- JUP recently tested a crucial support zone at $1,133, a level that previously triggered a sharp rebound.

- Jupiter’s founder announced an upcoming token verification system designed to enhance security and community involvement.

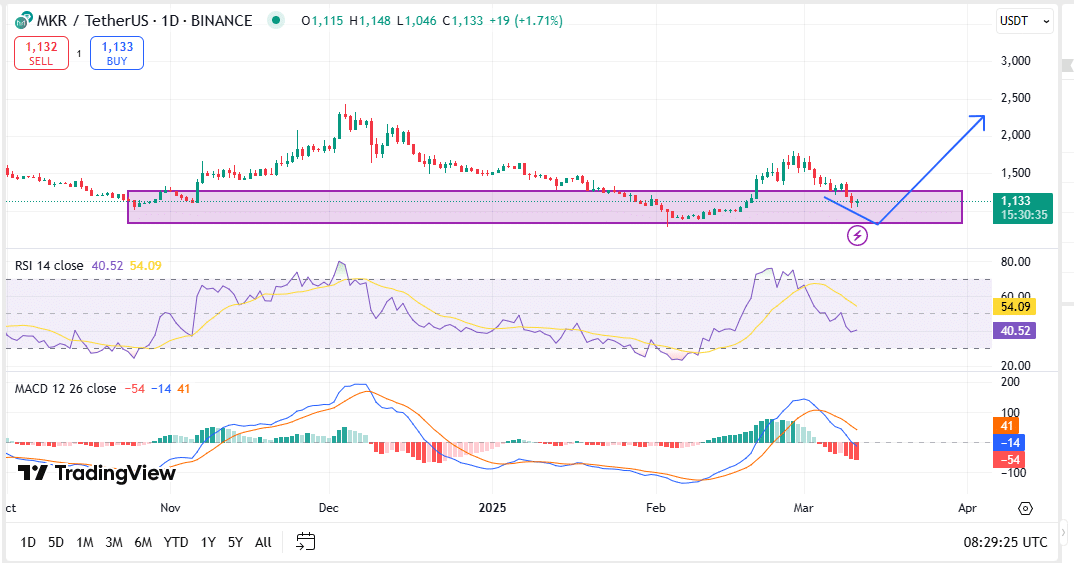

Jupiter [JUP] recently tested a crucial support zone at $1,133, a level that previously triggered a sharp rebound. This marked the end of an extended accumulation phase and signaled a potential shift in market structure.

The asset faced resistance at $1,500, while a broader range between $1,000 and $1,500 defined its recent price action.

JUP’s recent price action is hovering near critical levels that previously marked major market shifts. The asset remains in a consolidation phase, with its price fluctuating between key support and resistance zones.

Trading volume and market positioning suggest that investors are closely monitoring price movements for potential breakouts or breakdowns.

On the 11th of March, JUP traded at $1,132, just under this key support. A breakout above $1,500 could confirm a bullish reversal, setting the stage for a move toward $2,000.

Conversely, a drop below $1,000 might drive prices down to $800, resuming the downtrend. The RSI stood at 40.52, near oversold territory, suggesting a possible rebound.

If JUP sustains above $1,133 and breaks resistance, it could replicate previous upward movements.

JUP: Key support and resistance levels

The anchored volume profile indicated strong trader activity around the $1,133 level. This area acted as a high-volume node, reinforcing its importance as a support zone.

Historically, JUP rebounded from this level, reflecting strong market participation.

Price action at press time remained near this volume-heavy zone. A bounce from $1,133 could push prices to $2,000, as past volume trends suggest.

However, a breakdown might lead to a decline toward $800, where lower-volume nodes exist. Volume surges above $1,500 could indicate renewed bullish momentum.

Conversely, fading volume below $1,000 might trigger further selling pressure. Traders should track volume clusters to anticipate price direction.

Technological advancements

Jupiter’s founder announced an upcoming token verification system designed to enhance security and community involvement. This upgrade aims to improve investor confidence, potentially driving adoption.

Normally, trends suggest that similar technological developments in blockchain projects often lead to 20-30% price increases post-launch.

Recently, JUP traded at $1,132. If the new system successfully boosts engagement, prices could target $1,500 or even $2,000.

However, implementation risks, such as delays or technical issues, might cause a 10-15% price dip, testing the $900-$1,000 range.

Previous cases, including Ethereum’s upgrades, led to long-term bullish trends.

Market sentiment shift

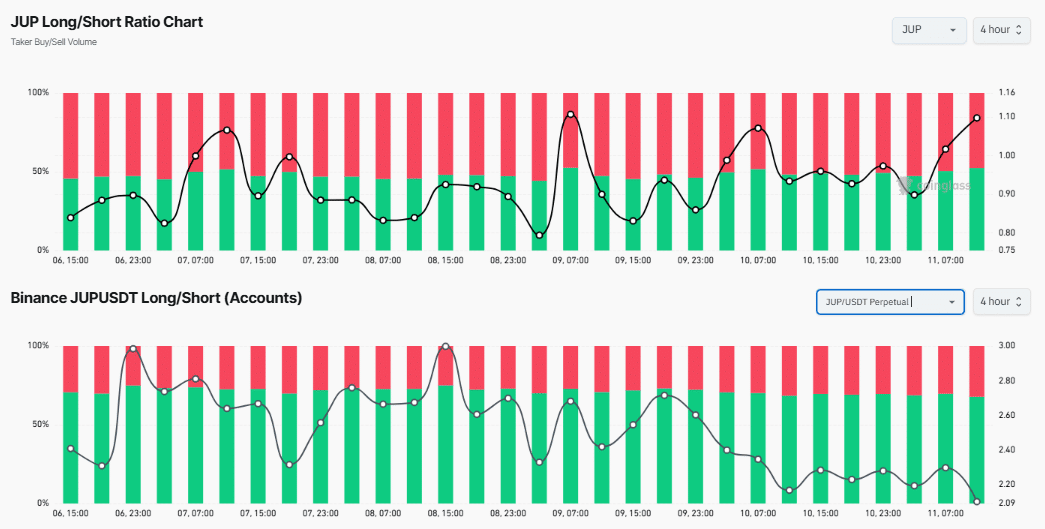

JUP’s Long/Short Ratio revealed shifting sentiment over the past four hours. The taker buy/sell volume ratio stood at 1.16, with long positions accounting for 54% and shorts at 46%.

The account-based ratio showed similar dynamics, with 52% longs and 48% shorts, indicating a balanced market with slight bullish leanings.

If the ratio rises to 1.30, strong buying pressure could push JUP from $1,132 to $1,500 or higher. Conversely, a drop to 0.90, indicating short dominance, could lead to a decline toward $1,000 or $800.

The last time the ratio moved from 1.10 to higher levels, JUP saw a price rebound.

In conclusion, JUP remains at a pivotal price point, with $1,133 acting as a major support level. Historical price behavior and volume patterns suggest that this zone could determine the next major move.

A breakout above $1,500 may confirm a bullish trend, with $2,000 as a potential target. On the downside, failure to hold $1,133 could lead to a retest of $1,000 or lower.