosis. The OBV has also been trending southbound since late May – A sign of greater selling volume.

On Friday, 13 June, Shiba Inu fell as low as $0.0000114. At press time, the local support at $0.000012 was being defended. This might change in the next 24-48 hours. The downward wick made last Friday seemed highly likely to be tested soon.

Source: Coinglass

The liquidation heatmap with a 3-month lookback period agreed with this statement. It revealed two clusters of liquidity near the price. The one further away from the price was at $0.0000136. The closer magnetic zone sat at $0.0000114, the low from Friday.

The bunched up liquidation levels around and just below the local low would likely to be visited soon, but this may not be a guarantee. At the same time, a bullish reversal from the range lows should not be taken for granted either. This, because of the declining OBV.

Traders can keep an eye on the $0.0000110-$0.0000114 area for a bullish reversal in the lower timeframe charts, or a bullish divergence to show itself in the coming days. This could be the cue for going long. Until then, the short-term bias can remain bearish.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion