Coincheck, the Japanese, NASDAQ-listed crypto exchange, has unveiled a new cryptoasset custody services platform for corporate users.

Per a Coincheck press release , the new service is named Coincheck Prime and is “specifically targeted” at “corporate and institutional” crypto investors.

Coincheck: Responding to Growing Demand from Corporate Sector?

The firm said its new service will cater to “corporate clients” with deposit balances worth “10 million yen ($66,763) or more.”

It will also cater to big-spending firms and investors who are prepared to spend similar amounts on one-off or continuous crypto purchases.

Coincheck said its service will also provide trading and management support from “specialized” experts.

Until very recently, the majority of Japanese corporate players dealing with crypto were web3 and blockchain players.

But since late last year, there has been a rise in the number of corporations looking to raise funds through crypto investment.

Some companies have also gone on the record as stating that they think crypto can help them protect their liquid assets against fiat inflation.

Coincheck also suggested it could use its Prime services to help institutional investors who might require custody services should the government approve crypto spot ETFs at a future date.

OTC Options

The new platform will also allow users to make large over-the-counter (OTC) trades “at preferential rates.”

It also promises to provide users with “robust security” for cryptoassets in the exchange’s custody.

The company suggested its NASDAQ listing could help it build trust in its new services.

It also pointed out that its owner, the securities giant Monex Group, is listed on the Tokyo Stock Exchange’s Prime Market. Coincheck claimed:

“We adhere to global standards for internal controls, risk management, and security levels as required by [stock market-]listed financial group companies. We also provide services with a high level of transparency.”

Coincheck claims that its total customer assets were worth 1.29 trillion yen (over $8.6 billion) as of the end of January 2025.

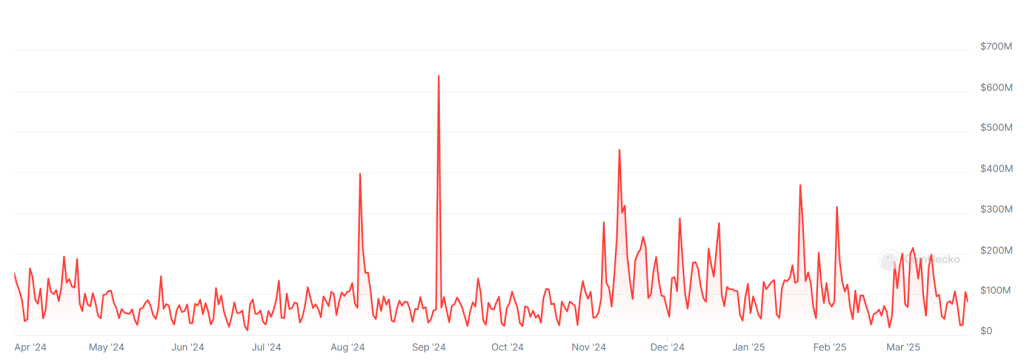

It also said that it was “the number one exchange in Japan in terms of Bitcoin (BTC) spot trading volume in the second half of 2024.”

Japanese Companies Flocking to BTC, Altcoin Markets

Corporate crypto investment is increasing rapidly in Japan, with companies now scrambling to use their balance sheets to buy Bitcoin and altcoins.

Earlier this month, the Tokyo Stock Exchange-listed real estate and digital transformation firm Value Creation announced it had recently spent $667,000 on Bitcoin.

Other notable Japanese firms buying BTC or unveiling plans to do so in recent months include the bullish investment player Metaplanet, as well as the SBC Medical Group and the auto trading firm Remixpoint.

Remixpoint spent around $3.2 million on BTC in January this year, and has earmarked another $16 million for Bitcoin and altcoin buys.

The company has also bought smaller amounts of Ethereum (ETH), Solana (SOL), XRP, Avalanche (AVAX), and Dogecoin (DOGE).

Metaplanet, meanwhile, has publicly claimed it wants to cement its position as “Asia’s leading Bitcoin treasury company.”

It has also spoken of a wider “goal” to “expand” the size of its Bitcoin holdings to BTC 10,000 by the end of this year.

The post Japan’s Coincheck Launches Corporate Crypto Custody Service appeared first on Cryptonews.